Market News

Dr Reddy’s Q3 results: Check earnings preview and options strategy ahead of results

.png)

3 min read | Updated on January 23, 2025, 10:43 IST

SUMMARY

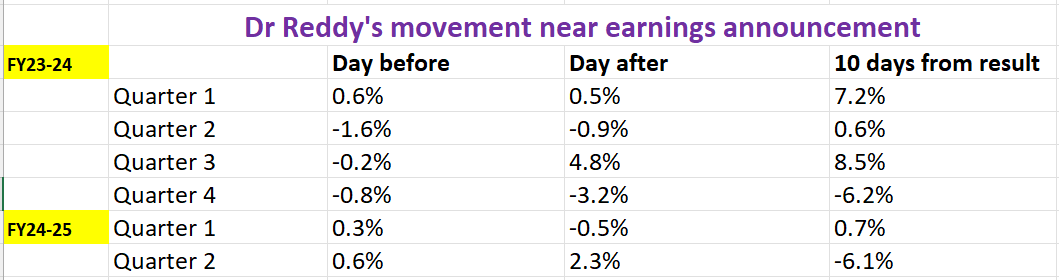

Ahead of its Q3 results, shares of Dr Reddy’s Laboratories are implying a ±4.2% move ahead of their 30 January expiry, according to the options market.

Stock list

Experts believe the company’s revenue is likely to see a 10-14% year-on-year (YoY) growth.

Experts believe the company’s revenue is likely to see a 10-14% year-on-year (YoY) growth, reaching between ₹7,950 crore and ₹8,300 crore. Sequentially, revenue could increase by 1-3%.

However, net profit is expected to remain within the ₹1,350-₹1,430 crore range, reflecting low single-digit growth. Profitability could be under pressure due to weaker sales of its high-margin cancer drug, Revlimid, and overall subdued growth in the U.S. market.

Investors will closely watch the management’s commentary on new drug approvals, product launches, and key financial indicators such as EBITDA margins.

Ahead of the Q3 results, Dr Reddy’s shares are trading 0.56% lower at ₹1,289 per share on Thursday, January 23. The stock has declined 6.64% so far this month.

Technical View

Shares of Dr Reddy’s Laboratories are currently trading below the 21-day and 50-day exponential moving averages (EMAs), indicating weakness. Additionally, it formed an inside candlestick pattern on the daily chart. For short-term clues, traders can monitor the high and low of the 21 January. A close above or below these levels will provide further clues.

Options outlook

Based on options data of 30 January, the significant call open interest (OI) was seen at 550 and 510 strikes, while PUT OI was placed at 500 and 480 strikes.

Options strategy for Dr Reddy’s Laboratories

With the options market predicting a price movement of ±4.2% till 30 January, traders can consider long and short straddle strategies to take advantage of the expected volatility.

Related News

About The Author

Next Story