Business News

Options strategies that can be deployed during earnings season

8 min read | Updated on July 19, 2024, 20:53 IST

SUMMARY

The days surrounding an earnings announcement will usually have higher volatility for individual stocks.

Option Greeks can be used to forecast the price change of an option

It's that time again – earnings season is underway, with numerous companies gearing up to unveil their latest quarterly results. But what exactly does earnings season entail, how do stocks respond to these releases, and how can you strategically position your portfolio or execute trades during this pivotal period?

Companies disclose their earnings four times a year, providing a comprehensive summary of their financial performance over the last quarter. Accompanied by a press release, these announcements include detailed financial statements such as the balance sheet, income statement, and cash flow statement. Key metrics like total revenue, revenue growth, and profit margins are also highlighted. Additionally, companies often host conference calls where management discusses results, provide reasons behind any unexpected surprises or misses, and outline potential risks to future performance.

Given the significant impact on stock prices, earnings announcements often occur outside regular market hours – either before the market opens or after it closes. Occasionally, these announcements may occur over weekends or holidays. Despite the flexibility of release dates throughout the year, they tend to cluster within specific weeks, collectively referred to as 'Earnings Season.'

The days surrounding an earnings announcement will usually have higher volatility for individual stocks. Prior to the disclosure, there's a considerable information gap since the last official financial release. This period is characterized by uncertainty about the company's business performance, given the potential changes during this timeframe. Post-announcement, investors and traders gain clarity on the company's current stability and future outlook, making it a unique and crucial time.

Because of this uncertainty, traders will engage in speculation by buying stocks or options before the announcement. However, it isn’t possible to reliably and consistently predict how a company’s share price will react against market expectations following the release of earnings. Even if a company exceeds earnings expectations, the stock may either rise or fall in response to this new information.

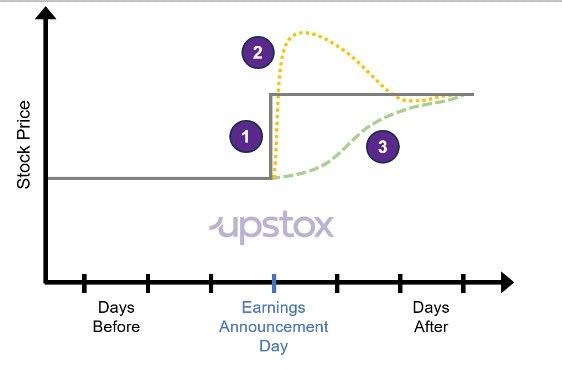

One thing to consider is that markets aren’t perfectly efficient. With traders being highly active around earnings, there could be an overcorrection where the price shoots up or down and over time. After several days, the price will adjust as traders and investors assimilate all the information provided in the earnings announcement. In a different scenario, there may be a lack of interest in a particular stock leading to an undercorrection where the stock slowly drifts up or down following an earnings announcement. In the illustration below, line (1) would be an example where markets are perfectly efficient and are able to immediately and correctly digest all information relayed in the earnings announcement. This perfect adjustment is what you won’t see. Instead, you will likely see a price overcorrection, price undercorrection, or possibly minimal price movement. Price overcorrection is illustrated as curve (2) where the traders push the price higher and over time, the market realizes that the true price is actually lower. Undercorrection is illustrated as curve (3) as a drift in price over several days.

Unfortunately, predicting the market’s reaction to a company’s earnings announcement isn’t possible but that doesn’t mean that there aren’t ways to still profit from price action that occurs surrounding those announcements. As part of speculative trading activity, option traders will often buy straddles on individual stocks in anticipation of a large price movement surrounding the earnings release. A straddle is when you buy both a call option and a put option. To profit, the underlying would need to move up or down by more than the cost of the straddle. For example, if a straddle costs ₹100 to purchase, the underlying stock must move either up or down more than ₹100 in order for the trader to profit.

Using the current price of a straddle, you can see how much the underlying stock needs to move in order to break-even. If you believe that this earnings announcement will drive a large amount of price variability – more than what the straddle is currently priced at – then your opportunity would be to buy or ‘go long’ a straddle. On the other hand, if you believe that the stock will remain relatively flat following earnings, then you could sell a straddle. This will allow you to collect a premium upfront and if the underlying doesn’t move from the strike price, then you will profit. A short straddle has the potential for large losses if the underlying moves significantly. An alternative is to use a hedged strategy like an iron condor that still collects a premium upfront but has fixed loss potential if the trade goes against you.

When there is a lot of option buying activity, implied volatility can rise. Once the earnings announcement occurs, uncertainty is reduced, and option positions are closed out. This leads to a drop in implied volatility.

If you own the stock, this option activity could provide an opportunity. You can short a call option against your stock which will provide you with a premium. Because implied volatility is higher around the earnings announcement, the premium you receive will likely be higher than average. The drawback is that you have the obligation to sell the stock should the price of the stock rise above the strike price. In addition, if the stock falls in price after the earnings announcement, you will still own the stock which will have a lower value. However, this loss will be partly offset by the premium collected from selling the call option. So, if you intend to hold a stock through an earnings announcement and don’t mind having to sell it if the price rises, executing a covered call could be the “option” for you.

As an example, if a stock that you own is expecting an earnings announcement. This stock is trading for ₹1,000 and the price of the 5% out-of-the-money call is trading for ₹30. If you sell this call, you will receive a 30 premium which represents a 3% yield (30 / 1000). If the stock doesn’t move, your return will be the 3% yield from the short call. If the stock goes up by 5% or more, then you will receive the 5% return plus the 3% yield.

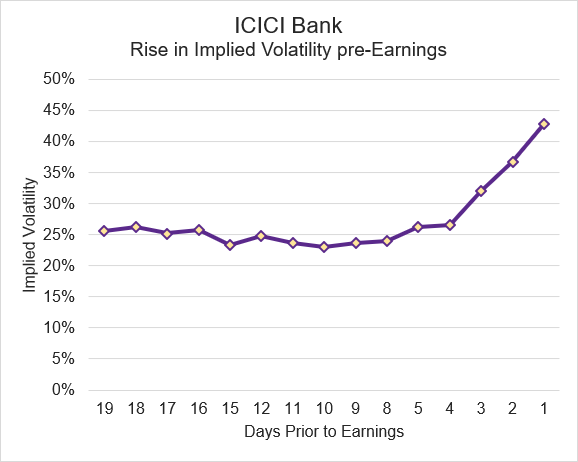

To illustrate how covered calls can be more lucrative surrounding earnings announcements, the below chart is the implied volatility of ICICI Bank. The dates are from 1 Jan 2024 to 19 Jan 2024 for the 25 Jan expiration date. ICICI Bank announced earnings on 20 Jan 2024. As you can see, implied volatility was around 25% but, in the days preceding the announcement, increased as traders began buying options. This increase in implied volatility provides an opportunity to earn more from selling covered calls.

Now, consider a scenario where you are holding a stock with an upcoming earnings announcement but you are worried about potential downward price movements. An approach to protect against a price decline involves using protective puts. Using this strategy, you keep holding the stock and you simply buy a put option. If the stock moves below the strike price of the put, your option will start to have a positive payoff. The drawback to buying put options is that you have to spend money upfront for this downside hedge.

If you want to offset this cost of buying a protective put option, you can also sell a call option. The premium received from the call option can partially mitigate the cost of the purchased put option. This strategy of combining stock ownership, a protective put, and a short call is known as a “collar”.

Here is a quick example. You own a stock that is trading at ₹500 and worry that it could go down by more than 5% if an upcoming earnings announcement is negative. You purchase a put option with a strike price of ₹475 which is 5% below the current price. The price of the put option is ₹30. To minimize the cost of this hedge, you decide to sell a corresponding call option that is 5% above the current price or ₹525. The current price of the 525-strike call option is ₹25 so you will receive this premium when you sell the call. In total, your net cash outlay is ₹5.

Overall, you are completely hedged against a downside move of more than 5% in the underlying stock should that occur prior to expiry. In addition, you will be able to retain all gains on the stock as long as it doesn’t close more than 5% above its current price on expiration. If that happens, then you will need to sell the stock. Depending on how you structure your collar, you could enter into a collar for no cost, a net credit, or a net debit.

Whether you are a long-term investor, an intraday equity trader, or an options trader, earnings announcements are an important time of the year for a company. Leading up to the announcement, opportunities abound as 1) option traders can speculate with non-directional strategies (long straddle or iron condor), 2) investors can capitalize on higher yields with covered calls, and 3) risk-averse investors can protect against downside movements with protective puts and collars.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story