Business News

RBI MPC Highlights: Repo rate remains unchanged at 6.5%, inflation seen at 4.5% in FY25

.png)

7 min read | Updated on August 08, 2024, 12:03 IST

SUMMARY

RBI MPC LIVE Updates: The Reserve Bank has decided to hold the repo rates, in the backdrop of a sticky inflation driven by high food prices. The "withdrawal of accommodation" stance of the central bank remains unchanged. For FY25, the real GDP growth forecast has been maintained as 7.2%.

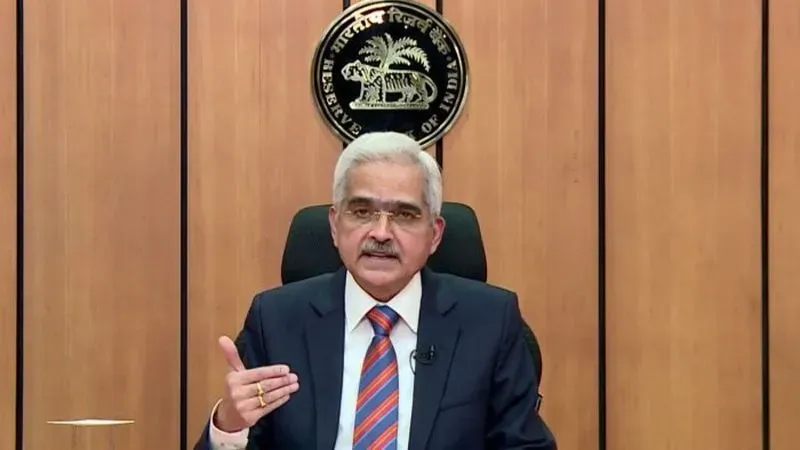

Reserve Bank of India (RBI) Governor Shaktikanta Das will announce the repo rate decision in a press briefing following the MPC meeting

RBI MPC Highlights: Guv Das concludes statement; repo rate, inflation and growth forecast remain unchanged

Reserve Bank of India Governor Shaktikanta Das has concluded his statement. He would be addressing a press conference later. The key updates shared by Das following the conclusion of the MPC meeting is as follows:

- Repo rate remains unchanged for the ninth consecutive time at 6.5%.

- Inflation forecast for the second and third quarter has been revised upwards, but the overall retail inflation in FY25 is seen at 4.5% -- the same as the last projection.

- The real GDP growth forecast for the current fiscal year also remains unchanged at 7.2%.

RBI MPC LIVE Updates at 10:37 am: Headline inflation retreating but pace remains uneven, says Guv Das

In his concluding remarks, RBI Governor Shaktikanta das said the country's growth remains resilient and inflation is edging downwards, but the goal to achieve price stability remains uneven due to supply price shocks in food items.

The headline inflation is retreating but the pace remains uneven, he reiterated.

RBI MPC LIVE Updates at 10:32 am: Expect current account deficit to remain under control, says Das

The central bank expects the current account deficit to remain under control during the current financial year, the RBI Governor said. The overall external sector remains resilient, he added.

RBI MPC LIVE Updates at 10:29 am: Recent outage showed how minor tech issues can derail operations, says Guv Das

A recent outage showed how minor technical issues can also wreak havoc, the RBI Governor said, apparently referring to the Microsoft outage last month. Banks and other financial institutions should focus on strengthening their systems, cybersecurity mechanism and other related tech, Das added.

RBI MPC LIVE Updates at 10:24 am: Domestic economic activity continues to be resilient, says Guv Das

"Domestic economic activity continues to be resilient. On the supply side, steady progress in the southwest monsoon, higher cumulative Kharif sowing, and improving reservoir levels auger very well for Kharif output. Manufacturing activity continues to gain ground on the back of improving domestic demand."

RBI MPC LIVE Updates at 10:21 am: Food inflation pressures cannot be ignored, says Guv Das

Food inflation accounts for 46% of the overall basket of India's headline inflation, hence it "could not be ignored", the RBI Governor said. Secondly, the public at large relate food prices with inflation, he added. It is also a fact that high food prices affects households, he further noted.

RBI MPC LIVE Updates at 10:17 am: CPI inflation for FY25 projected as 4.5%

The CPI or retail inflation for financial year 2024-25 is seen at 4.5%, RBI Governor Shaktikanta Das said. He shared the quarter-wise breakdown for the remainder of the fiscal year:

- Q2FY25: 4.4% (up from 3.8% in previous forecast)

- Q3FY25: 4.7% (up from 4.6% in previous forecast)

- Q4FY25: 4.3% (lowered from previous forecast of 4.5%)

RBI MPC LIVE Updates at 10:14 am: Real GDP growth seen at 7.2% in FY25, says Governor Das

The real GDP growth is seen at 7.2% in FY2024-25, RBI Governor Shaktikanta Das said. He shared the quarterwise breakup as follows:

- Q1FY25: 7.1%

- Q2FY25: 7.2%

- Q3FY25: 7.3%

- Q4FY25: 7.2%

RBI MPC LIVE Updates at 10:11 am: Manufacturing activity improving on back of domestic demand

The manufacturing activity has improved in the country in the backdrop of domestic demand, the RBI Governor said. The services sector maintained buoyancy, as reflected in the availability of high-frequency indicators.

RBI MPC LIVE Updates at 10:09 am: 'Withdrawal of accommodation' stance to continue

Das maintained that the MPC voted in favour of continuing the stance of "withdrawal of accommodation", with the goal to support growth while keeping inflation in check.

RBI MPC LIVE Updates at 10:07 am: MPC decided to hold rates while maintaining vigil on inflation

The rate-setting panel decided to hold the rates while keeping a vigil on the inflation trajectory, the RBI Governor said, adding that focus will remain on controlling inflation and supporting price stability.

RBI MPC LIVE Updates at 10:05 am: Repo rate remains unchanged at 6.5% for 9th consecutive time

After a detailed assessment of the evolving macroeconomic condition and the overall outlook, the MPC by a majority of 4:2 decided to keep the repo rate unchanged at 6.5% for the ninth consecutive time, RBI Governor Das said.

RBI MPC LIVE Updates at 09:55 am: Governor Das to announce monetary policy review outcome shortly

RBI Governor Shaktikanta Das is expected to announce the monetary policy review outcome shortly. The statement to the press is expected to be issued at 10:00 am. Stay tuned here for the updates.

RBI MPC LIVE Updates at 09:45 am: Food inflation likely concern for rate-setting panel

The MPC is expected to have refrained from voting for a reduction in rates in view of the climb in retail inflation, driven by a surge in food prices. Food inflation has remained on the upswing over the past several months, and reached 9.24% in June.

RBI MPC LIVE Updates at 09:35 am: RBI to hold rates, may sound more confident of reaching inflation target: HSBC

The Reserve Bank is expected to hold its key rates at the forthcoming policy review, but may sound more confident about reaching its 4 per cent inflation objective, HSBC said. The rate-setting panel may prefer to stick to the 'withdrawal of accommodation' stance of the monetary policy, it said in a report released on the eve of the RBI MPC's decision.

RBI MPC LIVE Updates at 09:25 am: Rupee rises in early trade ahead of repo rate decision

Rupee rose 1 paisa to 83.94 against the US dollar in early trade on Thursday. The uptick in the currency's value comes ahead of RBI monetary policy outcome, which will be announced shortly.

RBI MPC LIVE Updates at 09:15 am: What to expect on repo rate front?

According to a Reuters poll of economists, the repo rate is likely to remain unchanged at 6.5%. The rate has remained unchanged since February last year. As per the poll, one reduction of 25 basis points is expected in the next quarter.

RBI MPC LIVE Updates at 09:00 am: Why inflation outlook is awaited

The central bank's inflation outlook, which will be shared following the MPC meeting today, will remain in focus in view of the recent uptick in inflation. The retail inflation climbed to a five-month high of 5.08% in June, with food inflation spiking by 9.24% year-on-year.

RBI MPC LIVE Updates at 8:40 am: Repo rate decision to be announced at 10 am

RBI Governor Shaktikanta Das will declare the Monetary Policy Committee's decision on repo rate at 10 am, when he is scheduled to issue a statement to the press. Das would address the questions from the media in a press conference that would be held shortly thereafter.

The repo rate or the rate at which the RBI lends to commercial banks current stands at 6.5%. The benchmark lending rate has remained unchanged since February 2023.

In the last eight MPC meetings, the members by a majority voted in favour of maintaining status quo, in view of the RBI's target to achieve an inflation rate of 4%.

Ahead of the meeting, a Reuters poll of 59 economists indicated that the RBI would hold the rates steady in view of the uptick in inflation.

The retail inflation climbed to a five-month high of 5.08% in June, with food inflation spiking by 9.24%.

In this backdrop, the RBI's inflation outlook -- to be shared following the MPC meeting today -- will also remain in focus. In the past, the central bank has said that sustained efforts are needed to scale inflation to the target of 4%.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story