Business News

Budget 2024-25 Highlights: Capex target retained at ₹11.11 lakh crore; standard deduction upped to ₹75K

.png)

4 min read | Updated on July 23, 2024, 19:28 IST

SUMMARY

The FM announced that ₹26,000 crore will be allocated for highways in Bihar and ₹15,000 crore will be arranged in the current fiscal year to develop Andhra Pradesh.

Stock list

FM Sitharaman presented her seventh consecutive Budget on Tuesday, July 23.

Finance Minister Nirmala Sitharaman, in her Budget 2024-25 speech, notified nine priority areas for the government: productivity and resilience, employment and skilling, manufacturing and services, energy and security, infrastructure, manufacturing, land reforms, and urban development and next-generation reforms.

Here are the top highlights of the Budget speech:

-

The government's capital expenditure for the fiscal year 2025, has been retained at ₹11.11 lakh crore, which is 3.4% of the GDP.

-

The fiscal deficit target has been estimated at 4.9% of the GDP. This is lower than 5.1% announced in the interim Budget.

-

The FM announced that ₹26,000 crore will be allocated for highways in Bihar and ₹15,000 crore will be arranged in the current fiscal year to develop Andhra Pradesh.

-

Provision of ₹1.5 lakh crore for long-term interest-free loans to support Infrastructure Investment by the State Governments;

-

Complete removal of Angel taxes on startups

-

Corporate tax rate on foreign companies reduced from 40% to 35%

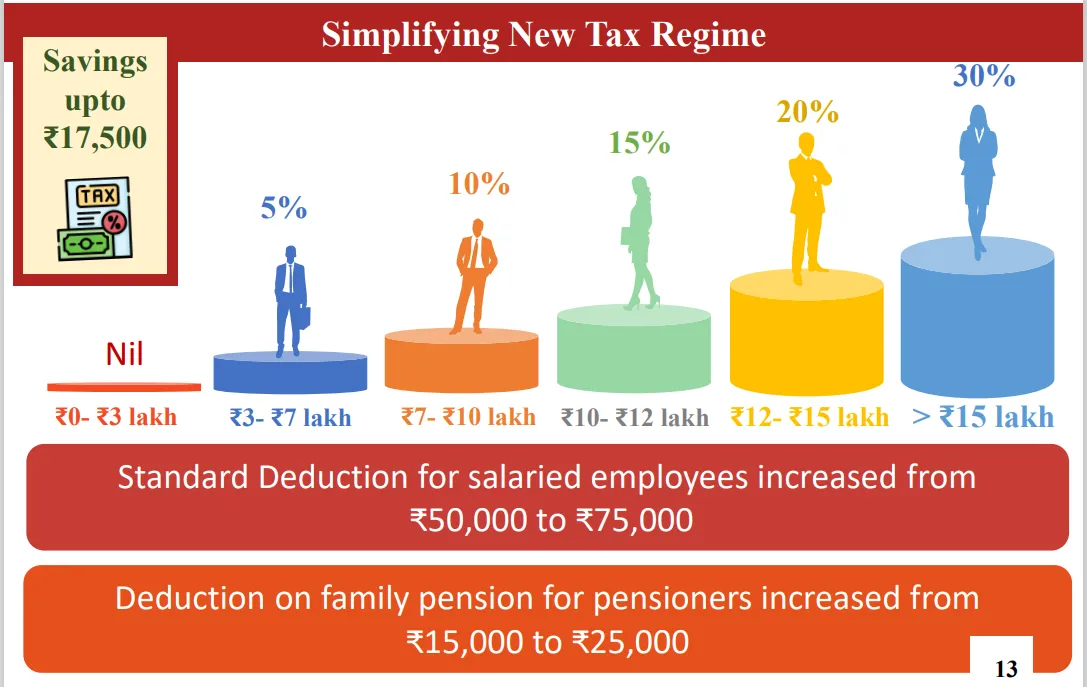

| Tax Slab for FY24 | Tax Rate | Tax Slab for FY25 | Tax Rate |

|---|---|---|---|

| Upto ₹3 lakh | NIL | Upto ₹3 lakh | NIL |

| ₹3 to ₹6 lakh | 5% | ₹3 to ₹7 lakh | 5% |

| ₹6 to ₹9 lakh | 10% | ₹7 to ₹10 lakh | 10% |

| ₹9 to ₹12 lakh | 15% | ₹10 to ₹12 lakh | 15% |

| ₹12 to ₹15 lakh | 20% | ₹12 to ₹15 lakh | 20% |

| ₹15 lakh and above | 30% | ₹15 lakh and above | 30% |

-

The FM added that salaried employees under new tax regime will save up ₹17,500 annually in taxes due to changes proposed in FY25 Budget.

-

Similarly, deduction on family pension for pensioners is proposed to be enhanced from ₹15,000 to ₹25,000. "This will provide relief to about four crore salaries individuals and pensioners," the FM said.

- The Finance Minister proposed ₹10 lakh crore for PM Awas Yojana - Urban 2.0 to address housing needs of 1 crore urban poor, middle class.

• 1 crore farmers across the country will be initiated into natural farming, supported by certification and branding in next 2 years.

• 10,000 need-based bio-input resource centres to be established.

• Financing for Shrimp farming, processing and export will be facilitated through NABARD.

• Scheme for providing internship opportunities in 500 top companies to 1 crore youth in 5 years.

• Allowance of ₹5,000 per month along with a one-time assistance of ₹6,000 through the CSR funds.

- Pradhan Mantri Gram Sadak Yojana: Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations, which have become eligible in view of their population increase," FM Nirmala Sitharaman added.

- List of exempted capital goods for use in the manufacturing of solar cells and panels in the country to be expanded;

- The FM announced an increase in the deduction limit to 14% from 10% for employers contributions to NPS;

- STT on F&O of securities has been increased by 0.02% and 0.1%; income receipt on share buybacks will now be taxed in the hands of recipients, the FM announced.

- Mudra Loans: The Budget 2024-25 has enhanced the limit to ₹ 20 lakh from the current ₹ 10 lakh under the ‘Tarun’ category. Mudra loans are provided to MSMEs.

- Capital gains tax

-

The government will launch three employment-linked schemes, Finance Minister Nirmala Sitharaman said. These schemes will be based on enrolment in Employees' Provident Fund Organization (EPFO), Sitharaman said in the Lok Sabha. Click here to read more.

-

Tourism in Bihar

- Under Innovation, Research & Development Priority, the FM announced the operationalisation of the Anusandhan National Research Fund for basic research and prototype development. The FM also announced the private sector-driven research and innovation at commercial scale with a financing pool of ₹1 lakh crore.

For Space Economy, a venture capital fund of ₹1,000 crore will be set up.

About The Author

Next Story