Options & Equity strategies: Hindustan Unilever

Hindustan Unilever is scheduled to announce earnings on 20 July. The LTP (last traded price) of HINDUNILVR as of the 13 July close is ₹2,658.25. The price of a straddle expiring on 27 July on HINDUNILVR is ₹98.98 with the asking price of the at-the-money call and put option being ₹53.45 and ₹45.45 respectively.

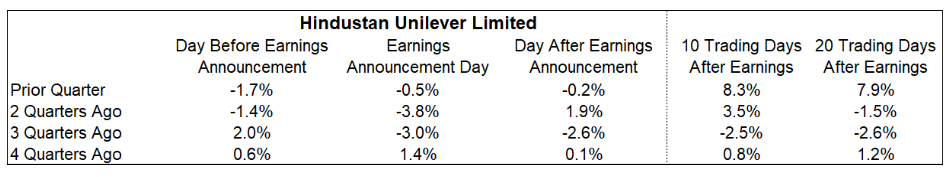

The price of a straddle is what the options market estimates as the range of potential price movement prior to expiry. In the case of Hindustan Unilever, the straddle price is implying a range of an approximate ±3.7% move between now and 27 July. For reference, this is the price movement surrounding this company’s earnings announcement for the last four quarters.

Interested in trading options on HINDUNILVR?

For options traders, earnings announcements provide an opportunity to trade on the volatility. If you believe that Hindustan Unilever will move more than (±3.7%), the current price of a Straddle, you could buy a Straddle. If you believe that Hindustan Unilever will move less than (±3.7%), you could sell a Straddle or buy an Iron Condor.

Interested in owning Hindustan Unilever and earning an extra short-term yield through options?

As an earnings date approaches, option traders will often buy calls, puts, or straddles in anticipation of profiting on a price move. Because of this, implied volatility increases before earnings. This provides an opportunity to capture a higher yield on covered calls. A Covered Call is an equity-option combination where you own the stock and sell a call option on that stock. By selling the call option, you will receive an upfront premium. If the stock rises above the strike price of the short call, you forego any future gains on that stock.

If you believe that Hindustan Unilever will trade within expected range of ±3.7% prior to expiry, you could sell a call towards the upper end of the expected price range. For example, a short call with a strike of 2760 would provide a premium of ₹16.60 as of market close on 13 July. This represents a yield of 0.6% for the 14 days until expiration which is an annualized yield of 18%. If HINDUNILVR moves to the 2760-strike price on expiration, your total return would be 4.4% (stock return of 3.8% + short call yield of 0.6%).

Interested to know more about straddles, iron condors, or covered calls? Check out our UpLearn education content. If you want to see more historical earnings price data like in the table above for this stock, sign-up for our community, let us know, and we will share it!

Disclaimer

Investments in the securities market are subject to market risk, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. To know more visit https://upstox.com/

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.