Cover orders: We’ve got you covered.

The market offers plenty of opportunities and, at the same time, is full of uncertainty. How can one benefit from the first and protect oneself from the second? One of the ways is to use a cover order.

What is a cover order?

A cover order is a combination of a market or limit order and a stop-loss order. It has 2 legs: the first leg is a limit or market order, which allows you to enter into a trade and benefit from the favourable movement in the price of a stock. The second leg is a stop-loss order, which limits your risk in case the price moves in the opposite direction. Let’s understand this with an example.

Example 1: Market/limit buy and stop-loss sell

Assume that we’re placing a buy order for 1,000 shares of Reliance Industries at ₹1,980. Let’s say that the stop-loss is placed at ₹1,970. Thus, the maximum loss if the stop-loss is triggered will be ₹10,000 (₹10 x 1,000).

Example 2: Market/limit sell and stop-loss buy

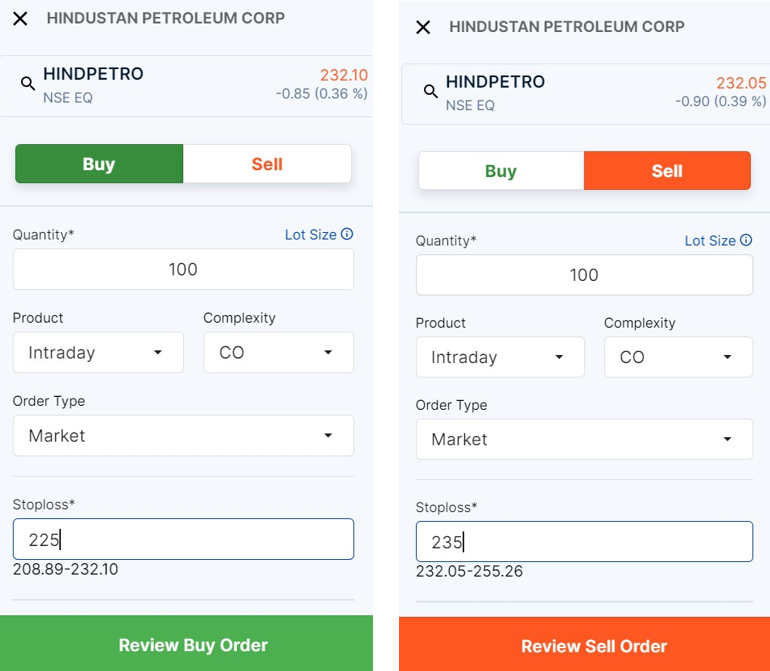

Let’s say that we’re placing a sell order for 100 shares of HPCL at ₹230. Now, assume that we’re set the stop-loss at ₹235. In this case, the maximum loss if the stop-loss is triggered will be ₹500 (₹5 x 100).

What are the benefits of a cover order?

Cover orders allow up to 5x margin for equity and up to 2x for futures. At the same time, stop-loss reduces downside risk, while placing no limits on returns. To know more about our margins click** here**.

Just like all intraday orders, auto square-off for cover orders takes place at 3:00 pm.

How to place a cover order on Upstox?

To place a CO for intraday equities and futures trading, follow the steps below:

- Select either ‘Buy’ or ‘Sell’.

- Enter the number of shares you want to buy in the ‘Quantity’ field.

- Select ‘Intraday’ under ‘Product’ and ‘CO’ under ‘Complexity’ from the drop-down menu.

- Select either ‘Limit’ or ‘Market’ depending on the order type.

- If you selected ‘Limit’, enter the limit price within the prescribed range.

- Enter the stop-loss price.

- Click on Review Order, and review the details.

- Click on Place Order.

Things to remember

- Once the cover order has been placed and the first leg has been traded, you won’t be able to cancel the cover order. You can only exit the current one-sided position.

- If the first order has not been traded, you can cancel the cover order.

- The stop-loss order can be modified within the stipulated price range. After the order has been modified, the margin will be recalculated.

Conclusion

Cover orders are a way of using margins to make profits, while limiting your potential losses. We are sure that the day traders among you will love using the CO feature on Upstox. Which other feature would you like us to add to our platform? We’re all ears.

Happy trading!

Disclosures and Disclaimer

Investment in securities markets are subject to market risks; please read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Past performance is not indicative of future results. Details provided in the above newsletter are for educational purposes and should not be construed as investment advice by RKSV group. Investors should consult their investment advisor before making any investment decision.