What is the Awesome Oscillator? How Does It Work in Trading?

Written by Subhasish Mandal

Published on January 07, 2026 | 3 min read

In the world of trading, traders often rely on a variety of technical indicators to make decisions about buying and selling of securities. One such indicator is the Awesome Oscillator. Developed by a trader and author, Bill Williams, the Awesome Oscillator is a technical analysis tool that is used to identify market trends, reversal and potential trade opportunities.

Understanding Awesome Oscillator

The Awesome Oscillator (AO) is a technical indicator used to measure the market momentum. It calculates the difference between a 34-period and a 5-period simple moving average (SMA). In this, the simple moving average is not calculated using the closing price, but rather it is calculated using the mid-points of each candlestick's bar.

AO also uses a zero line in the centre, either side of which price movements are plotted according to a comparison of 34-period and 5-period moving averages.

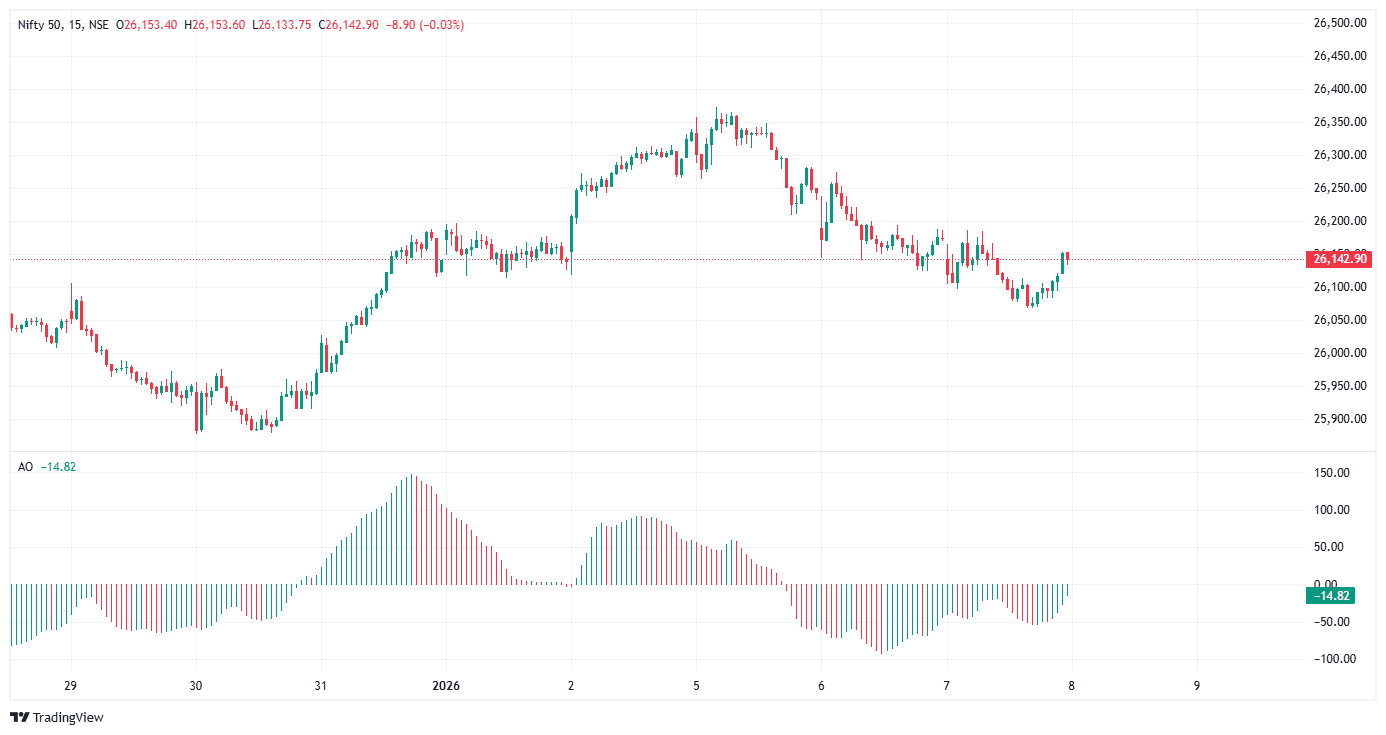

Here is the image of the Nifty price chart with an Awesome Oscillator placed in it.

Source: Upstox, TradingView

Formula of Awesome Oscillator

The Awesome Oscillator involves calculating two moving averages, which are subtracted from different period SMA to get the final figure. Follow the steps below.

Step 1: Calculate the 5-period SMA using the midpoint of each candlestick's bar.

- Midpoint price of a candle = (High + Low) / 2

- Take the midpoint price of the last 5 candlesticks.

Step 2: Calculate the 5-period SMA using the midpoint of each candlestick's bar.

- Midpoint price of a candle = (High + Low) / 2

- Take the midpoint price of the last 34 candlesticks.

Step 3: Subtract the 34-period SMA from the 5-period SMA.

- Awesome Oscillator formula = 5-period SMA - 34-period SMA.

How Does the Awesome Oscillator Work?

The Oscillator fluctuates above or below zero, indicating changes in the momentum of securities.

When the histogram bar is above the zero line (centre line), signals market momentum is bullish, and prices are expected to rise. Here, the numerical figure of the oscillator is positive.

However, when the histogram bar is below the zero line, signals market momentum is bearish, and prices are expected to fall. Here, the numerical figure of the oscillator is negative.

Awesome Oscillator Trading Strategies

Traders use signals generated by the Awesome Oscillator to plan their entry and exit points. Some of the common AO trading strategies you can use to improve your trading.

An Awesome Oscillator can be a very valuable tool for traders who look to identify the price points of shifting momentum. AO can be used as an indicator which generates buy/sell signals based on advanced statistical calculations using simple moving averages. Understanding AO trading strategies can help traders to make informed decisions during the live market.

About Author

Subhasish Mandal

Sub-Editor

finance professional with strong expertise in stock market and personal finance writing, he excels at breaking down complex financial concepts into simple, actionable insights. Holding a Master’s degree in Commerce, he combines academic depth with practical knowledge of technical analysis and derivatives.

Read more from SubhasishUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.