What happens After You Open a Demat Account?

Written by Upstox Desk

Published on February 06, 2026 | 4 min read

A demat account can be easily opened online. But have you ever wondered what happens after you open a demat account?

Once you open a demat account, you’ll officially enter the world of investing. You will receive a unique User ID and password to login into your trading account.

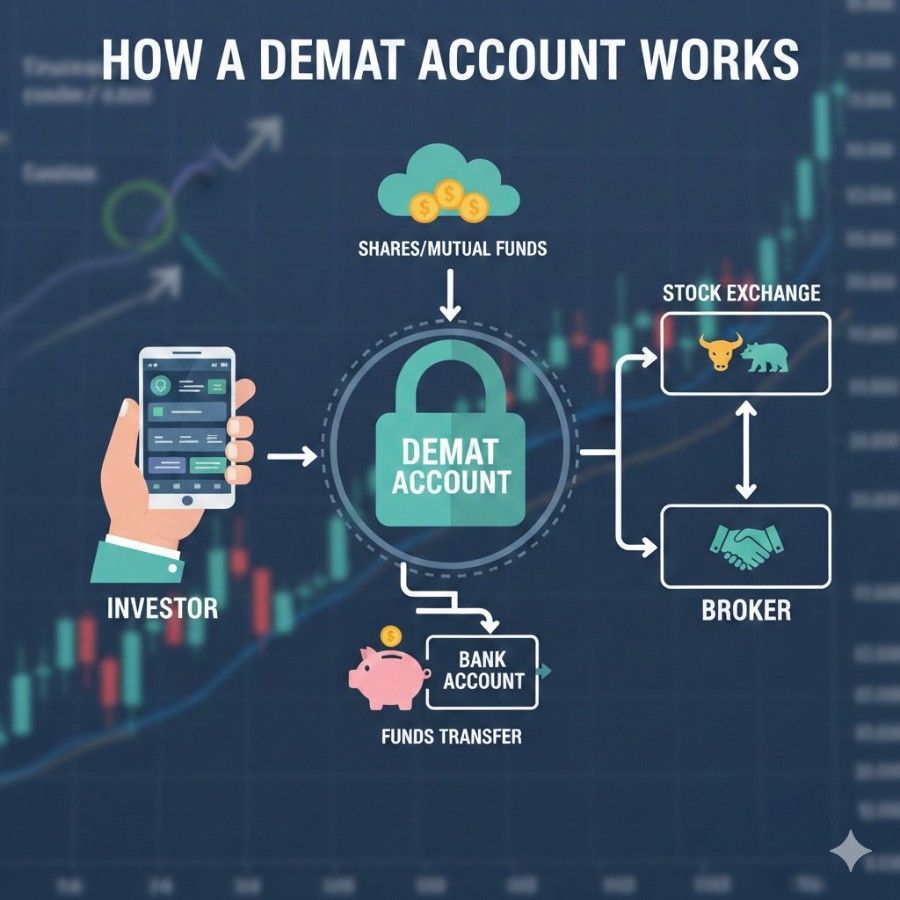

The trading is automatically linked to your bank account and demat account. After logging in, you can buy and sell shares online, which will be stored digitally in a demat account.

Before going forward, let’s understand what depositories and depository participants are.

Who is a Depository?

A depository is an institution that maintains an electronic record of securities and keeps everything safe in a demat account.

In India, there are two depository institutions. National Securities and Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

The facility of a demat account is provided by the depository for all investors through market intermediaries known as depository participants (DPs).

Who is a Depository Participant (DP)?

Depository participants (DP) are the stock brokers, banks, or financial institutions that act as intermediaries between the depository and investors. The primary task of DPs is to provide a platform for investors to open a demat account and buy/sell securities.

Coming back to the topic, after an investor completes the demat account opening process.

- KYC documents are verified by the DP

- After verification, the account is activated, and the user receives the account credentials.

- The demat account is linked to your trading account for buying/selling of securities and to your bank account for fund addition/withdrawal.

How Demat Account Work?

A demat account holds the securities bought by the investors. The securities are bought and sold through a trading account.

When an investor buys a security on a delivery basis, it gets electronically credited to their demat account. The funds are deducted from the trading account.

In contrast, when an investor sells a security, it gets debited from their demat account, and the funds are added to their trading account.

Since the securities are stored electronically in a demat account, all corporate actions related to a company (such as dividends, bonus shares, splits, etc.) are also settled automatically.

##Features of a Demat Account

Here are some important features of a demat account:

1. Easy Access to Securities: In a demat account, securities are held electronically and can be accessed by an investor from anywhere. All you have to do is log in to your broker account and find your investments under the holdings page.

2. Safe and Secure: Securities in a demat account are safe from the risk of forgery or theft. Only the investor can access his/her securities using the demat account credentials.

3. Loan Against Securities: Investors can also use their holdings as collateral to get a loan. The ownership of these pledged securities remains with the investor, but they are blocked from being sold.

4. Transfer of Shares: It is easy to transfer your securities from one demat account to another demat account, both held in the same investor's name.

5. Account Freezing: Investors get an option to freeze the securities for a certain period of time, restricting any transaction related to those holdings.

Conclusion

Opening a demat account is just the beginning of your investment journey. Once activated, it allows you to buy, hold, and track securities easily through a single platform.

From storing securities digitally to automatic credit of dividends, everything is managed efficiently without any paperwork. A demat account brings transparency, safety and convenience on a single platform.

Whether you are a beginner or an experienced investor, understanding what happens after you open a demat account helps you better understand the modern financial markets.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.