How Investments are Protected in a Demat Account?

Written by Upstox Desk

Published on February 03, 2026 | 4 min read

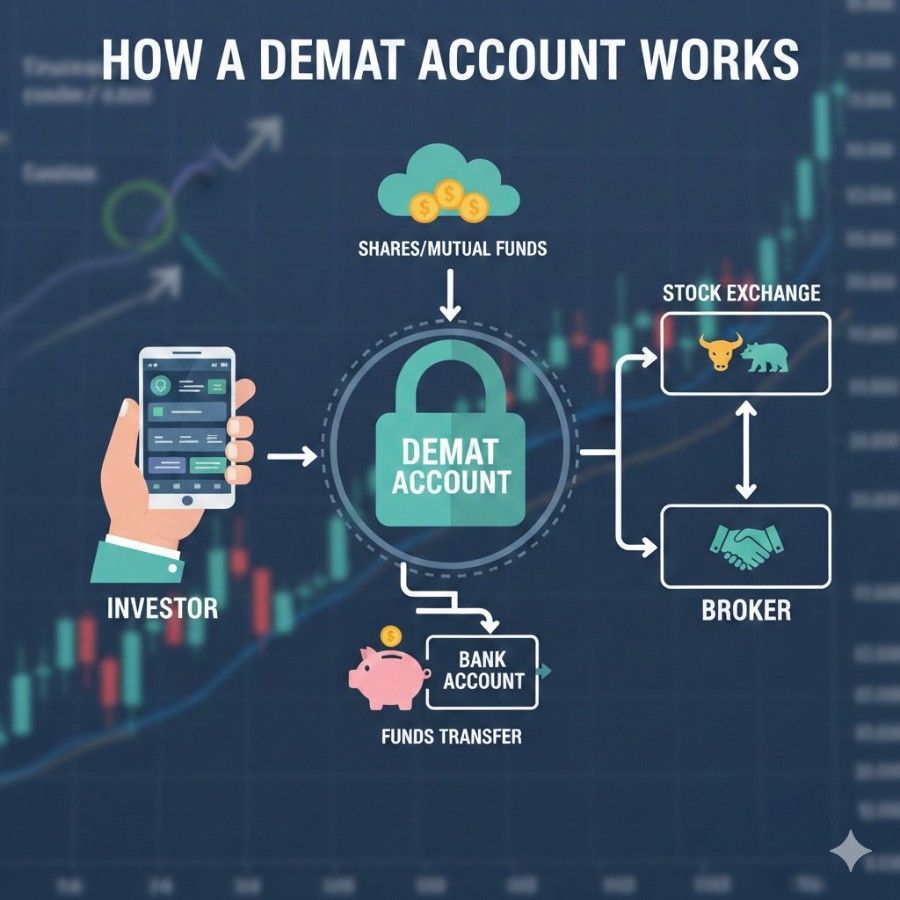

A demat account is a digital wallet where all your securities are stored electronically, making it easier to invest in the stock market. The investments are protected through a regulatory framework and encrypted digital safeguards.

The system is regulated by the Securities and Exchange Board (SEBI), which ensures your holdings are secure and traceable in electronic form.

Before diving into the topic, let’s see a brief overview of the demat account.

What is a Demat Account?

A demat account, also known as a dematerialised account, is a digital locker for your financial securities (e.g. shares, bonds, government securities, mutual funds, ETFs, etc). It protects the ownership of the asset by recording it electronically, eliminating the risk of holding paper certificates.

A demat account also simplifies the transfer of securities from one investor to another. The stocks you buy in your demat account today are credited on the next trading day. This is known as a T+1 settlement process.

Protection Mechanism in Demat Account

The safety of a demat account is managed with a multi-layered system involving regulatory bodies, depositories, and other security measures.

-

Regulatory Supervision: SEBI regulates the working mechanism of every demat account and also monitors the entire stock market. It enforces the rules for depositories and depository participants (stock brokers, banks, or other financial institutions) to ensure fair trade practices.

-

Separation of Share Holdings: The shares are held electronically with either of the two depositories, CDSL or NSDL. Stock brokers, banks, and other financial institutions only provide a platform for buying & selling financial securities. They don’t have the authority to hold the securities. This separation between depositories & depository participants protects the investor in case of any fraud or mismanagement.

-

Verified Transaction: As per the new rules, when selling shares, an extra security layer of authorisation is required. The selling transaction is either verified through TPIN or OTP sent to a registered mobile number. It restricts the unauthorised transfer of shares.

-

Payout to Investor Bank Account: As per the SEBI rules, funds received after selling securities can only be transferred to a bank account linked to the investor’s PAN card. This process reduces the risk of fraud or illegal transfer.

-

Real-time Alerts: For every buy or sell transaction, investors are notified by the depository via email and SMS. This helps investors spot and report suspicious transactions.

-

Investor Protection Fund (IPF): The government has created a fund to provide financial security and compensation to investors in case of any defaults or misuse of investors' money by market intermediaries.

-

Nomination: Demat account holders are required to register at least one nominee for a hassle-free transfer of financial securities at the time of an unfortunate event. The nomination facility helps in avoiding legal disputes.

-

Account Freezing: Investors can freeze their demat accounts temporarily if any suspicious activity is detected. This facility blocks all debit transactions from the account.

Is a Demat Account Safe?

Yes, a demat account is completely safe. Make sure to open a demat account only with a SEBI-registered depository participant (stockbroker, bank, or financial institution). Demat accounts are encrypted with advanced technology and multiple layers of verification to prevent any fraud or misuse.

Along with these safeguards, investors must use a strong password, keep the account details private, and check account activity regularly.

Conclusion

A demat account makes it safe & convenient to invest in the stock market. It safely stores the securities in an electronic form with a detailed record of every transaction. Each demat account is unique and is encrypted with advanced technology. This reduces the chances of any fraud or misuse. These protection mechanisms provide a sense of safety for investors to explore the stock market.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.