How A Demat Account Works?

Written by Upstox Desk

Published on February 06, 2026 | 4 min read

A demat (dematerialised) account works as a digital wallet for your securities (stocks, mutual funds, ETFs, bonds, IPOs, etc). It digitally stores the stocks and other financial securities, eliminating the need for paper documents. A demat account is mandatory to invest in the stock market.

With a free demat account on Upstox, you can access a range of powerful tools to participate in the stock market.

What is Dematerialisation (Demat)?

Dematerialisation is a process of converting physical share certificates into an electronic form. In this process, the company retrieves physical share certificates, and an equivalent number of shares is then credited to the investor's demat account. Buying shares using physical certificates isn’t possible anymore, as the process is now completely online.

When Was Demat Account Started in India?

In India, the Securities Exchange Board of India (SEBI) started issuing demat accounts in 1996, mainly for transactions in the National Stock Exchange (NSE). Demat account revolutionised investing by making it more secure, efficient and paperless, thereby increasing access to every Indian.

The system of a demat account operates through three major components:

Depositories

Organisations like National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) hold the securities in electronic form.

They maintain accurate records, handle account transfers, track corporate actions (e.g. dividends, bonus issues, stock splits, etc), and ensure the smooth functioning of demat accounts.

Depository Participants (DPs)

DPs are financial intermediaries that bridge the gap between depository institutions and investors. DPs can be stockbrokers, banks or financial institutions. Investors can open their demat accounts with a DP and use that account to buy/sell shares in the stock market.

Market Regulator

Being the market regulator, the Securities and Exchange Board of India (SEBI) ensures that all operations in the stock market are transparent & as per the regulations to protect the interests of the investors. SEBI closely monitors the operations of all market participants, including stock exchanges, brokers, listed companies and investors.

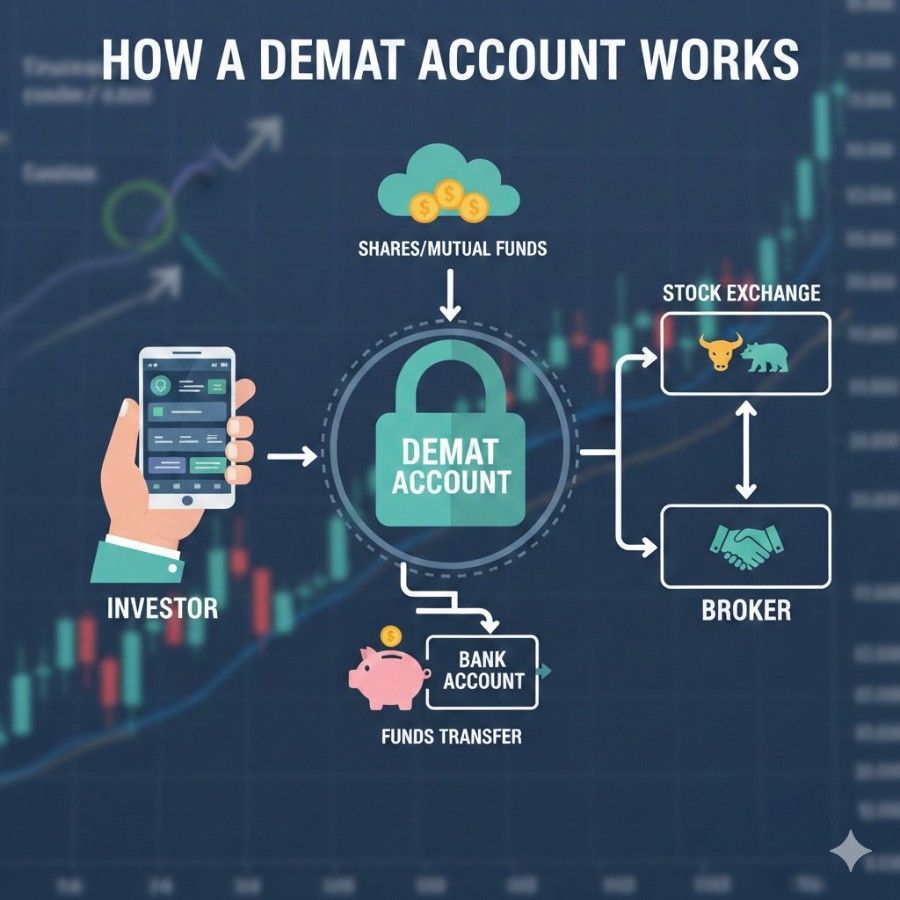

How Does a Demat Account Work?

The purpose of a demat account is to hold shares for the short or long term. Here is a step-by-step process to explain how a demat works:

-

Opening a Demat Account: An investor needs to open a demat account with a depository participant (DP). The DP can be a stockbroker like Upstox, which must be registered with a Depository (either CSDL or NSDL).

-

Linking Demat with Trading Account and Bank Account: At the time of opening a demat account, the broker automatically links your trading account with your bank account, which helps in transferring funds. A trading account is a service provided by a broker, which is mandatory for buying/selling stocks.

-

Buying Shares: When you place a buy order from your trading account, the money is debited from your trading account, and the broker sends instructions to the depository (CDSL or NSDL) to credit the shares in your demat account.

-

Holding Shares: After the T+1 settlement, the bought shares are stored in a demat account. DP maintains the record of ownership, transaction history and corporate actions.

-

Selling Shares: When an investor wishes to sell the shares, they place a sell order from the trading account. The broker informs the depository about the sell order, and the shares are debited from the demat account. This transaction is only possible when a buyer is available and ready to pay the price at which the sell order is placed.

How are Trading and Demat Accounts Different?

Trading and demat accounts are different types of accounts used together to complete the investing process.

A trading account provided by your broker is used to place buy and sell orders in the stock market. It is linked to your bank account and demat account. Whereas a demat account is where your shares and other financial securities are stored digitally after the purchase.

Conclusion

Demat accounts are crucial for the digital age of investing. Holding your securities in an electronic form makes it safer, convenient, and efficient. It eliminates the need for physical share certificates and reduces the risk of loss or forgery.

The working of a demat account is managed by the depositories (NSDL and CDSL), which maintain the record of ownership, transaction history and corporate actions.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.