All You Need To Know About a Demat Account

Written by Upstox Desk

Published on February 06, 2026 | 4 min read

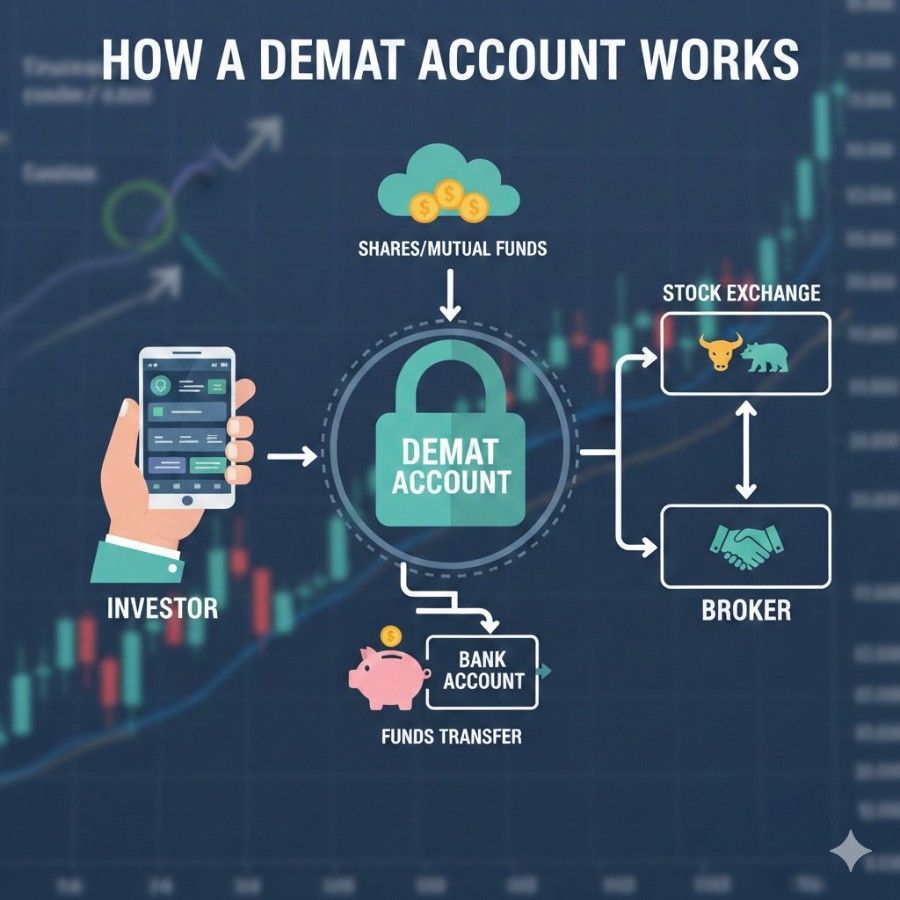

When I thought of investing in the stock market, the first question was, do I need a separate account other than my bank account? After researching, I came across the term “Demat Account”. A demat account is a digital wallet used to securely hold financial securities like shares, bonds, mutual funds, etc.

In India, a demat account is mandatory to invest in the stock market. But wait, a demat account works as a wallet to store securities, how am I able to buy or sell those securities from the stock exchange? To buy/sell securities, you need a trading account.

Both a trading account and a demat account are mandatory to invest in the stock market.

Types of Demat Account

Demat account can be classified into 4 main types. Investors can opt to open a demat account in any of the following types:

1. Basic Services Demat Account (BSDA): This is a low-cost demat account meant for small investors whose investment value of holding does not exceed ₹2 lakh. The BSDA demat holders will not be charged annual maintenance charges (AMC) for a holding value up to ₹50,000.

For holding value between ₹50,000 to ₹2,00,000, ₹100 will be charged as AMC. For a holding value above ₹2,00,000, the AMC charges will be the same as a regular demat account.

2. Regular Demat Account: This is a normal demat account available for every Indian resident. The AMC charges are higher compared to a BSDA account, but they offer additional services.

3. Repatriable Demat Account: This demat account can be opened by Non-Resident Indians (NRIs). Investors can transfer investment profits from India to a foreign country. It is linked to a Non-Resident External (NRE) bank account.

4. Non- Repatriable Demat Account: It is also a type of demat account which is opened by Non-Resident Indians (NRIs). But in this account, profits earned through investment cannot be freely transferred to a foreign country. The money must stay in India and should only be used for expenses or investment within India.

Benefits of a Demat Account

Investors looking to open a demat account can enjoy several benefits. Here are the most common benefits:

1. Digital Record of Securities: All financial securities are stored electronically in a digital format, making it easy to access from anywhere.

2. Automatic Updates of Corporate Actions: Corporate actions such as dividends, bonus shares, rights issues, etc., are all automatically updated.

3. Easy Transfer Process: Shares can be easily transferred to a nominee in case of any unfortunate event.

How To Open A Demat Account Online?

To open a demat account online with Upstox, you need to visit the website or download the mobile app and complete the KYC process. Below is the step-by-step guide:

1. Visit Upstox Online:

- Visit the Upstox official website or,

- Download the Upstox App from Google Play or App Store.

2. Start the Sign Up Process

- Enter your mobile number

- Verify the number with an OTP

3. Set Your Login Pin and Email

- Set a 6-digit login pin for a secure login.

- Enter your email and verify with OTP

4. Personal Details

- Full Name

- Date of Birth

- Occupation

- Annual Income

5. Enter PAN and Aadhar Number

- Enter PAN number

- Enter your Aadhaar number and verify it with the OTP sent to your Aadhaar-registered mobile number.

6. Complete the E-KYC process

- Link your Digilocker to fetch identity proof and address details.

7. Live Photo/IPV (In-person verification)

- Allow the camera access of your device and click a live photo to verify identity.

8. Link Your Bank Account

- Add your bank account

- Enter the account number and IFSC code

9. Select Segment

- Equity

- Future and Options (requires income proof)

- Commodity

- Currency

10. Draw or Upload Signature

- Draw your signature inside the app or upload the image of your signature (on white paper).

11. Add Nominee Details

- Add a nominee to your demat account. (You can add a nominee after opening your account as well)

12. E-sign and Submit

-

E-sign the account opening form with Aadhaar-based OTP and click on submit.

-

Once the account opening form is submitted, the Upstox team will review it and verify the details. If all details are correct, your account will be activated, and a User ID along with a password will be sent via email/SMS.

Conclusion

A demat account is essential and mandatory for investors looking to invest in the stock market. It keeps the record of securities and stores them in a digital format, making it safe from the risk of forgery or theft. Opening a demat account is a quick and easy process that can be done online in just a few minutes.

About Author

Upstox Desk

Upstox Desk

Team of expert writers dedicated to providing insightful and comprehensive coverage on stock markets, economic trends, commodities, business developments, and personal finance. With a passion for delivering valuable information, the team strives to keep readers informed about the latest trends and developments in the financial world.

Read more from UpstoxUpstox is a leading Indian financial services company that offers online trading and investment services in stocks, commodities, currencies, mutual funds, and more. Founded in 2009 and headquartered in Mumbai, Upstox is backed by prominent investors including Ratan Tata, Tiger Global, and Kalaari Capital. It operates under RKSV Securities and is registered with SEBI, NSE, BSE, and other regulatory bodies, ensuring secure and compliant trading experiences.