- Home/

- IPO

1.32x

subscribed

Euro Pratik Sales

1.32x

subscribed

Euro Pratik Sales Limited IPO Details

Euro Pratik Sales Limited IPO Overview

Euro Pratik Sales Limited IPO date

Euro Pratik Sales Limited IPO will open for subscription on September 16, 2025, and the closing date for the IPO is September 18, 2025. After this, investors are expected to be updated about the allotment status on September 19, 2025.

Investors who have been allotted shares can expect them to be credited to their demat account on September 22, 2025. The shares will be listed on the NSE and the BSE on Tuesday, September 23, 2025.

Euro Pratik Sales Limited IPO price band

The IPO includes an offer for sale. The IPO price band has been set between ₹235 to ₹247 per share. Interested investors can choose a price within this band to apply for the IPO.

The IPO is a book-building issue, comprising an offer for sale of ₹451.31 crore only.

Euro Pratik Sales Limited's IPO listing price will be determined on September 23, 2025. The listing price is the price at which a company’s shares debut on the stock exchanges.

Euro Pratik Sales Limited IPO lot size

Euro Pratik Sales Limited IPO details have been declared. The minimum lot size for an application is 60 shares, and the investor would have to apply for a minimum of 1 lot. Meanwhile, the IPO issue size is approximately ₹ 451.31 crore.

Checklist

Compare

Companies in this sectorObjectives

Strength and Weakness

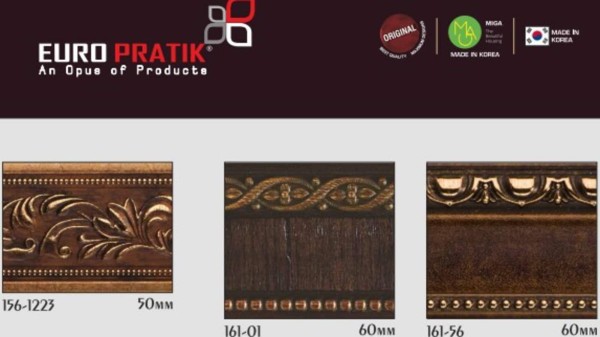

The company has a 15.87% revenue market share in FY23 among organised players, making it one of the biggest brands in this category. Its brands “Euro Pratik” and “Gloirio” are well recognised due to their focus on quality, trendy designs, and customer satisfaction.

As of FY25, the company had 30+ categories, 3,438 SKUs and 3,000+ designs. It has introduced first-to-market products like Louvers, Chisel, and Auris, which gave it a head start over competitors. The portfolio also includes 11+ laminate products (Sapphire, Acroglass, Aster, Corriano, Icore, Docore, Mirage, etc.) plus other items.

The company works like a fast-fashion brand for interiors, always updating collections. It launched 113 product catalogues in 4 years. Its strong design team and advisory architects guide new product creation. Currently, it has 9 new products and 308 designs in the pipeline.

As of FY25, it had 180 distributors across 25 states and 5 union territories. The distribution network covers metros, mini-metros, tier I to tier III cities, ensuring deep consumer reach. In terms of sales, the South region brought in the highest share at 27%, followed by the North and West at about 18% each, while the East contributed around 10% and the Central region about 3%.

The company outsources the manufacturing to 36 contract manufacturers across India, South Korea, China, the USA, Turkey, Portugal etc. This avoids heavy investment in factories and keeps operations cost-efficient. It focuses instead on branding, product design, and distribution, which are high-margin areas.

About Euro Pratik Sales Limited

IPO Analysis