Introduction to Option Greeks

Introduction to the Option Greeks

The next several lessons will cover the “main” option Greeks. The Greeks can inform a trader about how the option price will change if other factors – like the underlying price – change. These are some example questions that the Greeks can help you understand:

- How will the price of the option react if the underlying price goes up or down?

- How will the price of the option react if the volatility of the underlying goes up or down?

- How will the price of the option react as expiration gets closer?

- How will the price of the option react if interest rates go up or down?

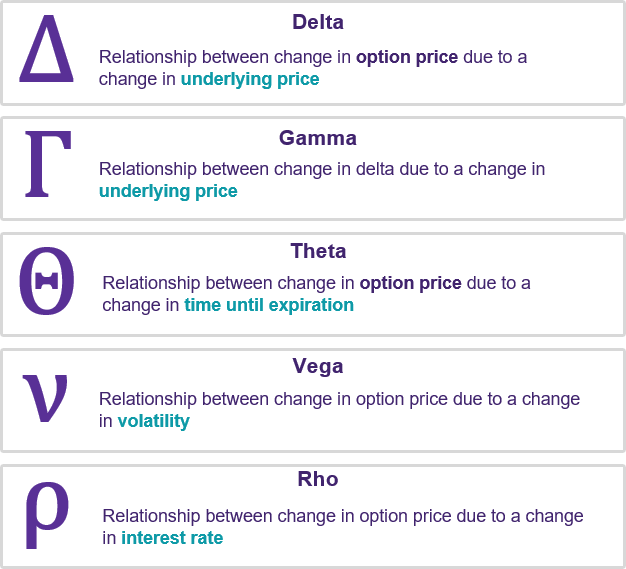

Illustration 1 provides a preview of the “main” Greeks.

Illustration 1

Source: Upstox

Source: UpstoxWe differentiate them as “main” Greeks because there are additional Greeks that are derivatives of these and are beyond the scope of this course. For your reference, these “secondary” Greeks are:

- Charm: Sensitivity of delta to time decay (also known as delta decay).

- Vanna: Sensitivity of delta to changes in implied volatility.

- Veta: Sensitivity of Vega to time decay (also known as Vega decay).

- Vomma: Sensitivity of Vega to changes in implied volatility (also known as Vega convexity).

The Greeks & Upstox

As we discuss the Greeks in the upcoming lessons, there isn’t a need to perform any calculations or analysis. All of this information is available in the option chain. The Upstox Pro app provides the Greeks as well as other data points such as open interest, volume, and put-call ratio in the option chain.

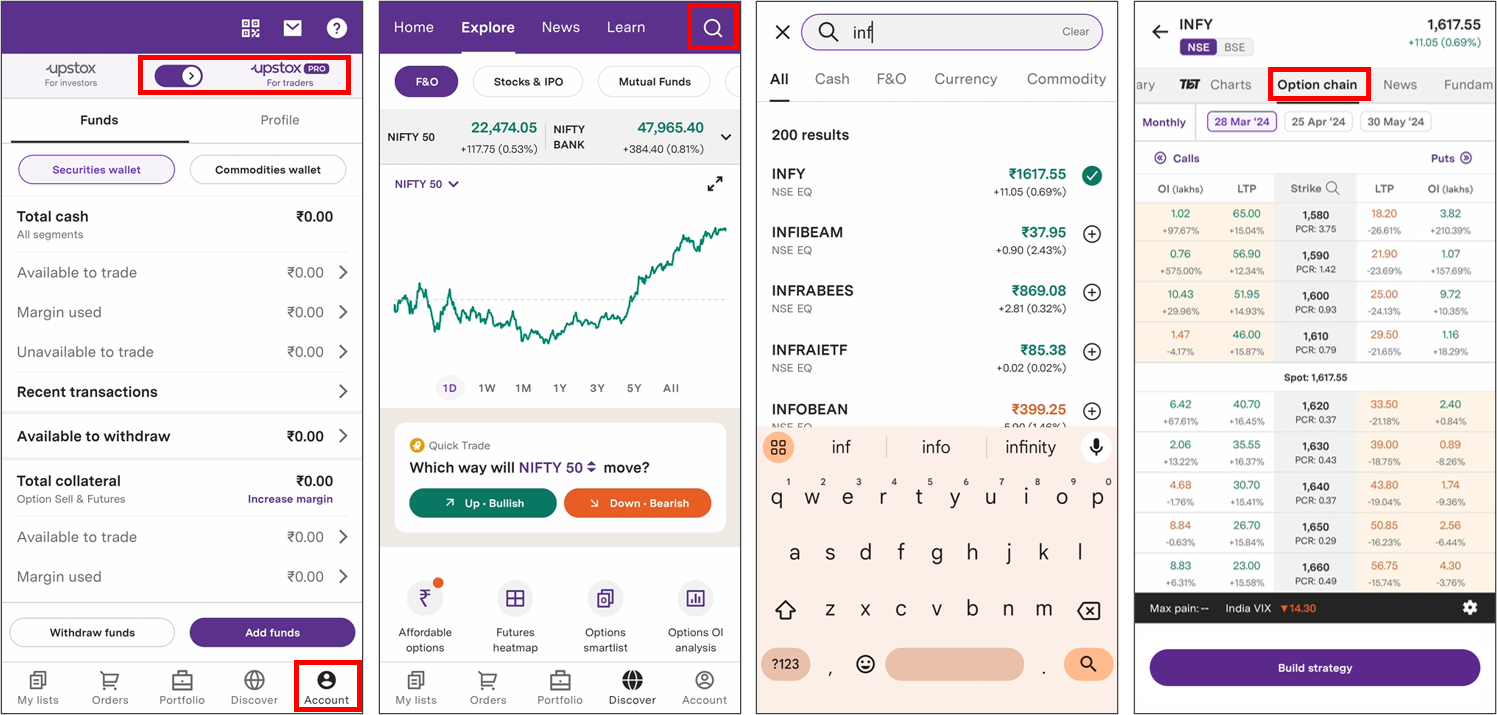

Illustration 2 shows you how to navigate to this feature.

Illustration 2

Source: Upstox

Source: UpstoxTo access the Option Chain in Upstox:

- Login to the Upstox app and ensure that you are on the Pro section of the app. If you aren’t on the Pro section, you can toggle over from the Invest section of the app in your “Account” which you can find on the bottom right.

- If you are on the Pro section of the app, click the “Discover” button on the bottom rail.

- In our app, there are a number of ways to do certain actions, but we will go through the most common. You will see a search icon in the top right.

- Type in the name of the company or ticker symbol you are looking for. Click on the search result.

- You will be directed to the “Summary” tab which provides the details for the particular symbol.

- Click on the “Option Chain” tab.

On this tab, you will see the Upstox Option Chain where you can select various expiries and scroll to view additional data points. To configure what you see on your option chain, you can click on the ‘gear’ icon on the bottom right. This will allow to select or de-select the different data points as well as reorder them.

Summary

- Option Greeks provide traders with information about how the option price will vary as certain parameters change like the underlying price, implied volatility, or time until expiration.

- There are main, or primary, Greeks as well as secondary Greeks. The primary Greeks are Delta, Theta, Vega, Gamma, and Rho.

- You can find option Greeks in many option chains. The Upstox option chain can be found in the Pro section of the Upstox app.

Is this chapter helpful?

- Home/

- Introduction to Option Greeks