Upstox Originals

What gives Asian Paints an edge over its peers?

.png)

5 min read | Updated on July 18, 2024, 20:01 IST

SUMMARY

Asian Paints boasts of over 160,000 retail touchpoints across the country. On the contrary, Berger Paints, the second largest paint company in India, has a distribution network of 60,000, which is less than half of Asian Paints. The company offers single-digit margin to its players but dealers prefer to keep inventory of Asian Paints compared to other brands as its products are fast-moving, which results in high inventory turnover and profitable business for the dealers.

Stock list

Asian Paints products are fast-moving, which results in high inventory turnover and profitable business for the dealers.

The company generates most of its revenue from decorative paints (88% of FY24 revenue) followed by International business (9% of revenue) and industrial paints (3% of revenue).

Higher margins

Asian Paints boasts the largest distribution network in India, which acts as a moat for the company.

The conventional distribution channels start from the manufacturer and then go through wholesalers, distributors, and retailers, and finally reach end customers. However, in the mid-19th century, the company took a bold decision to bypass wholesalers and distributors and reached out directly to retailers. Consequently, the company started to enjoy higher margins, and the prices of its final products were lowered due to the elimination of commissions charged by wholesalers and distributors. The company now retains more than 90% of the maximum retail price (MRP), whereas other companies typically retain only 60-70% of the MRP.

Ahead of its time

In 1970, the company spent a whopping ₹8 crore to buy the first supercomputer in India, this decision was way ahead of its time and now the company boasts one of the most efficient demand forecasting mechanisms in the country. Asian Paints’ demand-forecasting mechanisms use real-time and historical data, market intelligence, and advanced statistical models, including machine learning algorithms, to generate accurate estimates at the depot SKU level. This mechanism helps a company to forecast the demand accurately and efficiently manage supply to paint shops in advance. Notably, with this robust demand forecasting mechanism Asian Paints delivers its products to dealers 3-4 times a day which no other paint company in India can match.

Ahead of its peers

Asian Paints boasts of over 160,000 retail touchpoints across the country. On the contrary, Berger Paints, the second largest paint company in India, has a distribution network of 60,000, which is less than half of Asian Paints. The company offers single-digit margins to its dealers However, they prefer to keep an inventory of Asian Paints over other brands as its products are fast-moving, resulting in high inventory turnover and profitable business for the dealers compared to slow-moving products with high margins.

Additionally, another initiative that helped the company thrive in the paint business is the pioneering concept of tinting machines. For an industry like paint, it is very difficult or even impossible to predict the demand as there are hundreds and thousands of shades of paint and different customers will demand different shades of paint. Making the right paint available just when the customer needs has resulted in stellar growth for Asian Paints. The tinting machines can help to deliver the exact shades demanded by the customer as it is equipped with various colourants and pigments that can be precisely measured and mixed according to the customer's requirement.

The machine dispenses the required shade colours into a base paint, which is generally a white or neutral-coloured paint. With this, the customers get their desired shades within a few minutes. Earlier, it would have taken a couple of weeks at least to deliver the customised shade of paint.

As per an industry report, Berger and Nerolac together have deployed around 46,000 tinting machines through their dealers whereas, Asian Paints alone has more than 50,000 tinting machines.

Strong distribution network

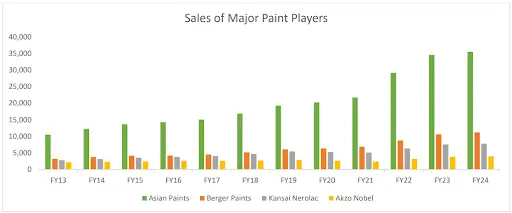

The company is leveraging its robust distribution network to deliver hundreds or thousands of shades of paints to end customers as and when there is demand. This strong supply chain and robust distribution network have helped Asian Paints to beat the competition and consistently maintain its leadership position for such a long period. Consequently, Asian Paints generates revenue, which is more than the combined revenue of the other 3 major paint players in India.

The company is leveraging its robust distribution network to deliver hundreds or thousands of shades of paints to end customers as and when there is demand. As per an Industry report, Berger and Nerolac combinedly have deployed around 46,000 tinting machines through their dealers whereas, Asian Paints alone has more than 50,000 tinting machines.

Commanding position for decades

This strong supply chain and robust distribution network have helped Asian Paints to beat the competition and consistently maintain its leadership position for such a long period. Consequently, Asian Paints generates revenue, which is more than the combined revenue of the other 3 major paint players in India.

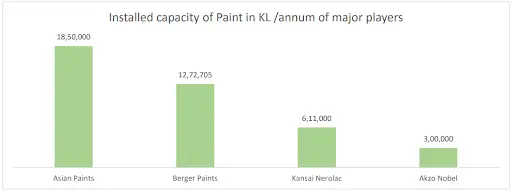

The company also has India’s largest decorative paint manufacturing capacity of 18,50,000 (KL/annum) as of FY24 which has jumped from only 6,00,000 in the fiscal year 2010-11.

Wealth & value creation for investors

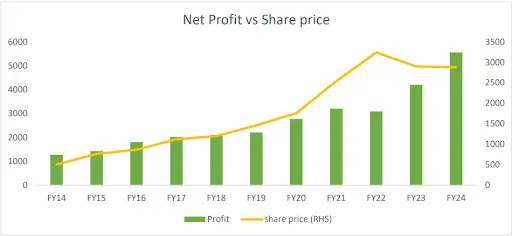

With a strong brand value, a robust distribution network coupled with efficient demand forecasting mechanism technology, Asian Paint has created massive wealth for its investors through capital appreciation and has been paying regular dividends as well. The average dividend payout ratio for the last 10 years is around 50%. Remarkably, during FY14-24, the company’s net profit grew at a CAGR of 16% and this is reflected in the stock price of the company, which grew at a CAGR of 19%. The 3% extra CAGR over the growth rate of net profit is due to expansion in the company's price-to-earnings multiple from 40 in FY14 to 50 in FY24. Compared to Asian Paints’ 19% CAGR during FY14-24,the BSE 100 delivered a CAGR of around 13.5%.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story