Upstox Originals

SME IPO frenzy: What investors need to know

.png)

6 min read | Updated on September 14, 2024, 11:30 IST

SUMMARY

~40%! That is how much the top 10 retail subscribed SME IPOs of 2024 are down from their 52W highs. Despite this, SME IPOs continue to see a significant rise in popularity, attracting large investments. There are genuine company offerings, of course. However, the surge in retail participation without adequate diligence can lead to huge financial losses. This among other reasons has promoted SEBI to introduce measures to address these issues and protect investors. Read on to learn more.

Frenzy in SME IPOs could lead to losses for investors

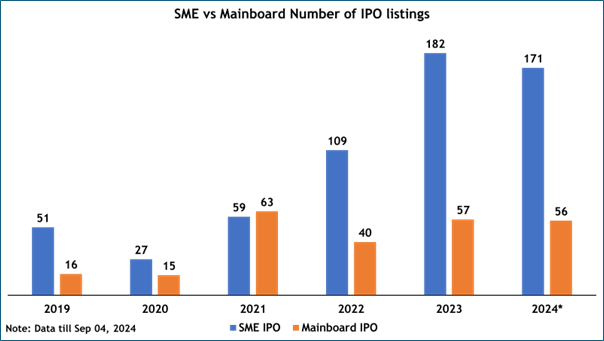

SME IPOs have recently taken the Indian stock market by storm, with over 100 companies debuting in the last three years. While investor enthusiasm has surged, with record-high subscriptions, concerns are emerging that this boom may be more of a speculative fad than a sustainable trend.

Among others, two recent SME IPOs have further fueled these concerns.

- Boss Packaging, aiming to raise just ₹8 crore, received bids exceeding ₹1,000 crore, despite questions being raised about underlying fundamentals.

- Similarly, Resourceful Automobile, a modest Delhi-based motorbike dealer with just 2 showrooms and 8 employees, sought ₹12 crore but saw bids worth ₹4,800 crore, even as it reported negative cash flow.

These cases highlight the current frenzy, with both IPOs being subscribed hundreds of times over. SEBI has flagged potential risks, warning that this excitement might lack solid financial foundations. As tighter regulations loom, the question arises: is the SME IPO rise a bubble on the verge of bursting?

The graph tells a striking story: in 2021, Mainboard and SME IPO listings were neck and neck. Fast forward, and SME IPOs have skyrocketed, surging a staggering threefold, while Mainboard IPOs have plummeted in a dramatic decline.

Source: Chittorgarh.com

SME IPOs have lower regulations to access the capital markets more easily. This "light-touch" regulatory framework reduces compliance burdens and lowers costs, making it more feasible for smaller companies to go public. By easing these regulations, SME IPOs provide a valuable alternative to traditional bank funding, helping businesses raise capital while also increasing their visibility in the market.

Difference between Mainboard IPO and SME IPO

| Basis of Difference | Mainboard IPO | SME IPO |

|---|---|---|

| Minimum subscribers/allottees | 1,000 | 50 |

| Prospectus vetting | By SEBI | By Exchanges |

| Minimum Investment amount | ₹13,000 - ₹15,000 | ~₹1 lakh |

| Cost & time | Costlier, slower | Cheaper, faster |

| Reporting frequency | Quarterly | Half-yearly |

| Issue eligibility | Strict SEBI norms | Relaxed norms |

| Listing Exchange | BSE/NSE | BSE SME/NSE Emerge |

Source: Wright research, Investor gains

SME IPO markets seem to be in a frenzy, here’s what the data shows us

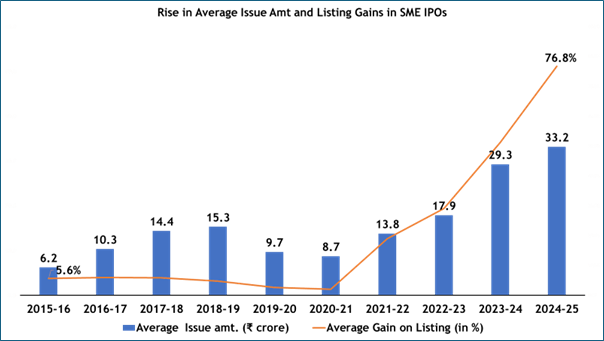

Rise in average issue amt and elevated listing gains

From 2015 to 2021, average listing gains for SME IPOs hovered between a modest 5-10%. But in a dramatic turn, these gains have skyrocketed to a staggering 76.8% in recent times. And that’s not all—average issue amounts have also seen a meteoric rise, nearly quintupling from ₹6.2 crore in 2015-16 to an impressive ₹33.2 crore for 2024-25.

Source: Prime Database, NDTV Profit

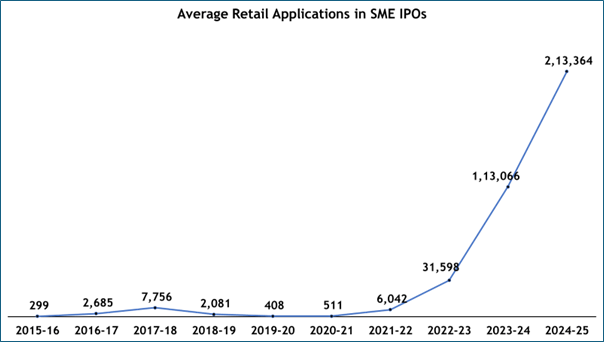

Meteoric rise in retail SME IPO participation

In 2015-16, SME IPOs saw a mere 299 retail applications on average. Fast forward to today, and this figure has exploded by an astonishing 700x, with a jaw-dropping 213,000 applications per IPO in the current fiscal year. Over 2022-2024, this number has gone up almost 35x. On comparison, the average number of retail investor applications for Mainboard IPOs surged to 12.1 lakh, just double from the 5.1 lakh in 2022 (source: Prime Database, Economic times)

Source: Prime Database, NDTV Profit

The risks: How investor unawareness in SME IPOs can lead to significant losses

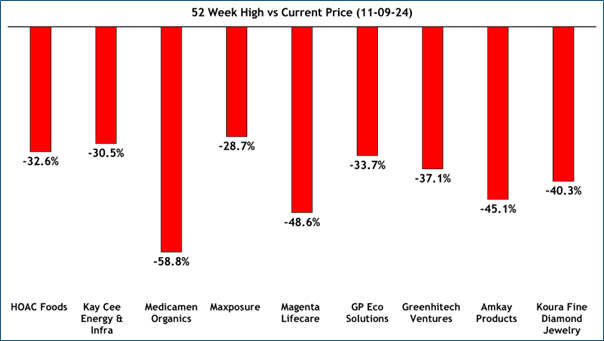

Top retail subscribed SME IPOs of India in 2024

| Issue Name | Issue Size (₹ Cr) | Retail subscription (x) | Total subscribed (x) |

|---|---|---|---|

| HOAC Foods India Limited | 5.5 | 2556.5 | 2013.6 |

| Kay Cee Energy & Infra Limited | 15.9 | 1311.1 | 1052.5 |

| Medicamen Organics Limited | 10.5 | 1309.8 | 993.6 |

| Maxposure Limited | 20.3 | 1034.2 | 987.5 |

| Magenta Lifecare Limited | 7.0 | 778.4 | 983.2 |

| GP Eco Solutions India Limited | 30.8 | 793.2 | 856.2 |

| Greenhitech Ventures Limited | 6.3 | 597.4 | 770.0 |

| Amkay Products Limited | 12.6 | 973.1 | 748.0 |

| Koura Fine Diamond Jewelry Limited | 5.5 | 1084.0 | 733.0 |

Source: Chittorgarh.com

Despite the impressive oversubscription rates and strong initial listing gains, many of the companies in the table show a worrying trend. After reaching their respective 52-week highs shortly after their debut, the stock prices began to decline sharply. This pattern has left many early investors facing negative returns within days or weeks of listing, turning what initially appeared to be a winning investment into a losing proposition.

Source: NSE, BSE

The sharp downturn from the 52-week high raises concerns about the sustainability of these IPO gains. It suggests that the initial stock price surge may not be fully supported by market fundamentals, with prices often declining once the early excitement fades. For retail investors, this volatility presents a risk, as early optimism can quickly give way to negative returns.

Some potential reasons for this euphoria could be: -

- Greed: Some promoters are tempted to manipulate financial statements to boost their share prices and cash out at higher valuations.

- Lack of oversight: The SME market, while growing rapidly, may have fewer safeguards compared to the mainboard market. This can create opportunities for fraud.

- Investor naivety: Some investors may not conduct sufficient due diligence, making them vulnerable to scams.

Key precautionary measures

Steps SEBI has taken to curb enthusiasm for SME IPOs

- 90% cap on listing gains: SEBI imposed a 90% cap on SME IPO listing gains to curb speculation and reduce post-listing volatility.

- Advisory on SME promoters: SEBI warned intermediaries to avoid unethical SME promoters, highlighting concerns over inflated fees and questionable practices.

- Increased scrutiny of intermediaries: SEBI urged intermediaries like merchant bankers and auditors to be cautious about the companies they support, emphasizing integrity in the IPO process.

- Enforcement actions: SEBI has taken steps to penalize companies manipulating IPOs, with potential consequences for those inflating financials or taking shortcuts.

Steps Investors can take

- Investor education: Increase awareness campaigns to inform retail investors about the risks of SME IPOs and encourage investment based on fundamentals, not short-term gains.

- Prioritize transparency: Focus on companies with clear, detailed financial reports to avoid inflating their value.

- Stay Informed on regulations: Keeping up with SEBI's evolving rules can help investors make better decisions.

- Understand risks: Acknowledge the volatility and risks inherent in SME IPOs to make more cautious investments.

- Monitor performance: Keep track of a company’s post-IPO performance and adjust strategies if necessary.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story