Upstox Originals

Ola Electric IPO: Charging ahead in the EV industry

.png)

7 min read | Updated on August 01, 2024, 08:44 IST

SUMMARY

Ola Electric, India's electric two-wheeler pioneer, is all set to make waves with its IPO opening on August 2, targeting a valuation of ~$4.2 - $4.4 billion. This article analyses its journey and evaluates its market share, financials, and valuations. We also highlight a few key factors for investors to monitor.

Ola Electric is India’s first homegrown pure E2W company

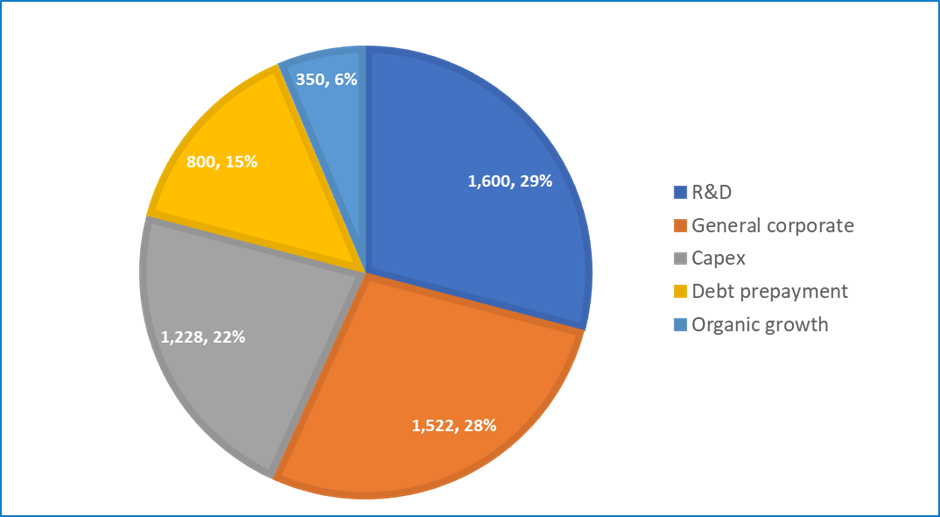

Ola Electric, India’s homegrown pure E2W company is set to hit Dalal Street with a fresh share issue worth ₹5,500 crore and an offer for sale (OFS) of ₹646 crore. It is targeting a valuation of ~$4.2 - $4.4 billion. The chart below shows the use of funds raised via the fresh issue.

Use of funds (₹ Crore)

Source- Ola Electric RHP

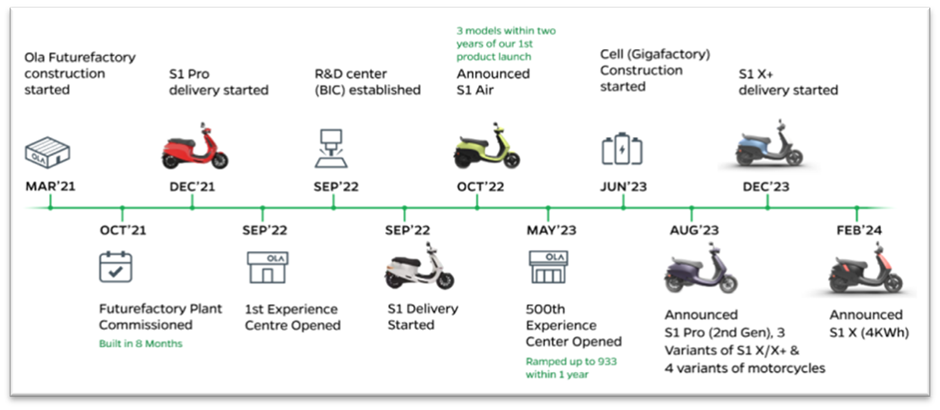

Source- Ola Electric RHPHistory of Ola Electric in India

Ola began its journey as a pure EV player in 2017 and introduced its first EV scooter, the Ola S1 Pro in December 2021. As of March 31, 2024, Ola had 870 experience centers and 431 service centers.

Source- Ola Electric RHP

Source- Ola Electric RHPOla’s current product portfolio

Ola's current portfolio includes 6 Scooters, with prices ranging from ~₹80,000-₹1,50,000. These are powered by its Gen-2 platform. Compared to Gen-1, these scooters have features like 11 kW motor power, 0-40 kmph acceleration in 2.6 seconds, a higher certified range of 195 km, and a top speed of 120 kmph.

Source- Ola Electric RHP

Ola’s portfolio analysis

| # | Scooter | Major select competitors |

|---|---|---|

| 1 | Ola S1 Pro | Ather 450X, TVS iQube Electric, Hero Electric Photon HX |

| 2 | Ola S1 (Air) | TVS iQube S, Hero Electric Optima CX, Simple One |

| 3 | Ola S1 (X+) | TVS iQube Standard, Hero Electric Optima CX, Ampere Magnus EX |

| 4 | Ola S1 X(4kWh) | TVS iQube Standard, Hero Electric Optima CX (Double Battery), Ampere Magnus EX |

| 5 | Ola S1 X(3kWh) | Hero Electric Optima CX (Single Battery), Ampere Magnus EX, Okinawa PraisePro |

| 6 | Ola S1 X(2kWh) | Okinawa PraisePro, Bounce Infinity E1 |

Source- Ola Electric RHP

Below, we compare the Ola S1 Pro to Ather 450X. We note that the Ola scooters pack in more in a similar price range.

Ola S1 Pro versus Ather 450X

| Model | Ola S1 Pro | Ather 450X |

|---|---|---|

| Range | 181 Km | 150 Km |

| Top speed | 115 | 90 |

| Motor power | 8.5 kWh | 6.0 kWh |

| Battery capacity | 3.97 kWh | 3.7 kWh |

| Charging time | 6.3 hours | 5.5 hours |

| Touchscreen display | Yes | Yes |

| Fast charging | Yes | Yes |

| Navigation | Yes | Yes |

| Cruise control | Yes | No |

Source- Ather and Zigwheels

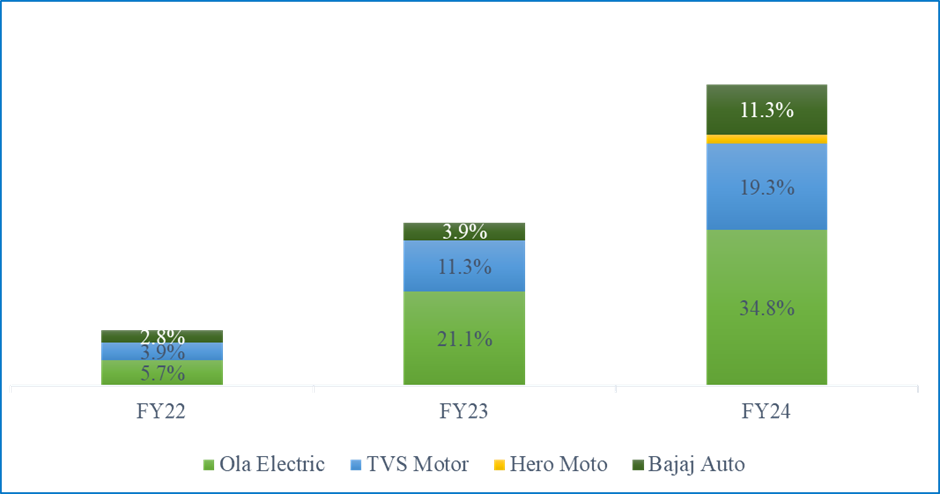

Domestic market share

Ola, TVS, and Bajaj Auto control ~65% of the total market. In FY24, Ola sold ~3.3 lakh scooters in India, up from ~1.6 lakh in FY23. Its market share has grown from 5.7% in FY22 to 34.8% despite increasing competition.

Domestic E2W market share of major players*

Source- Ola Electric RHP; *As of June 11, 2024; Note- Market share excluding Telangana.

The table below shows the sales volume by model. We note that, while the Gen 2 has been launched for around a year, it is already over 40% of the S1 pro sales and 25% of overall sales - helped by its better value proposition. Also, despite being their highest-priced offering - the S1 Pro remains its top-selling product.

Sales volume by model (in Units)

| Model | Retail Price (₹) | FY22 | FY23 | FY24 |

|---|---|---|---|---|

| Ola S1 Pro (Gen 1) | 1,47,499 | 20,948 | 98,199 | 1,08,701 |

| Ola S1 Pro (Gen 2) | 1,29,999 | NA | NA | 83,328 |

| Ola S1 | 1,19,999 | NA | 58,052 | 9,409 |

| Ola S1 Air | 1,09,999 | NA | NA | 74,535 |

| Ola S1 X+ | 74,999-99,999 | NA | NA | 53,645 |

| Total | 20,948 | 1,56,251 | 3,29,618 |

Source- Ola Electric RHP

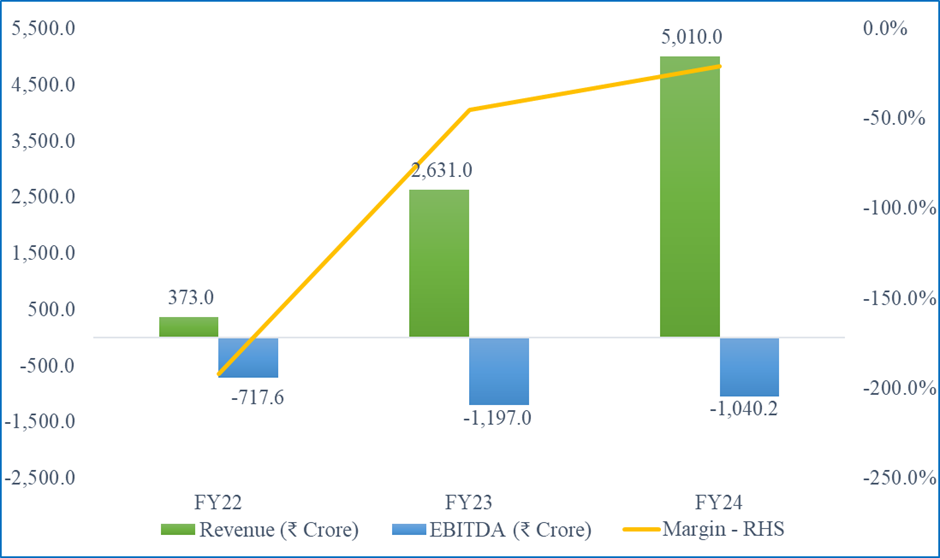

Financial performance

Ola benefited from being a first mover in the EV segment and lack of substantial competition, which helped propel its revenue more than 10x in the last 3 years.

Financial performance: Snapshot

Source- Ola Electric RHP

The table below gives the revenue contribution of the various models.

Model wise revenue contribution to total revenue (%)

| Model | FY22 | FY23 | FY24 |

|---|---|---|---|

| Ola S1 Pro (Gen 1) | 85.1 | 58.2 | 33.7 |

| Ola S1 Pro (Gen 2) | NA | NA | 25.9 |

| Ola S1 | NA | 29.4 | 2.7 |

| Ola S1 Air | NA | NA | 18.9 |

| Ola S1 X+ | NA | NA | 10.7 |

Source- Ola Electric RHP

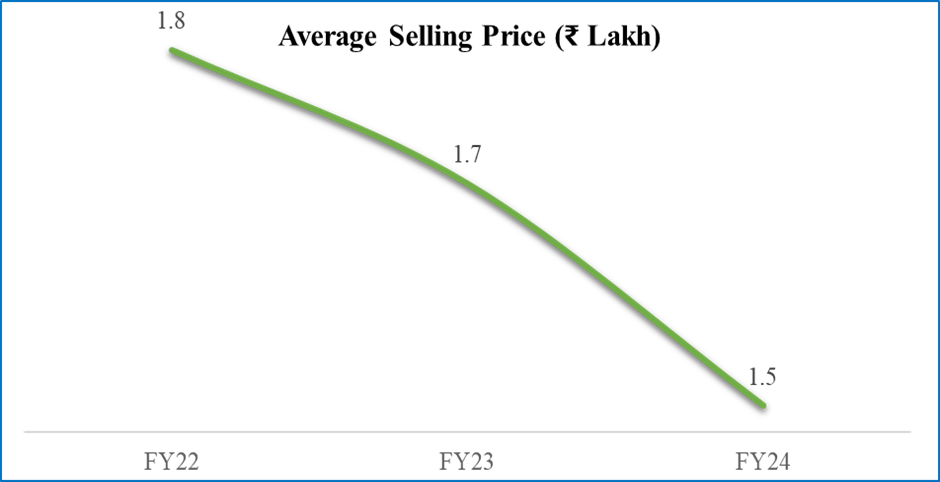

Falling ASP - area to monitor

The revenue growth is entirely led by higher volumes as its average selling price (ASP) fell from ₹1.78 lakh in 2022 to ₹1.51 lakh in 2024. This fall in ASP can be ascribed to

- Changing model mix: As lower price models start to increase in sales, ASP will be impacted

- Discounts: The company is offering discounts in the range of ₹25,000-₹30,000 on its vehicles, which is impacting ASPs

Source- Ola Electric RHP

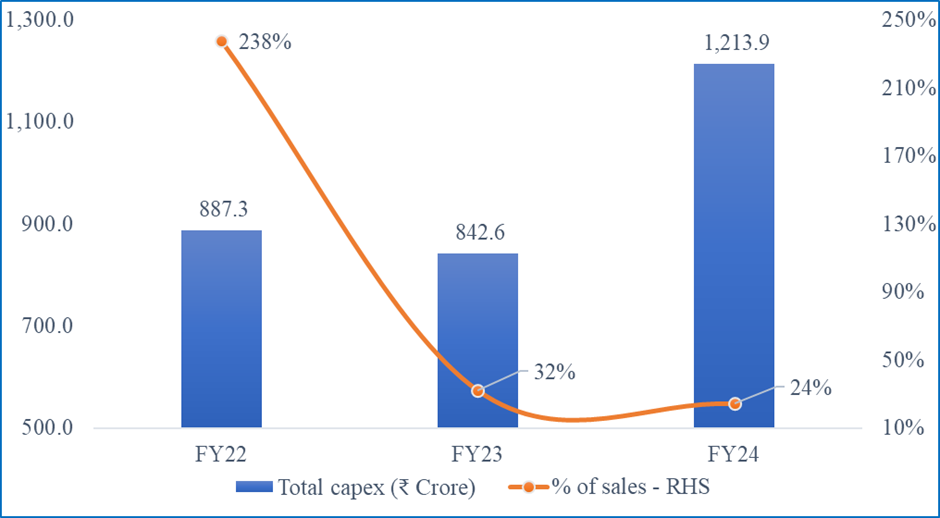

Capital Expenditure

Source: Ola Electric RHP

Source: Ola Electric RHPOla is investing heavily in capital expenditure including Gigafactory to produce Indigenous lithium-ion batteries, and R&D to optimise the supply chain.

How does valuation stack up?

We value Ola using Price-to-Sales (P/S) as Ola is loss-making. Unfortunately, there is no direct peer to compare it with, but our analysis indicates that the average and median P/S ratio of conventional ICE 2W OEMs is ~4.2x and ~3.7x respectively (as of 26th July). In comparison, at its aspired valuation, Ola is trading at ~6.7x.

As the first and only pure-play EV maker, it could attract some scarcity premium.

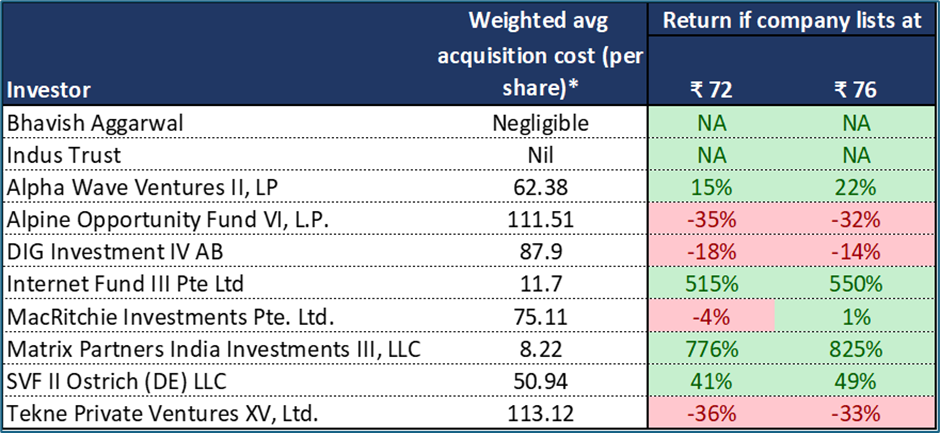

Who is selling?

As per news reports, Ola's expected valuation is ~18.5-22% cent lower than in its last funding round in September 2023. This round was led by Singapore's Temasek which valued Ola at ~$5.4 billion. The table below looks at the investors who are selling their stake via this IPO, and their potential profit or loss.

Weighed average cost of acquisition by investors

Source- Ola Electric RHP, Tracxn; *Calculated on a fully diluted basis

Source- Ola Electric RHP, Tracxn; *Calculated on a fully diluted basisKey operating risks -

-

Ola has recalled over 200,000 scooters in 2023 alone. The issues include poor build quality, erratic performance, and incidents like fire and sudden acceleration, indicating quality control problems.

-

Ola experienced high employee attrition rates of 44.3% and 47.5% in FY24 and FY23, respectively. Among others, Slokarth Dash (Head of Planning and Strategy), Saurabh Sharda (Head of Partnerships and Corporate Affairs), and Ranjit Condesan (Head of Human Resources) resigned from the company at the end of 2023 and 2022, respectively.

-

MapMyIndia has recently accused Ola Electric of using its map data without permission in its own map application and has issued a legal notice.

Conclusion

Ola has carved a niche for itself due to its first-mover advantage in the E2W space, an area that traditional auto companies were slow to enter, and this has benefited the company.

It is also working on building an in-house battery cell manufacturing Gigafactory, aimed at making batteries more affordable. This could reduce E2W costs and help Ola with operating leverage, improving its financial position.

While these are encouraging factors, we note that the company will have to walk a tightrope between profitability and market share. Any reduction in discounts could impact demand in a competitive market. On the other hand, an increase could further hurt ASPs and impact its profitability goal adversely.

About The Author

Next Story