Upstox Originals

NTPC Green Energy IPO: One more milestone in India’s renewable journey

.png)

7 min read | Updated on September 27, 2024, 19:20 IST

SUMMARY

NTPC Green Energy is gearing up for a major milestone with its upcoming IPO of ₹10,000 crore. The funds will be utilised for capacity expansion. This article examines the company’s history, product offerings, and operational projects. We will also evaluate the renewable energy industry, NGEL’s financial performance, market share, and how it fares against competitors.

Key things to know about NTPC Green Energy IPO

NTPC Green Energy (NGEL) plans to raise ₹10,000 crore through its IPO via fresh share issuance. The company focuses on developing and operating renewable energy projects across India, primarily in solar and wind.

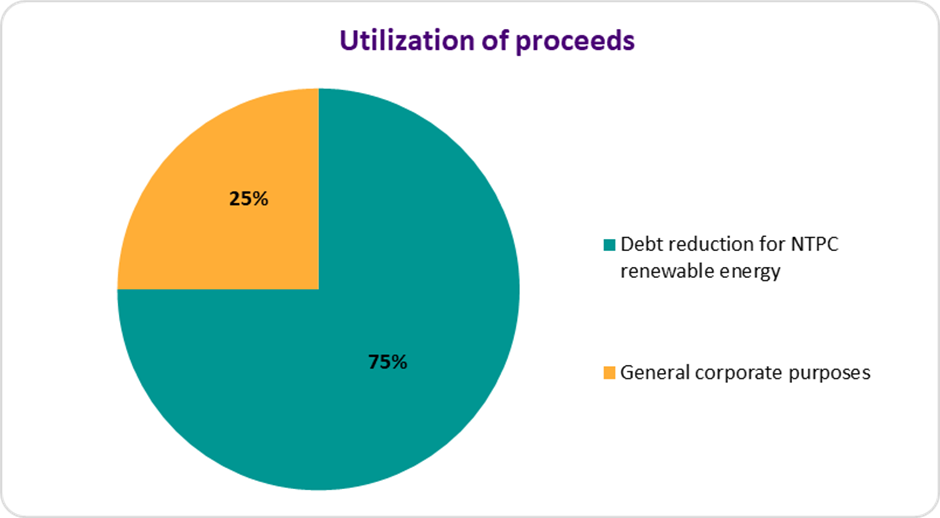

Use of funds

The proceeds will primarily be used to reduce debt, with ₹7,500 crore (75%) allocated for this purpose. The remaining ₹2,500 crore (25%) will be used for general corporate purposes.

Source: DHRP

History of NTPC Green Energy

NGEL was founded in April 2022 as a part of NTPC Ltd to focus on renewable energy. Backed by NTPC, one of India’s largest power companies, NGEL has mostly solar and wind power. Its current capacity details are as follows:

| Particulars as on FY24 | Operational Capacity | Capacity utilization* factor (CUF) % | Under construction | Development capacity pipeline |

|---|---|---|---|---|

| Solar | 3.34 GW | 23.9 | 8.13 GW (Solar + Wind total) | 10.57 GW (Solar + wind total) |

| Wind | 0.21 GW | 19.7 |

Source: DRHP; *Capacity utilization is the weighted average CUF of the installed capacity on a given date. Note: Wind CUF was lower in FY24 due to the new Dayapar wind project's commissioning during the low wind season.

Further, NGEL leverages the support and expertise of the NTPC Group, which aims to expand its non-fossil capacity to 45-50% of its portfolio, targeting 60 GW of renewable energy by 2032.

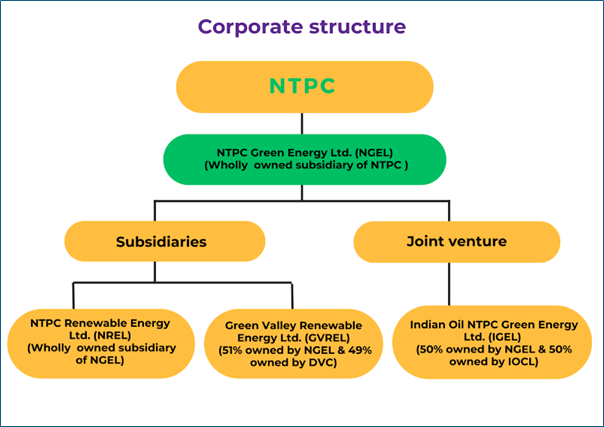

As of August 31, 2024, it manages solar and wind projects across six states. The company has long-term agreements to supply renewable power to government and public utilities. NTPC has two subsidiaries, NTPC Renewable Energy Ltd. and NTPC Green Energy Ltd., along with a JV, Indian Oil NTPC Green Energy Pvt. Ltd., in partnership with Indian Oil Corporation Ltd.

Source: DRHP

Product portfolio

The company’s portfolio mainly includes solar and wind assets, while exploring green hydrogen, ammonia and energy storage systems areas to align with global trends toward decarbonization and India's renewable energy targets.

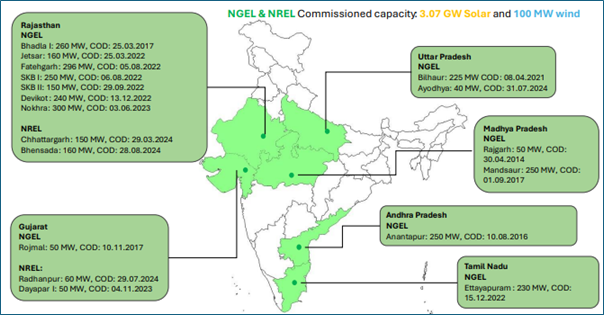

Operational projects as of August 31, 2024

NGEL’s renewable energy projects are mainly located in resource-rich states like Rajasthan and Gujarat, which have strong potential for renewable energy development and consistent demand. Additionally, the company has projects in 7 other states across India, which helps reduce the risk of relying too much on any single buyer, such as central and state government agencies or public utilities.

Source: DHRP

Industry overview

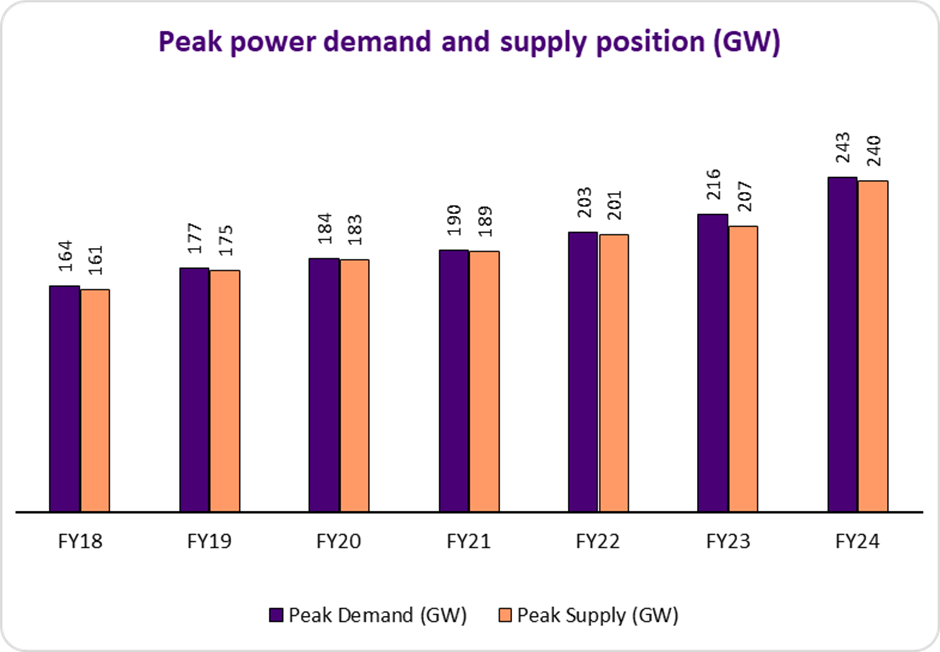

India's electricity demand grew from 164 GW in 2018 to 243 GW in 2024, increasing by about 6.8% each year.

Source: DRHP

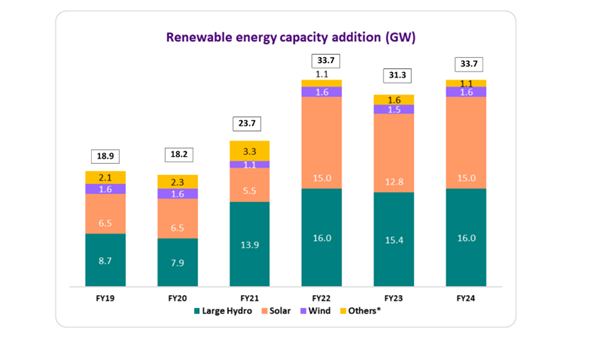

Renewable energy capacity addition

With more support from the government and better economics, renewable energy has become more attractive to investors. Between 2018 and 2024, India added around 76 GW of renewable energy. The total renewable energy capacity grew from 114 GW in 2018 to 191 GW in 2024, increasing by about 8.9% per year. Solar energy made the biggest contribution, adding about 60 GW, followed by wind with 12 GW, and other renewable sources added around 4 GW during this time.

Source: DRHP; *Others include biomass, small hydro, geothermal, and tidal.

Key financials

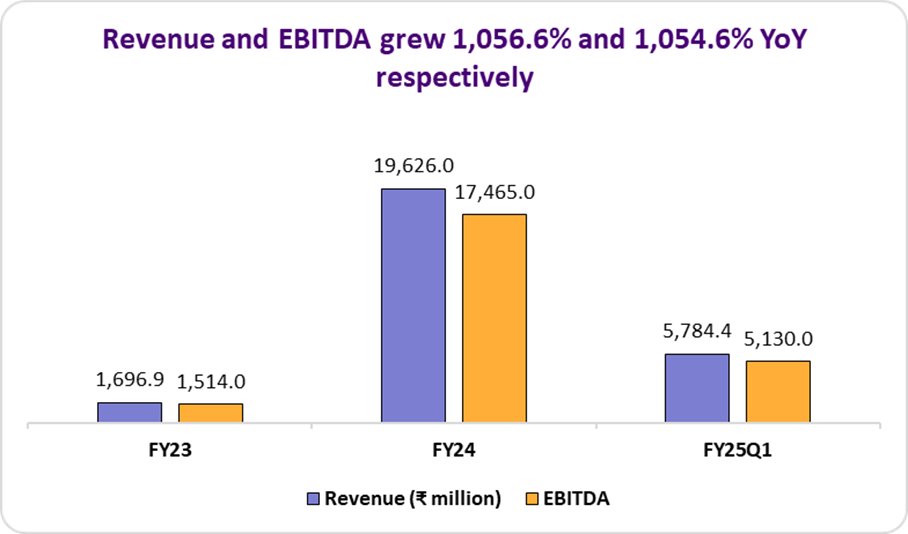

NGEL experienced a significant revenue surge of over 1,000% from FY23 to FY24, with PAT nearly doubling in the same period. The company’s strengths include its portfolio of solar and wind projects, increasing capacity utilization, operational efficiency, and low operating costs, driving growth in revenues and EBITDA.

Source: DRHP

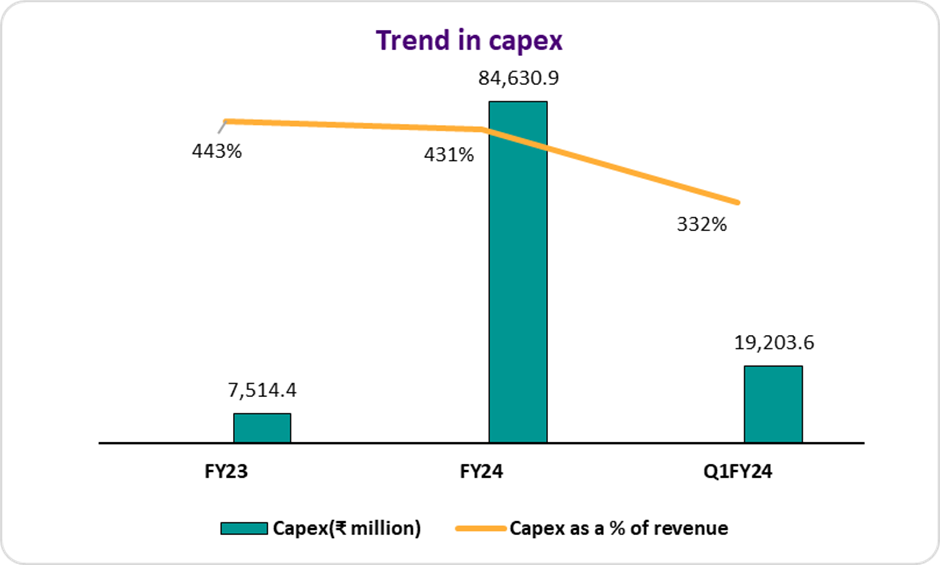

As mentioned earlier, the company has ambitious plans to keep expanding its capacity, so capex intensity is expected to remain high. The company is currently FCF negative, and investors will monitor its ability to turn FCF positive. The chart below shows the past trends in capital expenditure:

Source: DRHP

The company's debt level can be high as it continues to invest in capex. This ongoing spending can increase debt intensity as the business funds expand through borrowing. That said, NGEL has a AAA credit rating, benefiting from access to low-cost capital due to its affiliation with the NTPC Group.

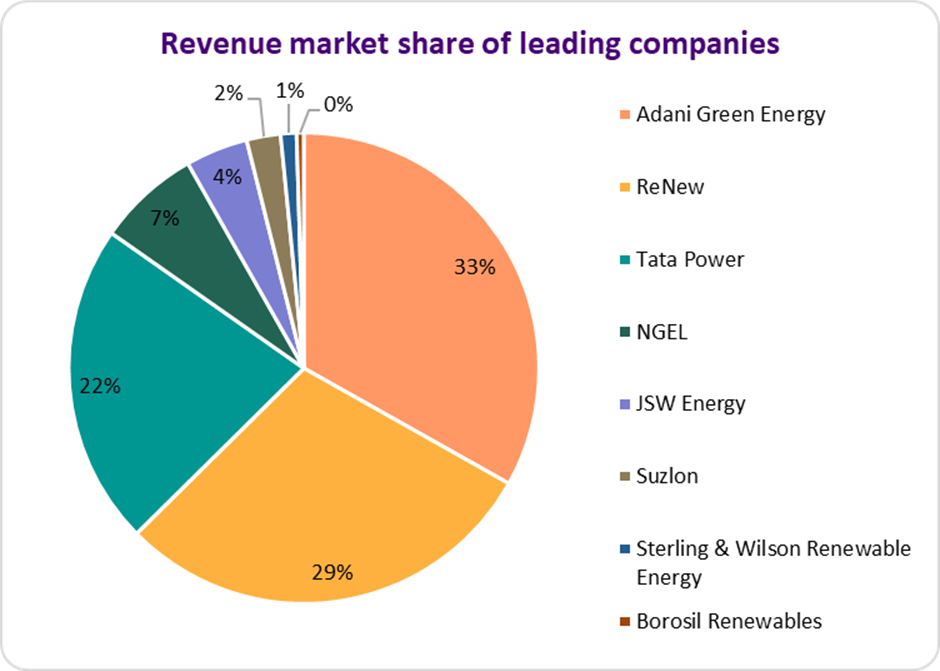

Market share

The renewable energy sector is very competitive, with many companies trying to get a bigger share of the market. As of FY24, NGEL accounts for 7% of the market share in revenue among the top companies in the renewable energy sector.

Source: DRHP

Peer analysis

Almost 99% of NGEL’s operating revenue comes from energy sales. Compared to its competitors, the company has made better EBITDA and PAT margins. For FY24, the company’s debt-to-equity ratio of 1.97, which shows it has moderate debt compared to how much it owns. This is better than its competitors because NGEL relies more on funding through equity rather than borrowing money.

| Financials as on FY24 | Total Revenue (INR Mn) | Operating EBITDA (INR Mn) | Margin (%) | Cash PAT margin (%) | Cash RoE (%) | Debt/Equity |

|---|---|---|---|---|---|---|

| NGEL | 19,626 | 17,465 | 89.0% | 50.3% | 17.8% | 2.1 |

| ReNew | 81,948 | 58,648 | 71.6% | 26.5% | 20.5% | 4.5 |

| Adani Green | 92,200 | 75,860 | 82.3% | 34.3% | 36.9% | 2.9 |

| Average | 64,591 | 50,658 | 78.4% | 37% | 25.1% | 3.1 |

Source: DRHP; *Cash PAT = PAT + Depreciation

We compared key financial ratios of NGEL with its two competitors, Adani Green Energy Ltd and ReNew Energy Global PLC, showing their relative performance:

Since NGEL’s price band is not yet set, we are unable to make any comments.

Source: DRHP; #To be included post-finalization of the Issue Price

Key strengths

- The company ranks among the top 10 renewable energy firms in India as of June 30, 2024.

- It is backed by NTPC Limited, which has a strong track record in managing large projects and good relationships with suppliers and customers.

- As of June 30, 2024, it has a diverse portfolio of solar and wind projects across various locations and has 15 customers for its energy.

- It is the largest public sector company in renewable energy (excluding hydro) in terms of capacity and power generation for Fiscal 2024.

Key risks

- Construction projects may face delays or cost overruns, affecting finances and operations.

- Most of its projects are in Rajasthan, so any disruptions in that area could harm the business.

- Delays in collecting payments from energy customers could negatively impact finances.

- The company needs significant funds for projects and may require more financing, which could hurt its financial health.

- A large portion of its revenue (over 87% in FY24) comes from just five main customers, with one customer alone providing about 50% of total revenue.

Conclusion

India’s renewable energy sector is growing fast, driven by government policies, corporate commitments, and global demand. The government aims to reach 500 GW of renewable energy capacity by 2030, up from about 200 GW today.

NGEL is set to play a key role in achieving this target. The company’s growth plans and strong project pipeline are promising. That said, investors should be aware of risks related to investing in companies that have a high gestation period, and reliance on government policies.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story