Upstox Originals

IPO Spotlight: Bajaj Housing Finance

.png)

7 min read | Updated on September 11, 2024, 18:51 IST

SUMMARY

This is the first IPO from the Bajaj Group in the past 31 years and is set to be one of India’s largest IPO this year. Bajaj Housing Finance is India's second-largest housing finance company and is aiming to raise ~₹6,650 crore via its IPO. This article explores the company’s evolution, assesses its market position and financial performance, and compares it with industry peers. We'll also evaluate how it stacks up against the competition at its targeted price point.

Bajaj Housing's IPO will be on the biggest IPO in India this year

Bajaj Housing Finance Ltd (BHFL) is grabbing headlines with its IPO! It is set to be one of the biggest Indian IPO of the year, beating out even Ola Electric (₹6,145 crore) and Bharti Hexacom (₹4,275 crore) with a total offering of ₹6,650 crore. This includes a fresh issue of ₹3,650 crore and an offer for sale of ₹3,000 crore. The price band is set at ₹66 to ₹70 per share.

Use of funds

100% of the net proceeds from this IPO will be utilized to grow the company

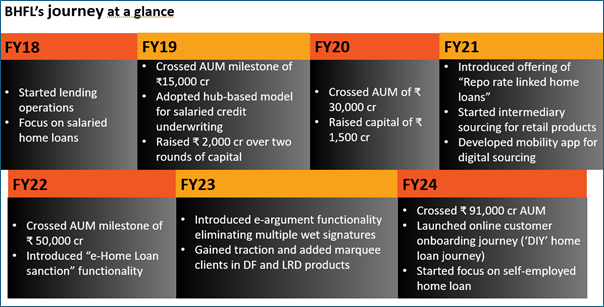

BHFL’s history

BHFL is a non-deposit taking Housing Finance Company (HFC), registered with the National Housing Bank since 2015. It began offering mortgage loans in 2018 and operates as a 100% subsidiary of Bajaj Finance Limited, serving over 88 million customers nationwide.

In 2022, the RBI categorized BHFL as an "Upper Layer" NBFC, meaning it's one of the top players in the non-banking financial sector. The company currently has about 215 branches across the country.

BHFL’s journey at a glance

Source: BHFL Investor presentation

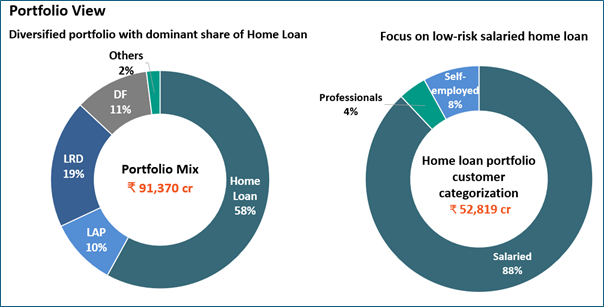

BHFL’s current portfolio

BHFL helps individuals and businesses finance buying or renovating homes and commercial spaces, offers loans against property, and even supports developers with construction financing and lease rental discounting for high-net-worth individuals and developers.

Products suite

| Product | Description |

|---|---|

| Home Loan (HL) | Financing for purchasing or constructing residential properties, with flexible repayment options. |

| Loan Against Property (LAP) | Allows borrowers to use their property as collateral to secure funds for various personal or business needs. |

| Developer Finance (DF) | Offers funding solutions to real estate developers for construction or project development. |

| Lease Rental Discounting (LRD) | Enables borrowers to receive funds by leveraging future lease rental earnings. |

Source: Company

Source: BHFL Investor presentation; portfolio view as of March 31, 2024

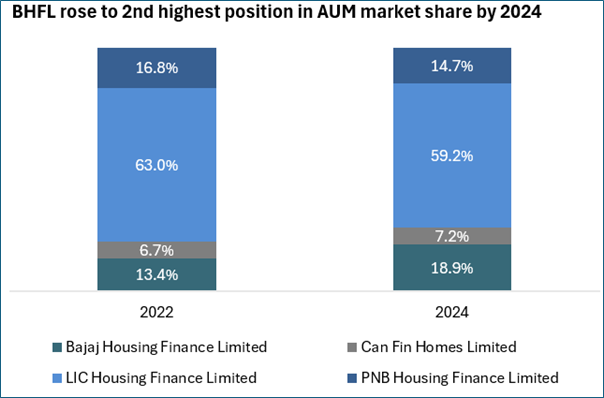

Domestic market share in the prime HFC segment

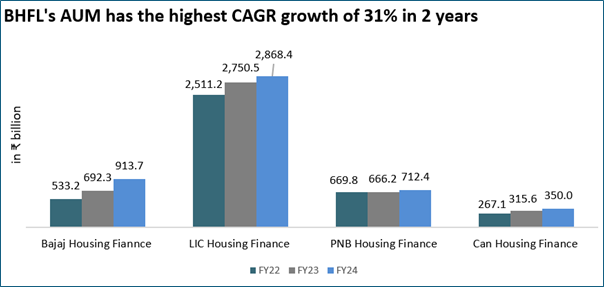

BHFL is currently the second-largest HFC in India, with an AUM of ₹913.7 billion as of FY24, just behind LIC Housing Finance (₹2,868.4 billion AUM). BHFL recorded a remarkable 31% CAGR (for AUM) from 2022-2024, making it the fastest-growing HFC trailed by Can Fin Homes with 14.5% CAGR.

Source: BHFL RHP

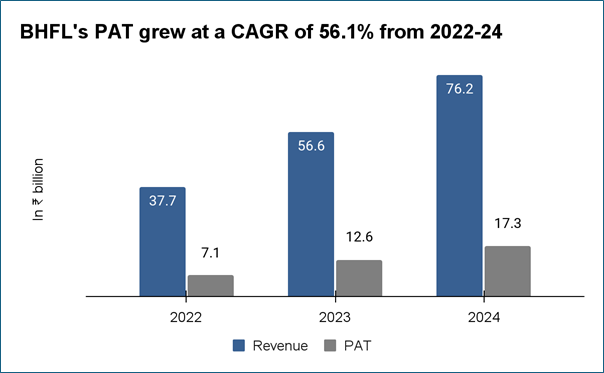

Financial Performance

BHFL has shown impressive growth over its seven years of operation, even in the face of challenges like the NBFC crisis, industry disruptions, and the COVID-19 pandemic. As of June 30, 2024, the company’s AUM reached ₹970.7 billion.

BHFL's total income grew at an impressive CAGR of 42.2% between 2022 and 2024. During the same period, its PAT surged at a CAGR of 56.1%, reflecting the company's strong financial performance. In FY24, BHFL also saw YoY growth of 31.0% in AUM and a 25.3% increase in total income.

Source: BHFL RHP

BHFL has demonstrated strong financial performance, with consistent growth in EPS and improved profitability, as seen in rising RoAA and RoAE figures. The company has the lowest GNPA and NNPA compared to its peers, highlighting robust asset quality.

Key financials

| Particulars | FY22 | FY23 | FY24 |

|---|---|---|---|

| EPS (₹) | 1.5 | 1.9 | 2.6 |

| RoAA (%) | 1.8 | 2.3 | 2.4 |

| RoAE (%) | 11.1 | 14.6 | 15.2 |

| GNPA (%) | 0.3 | 0.2 | 0.3 |

| NNPA (%) | 0.1 | 0.1 | 0.1 |

| Debt to Equity | 6.2 | 5.1 | 5.7 |

Source: BHFL RHP

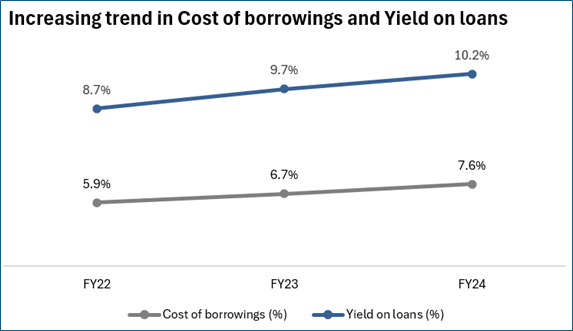

Despite the rising cost of funds, driven by the rising repo rate, BHFL has managed to maintain a healthy spread between the cost of borrowings and the yield on loans.

Source: BHFL RHP

Peer analysis

BHFL stands strong compared to its peers. It has the 2nd highest LCR of 192.31% after PNB Housing Finance. While its PBC ratio of 61.4% meets the required threshold, it's slightly behind top competitors like LIC Housing. Overall, the company has healthy liquidity and capital management in the housing finance sector.

| Particulars | Capital Adequacy Ratio (CRAR) | Liquidity Coverage Ratio (LCR) | Principal Business Criteria Ratio (PBC) |

|---|---|---|---|

| What does it mean? | Measures a company's financial strength by comparing its capital to risk-weighted assets. | Indicates the company’s ability to cover short-term obligations using high-quality liquid assets. | Shows the percentage of assets involved in the company’s primary business activities. |

| Bajaj Housing Finance Limited | 21.2% | 192.3% | 61.4 |

| Can Fin Homes Limited | 24.4% | 120.6% | 74.9% |

| LIC Housing Finance Limited | 20.7% | 175.3% | 84.3% |

| PNB Housing Finance Limited | 29.2% | 266.0% | 66.3% |

| Minimum regulatory requirement as of March 31, 2024 | 15.0% | 85.0% | 60.0% |

Source: BHFL RHP

Despite maintaining a solid financial position, BHFL has managed to grow its AUM at an impressive growth, the fastest compared to its key peers.

Source: BHFL RHP

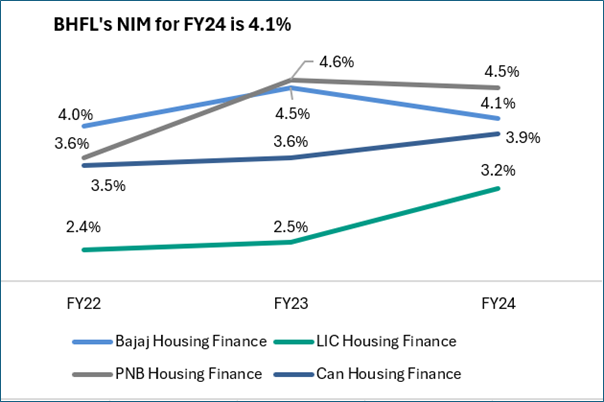

BHFL has also delivered a higher-than-average NIM margin for the past 3 consecutive years.

Source: BHFL RHP

How does valuation stack up?

We compare BHFL (FY24) valuation to Can Fin Homes, LIC Housing Ltd, and PNB Housing Finance, using the P/BV and PE multiples.

On both multiples, the company is trading higher than its peer average. To a certain extent, this premium can be attributed to robust fundamentals and an expectation that the company will be able to replicate its past performance in the future.

| Company | P/BV | P/E |

|---|---|---|

| BHFL* | 4.6 | 30.9 |

| Can Fin Home | 2.6 | 14.7 |

| LIC Housing Finance | 1.2 | 8.0 |

| PNB Housing Finance | 1.8 | 16.9 |

| Average | 2.6 | 17.9 |

Source: Annual reports, DHRP, NSE; *To value BHFL we have considered post-issue shares of the company and an average price of ₹68.

Key Risks

- BHFL’s high concentration of assets in four states and New Delhi makes the business vulnerable to adverse developments in these regions, which could impact operations, cash flow, and financial stability.

- Equity shares were issued to Bajaj Finance Limited in Fiscal 2023 at a price lower than the current IPO offer price, which could raise concerns.

- BHFL has significant exposure to the real estate sector, which means a downturn could lead to increased losses and challenges in recovering loans from properties used as collateral, potentially affecting financial performance.

Conclusion

The Bajaj Housing Finance IPO has attracted widespread interest, ranking among the largest in India for 2024. On its final day, the IPO was subscribed 14.05x, largely driven by non-institutional and qualified institutional investors.

With solid financial performance and ambitious growth strategies, the IPO aims to boost the company's presence in the housing finance sector. However, risks tied to its reliance on real estate and regional concentration remain considerations for investors. Despite these, the strong demand reflects confidence in BHFL's future potential.

About The Author

Next Story