Upstox Originals

Hyundai India: Revving up India play with IPO

.png)

5 min read | Updated on July 26, 2024, 19:55 IST

SUMMARY

After 2003, this will be the first IPO of a carmaker in India. Hyundai is set for its Indian IPO, targeting a valuation of $18-20 billion. In this article, we analyse its journey in India, evaluate its market share and financials, and provide a competitive analysis. At the aspired valuation, we analyse how it stacks up against its peer.

Since 2003, Hyundai will be the first carmaker to IPO in India

Hyundai Motor India (HMIL), India's second-largest carmaker, is set to raise ~₹25,000 crore through a complete offer-for-sale IPO. This will be India's biggest ever after LIC (₹21,000 crore). Its parent company Hyundai Motor is expected to sell 14.2 crore shares (~17.5% stake in HMIL), at an expected ~$18-20 billion valuation.

History of Hyundai in India

HMIL started its journey in India in 1996, and launched its first car Santro two years later, which gained immense popularity due to its features, affordable price, and design. Since its inception, Hyundai has launched 38 passenger vehicles or PVs (as of March 31, 2024). As of December 2023, HMIL had 1,366 sales outlets and 1,550 service centers across India.

HMIL’s India journey

Source- Hyundai Motors India DRHP

HMIL’s current product portfolio

HMIL's current portfolio includes 13 cars.

Hyundai’s portfolio analysis*

| # | Car | Type | Price (₹ Lakh)** | Major select competition |

|---|---|---|---|---|

| 1 | Grand i10 | Hatchback | 5,92,300- 8,56,300 | Maruti Baleno, Tata Tiago, Maruti Suzuki Swift |

| 2 | i20 | Hatchback | 7,04,400- 11,20,900 | Toyota Glanza, Maruti Baleno, Tata Altroz |

| 3 | Aura | Sedan | 6,48,600- 9,04,700 | Maruti Suzuki Dzire, Honda Amaze, Tata Tigor |

| 4 | Verna | Sedan | 11,00,400- 17,41,800 | Honda City, Maruti Suzuki Ciaz, Skoda Slavia |

| 5 | Creta | SUV | 10,99,900- 20,14,900 | Kia Seltos, MG Hector, Tata Harrier |

| 6 | Exter | SUV | 6,12,800- 10,27,900 | Tata Punch, Kia Sonet, Maruti Suzuki Brezza |

| 7 | Venue | SUV | 7,94,100- 13,48,100 | Tata Nexon, Toyota Urban Cruiser, Kia Sonet |

| 8 | Alcazar | SUV | 16,77,500- 21,28,400 | MG Hector Plus, Mahindra Scorpio N, Jeep compass |

| 9 | Tuscon | SUV | 29,01,800- 35,94,200 | Volkswagen Tiguan, Toyota Innova Crysta, Skoda Kodiaq |

| 10 | Ioniq 5 | Electric | 46,05,000 | Kia EV6, Audi e-tron, BYD Atto 3 |

Source- Hyundai DRHP, press releases; * We have not included Creta N Line, Venue N Line, and i20 N Line in the table above; **ex-showroom price in New Delhi

Key upcoming new launches*

| Car | Type | Tentative Price (₹ Lakh)** |

|---|---|---|

| Palisade | SUV | 40,00,000 - 50,00,000 |

| Stargazer | SUV | 10,00,000 - 17,00,000 |

| Creta EV | SUV | 22,00,000 - 26,00,000 |

Source: Carwale.com; *Refreshes, facelifts not included

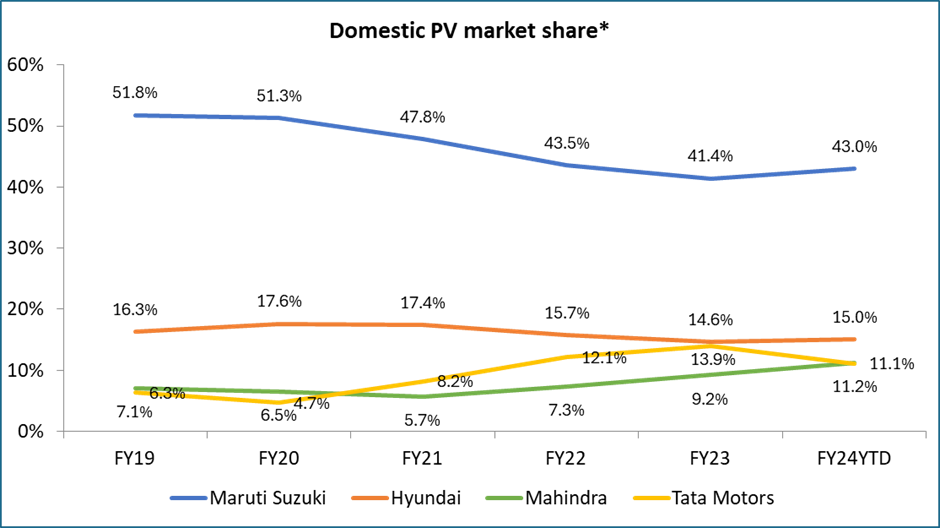

Domestic market share

HMIL, Maruti, Tata Motors, and M&M control ~80% of the total market. In FY24, HMIL sold ~6.2 lakh cars in India. Its market share has declined from 17.6% in FY20 to 15.0% now due to increased competition from Tata Motors, M&M, and Kia Motors.

Domestic PV market share*

Source- HMIL DRHP; *YTD numbers till February 2024

Source- HMIL DRHP; *YTD numbers till February 2024Financial performance

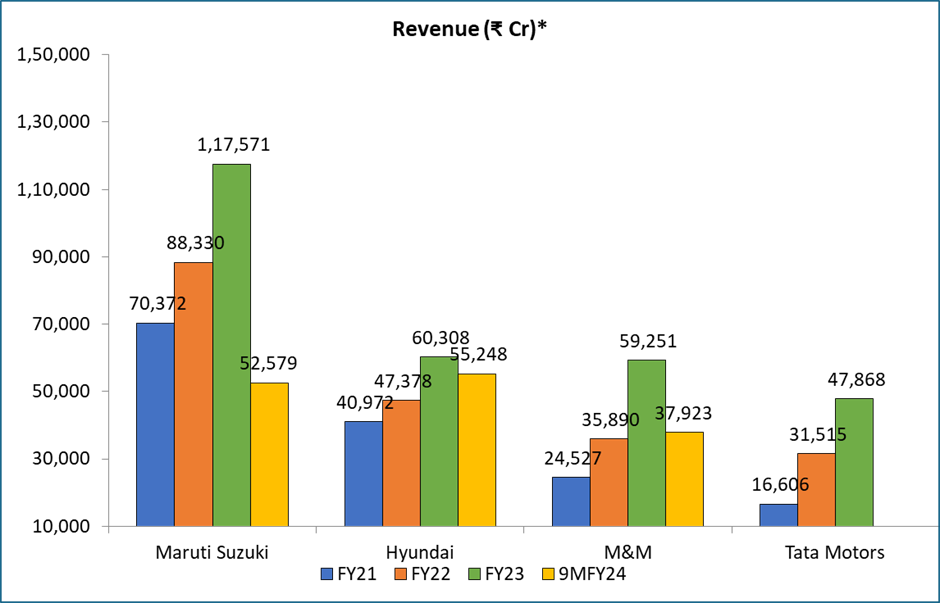

HMIL's revenue grew 47% between FY21 and FY23- driven by volume and ASP increase. Its strategy to premiumize led to a year-on-year ASP increase of ~8.4% to ₹725,416 in FY23. However, it has underperformed its rivals Maruti (67%), M&M (91%) and Tata Motors (188%), which can be attributed to

- Lack of any major fresh new launch

- Strong competition from peers like Tata Motors, M&M & Kia, who have a relatively new and refreshed product portfolio

Source: Hyundai DRHP; *M&M & Tata Motors financials are for their PV business.

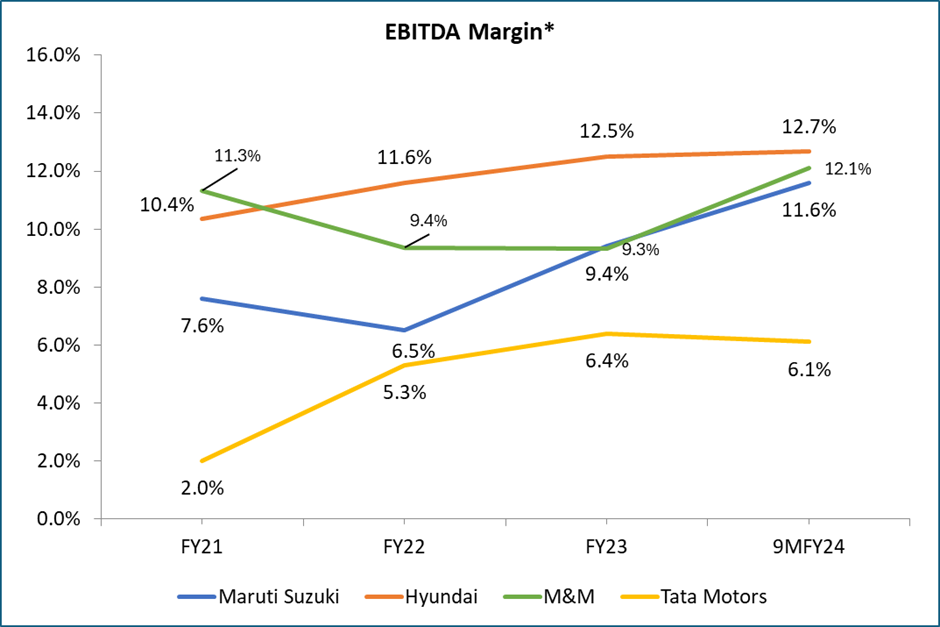

Profitability

More than 65% of sales come from higher-priced and more profitable SUVs, helping its margins expand to 12.5% in FY23 from 10.4% in FY21.

However, a 1% increase in the royalty per agreement between HMIL and its parent company, effective April 1, 2024, to 3.5% of revenue, is expected to weigh on margins and profitability.

Source: Hyundai DRHP, Company financials; *M&M’s 9MFY24 depreciation was an estimate based on past data

Source: Hyundai DRHP, Company financials; *M&M’s 9MFY24 depreciation was an estimate based on past data

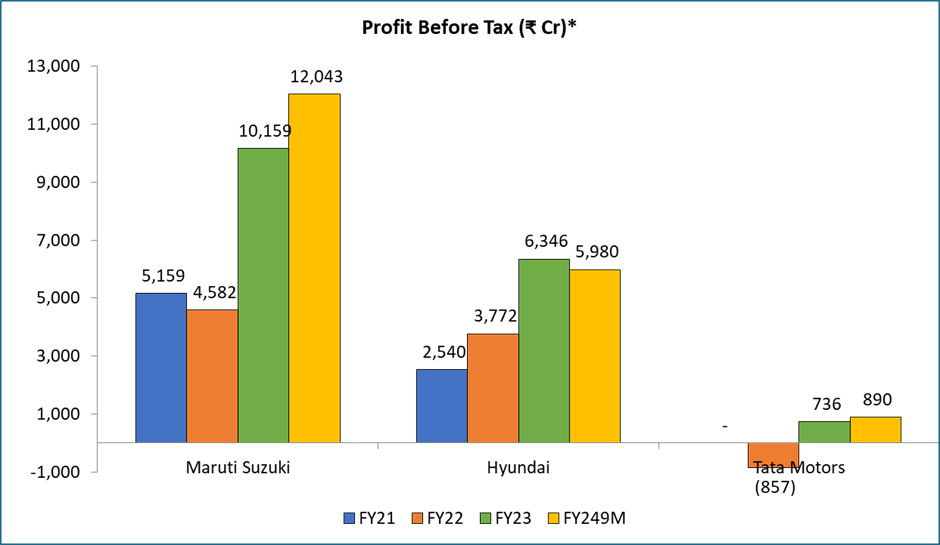

Source: Hyundai DRHP, Company results; *Note- M&M doesn't report PBT numbers for its auto Segment.

How does valuation stack up

We compare HMIL’s trailing (FY23) valuations to Maruti. We are limited in our choice, due to limited information on Tata Motors and M&M.

For HMIL - we have used an average valuation of $19 billion.

- On an EV/EBITDA multiples, Hyundai is trading in line with Martuti.

- On a P/E basis, however, it is trading at a discount. While we do not speculate, this could probably be attributed to Marurti’s recent performance. The market leader has demonstrated strong growth in recent years, which could have led to the premium.

| Company | EV/EBITDA | PE Ratio |

|---|---|---|

| Hyundai* | 18.9 | 33.8 |

| Maruti Suzuki** | 19.1 | 47.3 |

Source: Annual reports, DHRP, NSE; *In the case of HMIL average USD: INR exchange rate used is ₹83.7; **Maruti’s price is ₹12,487.

Key operating risks

- HMIL currently manufactures PVs only at Chennai. Any disruptions or stoppages could impact performance. It is setting up a plant at Talegaon, which is yet not operational

- Significant revenue depends on SUV sales; any adverse changes could impact operations

Conclusion

HMIL is one of the few foreign companies that have managed to carve a strong position in the fast-growing Indian PV market. It has done so with a good understanding of consumer trends, a strong product portfolio, and a good distribution network, among others.

The recent loss of market share and increased competition are key factors to monitor.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story