Upstox Originals

HDB Financial Services IPO: Tapping new areas of growth

.png)

10 min read | Updated on November 06, 2024, 13:20 IST

SUMMARY

HDB Financial Services, a major arm of HDFC Bank, is set to launch a ₹12,500 crore IPO, offering a unique shareholder quota for HDFC Bank investors. As a retail-focused NBFC, HDB serves segments like MSMEs and middle-income households with a diverse loan portfolio. This article covers all you need to know about HDB’s growth, performance, and IPO details.

HDB Financial Services is set to launch a ₹12,500 crore IPO

HDB Financial Services is one of India's leading diversified, retail-focused NBFCs, backed by HDFC Bank (which holds a 94.6% stake). It also serves as the BPO arm of the parent.

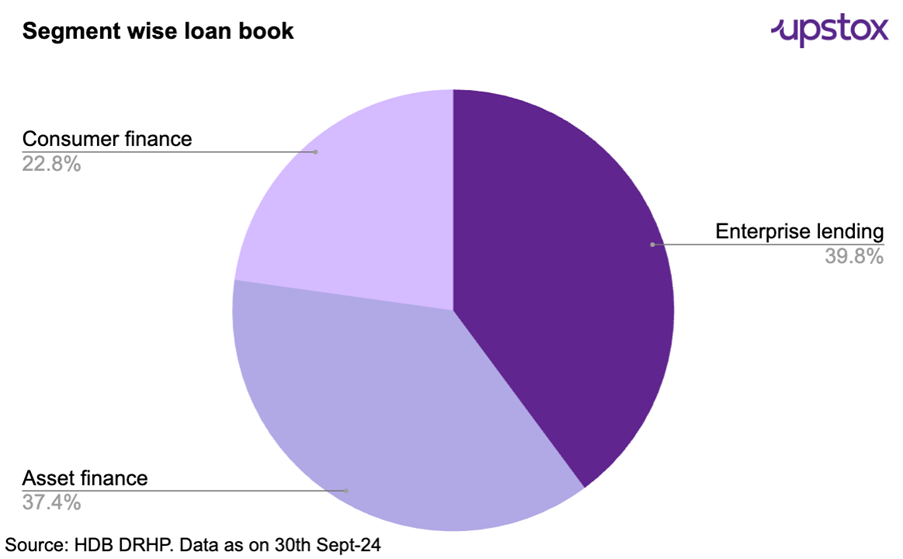

The company’s ₹ 98,624.2 crore loan book has main segments:

-

Enterprise lending - provides both secured and unsecured loans to MSMEs

-

Asset finance - secured loans for income-generating assets like vehicles and equipment

-

Consumer finance - Loans for consumer goods and personal needs

The company primarily serves low to middle-income households, catering to the credit needs of underserved and underbanked customers, including salaried individuals, self-employed professionals, and business owners.

Through a "phygital" distribution model—combining a widespread branch network with digital channels and external partnerships—HDB offers a broad portfolio of lending products tailored to various customer requirements.

Additionally, it extends BPO services to its promoter HDFC Bank and distributes insurance products to enhance customer convenience.

Going by the segmental analysis of both businesses, it's clear that the lending business has higher profitability margins which are also contributors to almost 90% of the revenue. Despite a larger base, the lending business has grown faster than BPO business. The recent dip in the BPO services business is largely due to an overall reduction in the headcount for the BPO activity.

HDB - Last 3-year performance

| ( ₹ crore) | FY22 | FY23 | FY24 | CAGR % | |

|---|---|---|---|---|---|

| Segment revenue | Lending business | 8,942.9 | 9,769.0 | 12,221.6 | 16.9 |

| Segment revenue | BPO services | 2,363.4 | 2,623.9 | 1,949.6 | -9.1 |

| Segment profit before tax | Lending business | 1,238.7 | 2,508.5 | 3,178.4 | 60.1 |

| Segment profit before tax | BPO services | 134.7 | 140.7 | 157.6 | 8.1 |

| Segment margin (PBT) - % | Lending business | 13.9% | 25.7% | 26.0% | NA |

| Segment margin (PBT) - % | BPO services | 5.7% | 5.4% | 8.1% | NA |

Source: HDB Financial Services DRHP

HDB - 6-month performance

| ( ₹ crore) | 6 Months ended 30th Sept-23 | 6 Months ended 30th Sept-24 | YoY (%) | CAGR % | |

|---|---|---|---|---|---|

| Segment revenue | Lending business | 5,727.3 | 7,282.6 | 27.2% | 16.9 |

| Segment revenue | BPO services | 1,175.2 | 608.0 | -48.3% | -9.1 |

| Segment profit before tax | Lending business | 1,493.8 | 1,568.5 | 5.0% | 60.1 |

| Segment profit before tax | BPO services | 88.4 | 37.6 | -57.5% | 8.1 |

| Segment margin (PBT) - % | Lending business | 26.1% | 21.5% | NA | NA |

| Segment margin (PBT) - % | BPO services | 7.5% | 6.2% | NA | NA |

Source: HDB Financial Services DRHP

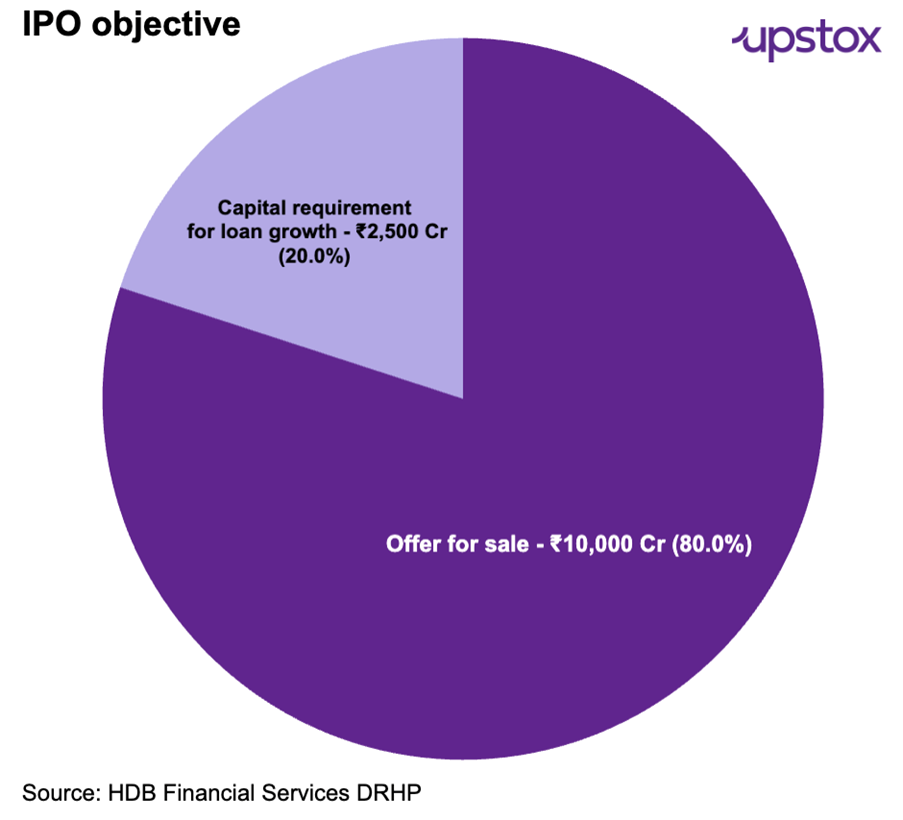

Objects of the issue

The company is planning for ₹ 12,500 crore IPO with the following objectives:

-

Fresh issue to meet fund growth, especially in the lending business. Besides that, to ensure adequate capital in line with regulations.

-

OFS: The promoters of the company i.e. HDFC Bank plan to sell a stake worth ₹ 10,000 crore via OFS.

-

Other: The decision to list HDB follows the Reserve Bank of India's mandate in October 2022, requiring NBFCs in the upper layer category to be listed on the stock exchanges. An upper layer NBFC is identified by RBI and includes the top ten NBFCs in terms of asset size and certain other regulations as per RBI norms.

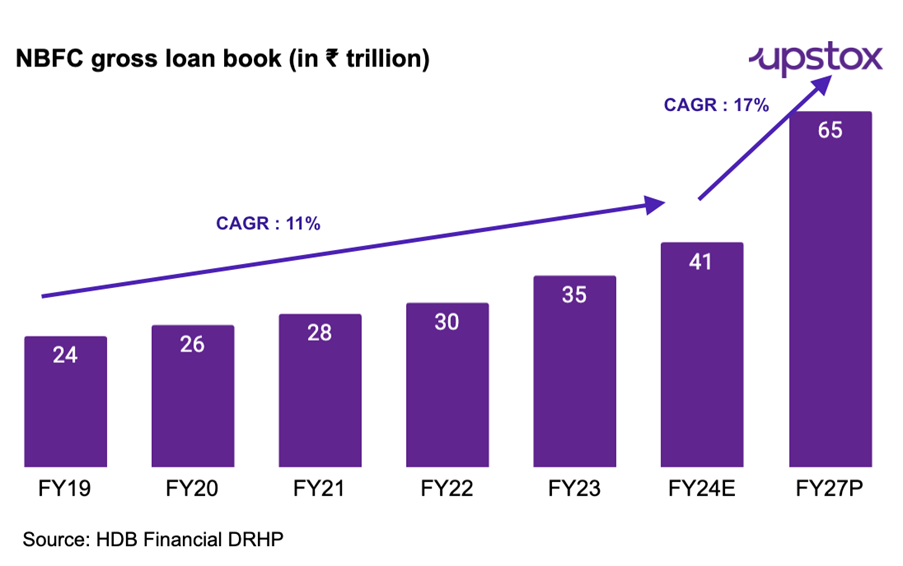

Industry insights

Gross loan book for Indian NBFCs is set to grow faster than systemic credit, continuing its trend of outpacing GDP growth. The sector expanded from under ₹24 trillion to ₹41 trillion in AUM by Fiscal 2024, with an 11% CAGR from 2019-2024. Favourable demographic dividends, rising digital & banking penetration and rising consumer demand are expected to drive NBFC growth, with CRISIL projecting a 15-17% annual increase from Fiscal 2024 to 2027, led by retail and MSME loans.

KPI analysis: How is HDB performing?

We break down key performance indicators of the company suggesting better operational and financial performance overall. Here is the detailed analysis:

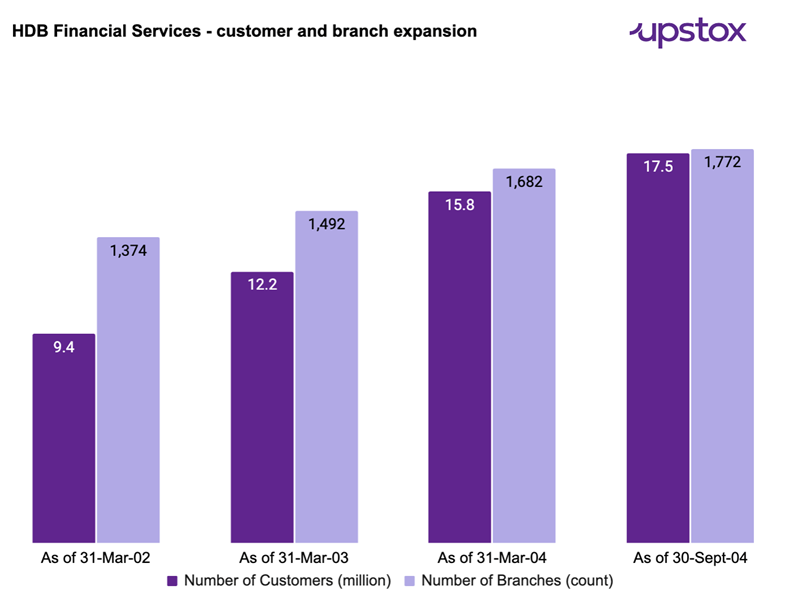

Customer and branch Growth:

The customer base increased to 17.5 million (up 25.9% yoy), reflecting strong customer acquisition on the back of brand expansion.

Source: HDB Financial Services DRHP

Loan portfolio and growth:

From FY 22-24, the company's revenue and Profit After Tax grew at a double-digit CAGR, attributed to a strong increase in the loan book, prudent risk management, enhanced operational efficiency, better asset quality, and an aggressive strategy for branch expansion and customer acquisition.

| Particulars | FY22 | FY23 | FY24 | 6M ended Sep 30, 2023 | 6M ended Sep 30, 2024 | FY22 - Sep 2024 CAGR (%) | |

|---|---|---|---|---|---|---|---|

| Total gross loans | 61,326.3 | 70,030.7 | 90,217.9 | 77,856.6 | 98,624.2 | 24% | |

| Total gross loans Growth yoy % | NA | 14.9% | 28.8% | NA | 26.6% | ||

| Enterprise lending | 29,942.8 | 31,618.7 | 36,822.6 | 33,263.0 | 39,300.7 | 13% | |

| Asset finance | 23,160.6 | 26,326.3 | 34,194.7 | 29,387.6 | 36,849.7 | 23% | |

| Consumer finance | 8,222.9 | 12,085.7 | 19,200.7 | 15,206.1 | 22,473.9 | 56% |

Source: HDB Financial Services DRHP

Income and Profit:

Growth in loan book coupled with consistent customer addition have also translated into strong financial performance for the company as can be seen below.

| Particulars | FY22 | FY23 | FY24 | FY22-24 CAGR (%) | 6M ended Sep 30, 2023 | 6M ended Sep 30, 2024 |

|---|---|---|---|---|---|---|

| Revenue from operations | 11,306.2 | 12,402.8 | 14,171.1 | 11.9% | 6,902.4 | 7,890.6 |

| Profit after tax (PAT) | 1,011.4 | 1,959.3 | 2,460.8 | 34.5% | 1,167.3 | 1,172.0 |

Source: HDB Financial Services DRHP

Profitability:

The company has been able to increase its loan book despite the recent interest rate increases. That said, it has increased the company’s cost of borrowing. Given that HDB competes in a retail market, with price-sensitive customers, it has not been able to fully pass on this increased cost of borrowing. Investors might keenly monitor further developments here.

We do note that HDB is a AAA-rated company and as such should have access to capital at reasonably favourable rates.

| Particulars | FY22 | FY23 | FY24 | 6M ended Sep 30, 2023 | 6M ended Sep 30, 2024 |

|---|---|---|---|---|---|

| Average yield % | 13.6% | 13.6% | 13.9% | 14.2% | 14.2% |

| Average cost of Borrowings % | 6.7% | 6.8% | 7.5% | 7.7% | 7.9% |

| Net interest margin % | 8.2% | 8.3% | 7.9% | 8.2% | 7.6% |

| Operating expense ratio | 3.2% | 3.7% | 3.9% | 4.0% | 3.8% |

Source: HDB Financial Services DRHP

Asset Quality:

The NNPA ratio has fallen by 50% from the 2022 peak, despite double-digit loan book growth suggesting better and prudent risk management. This helped the company increase its ROE from 11.25% in FY22 to 19.55% in FY24 despite a decrease in the proportion of secured loans in the overall loan book.

| Particulars | FY22 | FY23 | FY24 | 6M ended Sep 30, 2023 | 6M ended Sep 30, 2024 |

|---|---|---|---|---|---|

| Secured loans as % of Total gross loans | 73.6% | 72.9% | 71.3% | 71.9% | 71.1% |

| Gross non-performing assets (GNPA) | 4.5% | 2.7% | 2.1% | 2.4% | 2.1% |

| Net non-performing assets (NNPA) | 2.3% | 1.0% | 0.6% | 0.8% | 0.8% |

| Return on equity (ROE) | 11.3% | 18.7% | 19.6% | 19.5% | 16.4% |

Source: HDB Financial Services DRHP

Overall company is expanding successfully, with significant customer and loan growth. Improved asset quality, cost efficiency, and steady profitability position it well for continued growth. Challenges include maintaining NIM amid rising borrowing costs, but strong customer acquisition and loan growth offer positive momentum.

Key risks

-

Economic and interest rate risks: Economic downturns or interest rate changes could impact financial performance.

-

Loan default and recovery: High exposure to unsecured loans and potential collateral issues on secured loans present recovery challenges in case of defaults.

-

Dependency on promoter and brand: Reliance on the Promoter HDFC Bank branding means any ownership changes or brand issues could affect operations.

-

Competitive and regulatory pressures: Intense competition and strict RBI regulations pose ongoing risks.

-

Growth sustainability: Challenges in maintaining growth rates may impact future performance.

How does it stack up against peers?

HDB demonstrates solid performance in ROE and asset quality, showing effective equity utilization and credit risk management. However, it competes in a very rate sensitive environment with entrenched players like Bajaj Finance, could possibly hamper profitable growth.

HDB’s high debt-to-equity ratio indicates a reliance on debt that could introduce risk in unstable markets. Additionally, while its NIM is decent, it lags behind its peers, suggesting room for improvement in lending profitability.

| HDB Financial Services | Bajaj Finance | Sundaram Finance | L&T Finance | M&M Financial Services | Cholamandalam Investment and Finance Company | Shriram Finance | |

|---|---|---|---|---|---|---|---|

| Gross Loan Book (in ₹ Cr) | 90,217.9 | 247,852.5 | 42,520.6 | 102,596.8 | 221,667.7 | 146,945.0 | 85,564.5 |

| Revenue from Operations (₹ in Cr) | 14,171.1 | 54,969.4 | 7,267.1 | 13,580.5 | 15,796.8 | 19,139.6 | 36,379.5 |

| PAT (₹ in Cr) | 2,460.8 | 12,644.1 | 1,454.0 | 2,286.2 | 1,759.6 | 3,422.8 | 7,190.5 |

| ROE (%) | 19.6% | 20.5% | 16.9% | 10.3% | 10.0% | 20.2% | 15.7% |

| Debt to equity | 5.8 | 3.1 | 4.3 | 3.6 | 0.1 | 7.1 | 4.1 |

| Net interest margin % | 7.9% | 12.5% | 5.1% | 9.1% | 7.2% | 6.6% | 9.3% |

| NNPA% | 0.6% | 0.5% | 0.6% | 0.7% | 1.3% | 1.3% | 2.6% |

Source: HDB Financial Services DRHP, Data as of 31st March-24/ for FY24.

Valuations

The price and other details of the proposed IPO will be determined in due course by the competent body hence we cannot comment on the valuations of the company.

How can existing investors benefit?

HDB Financial Services IPO provides reservations for HDFC Bank shareholders. Shareholders of HDFC Bank as of the date of RHP filing will be eligible to apply for IPO under the shareholder reservation category with a maximum bid amounting to ₹ 2,00,000. Overall 10% of the offer size will be reserved for the shareholder reservation category.

Impact on HDFC Bank

Listing of subsidiaries and stake sales will lead to value unlocking for the HDFC Bank and bring one-time gains on offer for sale portion. The contribution of HDB to the overall market cap of HDFC Bank is expected to be less than 3%, per some market experts.

Conclusion

HDB Financial Services is planning a ₹12,500 crore IPO, with a 10% reservation for existing HDFC Bank shareholders. As one of India’s leading retail-focused NBFCs, HDB offers a diversified loan portfolio targeting underserved segments like MSMEs and low- to middle-income households.

The company has shown strong growth in its loan book, customer base, and branch network, supported by a "phygital" model combining physical branches with digital channels. HDB faces challenges in market reach and profitability compared to peers, but it benefits from solid asset quality and the backing of HDFC Bank.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story