Upstox Originals

Checking in: Leela Palaces set to tap markets with ₹5,000 crore IPO

.png)

8 min read | Updated on September 28, 2024, 13:32 IST

SUMMARY

Schloss Bangalore Limited, operating as The Leela Palaces, Hotels, and Resorts, is a luxury hospitality company aiming to raise ₹5,000 crore through its IPO. The company has shown strong growth in Average Room Rate and Revenue per Available Room and plans to expand its portfolio by adding eight new hotels.

The Leela brand is among the world’s top three hospitality brands

The primary business of Schloss Bangalore Limited is focused on the hospitality industry, where it operates luxury hotels and resorts under “The Leela” brand.

The Leela brand was ranked as #1 among the world’s best hospitality brands in 2020 and 2021, and among the world’s top three hospitality brands in 2023 and 2024, by Travel + Leisure World’s Best Awards Surveys.

The company's activities include owning, managing, and operating luxury hotels, as well as providing technical, managerial, and advisory services related to the construction and operations of these properties.

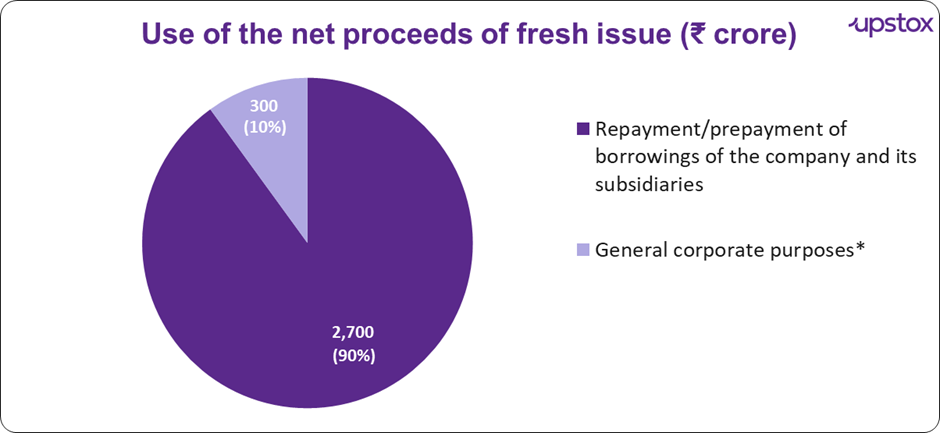

The company plans to raise a total of up to ₹5,000 crore through its initial public offering (IPO). This amount comprises:

- A fresh issue of aggregating up to ₹3,000 crore

- An Offer for Sale of up to ₹2,000 crore

Use of the net proceeds of fresh issue (₹ crore)

Source: DRHP; *Includes expenses related to business operations, growth strategies, and enhancing the company's infrastructure.

India’s hotel industry

The Indian hotel industry is growing rapidly, driven by economic expansion, rising incomes, and increased tourism. It has around 3.4 million hotel keys, with only 11% (375,000 keys) in the organized sector. Branded hotels make up about 45% of this organized inventory

Key factors driving growth include:

- Demand for premium experiences: Higher disposable incomes are driving interest in luxury travel. Demand for luxury rooms is set to grow at a CAGR of 10.6% from FY 2024-2028, outpacing supply growth of 5.9% (source: DRHP)

- Domestic tourism: Tourist visits are projected to grow at a CAGR of 13.4% from 2.5 billion in 2024 to 5.2 billion by 2030 (source: DRHP)

- Economic growth: India's GDP is expected to double from $3.6 trillion in 2023 to $7.1 trillion by 2030

- Infrastructure development: Improved travel connectivity boosts accessibility

Current portfolio

As of May 31, 2024, the portfolio includes hotels, spread across 10 destinations in India. The hotels are operated as follows:

- Owned and managed: Fully owned and managed by the company itself. They are located in Karnataka, Tamil Nadu, Delhi, and Rajasthan.

Source: DRHP

- Managed portfolio: Hotels and resorts managed by Schloss, but owned by a third party. These properties are located in Delhi, Haryana, Gujarat, Karnataka, and Kerala. The management includes brand promotion and day-to-day operations.

Source: DRHP

Additionally, one hotel which is owned and operated by a third-party owner under a franchise arrangement in Maharashtra.

| Business models | Description | Pros | Cons |

|---|---|---|---|

| Owned and managed | The owner has full control over the asset, operations, and branding and assumes all financial risks and benefits. | Full control over the property. All profits go to the owner. | High financial risk and investment. Requires significant management expertise. |

| Managed (under HMA) | A third-party management firm operates the property, handling daily operations. The owner oversees financial success and maintains financial responsibility. | Professional management expertise. Reduced operational burden for the owner. | Management fees reduce profits. Less control over daily operations. |

| Franchised | Owned by an individual or corporation, the property operates under a brand name through a franchise agreement, requiring adherence to brand standards while maintaining some operational influence. | Brand recognition and marketing support. Access to established operational procedures. | Ongoing royalty fees. Limited operational flexibility. |

Source: glion.edu, *HMA (Hotel Management Agreement)

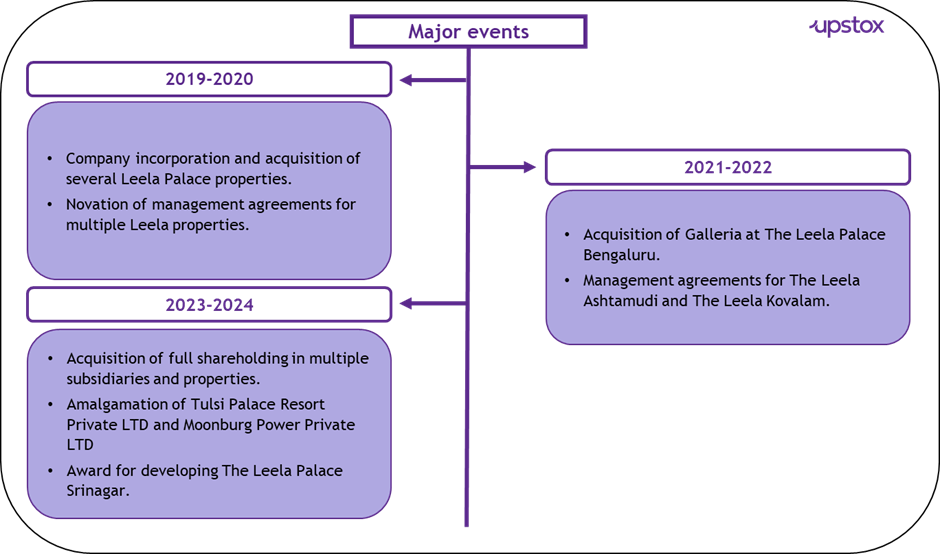

Schloss’s history

The company was incorporated as “Schloss Bangalore Private Limited” on March 20, 2019, as a private limited company in New Delhi. Below are the major events in the history of the company and its subsidiaries

Source: DRHP

Financials

Before we dive in, learn the lingo first

-

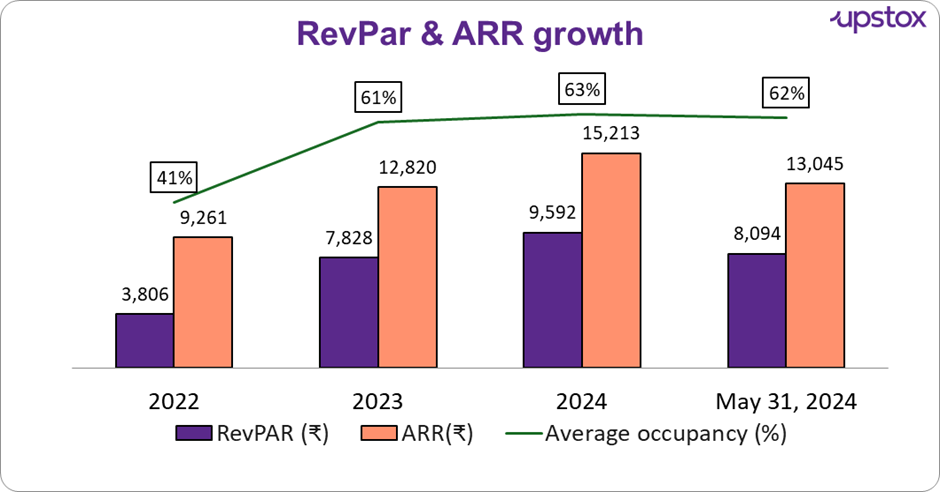

ARR (Average room rate): Represents average revenue per room. It is room revenue divided by the total number of room nights sold in a given period.

-

REVPAR (Revenue per Available Room): Is calculated by multiplying the ARR by the Average Occupancy Rate. It helps assess a hotel's ability to fill its available rooms at an average rate.

Coming back to the Leela hotels.

The chart below shows the amount of keys and hotels that they have. The Leela’s has fewer keys as compared to its peers like IHCL since they have multiple hotel categories ranging from luxury to budget. The Leela hotels are primarily focused on the luxury segment, focusing on a premium market position.

Source: DRHP; *Two months ended May 2024

The company’s owned portfolio demonstrated impressive growth, with the ARR and RevPAR increasing at a CAGR of 10.8% and 11.8% respectively from FY19-24, as opposed to the luxury hospitality segment’s growth rate of 8.4% and 8.6% respectively.

Moreover, the RevPAR across the company’s owned portfolio was 1.4x higher than the overall luxury hotel segment average in India. In comparison, the ARR and RevPAR of their managed portfolio were 1.4x and 1.3x higher, respectively, than those of comparable hotels in their micro-markets.

Source: DRHP; *Two months ended May 2024

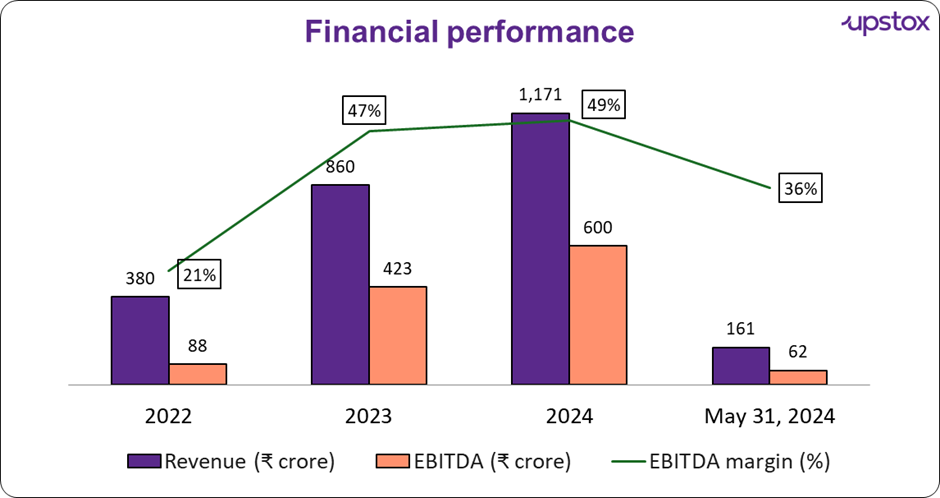

This has translated into robust revenue growth for the company. Strong revenue growth and Improved operating leverage have translated into an EBITDA margin improvement.

While this is encouraging, we note that for the last three years, the company has been making a net loss. High interest costs coupled with deprecation charges have weighed on its profitability

Source: DRHP; *Two months ended May 2024

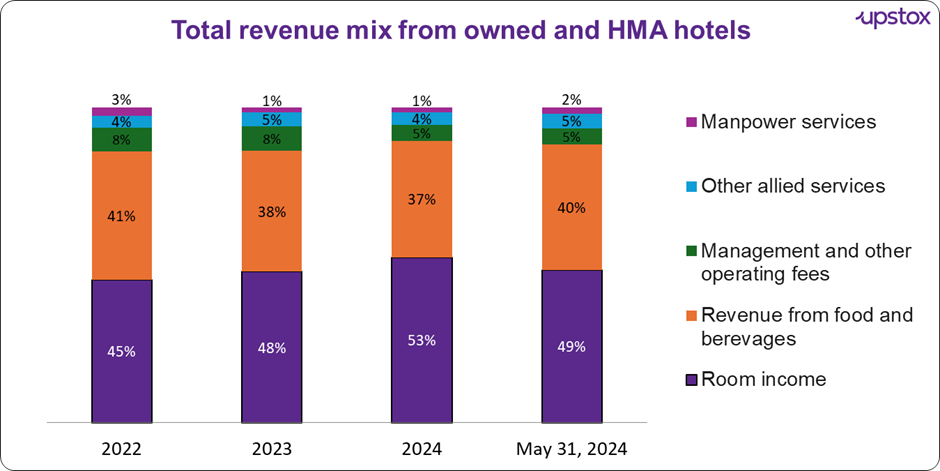

The company’s overall revenue mix shows a healthy distribution - with revenue from food and beverages (typically a high gross margin revenue stream) also contributing meaningfully to overall revenue.

Source: DRHP; *Two months ended May 2024

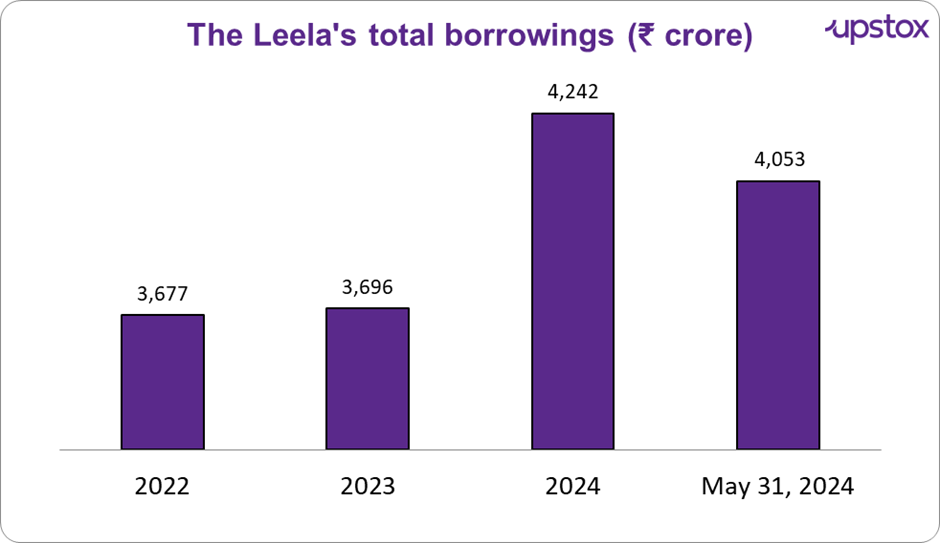

Finally, we look at the company’s balance sheet and debt status Total borrowings have increased as the company acquires more properties. Recognizing the increase in borrowing over recent years, the company has strategically decided to allocate a significant portion of the IPO proceeds to reduce its debt, thereby strengthening its financial position.

Source: DRHP; *As of May 2024

Future prospects

Schloss Bangalore Limited plans to expand its portfolio by adding 8 new hotels, increasing capacity by 24.6%. These include modern palace hotels in Agra and Srinagar, resorts in Ranthambore and Bandhavgarh, a hotel in Hyderabad, and serviced apartments near Mumbai’s international airport.

The company is diversifying into wildlife, spiritual, and heritage tourism. Additionally, they are expanding into managing residential clubs, developing properties adjacent to future Leela-branded hotels, and launching exclusive ‘members-only’ clubs.

Overview of select listed hospitality players

Some insights on how The Leela stands against its competitors.

| The Leela | IHCL | EIH | Juniper | Chalet | |

|---|---|---|---|---|---|

| Key brands | The Leela (Palaces, Hotels and Resorts) | Taj, Seleqtions, Vivanta, Gateway, Ginger | Oberoi, Trident | Grand Hyatt, Andaz, Hyatt Residences, Hyatt Regency, Hyatt and Hyatt Place | JW Marriott, Marriott Executive Apartments, Novotel, Westin, Courtyard and Four Points by Sheraton |

| Total operational keys | 3,382 | 24,136 | 4,269 | 1,895 | 3,052 |

| Total income % CAGR (FY22- 24) | 72% | 47% | 59% | 55% | 65% |

| EBITDA margin (%) | 49% | 34% | 40% | 39% | 42% |

| ROE | NA | 14.0% | 17.6% | 1.6% | 16.4% |

| D:E | NA | 0.2 | 0.1 | 0.5 | 1.6 |

Source: DRHP, Screener.in, information for ROE and D:E is not available as both net profit and equity are negative.

Valuations

Since the price band is not yet disclosed, we are unable to make any comments on its valuations.

| Particular | P/E | EV/EBITDA (FY 24) |

|---|---|---|

| The Leela | - | - |

| IHCL | 77.3 | 41.1 |

| EIH | 37.3 | 22.2 |

| Juniper | 268.2 | 28.5 |

| Chalet | 65.2 | 34.6 |

Source: DRHP

Conclusion

Schloss Bangalore Limited, under The Leela brand, aims to raise ₹5,000 crores through its IPO to reduce debt and expand its portfolio. Despite recent net losses, it has shown strong growth in ARR and RevPAR, outperforming the luxury segment. With plans to add 8 new hotels and diversify into wildlife, spiritual, and heritage tourism, The Leela is set for further growth in India’s luxury hotel market.

About The Author

Next Story