Upstox Originals

Ather Energy IPO: Advancing India's electric mobility journey

.png)

7 min read | Updated on September 13, 2024, 17:16 IST

SUMMARY

Ather Energy is a fully integrated electric two-wheeler (E2W) player in India. Backed by Hero Motocorp, Ather is the 3rd largest E2W player in India. The company is set to tap the IPO market to finance its expansion, aiming to raise ~₹3,100 crore ($370 million). This article analyses its journey and evaluates its market share, financials, and valuations. We also highlight a few key factors for investors to monitor.

Ather Energy is one of the largest E2W player in India

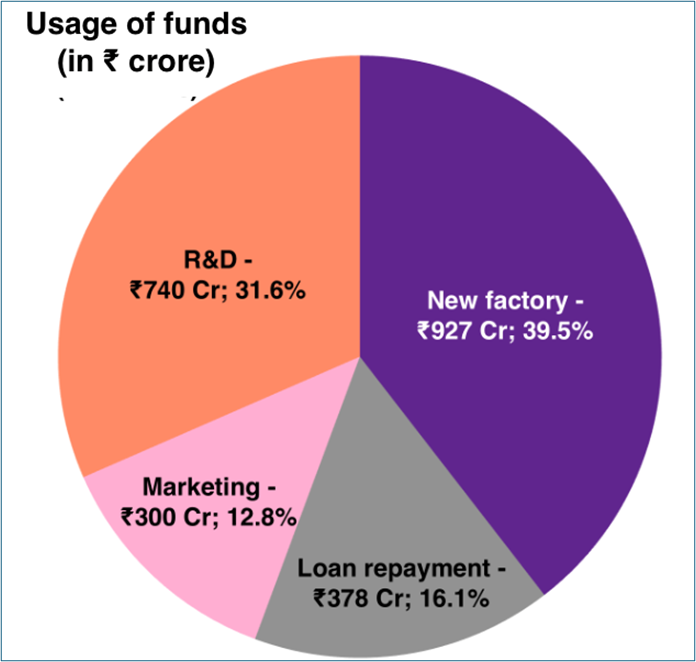

Ather Energy is the third largest electric two-wheeler (E2W) - in terms of market share, and is backed by Hero Motocorp. Ather has filed its DRHP to raise ~₹3,100 crore ($370 million) via IPO, which includes a fresh equity share issue and an Offer for Share (OFS) of up to 2.2 crore shares (10.7% of total shares).

Source: Ather DRHP, rounded up numbers. Usage of funds does not include OFS, hence lower than IPO size.

Ather’s history

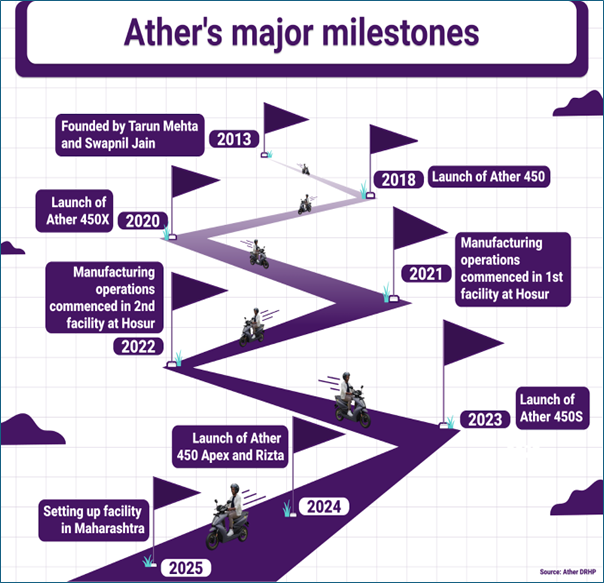

Ather was founded by Tarun Mehta and Swapnil Jain in 2013. The company has fully integrated operations encompassing the design and development of E2Ws, battery packs, charging infrastructure, associated software, and accessories with a focus on technology and product innovations. The company operates through its facilities in Hosur and also plans to establish a factory in Maharashtra.

The chart below provides a timeline of some of the key events for the company.

Source: Ather DRHP, company website

Industry insights

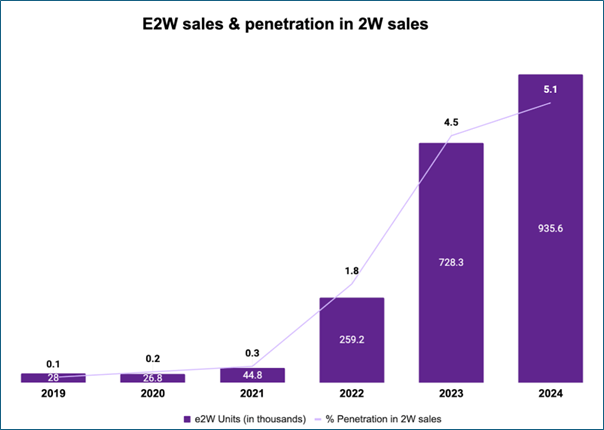

As seen in the chart below, EV adoption in India has been rising rapidly and consistently. Over FY19-24, in 2Ws, the conventional combustion segment contracted at a 3.7% CAGR, while the EV segment grew exponentially at a 101.7% CAGR. Despite this, penetration is still at around 5%, highlighting the potential for future growth.

Source: Crisil Report - Assessment of Electric Two-wheeler Industry in India

Increasing EV adoption is being driven by factors including:

- Attractive product portfolio with novel technology features

- Incentives like the FAME scheme make the products more affordable

- Better driving economics of an EV versus combustion vehicles (partially driven by the oil price increase over the past couple of years)

- Increase in the price of combustion vehicles, which has lowered the difference between initial outlay for consumers

Vehicle sales and market share

Ather's sales figures reflect a robust growth trajectory, with 109,577 units sold in FY24, up from 92,093 in FY23, despite pricing their products at a premium.

| Year | FY22 | FY22 | FY22 | FY23 | FY23 | FY23 | FY24 | FY24 | FY24 |

|---|---|---|---|---|---|---|---|---|---|

| Models | Units | Revenue (₹ in crore) | % of revenue | Units | Revenue (₹ in crore) | % of revenue | Units | Revenue (₹ in crore) | % of revenue |

| Ather 450S | - | - | - | - | - | 22,712.0 | 277.7 | 17.7 | |

| Ather 450X | 23,402.0 | 370.3 | 100 | 92,093.0 | 1,432.7 | 100.0 | 39,067.0 | 590.5 | 37.6 |

| Ather 450X (2.9 kWh) | - | - | - | - | - | - | 11,249.0 | 157.8 | 10.0 |

| Ather 450X (3.7 kWh) | - | - | - | - | - | - | 35,999.0 | 535.5 | 34.1 |

| Ather 450 Apex | - | - | - | - | - | - | 550.0 | 9.1 | 0.6 |

| Total | 23,402.0 | 370.3 | 100.0 | 92,093.0 | 1,432.7 | 100.0 | 1,09,577.0 | 1,570.60 | 100.0 |

Source: Ather DRHP

Please note the table above only considers revenue from vehicle sales. Over and above this, the company also generates revenue from software and services. Over the last 3 years, they have generated a revenue of ₹39.0 crore, ₹348.0 crore, and 184.0 crore in FY22, FY23, and FY24 respectively.

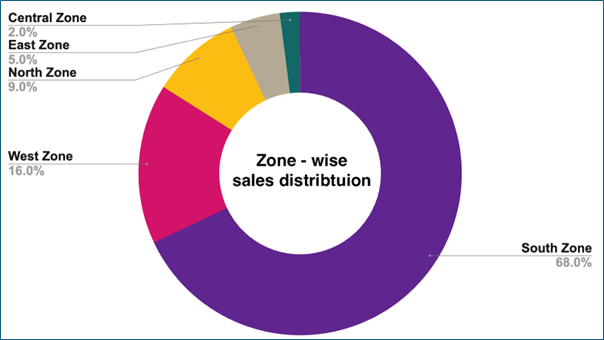

More than two-thirds of Ather's sales (68%) in the financial year 2024 came from the Southern part of India, with the second best coming from the West.

Source: Ather DRHP

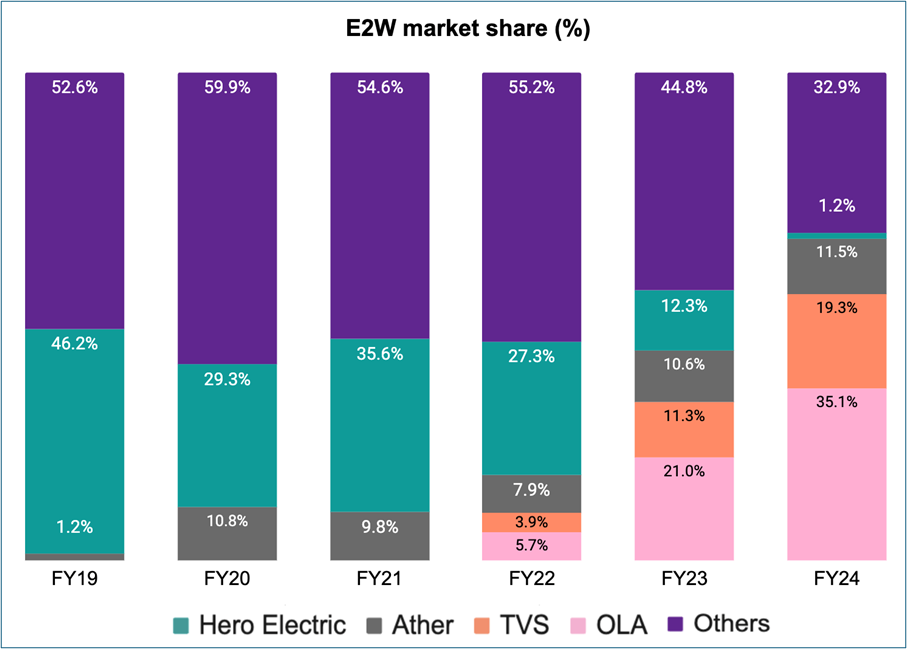

While absolute sales have increased for Ather, we believe its ability to sustain market share gains will be a key monitorable from an investor point of view. The company has regained the share it lost over FY20-22, reaching a high of 11.5%. While encouraging, competition in the E2W market is only expected to increase.

Source: Crisil Report - Assessment of Electric Two-wheeler Industry in India

Manufacturing capabilities and supply chain

Ather’s current manufacturing is concentrated in two factories in Hosur, Tamil Nadu. These factories operated at 29% capacity in FY 2024, down from 40% the previous year since the company has expanded capacities anticipating an increase in sales.

Ather is also working on "Factory 3.0" in Chhatrapati Sambhajinagar, Maharashtra, expected to be operational in phases starting in 2026.

- Current Capacity: 420,000 E2Ws and 379,800 battery packs annually.

- Planned Capacity (2027): 1.42 million E2Ws annually after Factory 3.0 is completed.

The company's supply chain resilience is bolstered by sourcing 99% of components domestically, excluding lithium-ion cells, enhancing local manufacturing and reducing dependency.

As of March 31, 2024, 80% of key components are designed in-house.

Financial performance

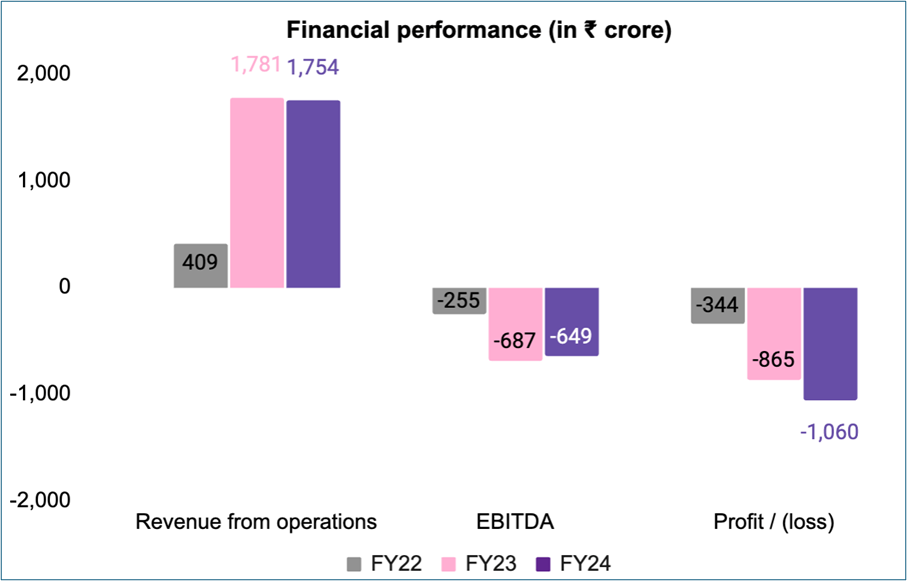

While the company is loss-making at the PAT level, the company has guided to become positive on the EBITDA level by FY27, expecting an improvement in sales, and better operating leverage.

The major reasons for current losses are:

- Expansion strategies, including expansion of the distribution network

- Investing in product R&D

- Talent acquisition

- Building and optimising the supply chain

Source: Ather DRHP

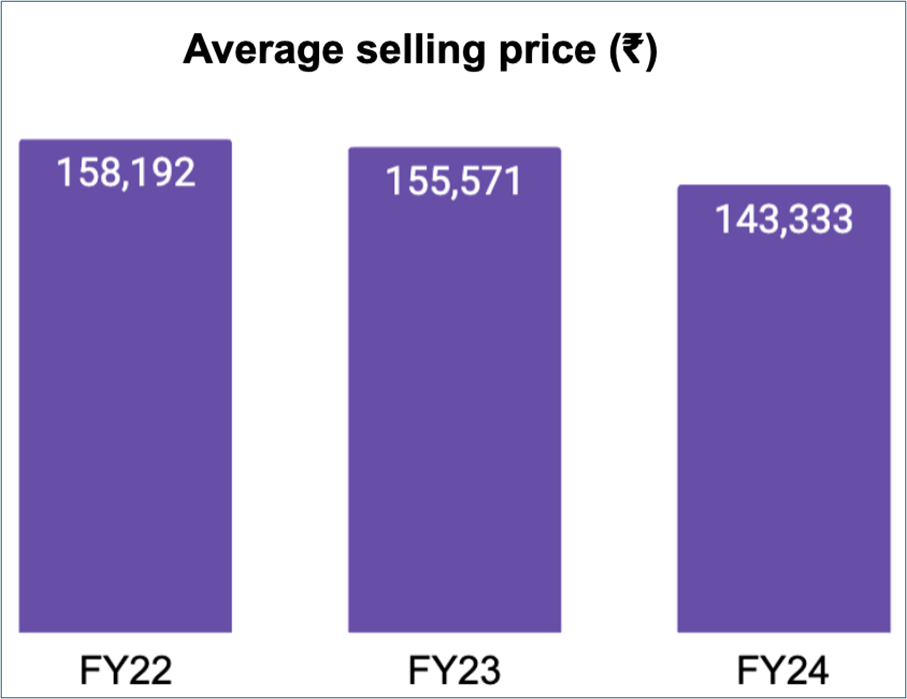

With introduction of economical variants of E2W, the average sales price has seen some decline

Source: Ather DRHP

How Ather stacked versus its peers?

In comparison with peers, Ather is comparatively weaker on various fundamental parameters from its peers especially Ola Electric.

| Particulars | Ather Energy | Ola Electric Mobility | Chetak Technologies | Greaves Electric Mobility | Okinawa |

|---|---|---|---|---|---|

| e2W Market share (FY24) | 11.5% | 35.1% | 11.4% | 3.3% | 2.2% |

| Operating revenue (₹ Crore) | 1,753.8 | 5,009.8 | 160.7 | 424.5 | 815.2 |

| Operating margin (%) | -37.0% | -26.7% | -10.5% | -3.3% | 15.2% |

| PAT margin (%) | -60.4% | -30.2% | -10.5% | -7.4% | 10.9% |

Source: Ather DRHP, Crisil Report - Assessment of Electric Two-wheeler Industry in India

How Ather's products stack up compared to Ola Electric (one of its key competitor)

| Ather Energy | Ola Electric | |

|---|---|---|

| Model | 450X | S1 Pro (2gen) |

| Ex-showroom price (₹ lakh) | 1.6 | 1.3 |

| Battery capacity (kWh) | 3.7 | 4.0 |

| Range (km) | 150 | 195 |

| Charging time (hrs) | 5.5 | 6.5 |

| Maximum speed (km/h) | 90 | 120 |

| Acceleration | (0-40 km) 3.3s | (0-40 km) 2.6s |

Source: Crisil Report - Assessment of Electric Two-wheeler Industry in India

Valuation: No official price band has been disclosed at the moment, as such, we are unable to comment on valuation

Key risks

- Intense Competition: India’s E2W industry has intense competition, with the top .-4 players accounting for a lion’s share of the market. The entry of new startups in the EV segment has further intensified competition, making it challenging for these new entrants to establish pricing power in the market.

- Financial Losses: Ather has been operating at a loss and has had negative cash flow. While the company has guided for when it will turn profitable, it is subject to a lot of uncertainties.

- Dependence on Hosur facility for manufacturing: It currently depends on its two manufacturing facilities near Hosur in Tamil Nadu to assemble its electric two-wheelers and manufacture battery packs. Any political events, labour disruptions or natural calamities could seriously disrupt production.

- Market concentration: As highlighted above, ~68% of sales are concentrated in southern India. Any disruption, natural or otherwise, could impact its market share and sales volumes.

Conclusion

The IPO marks a significant step for Ather Energy as it looks to expand its manufacturing capabilities, invest in R&D, and enhance its market presence. However, the company faces substantial competition and financial challenges, which could affect its long-term success.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story