Upstox Originals

With government capex slowing down, will the private sector step up?

6 min read | Updated on February 05, 2025, 11:14 IST

SUMMARY

After many years, the government has taken its foot off the capex pedal. It is now time for the private sector to step in and shoulder this critical responsibility. But, corporate capex is at an all-time low, with no visible green shoots. In this article, we analyse the trends in corporate capex and why it is critical to bolster India’s growth.

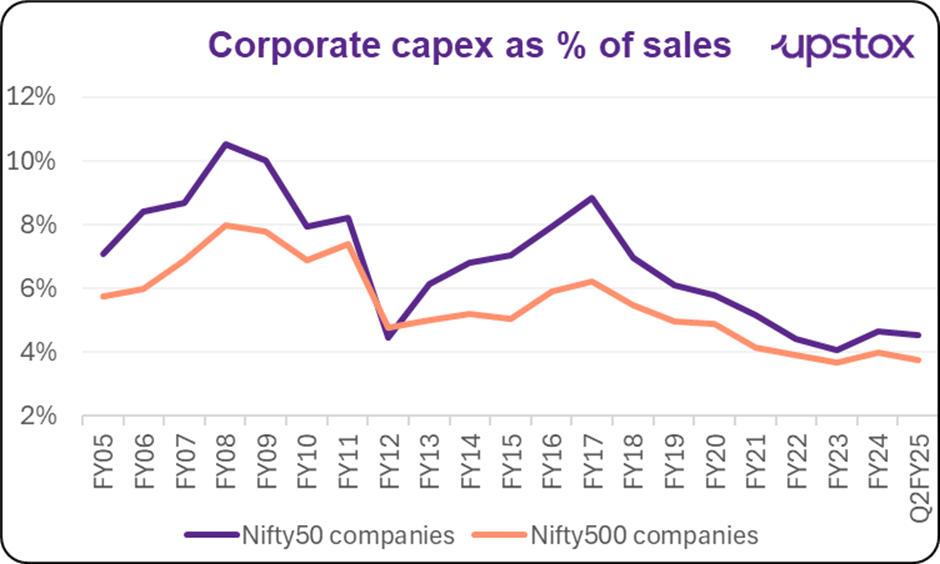

Corporate capex spend as a percent of sales has been falling

One of the major highlights of the Union Budget 2025 (besides the tax cut) was the government’s focus on fiscal consolidation. The government is targeting a fiscal deficit of ~4.4% in FY26 from an estimated deficit of ~4.8% in FY25. Besides that, the government has also committed to lowering debt.

For those not well versed, fiscal deficit is the difference between the government’s income and expenditure. If the government spends more than it earns, it is ‘running a deficit’ and will need to borrow money to pay for those expenses. Thus, lower deficits should also translate to lower debt.

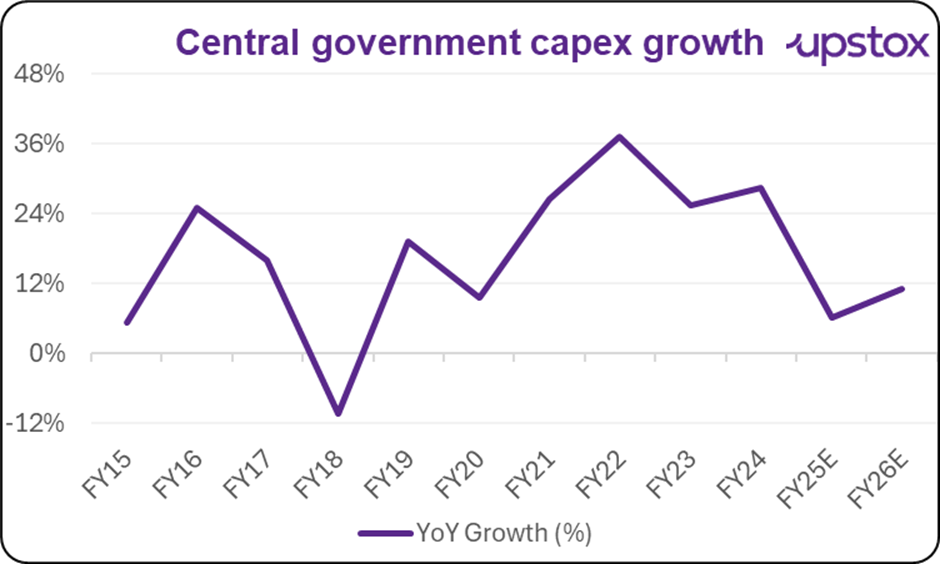

But, a lower deficit also means lower spending by the government. One major area where the government has reduced the pace of spending is capital expenditure or capex. As seen in the chart below, after almost 4-5 years of ~20%+ YoY growth, government capex in this and next year is expected to grow at about 8-10%.

Source: CEIC, news articles, press releases, government documents

There are two schools of thought here. One believes that, given the challenged growth outlook, the government should increase the rate of capex spending. The other suggests that the government can’t keep spending money indefinitely, and it is high time for corporations to step up. We will discuss this viewpoint in more detail.

So, let’s look at what is happening with corporate capex.

The corporate capex outlay has been falling for the past many years. After peaking out around FY17-18 (as a % of sales), corporate capex has been on a declining trend. Unfortunately, this does not paint a very optimistic picture.

Source: Ace Equity

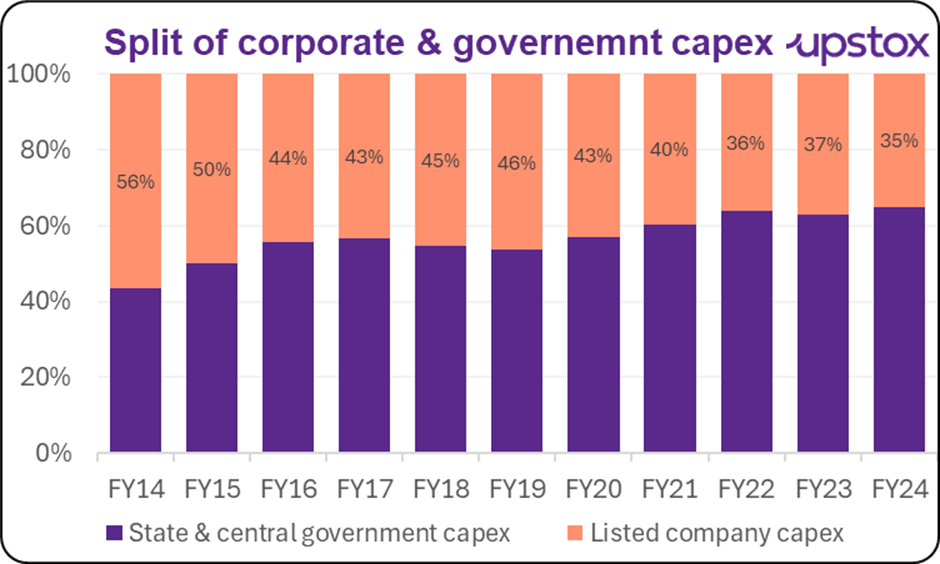

In fact, a significant (and slightly disappointing) trend is that of the split between corporate and government capital expenditure. From being almost equal partners in FY14-15, the government has been carrying a majority of the burden in the last few years.

Source: CEIC

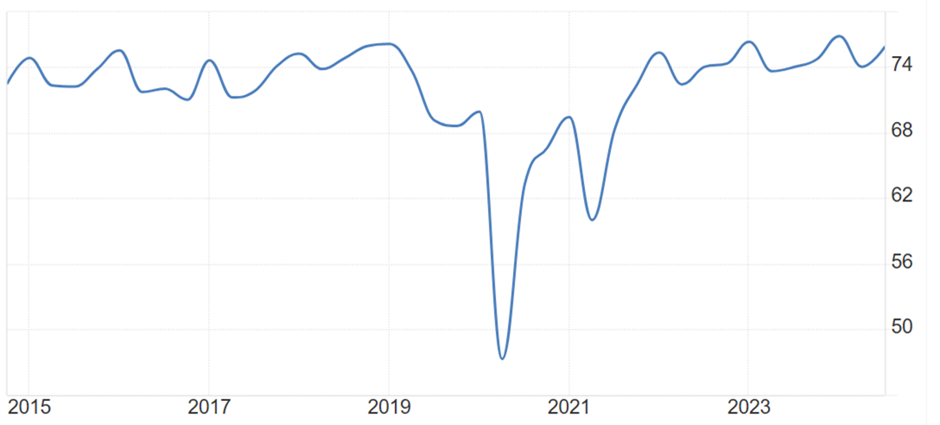

One logical conclusion is that the majority of the corporate sector spending is on brownfield capex—spending required to maintain the current asset base. Corporates are not expanding anymore, but spending money to redevelop or reuse existing facilities. This can further be validated by the fact that capacity utilisation over the past decade has broadly remained flat.

Trend in overall capacity utilisation (%)

Source: Trading Economics

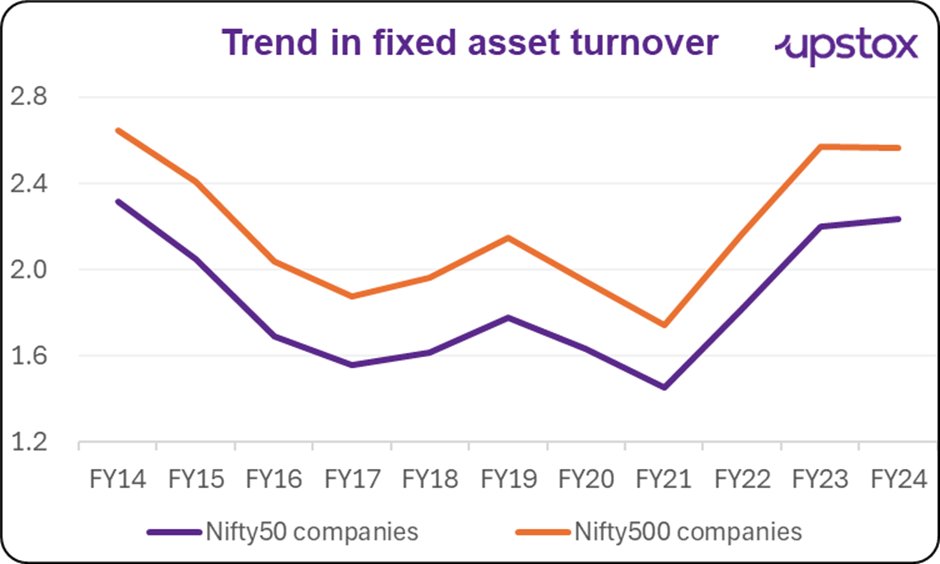

Few might argue that with improvements in technology, companies are becoming more efficient. So they are using their machines better and hence capital expenditure has been muted.

Perhaps, this is true to some extent. As can be seen below, the fixed asset turnover ratio (which shows how well companies are using their assets to generate revenue) has been improving for the past few years. That said, over the long term, it is broadly flat.

Source: Ace Equity

Now that we have established that corporate capex has been declining, let’s look at a few reasons for the same.

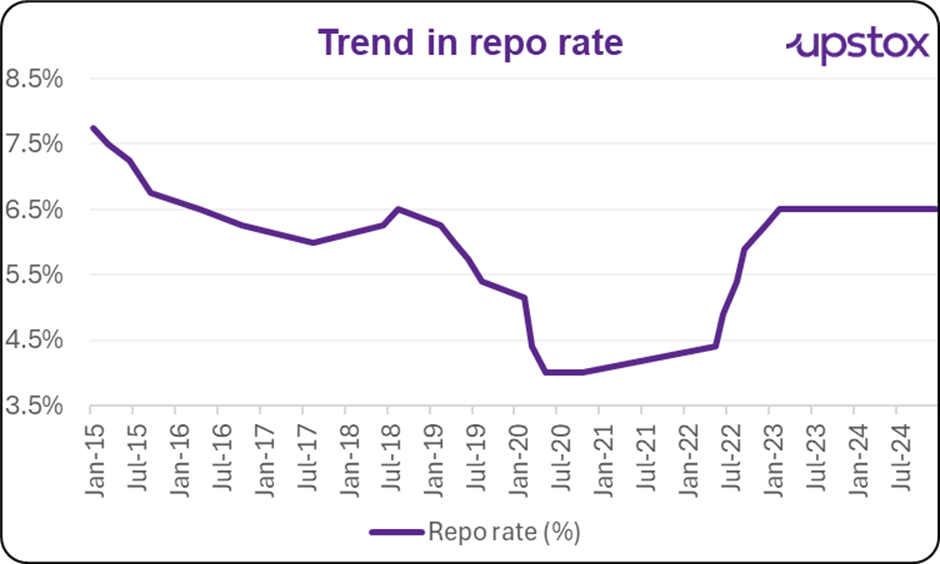

Cost of borrowing

Most market experts opine that interest rates should be reduced to not only boost consumption but also incentivise industries to borrow for more greenfield capital expansion (setting up new factories).

Source: Bankbazaar.com

Availability of skilled resources

In June 2024, some reports stated that L&T was facing a manpower shortage of about 45,000 employees (labourers and techies). In the year before that, there was a shortage of about 30,000 employees. It’s not just about one company. In September 2024, a study by the National Skill Development Corporation (NSDC) revealed that while demand for skilled labour was pegged at ~103 million, the supply was only ~74 million. Shortage of skilled labour, especially in manufacturing, is a key hurdle for additional resource allocation.

Corporate capex cycles are slow and cyclical

By their very nature, corporates are judicious about spending money. They only spend money when there is a reasonable degree of certainty (maybe even safety) about the return on investment. Private capex cycles are therefore typically slow to pick up.

Muted demand and consumption

Over the past year or so, reports have highlighted a slowdown in demand, specifically urban demand. Many CEOs have flagged this as a key worry. While a muted demand environment discourages additional investment, overall demand and consumption have only been muted over the past 12-18 months. As of today, this reason is therefore only partially responsible for corporate reticence to build newer capacities.

Besides the above-mentioned reasons, challenges in land acquisition and regulatory hurdles continue to persist in India. These serve as further deterrents for private spending.

In summary

While there is no denying that the government is always the first mover in building critical infrastructure, private capex needs to pick up to boost India’s overall growth. Compared to the government, the private sector is better placed at not only planning but also executing projects. This ensures effective asset allocation.

A kick-off in private sector capex can also help the ongoing unemployment challenges. Unfortunately, this is a vicious cycle. If workers do not get skilled jobs, they will be forced to take up any opportunity available and consequently, their focus on upskilling will diminish and worsen the unemployment situation.

To make matters even more challenging, the Economic Survey 2023-2024 found that between FY19-23, the private sector’s spending on productive assets like machinery, and equipment increased by ~35% while that on sunk costs like buildings and dwellings grew by 105%. Very loosely explained, this means monies are being spent on building newer offices rather than on productive assets which will drive future growth.

Government initiatives like the production-linked incentive scheme, incentives for Make in India, and opening up or encouraging FDI in certain sectors are all steps to encourage private-sector spending. The boost to consumption via tax cuts for the middle class should also help improve the demand environment and might lead the private sector to reconsider their spending plans.

But as they say, you can get a horse to the pond, but can't make it drink the water!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story