Upstox Originals

Will small and midcaps keep stealing the spotlight in 2025?

.png)

4 min read | Updated on December 13, 2024, 18:28 IST

SUMMARY

In recent years, markets have witnessed a notable trend towards diversification, with investors spreading their investments across market caps. Slowly but surely, they are reducing their concentrated bets on a few large stocks, and increasing exposure across the board. Not only does this bode well for the liquidity of these stocks, but also helps with price discovery and bolsters governance standards! This article dives deeper into this phenomenon.

FIIs and DIIs both turned net buyers on Tuesday, with ₹1800 crore worth of buying in the Indian markets

The Indian securities market is undergoing a significant transformation. Investors, once heavily reliant on largecap stocks, are now exploring opportunities in mid and smallcap segments.

This shift is evident from data showing a steady decline in the concentration of investments in Nifty50 and top-tier companies. Foreign Portfolio Investors (FPIs), for instance, have expanded their holdings to over 1,800 stocks, up from 1,200 just four years ago.

Similarly, Domestic Mutual Funds (DMFs) have broadened their portfolios to include record numbers of smaller companies.

These trends indicate a growing appetite for diversification, driven by attractive growth prospects and valuations in smaller companies. With large caps trading at elevated valuations, the mid and smallcap space offers a fresh horizon for investors seeking long-term growth in a dynamic market landscape.

What is Herfindahl-Hirschman Index (HHI)?

The HHI is a measure of market concentration. Simply put lower HHI means lower concentration with a higher number of stocks in the portfolio.

So, what do the current trends look like?

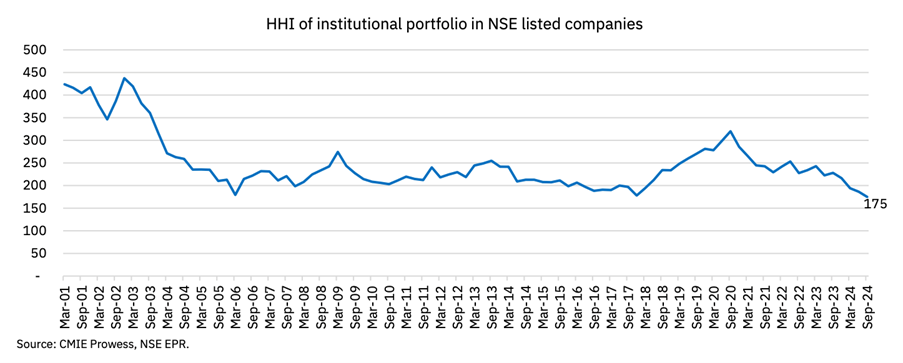

Institutional Investors: The HHI for institutional portfolios in NSE-listed companies dropped to 175 in the September 24 quarter, the lowest since 2001.

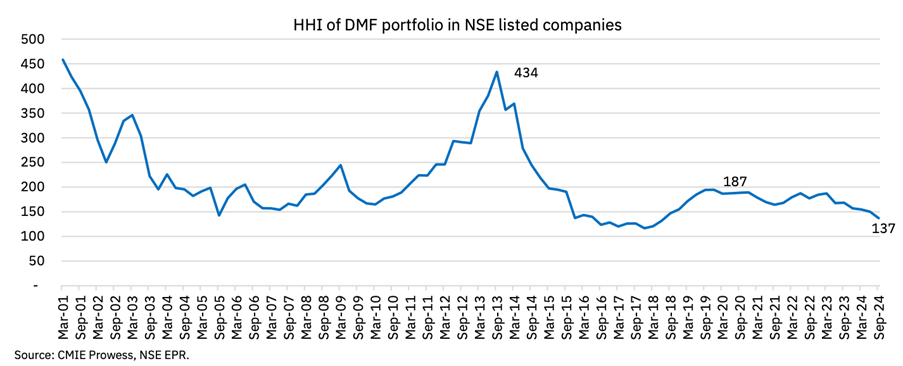

Domestic Mutual Funds (DMFs): HHI at 25 25-quarter low with an HHI of 137 as of September - 24.

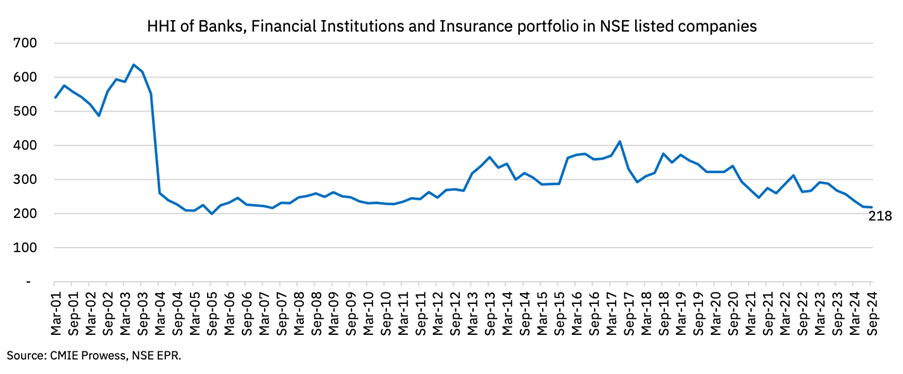

Banks, Financial Institutions, and Insurance Companies: Recorded a 17-year low with an HHI of 218 as of September - 24

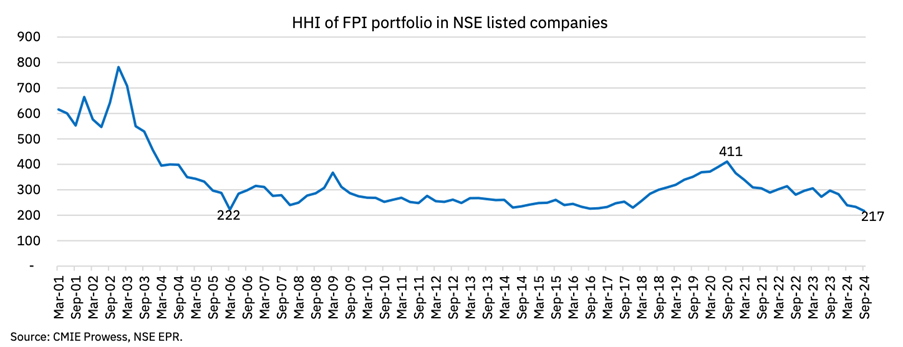

Foreign Portfolio Investors (FPIs): Their HHI was at 217 in September, reflecting the lowest concentration since our records began in 2001.

This decline in HHI across various investor groups points towards a strategic shift towards mid and smallcap stocks, as investors seek growth amidst the market's all-time high valuations.

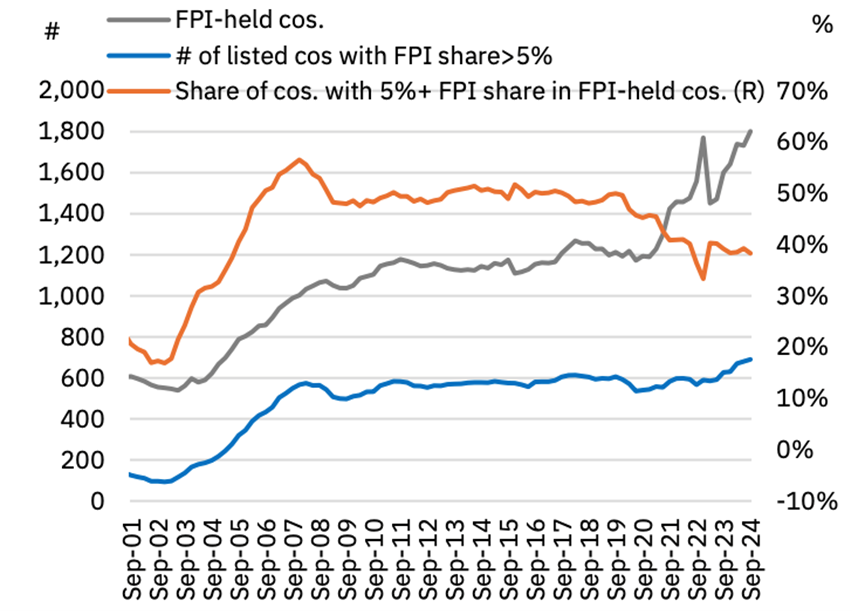

Expanding FPI holdings

From December 2020 to September 2024, FPIs significantly broadened their investment scope in India, increasing their holdings from approximately 1,200 companies to over 1,800.

Meanwhile, the count of companies in which FPIs hold a stake greater than 5% has also been steadily rising.

Increase in FPI holdings across market capitalisation

Source: NSE *FPI ownership includes ownership through depository receipts held by custodians

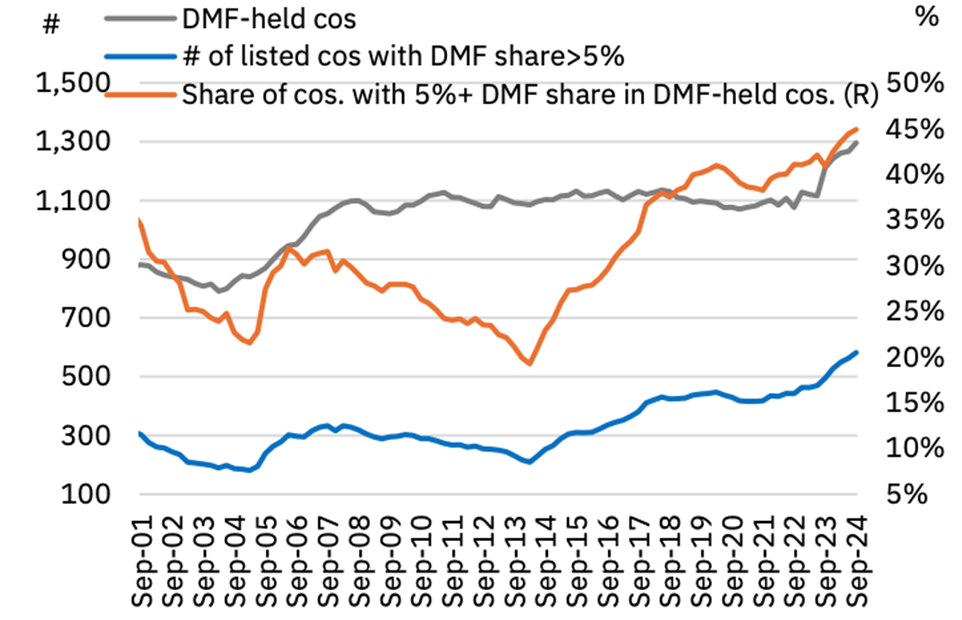

Domestic Mutual Funds (DMFs) are not far away and have also been steadily increasing their investment across different market capitalisation.

Increase in Mutual Funds’ holdings across market capitalisation

Source: NSE

The reason behind this emerging trend is better earnings growth and valuation prospects being offered by smallcaps and midcaps :

While the valuations of mid and smallcaps are still inflated, they compensate for that by offering higher-than-expected earnings growth, coupled with stronger ROE.

| Category | PE Ratio | EPS Growth CY24-CY26E | ROE |

|---|---|---|---|

| Nifty Large Cap 100 | 23.1 | 7% | 14% |

| Nifty Mid Cap 100 | 42.6 | 15% | 12% |

| Nifty Small Cap 100 | 35.5 | 17% | 15% |

| Nifty Small Cap 250 | 34.9 | 17% | 15% |

Source: Bloomberg, Trust MF; as of 5th Dec-24

Finally, we also look at fund flows.

October saw record net outflows from FPIs, particularly concentrated in the top 100 stocks while other segments of the market even saw some buying also evidencing the trend that FIIs are growing their exposure to Indian markets with small caps and midcaps through strategic diversification.

Index-wise flows in Oct-24 (in ₹ crore)

| Category | Nifty 50 | Nifty Next 50 | Nifty Midcap 150 | Nifty Smallcap 250 | Nifty Microcap 250 | Rest | Total |

|---|---|---|---|---|---|---|---|

| Prop | 2,393 | -849 | -2,542 | -2,153 | -959 | -8,141 | -12,251 |

| Individual | 13,595 | 4,338 | 3,471 | 1,515 | -706 | 7,382 | 29,594 |

| FPI | -90,594 | -19,024 | -8,276 | 851 | 1,202 | -1,436 | -117,279 |

| DII | 74,255 | 17,170 | 8,903 | 1,515 | 981 | 4,512 | 107,336 |

| Corporate | 868 | -847 | -1,042 | -626 | -285 | -1,717 | -3,649 |

| Others | -517 | -787 | -513 | -1,101 | -232 | -600 | -3,751 |

Source: NSE

Conclusion

The ongoing trend towards diversification in the Indian equity market reflects a maturation of investment strategies, where both domestic and foreign investors are increasingly looking beyond traditional largecap stocks. This shift not only supports market stability but also fosters growth in mid and smallcap segments. However, investors must remain vigilant, as sectoral concentration in certain industries highlights the need for a nuanced approach to portfolio management in varying market conditions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story