Upstox Originals

Why is the healthcare sector outperforming even as the NIFTY50 struggles?

6 min read | Updated on January 07, 2025, 20:53 IST

SUMMARY

Markets have been correcting since October 2024. Despite that, off the top of your head, could you name one sector that is still doing well? Take a guess. We are talking about the Healthcare sector. In this article, we look at the broader market performance and try to explore why this sector has remained resilient.

The Nifty Healthcare index is outperforming the market and its peers

Let’s be honest, if you are an investor, the last few months have had you a bit on the edge. Most market commentary has been a bit distressing. The market has corrected by so-and-so percentage points, stocks are in red, and Nifty50 has breached a certain level - these are the headlines that you might have come across in the past few months.

And it is true. 2024 started with a bang. Until the end of September, the benchmark Nifty50 had delivered over 20% YTD returns. Not a bad showing, wouldn’t you agree?

Since then, however, the markets gave up most of their gains, ending 2024 with a mere ~9.0% return. Returns earned over most of the year were wiped out in just a few months.

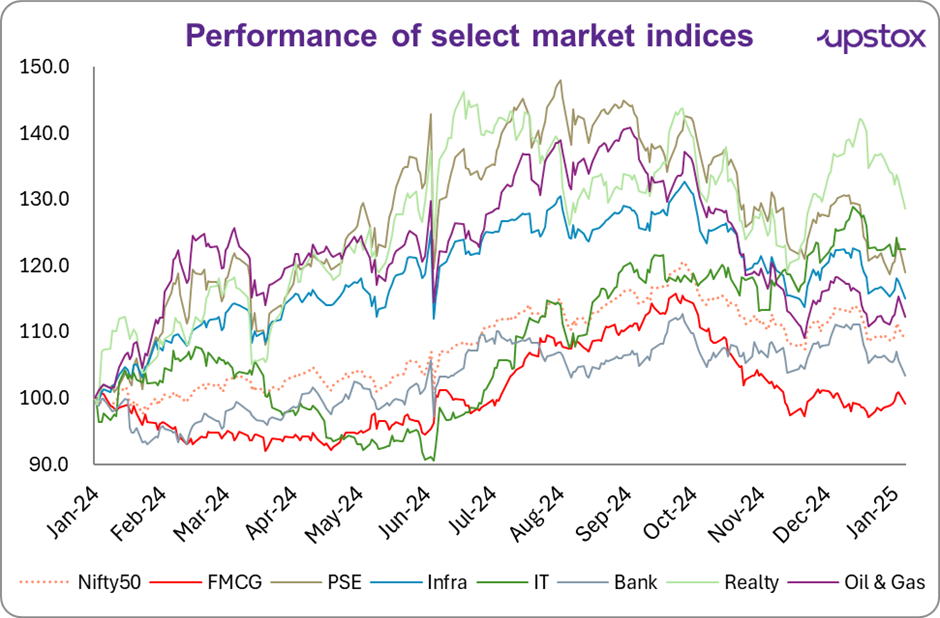

Not only the benchmark Nifty50 but even most of the sectoral indices have given up most of the gains made in 2024, as seen in the chart below.

Source: Investing.com; data as of January 6, 2025

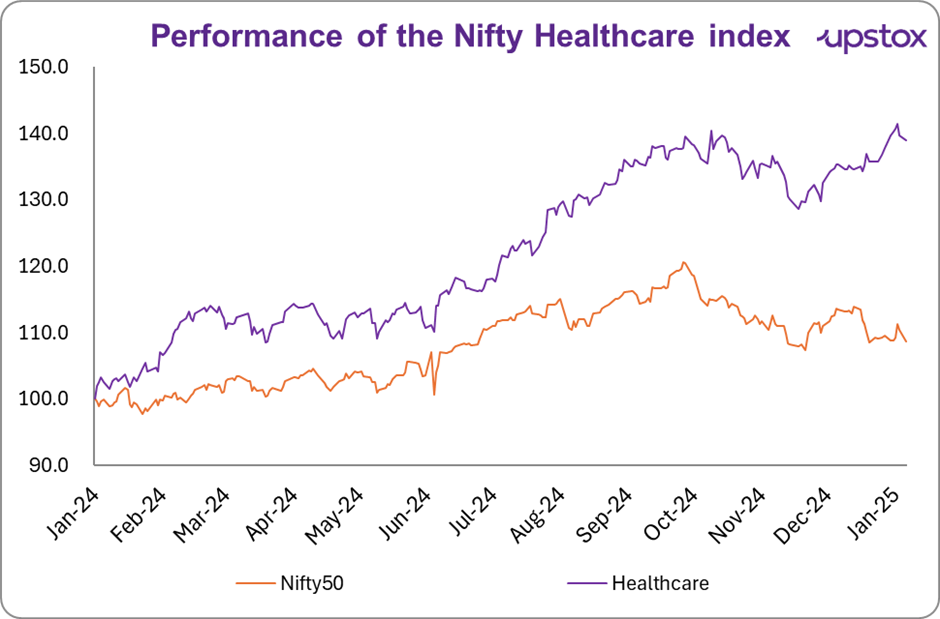

However, the Nifty Healthcare index is an exception to this broader trend, as shown in the chart below. Not only has this sector continued its uptrend, but it has also continued making new highs. While the Nifty Pharma also shows a similar trend, we’re considering the healthcare index because it is a broader index (including hospitals, diagnostics, and pharmaceutical companies)

Source: Investing.com; data as of January 6, 2025

This begs the question: what is driving this outperformance? Well, here are two reasons that support this recent performance.

Strong earnings growth

For most of 2024, markets moved from strength to strength. Not even the record FII outflows could daunt the markets.

However, one sectoral index that has managed to buck the trend is Nifty Healthcare. As seen in the table below, the 1-year CAGR earnings of this sector (on a reported net profit basis) has far outperformed most of its peers.

While one could argue that Nifty Realty has also delivered strong earnings over the last year, performance in the recent two quarters has left investors asking for more.

Reported net profit of select sectors (in ₹ crore)

| Sector | Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 | CAGR (%) |

|---|---|---|---|---|---|---|

| Realty | 1,158 | 1,289 | 2,360 | 1,626 | 1,582 | 37% |

| Healthcare | 7,722 | 6,637 | 12,508 | 8,855 | 9,894 | 28% |

| IT | 24,946 | 25,691 | 27,809 | 25,524 | 29,431 | 18% |

| Bank | 63,525 | 59,738 | 75,183 | 72,513 | 73,870 | 16% |

| Nifty50 | 150,164 | 159,749 | 175,000 | 159,379 | 169,350 | 13% |

| FMCG | 12,129 | 11,995 | 10,569 | 12,185 | 12,310 | 1% |

| PSE | 65,012 | 55,448 | 59,165 | 42,077 | 46,055 | -29% |

| Infra | 70,430 | 57,928 | 63,147 | 52,010 | 46,071 | -35% |

| Oil & Gas | 53,750 | 38,781 | 39,826 | 29,698 | 30,127 | -44% |

Source: Ace Equity

Flight to safety

When markets correct, investors look for safe shelters to park their funds and weather the storm. The healthcare sector is one such sector, and this explains its resilience compared to its peers.

A question one could ask is: why not FMCG? Regardless of where the market is, one would still need daily groceries, correct?

Wait, what about valuations?

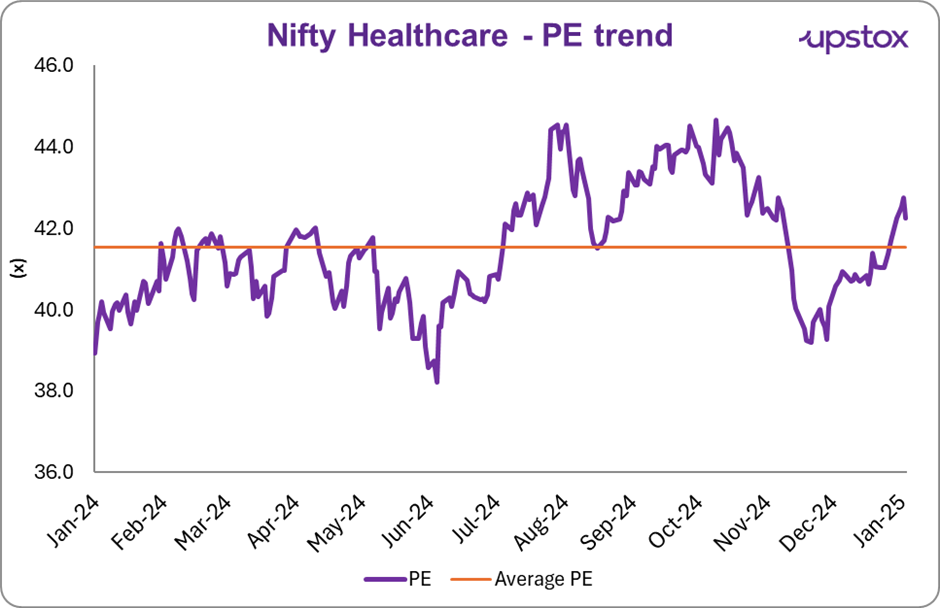

As shown in the chart below, after its recent correction, the healthcare sector remains reasonably valued.

Source: NSE; data as of January 03, 2025

Stock screener for the healthcare sector

In the table below, we provide a list of some stocks that are part of the Nifty healthcare index. Our screening criteria:

- ROE > 15% and

- Debt to equity ratio < 1x

Select companies from the Nifty Healthcare index

| Company | Market Cap (₹ Cr) | ROE (%) | 3Y profit growth (%) | 3Y price performance (%) | PE (x) |

|---|---|---|---|---|---|

| Sun Pharma | 443,385.0 | 16.7 | 25% | 31% | 39.6 |

| Cipla | 120,527.3 | 16.8 | 21% | 18% | 26.2 |

| Torrent Pharmaceuticals | 113,907.8 | 24.2 | 22% | 29% | 65.5 |

| Dr Reddy's Labs | 112,668.1 | 21.4 | 41% | 13% | 21.1 |

| Zydus Lifescience | 96,769.2 | 20.7 | 18% | 29% | 22.6 |

| Alkem Lab | 66,114.8 | 19.6 | 7% | 14% | 30.4 |

| Abbott India | 63,680.4 | 34.9 | 20% | 18% | 49.6 |

| Dr. Lal Pathlabs | 25,076.7 | 20.4 | 7% | -7% | 62.5 |

| Average | 1,30,266.2 | 21.8 | 20% | 18% | 39.7 |

Source: Ace Equity, Screener; data as of January 3, 2025

What does this mean for investors?

For investors, this provides an opportunity to consider portfolio diversification.

One of the key tenets of investment is diversification. The proverb ‘Do not put all your eggs in one basket’ while a cliche is still extremely critical to building a resilient portfolio.

Yes, you could have.

We do not question the long-term prospects of any of these sectors or the broader benchmark as well. That said, markets typically move from excess to distress. In other words, markets move in cycles.

Like it or not, a downtrend is inevitable at some point. Investors should, therefore, construct their portfolio to ensure that it is protected against any downcycle.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story