Upstox Originals

Why are Indian bonds gaining FPI attention?

.png)

4 min read | Updated on March 20, 2025, 19:38 IST

SUMMARY

India’s stock market has been struggling, with FPIs offloading equities at record levels. But in a surprising shift, debt markets have not only been resilient but are actually net inflows. In this article, we take a deeper look and analyse the reasons behind this trend and also what it means for the markets.

Indian debt markets are seeing an increase in foreign inflows

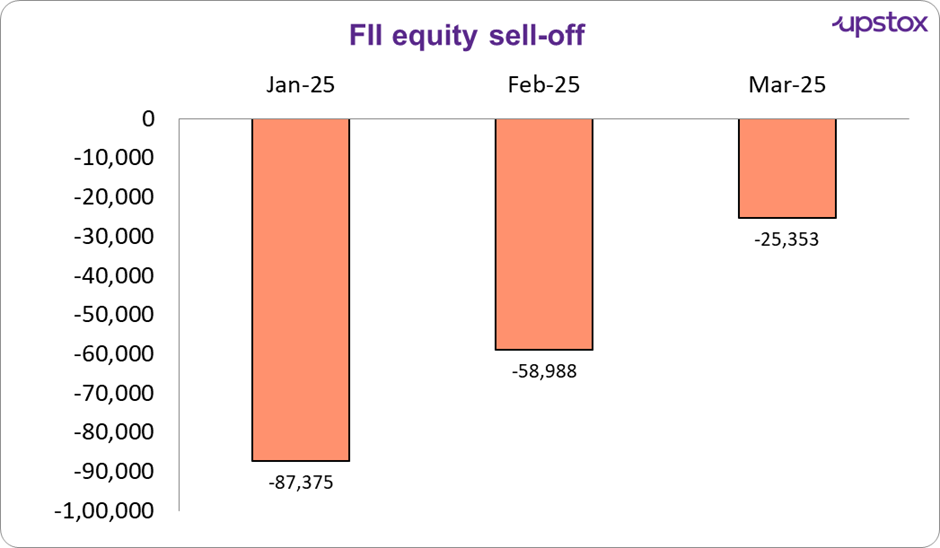

What if we told you FPIs are actually buying into the Indian markets? Sounds confusing, right? Recent news has been filled with persistent selling from FPIs who have been relentlessly selling Indian equities, as seen in the chart below.

Source: Moneycontrol, StockEdge; Note: data till March 19, 2025

So, where is the buying? While equity outflows have been making headlines, something interesting is happening on the sidelines—FPIs are quietly making a comeback in the debt market.

In this article, we dive deeper into why this is a significant development.

Bird’s eye view of FPI investment in Indian debt

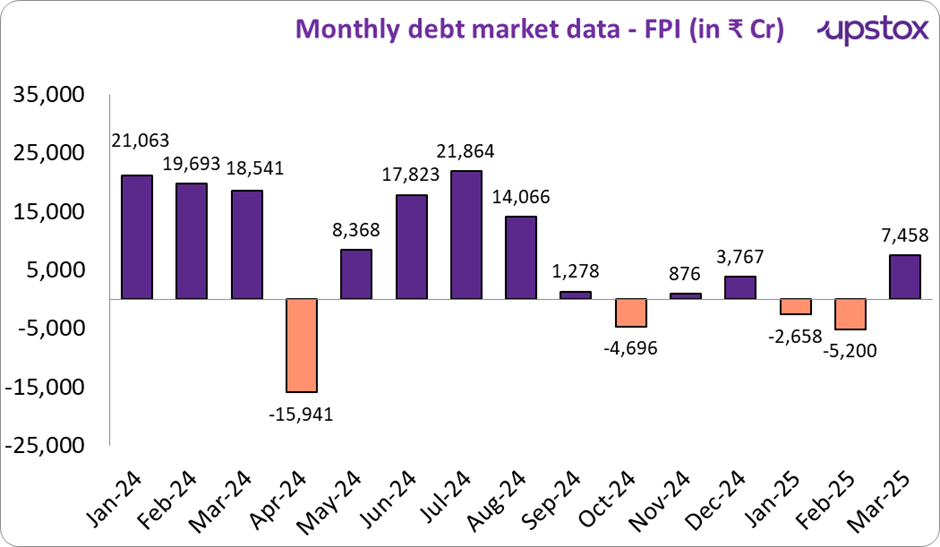

We track the monthly net flows by FPIs into the Indian debt markets. In 2024 debt markets had a relatively similar trajectory as equity markets. Strong net inflows till September 2024, and then the tide started to turn. From an average monthly inflow of ~₹13,000 crore (Jan-Aug 2024), flows dwindled in the latter part of 2024. Two key differences

-

Outflow from debt markets was not as strong as equity markets. This effectively indicated that the FPIs are not abandoning India, but simply reallocating their equity investments toward higher yielding countries.

-

The month of March (data is till the 18th) seems to indicate the worst may be behind us

Source: Moneycontrol, Stockedge Note: data till 18th March ‘25

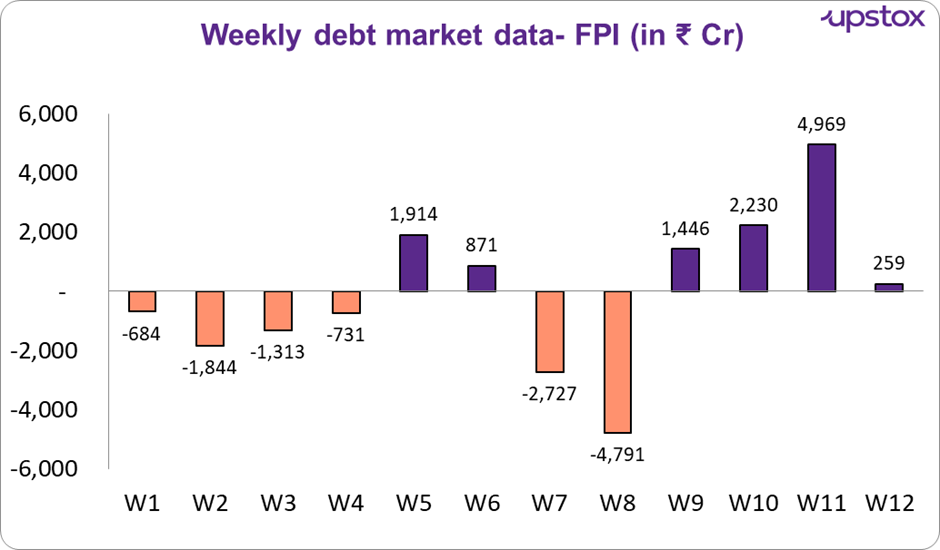

Let’s zoom-in to see exactly when the tide turned towards debt purchase. FPI debt investment data since the last 11 weeks (upto March 18th) indicates that, while FPIs were net sellers in the debt market until mid-February, things have seemed to take a slightly positive turn since then.

Source: Moneycontrol, Stockedge Note: data for 12 weeks starting from 1st Jan ‘25 to 18th March ‘25

It could be argued that only one month has seen a positive trend - and while that would be correct, we are encouraged by a few underlying developments

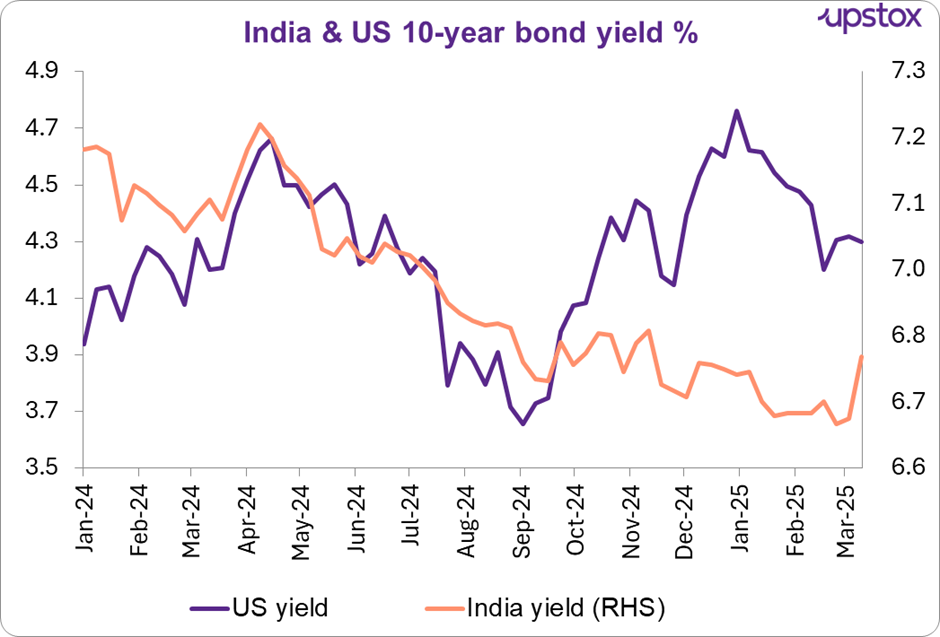

US-Indian bond yields

First - Indian yields have started to show an uptick since January 2025. Yields were falling till then, but now showing an uptick, indicating increasing interest and demand for Indian bonds.

Second - yields in the USA have started to come-off. After reaching near 5% levels, they have now come off by 50 bps, which could further make Indian debt look more appealing.

Source: Investing.com

INR stability; dollar cool-off

From November 2024 to February 2025, the rupee tumbled 3.8% against the US dollar, spooking foreign investors. However since late February, volatility has cooled, bringing stability—just what debt investors like to see.

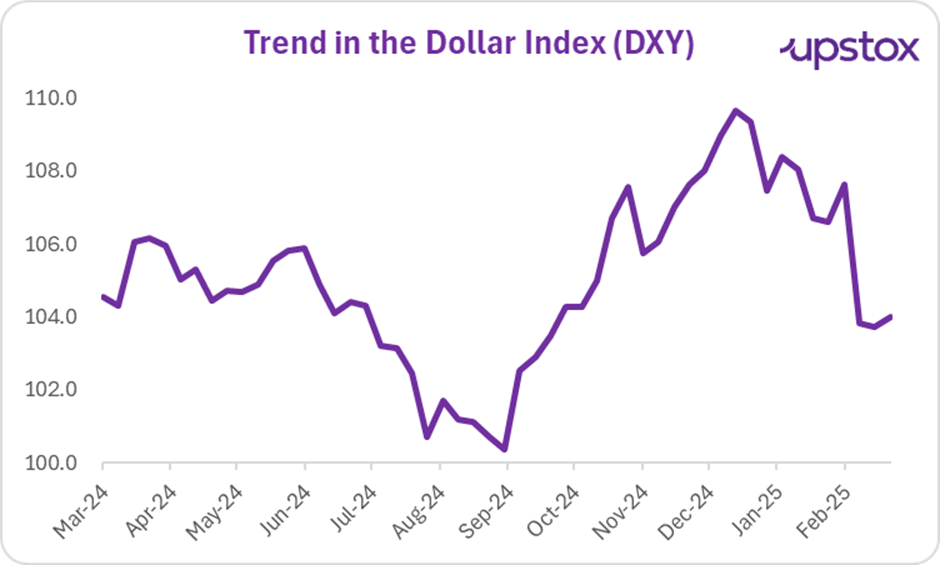

Furthermore, as seen in the chart below, overall dollar strength has cooled off in 2025. A falling DXY typically weakens the US dollar, making Indian debt more attractive to foreign investors due to better returns in their local currency. This can lead to increased demand for Indian bonds and lower borrowing costs for India.

Source: Investing

Recent RBI liquidity infusion

Since the start of February, RBI has intervened significantly to ease the liquidity crunch by buying ₹1 lakh crore worth of government bonds and injecting additional ₹87,000 into the economy through USD/INR swap, boosting local currency supply.

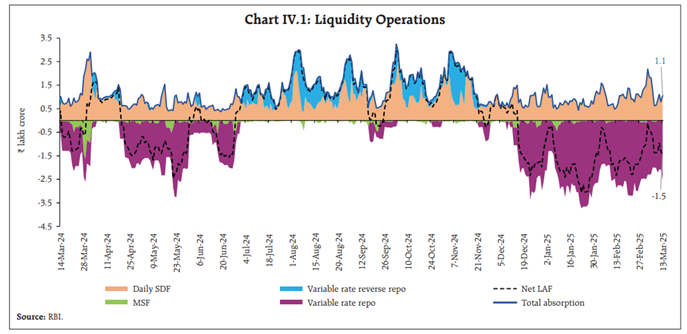

The impact? As seen in the chart below, liquidity conditions in India started to improve. If you track the dotted black line in the chart below, you note that from a liquidity deficit of ~₹3.5 lakh crore in early January, the deficit has narrowed to around ₹1.5 lakh crore now, easing overall liquidity in the markets.

This move is expected to lower certificate of deposit rates, ease corporate bond yields, and stabilise the bond market, which strengthens market confidence. To understand more about this read our article on India’s liquidity crunch.

Impact of RBI’s liquidity infusion

Inclusion in JP-Morgan & Bloomberg index

India’s inclusion in the JP-Morgan emerging market (EM) and Bloomberg emerging markets local currency index in July last year marked a pivotal shift in global investors access to Indian debt markets bringing several benefits for the bond market, like lower interest rates, rupee stabilisation, liquidity surge, global benchmarking etc.

What does this mean for the Indian markets?

While the data certainly presents an interesting trend, it's still early to make any conclusions. Markets are unpredictable, and investment flows can shift quickly. Rather than a clear-cut forecast, investors should see this as a development worth keeping an eye on. For now, keep an eye on the bond market—it might just be where the real action is.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story