Upstox Originals

What UltraTech’s foray into wires & cables means for industry dynamics

.png)

6 min read | Updated on March 07, 2025, 17:46 IST

SUMMARY

UltraTech Cement is entering the Wires & Cables industry with a ₹1,800 crore investment and a plant in Gujarat, aiming for ₹9,000 crore in revenue by 2030. With strong backward integration and an extensive distribution network, the move could disrupt a fragmented market. However, incumbents believe scaling and regulatory approvals will be key hurdles, much like Grasim’s entry into paints.

Stock list

UltraTech's entry in the cables and wires has created a stir in the segment

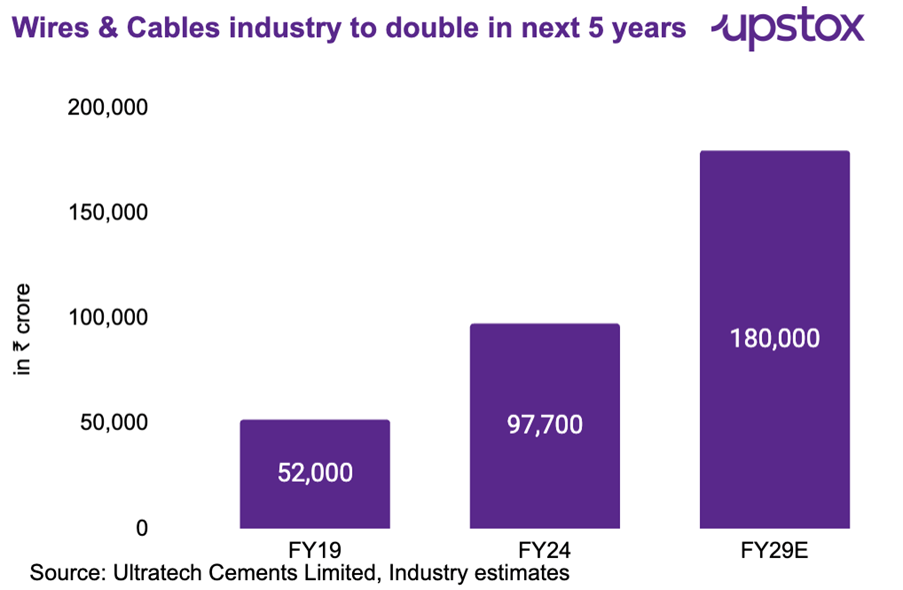

Cement giant UltraTech has recently announced its planned foray into the wires and cables industry (size of ~$9 billion in 2024). Over the past 5 years, this industry has delivered a revenue CAGR of ~13%. But wait, why is a cement company going into wires and cables?

To understand this, we first look at the underlying prospects of the industry. Majority of the revenue in the wires and cables comes from real estate, infrastructure, railways, adoption of electric vehicles, etc. As can be seen below, each of these underlying industries is poised to deliver strong growth in the long term.

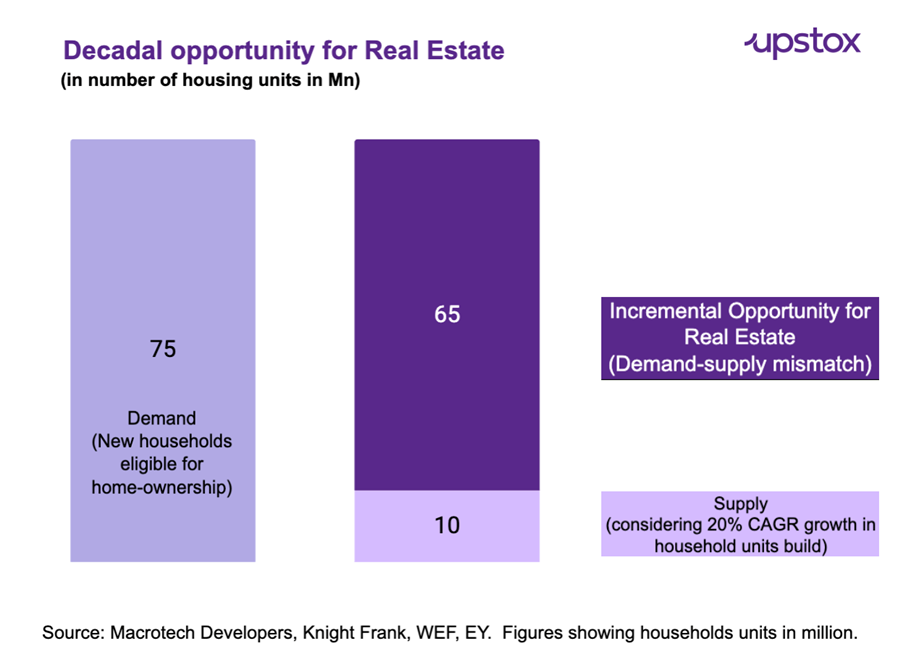

- Housing: India is on the brink of a rapid housing surge, with 75-100 million new households expected to become home-ownership capable by 2030. As millions of new homes get built, the building materials sector—including wires and cables—is experiencing a surge in demand.

- Infrastructure: India’s infrastructure investment has grown at a 26.1% CAGR from FY22-25. It goes without saying that infrastructure remains a critical sector to support India’s overall growth. With key projects like PM Gati Shakti (planned investments of ₹111 lakh crore), aimed at accelerating infrastructure development should boost demand for wires and cables. infrastructure project whether it is metro, building, bridge, dam etc. requires wires and cables for electrical fittings.

There are few industries like electronics (consumer durables), data centres, AI infrastructure, telecom infrastructure etc which are growing at decent pace due to growing demand in India will eventually also lead to demand for wires and cables.

How is the wires and cables industry stacked up?

The Indian wires and cables industry is expected to double by FY29 considering the above growth drivers.

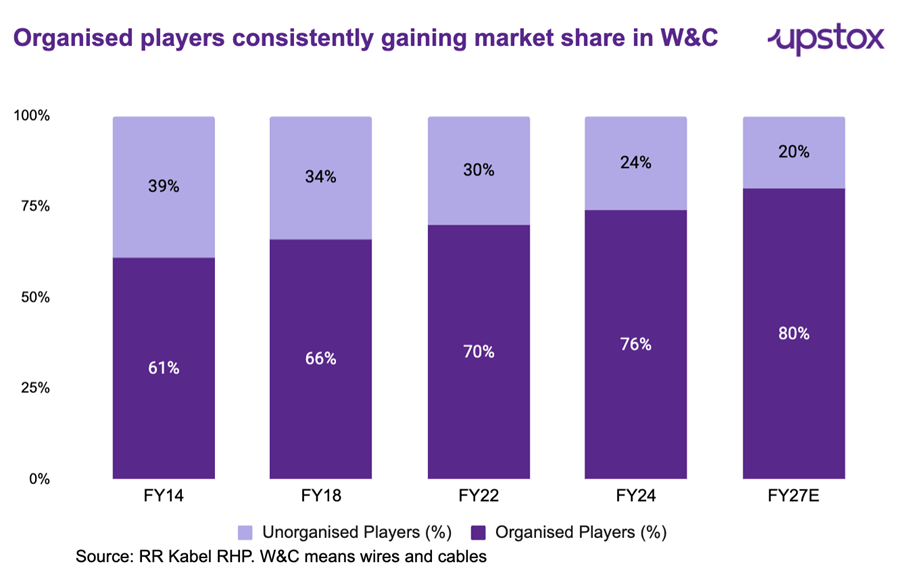

Now, apart from tailwinds in the sector, there is another thing going on that the industry is moving from unorganised players to organised players.

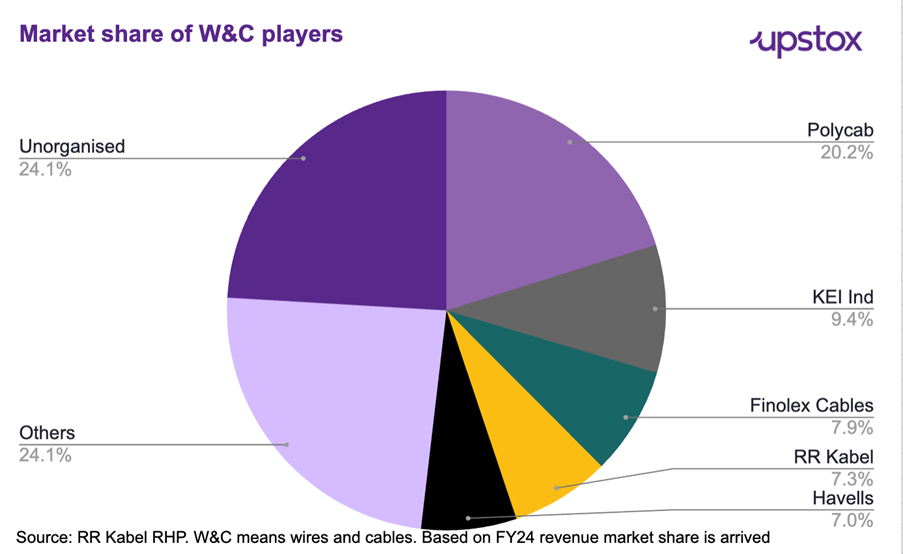

This is how players are stacked up in terms of market share; if you notice, almost 49% of the market is captured by unorganised players and other organised players, leaving an opportunity for another player.

UltraTech Cement’s foray and strategy ahead

UltraTech is expanding into the cables and wires market, leveraging its strong brand, distribution network, and manufacturing expertise. The company is setting up a plant in Jhagadia, Gujarat, with a production capacity of 35-40 lakh km of wires and cables.

Key Highlights:

- Investment: ₹1,800 crore capex

- Product Portfolio: Wires, low-tension, control, instrumentation, flexible, and rubber-based cables

- Distribution: Pan-India reach via UltraTech Building Solutions (UBS) network

- Financial Targets: IRR of ~25%, ROCE >20%, revenue ₹9,000 crore by 2030

- Launch Timeline: December 2026

- Leveraging distribution network, brand value and manufacturing expertise.

Strategy ahead

UltraTech’s foray into Cables & Wires (W&C) aligns with its strategy to increase its share of wallet from individual homeowners in the construction value chain. Strategically, the new plant will be located 100 km from Hindalco’s Dahej copper plant, ensuring a steady supply of copper, which constitutes ~75% of raw material costs.

This proximity will optimise working capital management. This will be the most important advantage to UltraTech since other listed players don’t have a dedicated copper facility for backward integration.

UltraTech remains committed to capital discipline, stating that it will not venture into any other building materials like tiles or sanitary ware in the next five years, ensuring focused execution in the W&C segment.

Impact on UltraTech’s financial

UltraTech’s foray into Cables & Wires (W&C) will have a minimal financial impact, as the total capital employed, including working capital, is estimated at ₹2,000 crores—just 2% of its ₹1 lakh crore capital base in cement.

The effect on ROE will be positive since UltraTech current ROE is around 12% while company is targeting more than 20% RoE for W&C business which will improve overall ROE for the company and in terms of operating margins it will lead to decline in overall margins since W&C has operating margins of 10% as compared to 15% in cement. While there may be some near-term pressure, the overall financial structure remains intact.

Moreover, management has assured that there will be no further diversification into other building materials, eliminating any concerns over capital misallocation.

Impact on other players

The impact on existing players will be negative since there will be pricing pressure leading to margin pressure and de-rating in valuation multiples of the players as most players trade above the PE ratio of 40 despite the current broader market correction.

Overall, existing players have announced a capex of almost ₹10,000 crore which could further aggravate these concerns. The fact about similar de-rating in the paint industry in terms of margins and valuation multiples is widely known.

What do existing players think?

Existing Wires & Cables players see no immediate threat from UltraTech, citing the market’s vast size and fragmentation. They believe scaling will take years, with stringent product approvals and distribution challenges.

Incumbents estimate it will take 3-5 years for UltraTech to set up plants and 5-8 years to build brand credibility. They also emphasise that cement’s distribution model won’t work for W&C, limiting UltraTech’s advantage.

Despite UltraTech’s cash reserves, competitors remain confident, asserting, “Nobody can take our market share or growth,” said KEI Industries. The industry outlook remains unchanged for the next five years.

Will UltraTech’s wies & cables business mirror Grasim’s paints success?

Grasim’s rapid success in the paints industry—traditionally considered a high-moat business—was largely driven by its aggressive distribution expansion and heavy investments in infrastructure. Within just a year of launch, Grasim has built a 50,000+ dealer network (targeted by Mar’25), expanded to 5,500+ towns, and established 131 depots, making it the second-largest in the decorative paint industry.

UltraTech’s Wires & Cables (W&C) foray shares some similarities. While 65% of sales in this segment come from cables, where approvals are more critical than branding, UltraTech’s strong investment capabilities and backward integration strategy could ease this challenge.

Securing approvals may take time, but given the Group’s track record in scaling up businesses and industry-best plant infrastructure (cement/paints), the company seems well-positioned to repeat the success seen in paints—albeit with a different execution playbook.

Risks in this move

- If the strategy of diversification does not succeed, then it could lead to capital misallocation.

- The consolidated margins for the company may see a dip considering wires and cables are low margins business. While cement has been a negative working cycle business for - UltraTech as mentioned by them in conference calls, foray into new business will require higher working capital and will change the dynamics.

In summary

Though UltraTech foray into W&C is unique in its nature since it be backed by group’s backward integration facility and will leverage their existing building material solutions capabilities.

Though other players have denied any impact considering tailwinds in the industry, while similar to Grasim’s paint disruption, W&C may also face some derating in margins and valuations of existing players.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story