Upstox Originals

What’s going on in China: Tracking its economic reset

.png)

5 min read | Updated on October 09, 2024, 18:17 IST

SUMMARY

China has been grappling with a slowdown triggered by multiple economic headwinds. In a bid to reverse this trend, it has unveiled extensive measures aimed at jumpstarting growth. This article unpacks the challenges, steps taken to recover, and the impact of the same. Also, hey what does this mean for India?

The Chinese government has announced measures to revive the economy

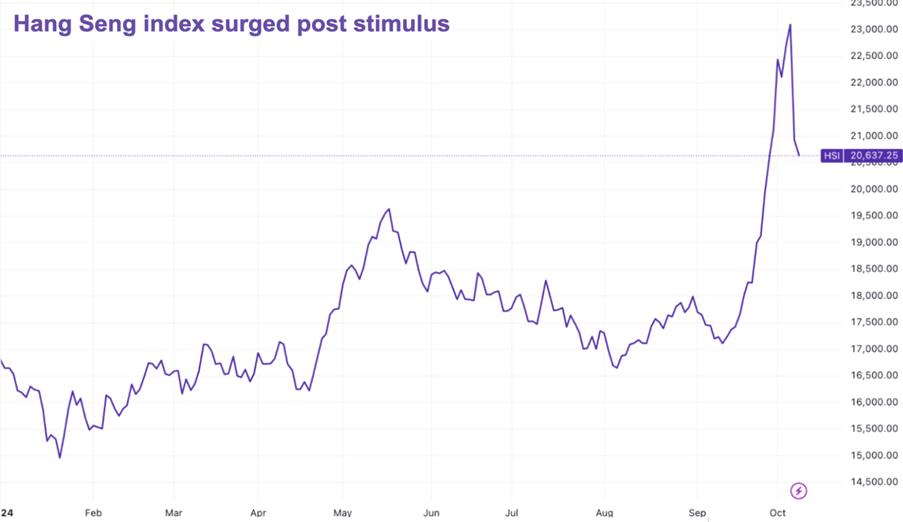

YTD (till October 7th) Hang Seng Index has risen ~39%, with close to 35% of this rise coming since early-mid September 2024. In the last two days, the markets have however corrected ~10%.

So, what is going on with China? That seems to be the question on everyone’s mind.

Is it time to look at Chinese stocks again?’ Is the next one

This sharp rally coupled with a change in perception that the government is once again growth-focused has once again renewed interest in the country.

In this article, we look at what ailed the Chinese economy and the steps taken by the government to revive it.

China’s economic slowdown explained

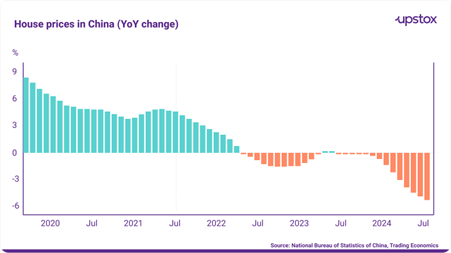

Real estate slowdown

China’s real estate market was a key growth driver. The sector accounts for almost 20-25% of its GDP. However, since 2021, the sector has been slowing down, plagued by high interest rates, debt burden, and rising unsold inventory. In fact, so severe was the challenge that some of China’s largest players like Evergrande and Country Garden filed for bankruptcy.

While the sector has yet to regain its former strength, the government has implemented measures to revive it, which we will explore further in the article.

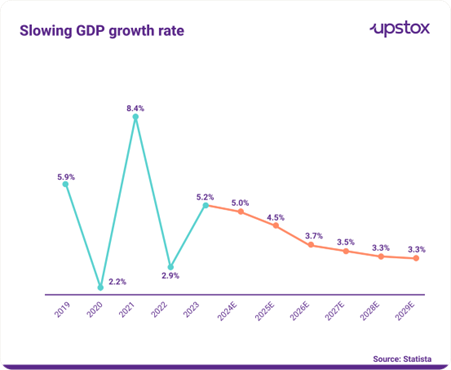

Slowing GDP

After decades of superlative growth, China’s GDP has in recent years slowed down. For a country that was accustomed to a 7%+ GDP growth rate for many years, saw its growth rate slip below 5% and continue to decline.

It goes without saying that when the sector that contributes almost a quarter of your GDP is slowing down, so will the GDP growth.

Beyond that, government intervention in business further shook confidence and exacerbated the economic slowdown.

We note that the most recent World Bank forecasts of October 2024 also peg the growth in 2025 and 2026 at sub-5% levels. While better than in the past, it is much lower than China’s historical run rate.

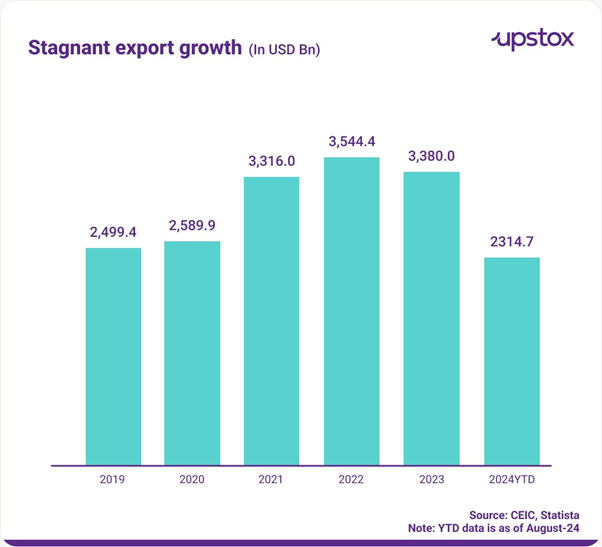

Exports slowdown

The trade dispute with America weighed on Chinese exports. US imports from China fell from a high of 21.8% in 2018 to 14.6% in September 2023. This trade dispute among other factors also gave rise to the China+1 sentiment, which further dampened exports.

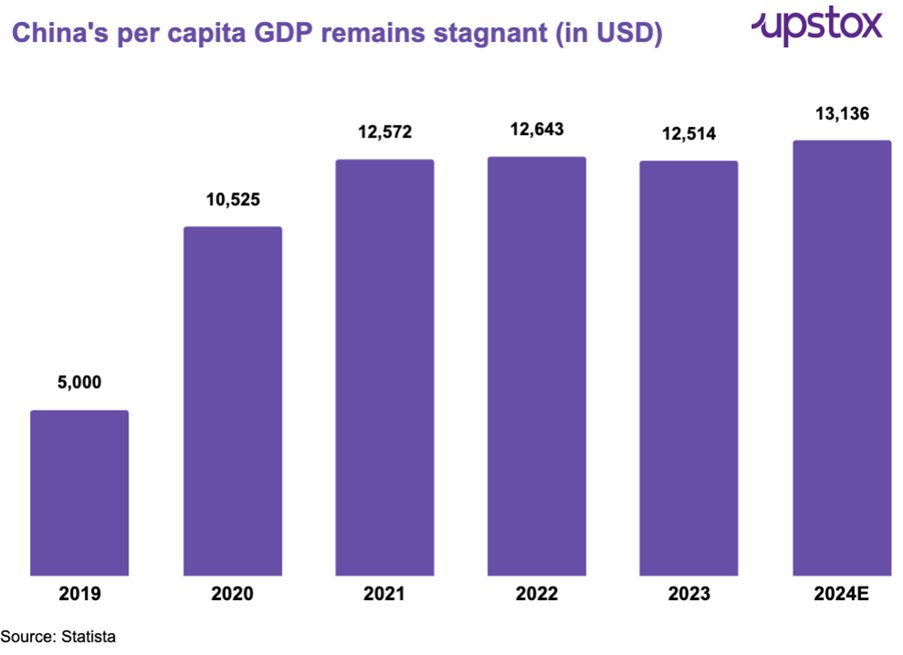

GDP per capita stagnating

Overall weak demand and poor sentiment resulted in a stagnating GDP per capita. That said, we do note, that China has seen a sharp increase in GDP per capita and the recent phase could just be some cooling-off

Dull consumer confidence

Is this any surprise? Given all the factors listed above consumer confidence and consumption took a sharp hit

China’s comeback strategy

Now to solve this problem China announced the biggest economic revival package since the pandemic, this includes:

-

More money for loans: China’s central bank decided to cut the reserve requirement ratio by 50 bps which is expected to be ~1 trillion yuan ($143 billion) in long-term liquidity for banks.

-

Loans for buying stocks: This $71bn facility allows securities firms, insurance companies, and funds to use PBOC money to buy equities providing support to equity markets

-

Cheap loans for buybacks: This program is worth $43 billion and allows listed companies and major shareholders to borrow from commercial banks to buy back shares and increase their holdings.

-

Relief for homebuyers: Reduced interest rates by 50 bps on existing home loans along with reduced down payment for all types of homes to 15% were announced to revive real estate markets.

-

Rate Cut: The Central bank is expected to cut the prime lending rates by 20-25 bps.

The impact

The Chinese markets cheered this stimulus, as seen by the spike in the Hang Seng Index.

Source: Tradingview

What does it mean for India?

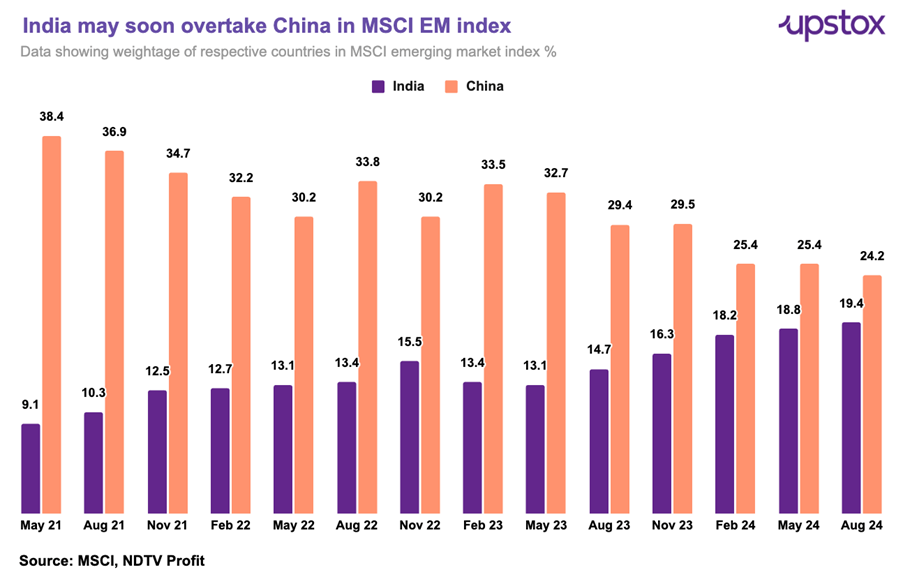

Indian markets have seen a consistent bull market since the pandemic and India has steadily been closing the gap with China in the MSCI EM Index. Valuations in the domestic markets are also frothy.

As such many markets expect some medium-term jerks in India - given that global investors would want to once again reassess their China investment strategy and allocation.

Conclusion

While steps taken by the Chinese government have encouraged investors and bolstered markets, the ride could be a bumpy one. For example - in the past couple of days, the Chinese markets have slipped ~10%, as the government did not announce any further stimulus that the market had anticipated.

Overall, the government’s approach represents a multi-faceted approach to reignite an economy facing several structural and cyclical challenges. By addressing both immediate liquidity issues and longer-term structural reforms, China aims to stabilise and then grow its economy sustainably.

For India, as indicated above, there could be some volatility as global fund flow realigns. That said, Indian fundamentals remain strong and continue to attract global flows and investment.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story