Upstox Originals

Can companies go public without an IPO? Here's how

.png)

5 min read | Updated on September 06, 2024, 17:54 IST

SUMMARY

Raymond Lifestyle recently went public, but there was no IPO! How did that happen you ask - well via a demerger. In this article, we look at how companies via demerger can list without going the traditional IPO way. We will discover what it means for you as an investor and how it affects company shares. Read on to find out more.

demergerthumb.jpg

What is a Demerger?

A demerger occurs when a company separates part of its business into a new entity, effectively splitting its operations. A company that splits into two is called a “demerged company”. The new company created from this split is referred to as “the resulting company”.

Why demerger? To unlock value, streamline operations, or focus on core competencies. When companies grow too big or too diverse, they might struggle with operational efficiency. A demerger allows them to refocus and improve performance. This way multiple business segments effectively separate from the parent company.

During a demerger, companies often allocate shares in the newly formed entity to their existing shareholders. This allocation follows a split ratio, which determines how many shares of the new entity a shareholder will receive for every share they hold in the parent company.

Let’s try to understand with an example

Imagine Company A decides to demerge its high-growth business into a new entity, Company B. If the split ratio is 1:5, it means that for every 5 shares you hold in Company A, you will receive 1 share of Company B.

For better visualization, suppose you had 10 shares of company A, with each share priced at ₹10. Your total investment in Company A is therefore ₹100.

-

Before demerger: You own 10 shares of Company A.

-

After demerger: You still own 10 shares of Company A plus 2 shares of the newly created Company B. . .but, how will it impact you, the shareholder?

-

You get shares in the new companies. Your original shares are divided and given to you in the new companies.

-

Your ownership stays the same. The percentage of the new companies you own will be the same as the percentage you owned in the original big company.

-

The overall value of a shareholder’s investment remains the same. Think of it this way, you owned a whole company worth ₹100. Now that company has been split into two parts - one worth ₹80 and the other one worth the balance ₹20. This is of course an oversimplified way of looking at a complicated process. But the idea is, theoretically, demergers will give you ownership in two companies, but your overall value remains the same, atleast at the time of the demerger. What’s the point then you ask? Well, read on to find out…

Raymond case study

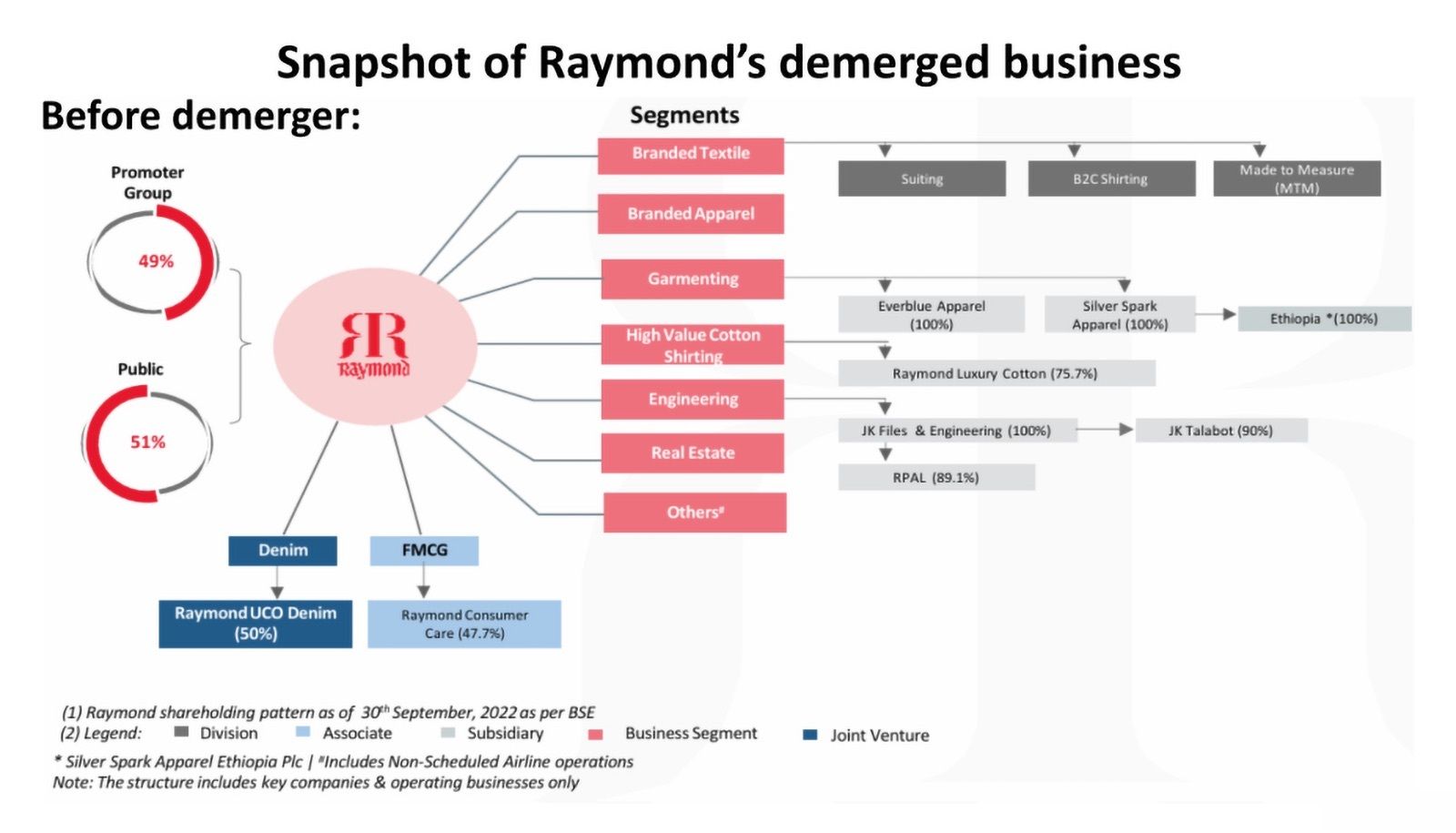

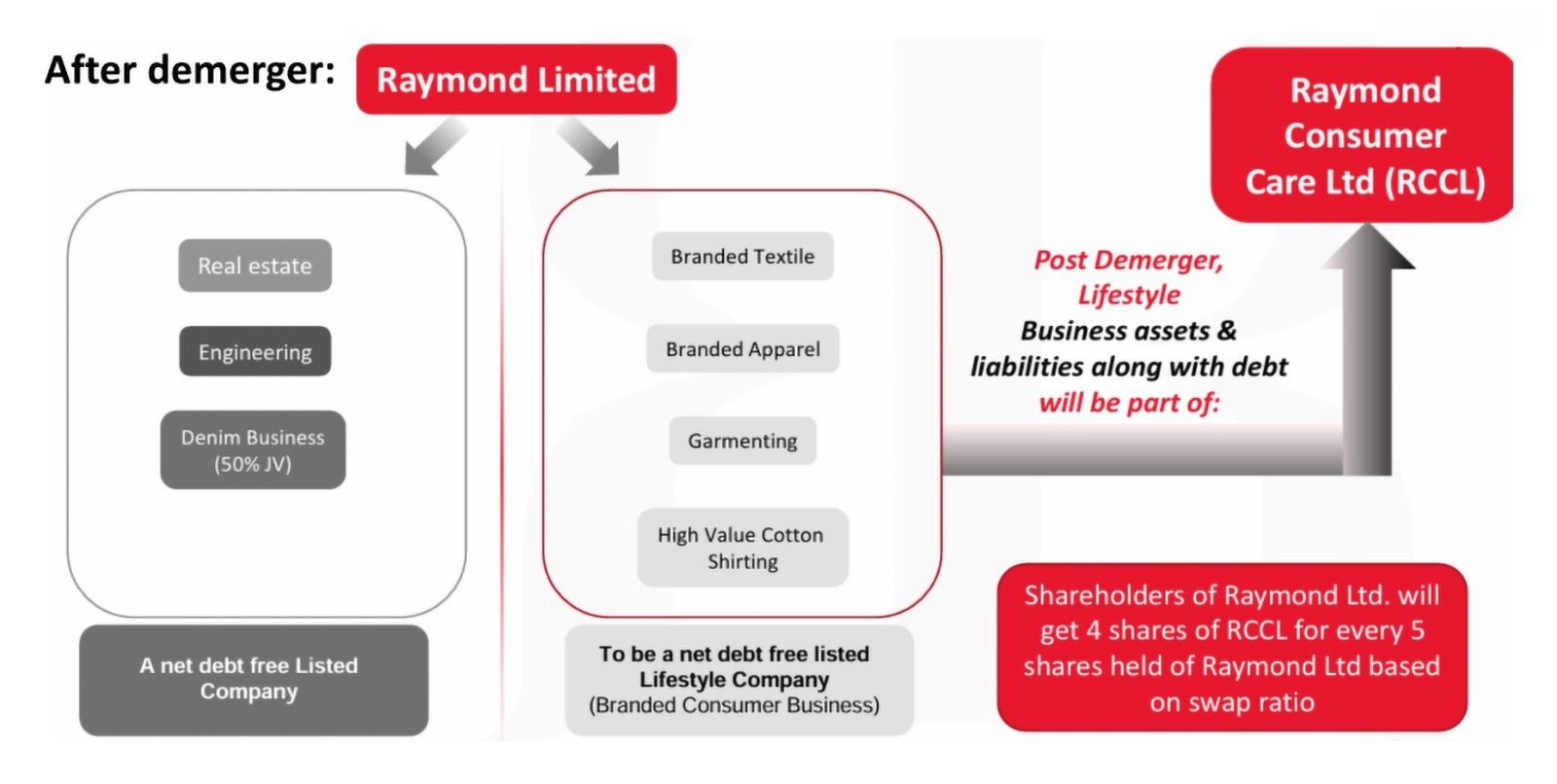

Raymond has approved the demerger of - the realty business and lifestyle business. Although the exact timeline of Raymond Realty's business is not disclosed, the Lifestyle business segment has been demerged and listed as - Raymond Lifestyle Limited (RLL).

Raymond’s decision to demerge its lifestyle business was strategic. By separating this fast-growing segment into RLL, the company aimed to unlock hidden value and allow the two businesses to flourish independently. Here’s how the stock allocation worked: for every 5 shares held of Raymond Ltd, a shareholder received 4 shares of RLL. This move allowed existing shareholders to benefit from both the stable, traditional Raymond business and the high-growth potential of the lifestyle brand. Over time, shareholders saw a clearer reflection of each business’s performance, which can lead to higher overall valuations.

Source: Company

How does an investor benefit from this?

You might be wondering if the ownership stake remains the same, what is in this for an investor? Well, let's look at a list of select demergers in the past and analyze the returns. As you will see from the table below, both the demerged company and the resultant ones have delivered strong returns. The rationale is since both companies can focus more on their businesses, it should logically and theoretically benefit the investors.

To be sure - demergers are not a sure shot reason for the sharp sustained share price spike. Businesses need to deliver performance to ensure positive share price performance.

A quick list of recent demergers

Here’s a glance at some of the notable demergers in India’s corporate landscape and how they performed post-demerger.

| Year | Demerged company | Resultant company | Stock Split ratio | Demerged company stock price CAGR to date* | Resultant Company stock price CAGR to date* |

|---|---|---|---|---|---|

| 14 Sep 2023 | Bajaj Electricals | Bajel Properties | 1:1 | (7.9%) | 36.8% |

| 21 Aug 2023 | Reliance | Jio Financial Services | 1:1 | 16.3% | 34.9% |

| 19 Oct 2022 | Piramal Enterprises | Piramal Pharma | 4:1 | 12.9% | 10.3% |

| 19 Mar 2021 | Jubilant Pharmova | Jubilant Ingrevia | 1:1 | 10.1% | 38.6% |

| 5 Nov 2018 | Adani Enterprises | Adani Total Gas | 1:1 | 61.4% | 49.2% |

| 1 Apr 2018 | Adani Enterprises | Adani Green | 761:1000 | 61.4% | 97.9% |

| 1 Apr 2015 | Adani Enterprises | Adani Energy | 1:1 | 54.7% | 44.8% |

| Average | 29.8% | 44.6% |

Source: News article, Trading View; *Returns are calculated from the date of the demerger to September 5, 2024

We hope this very simplified effort of ours to explain demergers will be helpful!

Conclusion

Demerger represents opportunities and risks for investors. They’re more than just technical stock splits; they are strategic decisions that can reshape industries and investor portfolios alike. Next time you hear about a demerger, look beyond the headlines. Understand the split ratio, the strategic intent, and how the new entities could drive future growth. It’s all part of the exciting world of corporate restructuring!

About The Author

Next Story