Upstox Originals

We live in times where safe investing feels stupid. But is it?

(1) (3).jpg)

6 min read | Updated on August 20, 2024, 16:18 IST

SUMMARY

With the benefit of hindsight, investing outcomes almost always seem obvious. However, sound long-term investing should prioritize stability and risk management over chasing high returns. As such, diversification across different assets and stock types is crucial for mitigating risks and protecting investments, even if it may seem less rewarding in a bull market.

Diversification is key to lower losses during challenging times

Here’s a thought experiment.

March 2020 has just come to an end. The stock market has crashed. You saw it coming and have been sitting on cash. It’s time to invest. You think it’s time to take some risk and bet ₹10 lakh, all the cash you have, on small-cap stocks. Stocks ranked 251st and beyond in terms of market capitalisation are termed “small caps”.

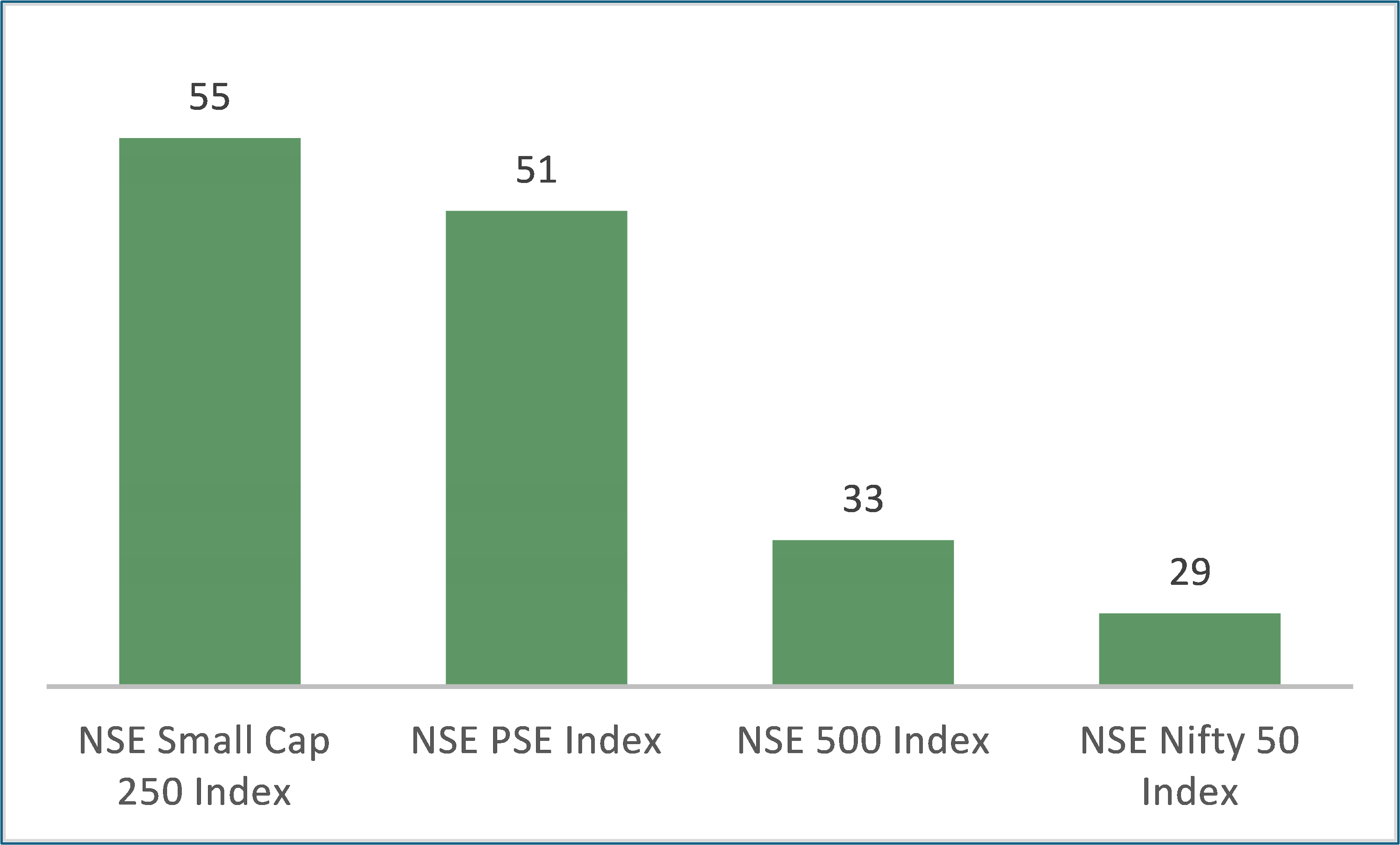

How much do you think that ₹10 lakh will be worth today? A little over ₹55 lakh. (The NSE Small Cap 250 Index is 5.5 times of where it was at the end of March 2020). This is a huge jump.

Now, before you invest ₹10 lakh you discuss this with a friend. She tells you, boss, you are taking a huge risk. The economy and the companies will both suffer in the aftermath of COVID-19. So, there is no point in taking such a huge risk. In fact, she shares her plan of investing in the shares of the biggest companies, which she thinks on the whole are the safest stocks to invest in.

She invests ₹10 lakh. How much do you think that ₹10 lakh is worth today? Around ₹29 lakh (The NSE Nifty 50 index, which represents the safe kind of stocks well, is 2.9 times of where it was at the end of March 2020.) This is a good jump, but not as good as where she would have ended up if she had invested in small-cap stocks.

Further, you speak to another friend. This friend says that she loves stocks of the primarily government-owned public sector companies. She invests ₹10 lakh in these companies. How much do you think that ₹10 lakh is worth today? Around ₹51 lakh. (The NSE PSE Index, which represents the public sector companies, is 5.1 times of where it was at the end of March 2020.) This friend doesn’t end up doing as well as you, nonetheless, she ends up in a very good position.

Finally, you speak to the person who introduced you to the idea of investing in stocks. This friend says that he is planning to bet on the broader market and invest in all kinds of stocks. He also decides to invest ₹10 lakh. How much do you think it will be worth today? Around ₹33 lakh. (The NSE 500 index, which represents the broader market well, is around 3.3 times of where it was in March 2020.)

Value of ₹10 lakh invested in each of these indices as on today (in ₹ lakh)*

Source: Author calculations on data from https://www.niftyindices.com/; *Numbers are rounded off

So, who do you think is the smartest of the lot? You.

Well, your ₹10 lakh is now worth over ₹55 lakh. But let’s not come to a conclusion so fast. It’s always easier to be wise in hindsight. Or everything is obvious once you know the answer. And this is a hypothetical example. In the summer of 2020, very few investors actually thought and knew that small cap stocks are going to rise at this astonishing pace. Of course, they may claim so now. But aggregate data doesn’t show that.

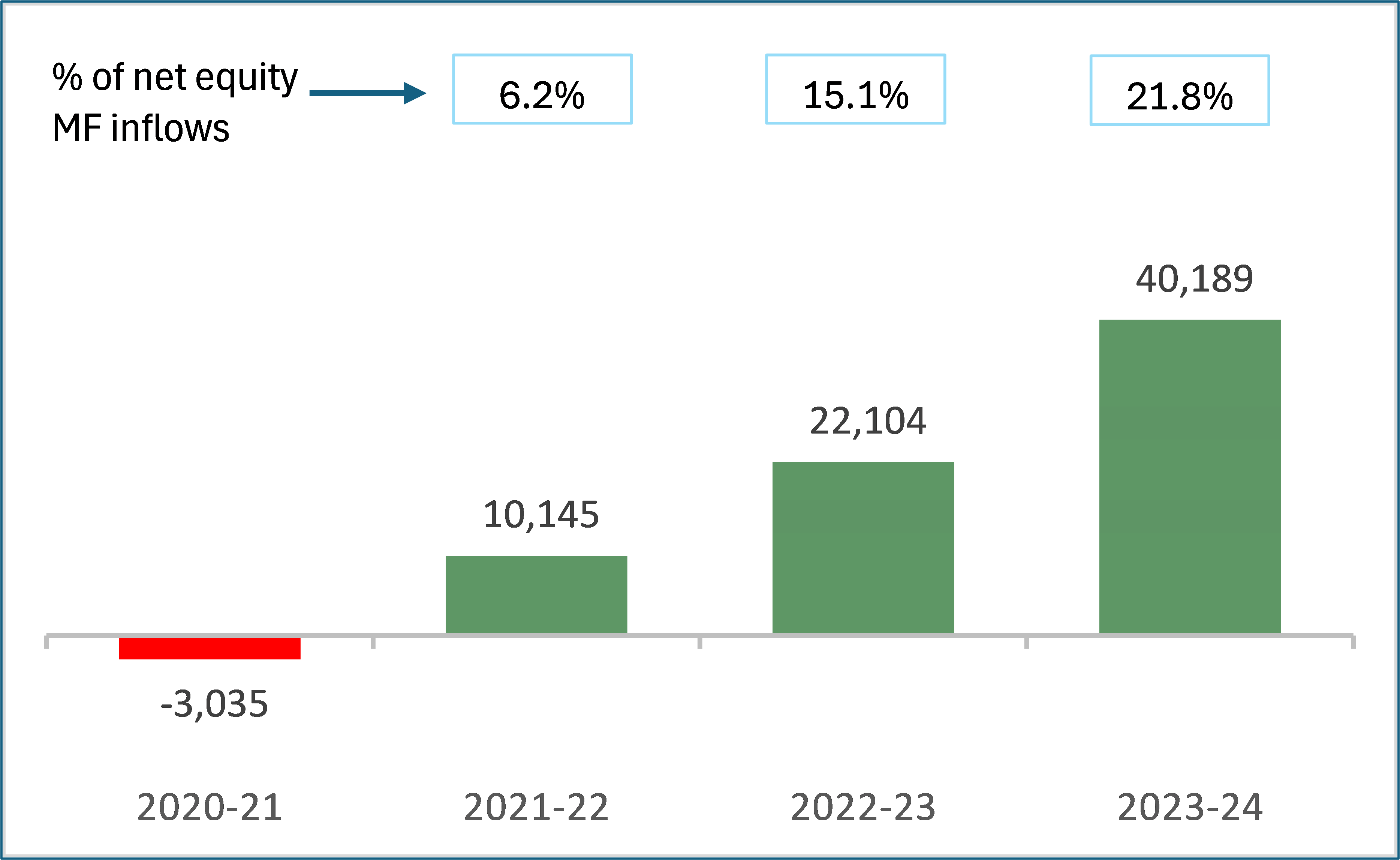

In 2020-21, small-cap MFs saw net outflows of ₹3,035 crore, implying that on the whole investors took money out of such schemes. Small-cap MFs largely invest in small-cap stocks.

In 2021-22, the net inflow into small-cap MFs stood at ₹10,145 crore or around 6.2% of the total net inflow into equity MFs. In 2022-23, the net inflow into small cap MFs stood at ₹22,104 crore or 15.1% of net inflows into equity MFs. In 2023-24, ₹40,189 crore of net inflows were seen in small cap MFs or 21.8% of the net inflows into equity MFs.

Net inflows into Small-Cap MFs by year (₹ crore)

Source: Centre for Monitoring Indian Economy

What does this tell us? It tells us that only after small cap stocks had rallied quite a bit did the average retail investor start betting on them.

But then that’s not really the point I wanted to make in this piece. When you don’t know what the future has in store for you, you hedge for the possibility of something negative happening. If and when that happens you want to be in the best possible position and not lose a bulk of your savings.

Now, small-cap stocks have been known to crash suddenly and crash big. Of course, someone who has been in the market only since March 2020 would not know that. But let them ask the old-timers on what happened to small-cap stocks in 2008 and then again in 2018. Every generation of investors like to think that a new era is upon us and that this time it will be different. But as history tells us that’s not how things actually turn out.

The prices of stocks of public sector companies have been known to remain stuck and not go anywhere for years at the end. Let’s take the case of the NSE PSE Index. It reached a peak in January 2008. This level was crossed only more than 15 years later in May 2023.

These possibilities need to be taken into account while investing. They need to be hedged for. Which is where diversification comes in. Any sensible investor who is in it for the long-term and is not just looking to get their adrenaline going, will diversify their investment.

This means investing in different kinds of stocks—large caps, midcaps and small caps. It also means not investing in just one sector like railways or defence e or just one theme like the government owned public sector companies. It also means investing across asset classes like fixed deposits and gold, and not just in stocks.

Of course, the risky concentrated bets have played out well in the last few years. And those who haven’t bet all their money or a large amount on such sectors and themes, may seem to have lost out. But does that make them stupid? Or unsuccessful? Not at all. Diversification is all about accounting for the possibilities of things happening because return of investment is more important than return on investment. And given that, just because negative things did not happen doesn’t make diversification bad. If the negative things had played out, those who had diversified would have come out on top. All investing needs to account for this possibility.

Having said that, such thinking is not appreciated at a time where stock prices have been hitting new highs. We live in an era when companies with stagnating sales have seen their stock prices go from strength to strength. We live in an era when companies which are unlikely to ever make money and just survive on the basis of the buzz they are able to generate on social media, have listed on stock exchanges at very high prices, and their price continues to rise. And if this continues—it will continue to make those diversifying their investments look stupid—until it doesn’t.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story