Upstox Originals

US 30-year bond yield crosses 5%; here's what it means for the markets

8 min read | Updated on January 21, 2025, 20:29 IST

SUMMARY

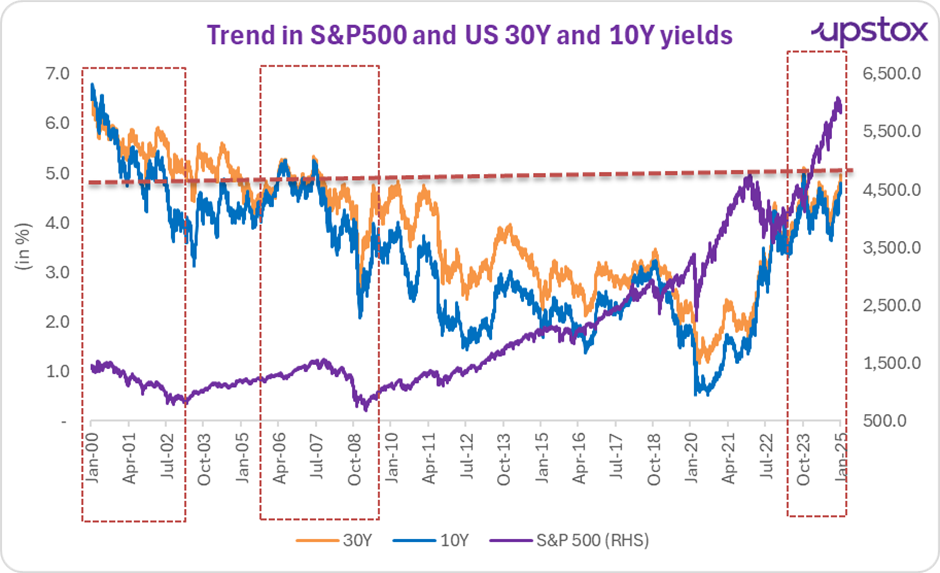

In the past two decades, when the US 30-year bond yield touched the 5% mark, it made market participants take note. In two out of the four times it touched this benchmark, global financial markets have experienced sharp corrections (as much as 50%). Recently, the yield crossed the critical level again. In this article, we delve into the historical context of this phenomenon and analyse current events to understand what all this means for the Indian investor.

When the US 30Y yields have touched 5%, markets have faced challenging times

In the last 25 years, the US 30-year bond yield has risen above 5% only four times. In two out of those four times, the US markets (by extension, most global financial markets) have seen corrections of almost 50%, first during the 2000-2002 periods and then during the Global Financial Crisis (GFC) of 2008.

Admittedly, the yields also touched the 5% mark around October 2023 and the S&P500 did not correct. We shall discuss that in more detail as well.

Source: Investing.com, Federal Reserve Bank of St. Louis; Data till January 15, 2025

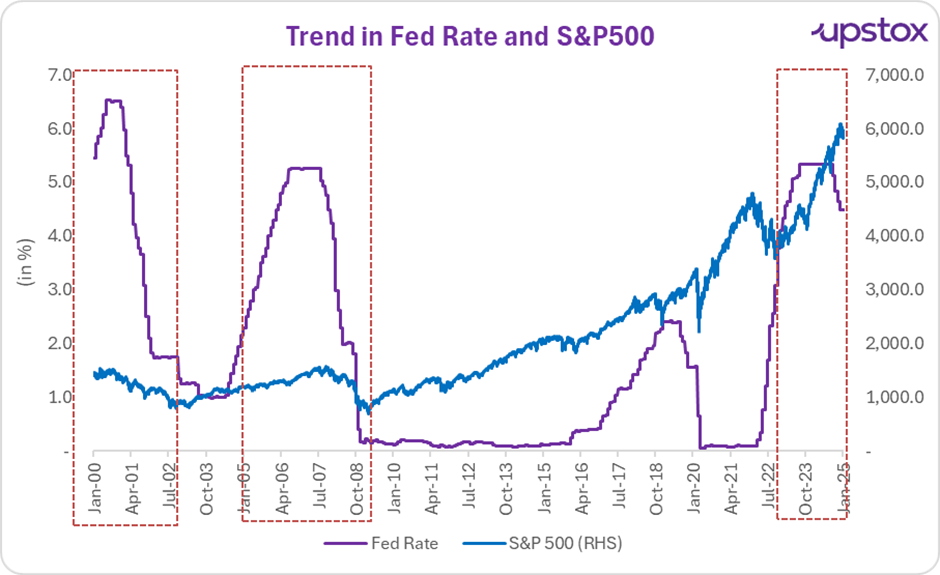

Similarly, even the Fed rate (similar to the RBI repo rate in India) indicates that markets could be in some more challenging periods. As with the bond yields, the last time the Fed rate was this high, markets saw significant declines.

Source: Investing.com, Federal Reserve Bank of St. Louis; Data till January 15, 2025

This prompts us to explore the current scenario in more detail.

What is a bond yield anyway?

A bond is a security issued by governments and corporations to finance their expenditures. It has a ‘coupon’, which is a periodic interest received by the bondholder. A bond yield, however, measures the actual return earned, including the coupon and any capital gain or loss on the investment.

Why does this matter?

Bond yields, like stock markets, are also a good indicator of investor sentiment. If risk increases, investors tend to shift towards bonds, which increases their demand and therefore increases yields. And vice versa.

Similarly, rising Fed rates cause an increase in the overall cost of borrowing, which hurts any future business spending, thus impacting growth.

Yields have been rising for a while

As you can see from the chart above, yields have been rising since 2021. The US 30-year bond yields crossed the 5% threshold in the early days of January 2025 (and in October 2023 as well). From the chart above, it could be argued that the yields have barely just crossed 5% and it remains to be seen if they can maintain that level, but:

-

Even back in 2007-2008, the 5% level was breached for a brief period.

-

Yields continue to remain elevated. As the US economy continues to strengthen, its GDP growth outlook was revised upwards for 2025 and job creation remains robust, demand for US bonds is likely to remain high. This could further spike yields.

So markets will continue to fall?

What the market does tomorrow, let alone in the next 6 months, is a coin toss. So, not too much to be gained by trying to predict the markets.

But that said, it is something to watch out for. Let me explain.

As a mode of investment, bonds are safer than equity. As a convention, bond yields, specifically 10-year government bond yields are used as a risk-free rate in the economy. Any rational equity investor would demand a premium over the bond yields to compensate for the risk. As such, one of the many ways investors calculate their required return on equity is bond yields plus some risk premium to invest in equity.

Even if we keep the risk premium steady, rising yields mean US investors will now demand a higher return from equity before they consider investing in that asset class.

Just because interest rates are high must markets fall?

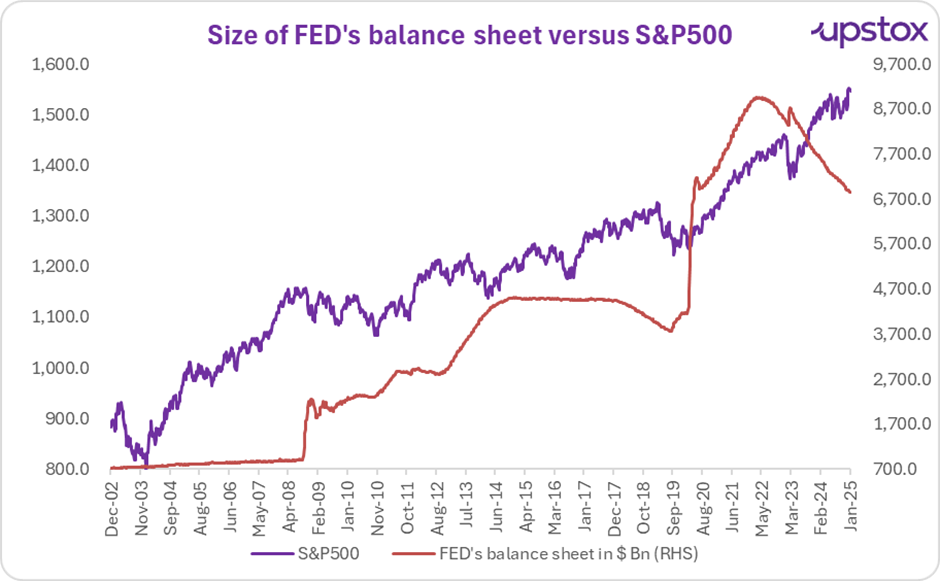

Well, not necessarily. But here is where the main issue lies. Since the 2008 Global Financial Crisis, the US Fed (America’s central bank) has been pumping liquidity to support growth. The pace of liquidity infusion has seen a further sharp rise since COVID-19. As the flow of money increased, the cost of borrowing started to reduce.

In fact, the chart on Fed rates above shows that from 2010 to 2015, the cost of borrowing was close to zero.

Simply put, money was practically free!

Source: Investing.com, Federal Reserve Bank of St. Louis; Data till January 15, 2025

The point is, since the Global Financial Crisis, the Fed has expanded its balance sheet at a historical pace, pumping in trillions of dollars. But now, as the Fed starts to roll back the stimulus, the cost of money has gone up. As a result, investors have become more considerate about their investment decisions.

So, is it all bad news from here?

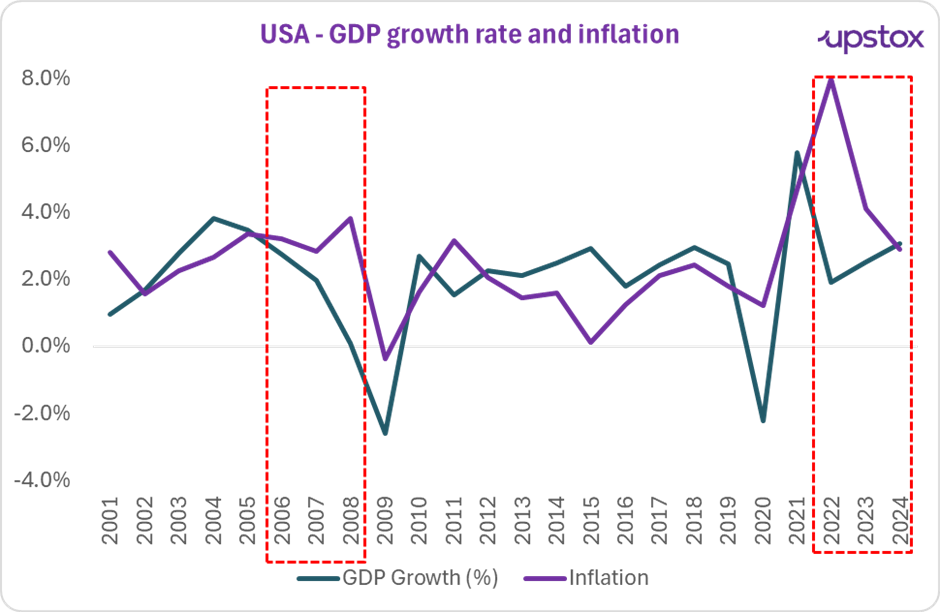

No. Unlike the phase of the Global Financial Crisis, when inflation was rising and growth was slowing down, this time around the trend is inverse. Growth in the US is strong and inflation has started to show signs of cooling off.

This gives some comfort that while normal market correction may or may not happen, a market collapse looks a little unlikely. On an even more optimistic note, this could make a case for rate cuts in the USA, which could help some cooling off in the bond yields as well.

Source: Macrotrends

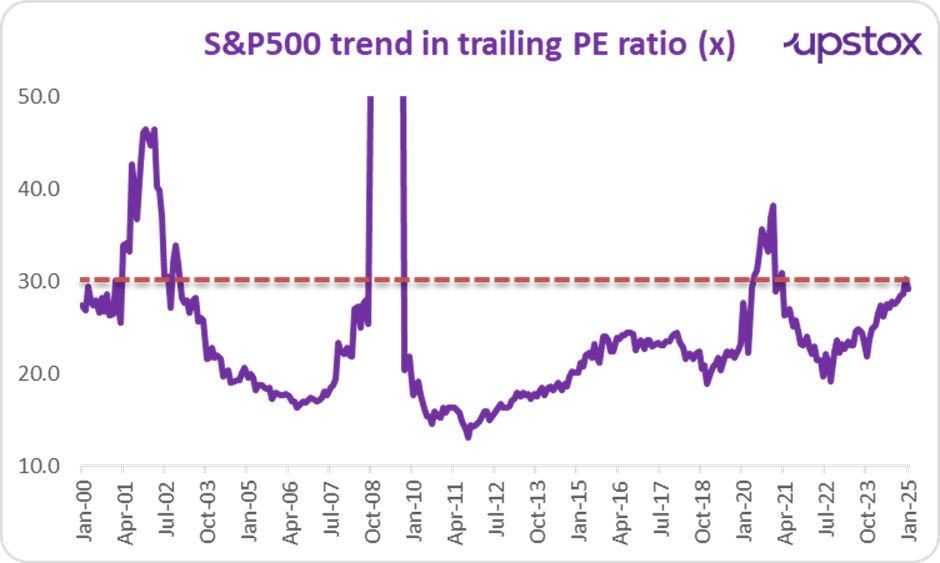

Besides this, valuations appear to be encouraging. While they still look elevated compared to the recent past, any support from earnings growth should continue to support valuations.

Source: Gurufocus; Macrotrends, Federal Reserve Bank of St. Louis

Let’s talk about October 2023

For a few days in October 2023, the US 30Y yields crossed the 5% threshold. And yes, the markets did not correct in 2024. In fact, the S&P500 delivered a stellar 20% return in 2024. Completely true!

However, at the start of 2024, many market experts predicted the US markets to either correct (in the best-case scenario) or enter a recessionary phase. Interest rates were high, there were significant concerns about the US growth.

To many people’s surprise, the US economy remained buoyant. It delivered better-than-expected GDP growth of greater than 2.5% in 2024 versus expectations of 1.5-1.7%. The underlying job creation numbers were stable and the Fed was able to reign in inflation.

Let's hope, the US economy continues to surprise.

What does this mean for India?

Whether we like to admit it or not, ‘when the US sneezes, the world catches a cold’. In other words, the US economy continues to be a key driver of the global financial market. The fact that a market collapse in the USA might not be imminent, Indian and even global markets can breathe a sigh of relief.

Having said that, the rising yields in the US, strong growth, as well as valuation support, are all a perfect trifecta for US investors to reconsider their investments beyond their home country (not just in India).

Further, rising yields could deal a double blow for Indian markets. Global investors, who will compare their potential returns across geographies, will:

-

Invest more in the US markets (which are expected to give higher returns) OR

-

Demand a higher return from Indian equities (since they are considered riskier than US equities). To a certain extent, this has already started to happen since late 2024. As highlighted in our article on FII outflows, FIIs have been withdrawing record amounts from the Indian markets.

At a time when market experts are cautioning against higher valuations in India, this rise in US yields could be a worrying development.

Indian equities will therefore need to deliver earnings growth that justifies the current valuations. While one could argue that valuations have come off after this recent correction, here is why that argument is not convincing.

The Q3FY25 earnings season (quarter ending December 2024) has just started. Companies like Infosys, HCL Tech, and Zomato (to name a few) delivered earnings that were not in line with investor expectations (exceeded or disappointed), and consequently, their stocks have seen sharp reactions. To a certain extent, this is one indication of elevated investor expectations and overreaction in case those are not met. This typically happens when inventors are either a little jittery, overall sentiment is mellowing, and earnings growth does not match up to their valuations.

As such, if the ongoing Q3FY25 results fail to meet investor expectations, markets could be in for some more pain.

The upcoming union budget could provide fiscal support to the economy which could shore up sentiment. Any support to individuals (read: tax cut) could also help provide a boost.

Finally, there are always some black-swan possibilities. If the new US president goes through with his threat of tariffs on China, it could escalate tensions, forcing investors to give India a fresh look. That said, we can all agree that is not the wisest investment strategy.

In summary, it would behoove investors to monitor some global trends as well, before deciding their next moves. While armageddon does not seem to be in the line of sight, a near-to-mid-term correction, or consolidation in the markets, may not entirely be out of the realm of possibilities.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story