Upstox Originals

UPI gets credit: What does it mean for traditional credit cards

.png)

6 min read | Updated on March 26, 2025, 18:26 IST

SUMMARY

If money transactions were a wrestling match, UPI and Credit Cards would be the final contenders. UPI is quick, seamless, and instant, while Credit Cards offer financial flexibility. Recently, RBI has allowed banks to provide credit via UPI. So, what does this mean for traditional credit cards? In this article, we explore both UPI and Credit Cards, and dive into the implications of the RBI’s new move.

RBI has allowed banks to provide credit via UPI

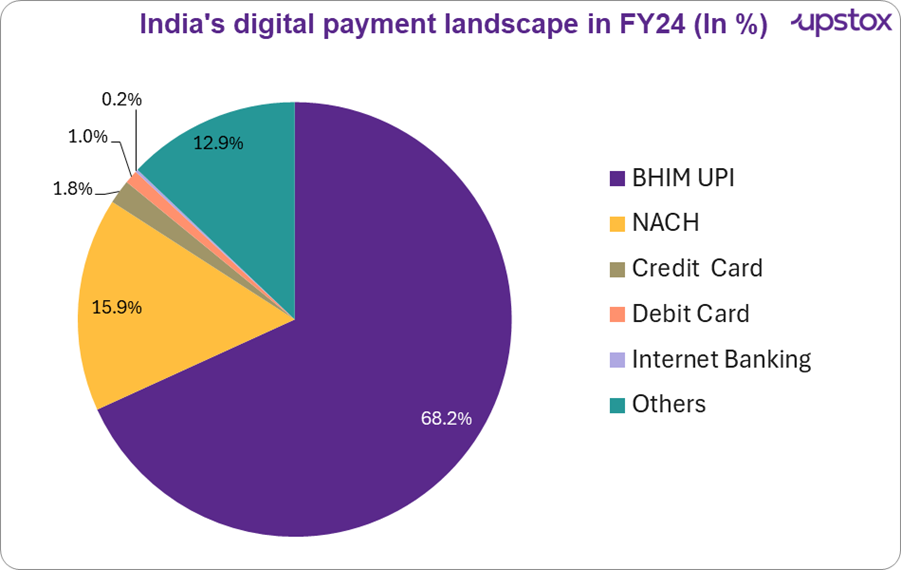

India is undergoing a digital payments revolution, with UPI transactions soaring from 34% of all digital transactions in 2019 to 83% in 2024 (DD News). With options like credit cards and UPI (Unified Payments Interface), consumers have more choices than ever when it comes to transactions. While credit cards offer financial flexibility, rewards, and global acceptance, UPI provides rapid, hassle-free, and cost-effective payments. But which one is better?

| Credit Card | UPI |

|---|---|

| Advantages | |

| Buy now, pay later with a credit line | Instant and easy transactions |

| Rewards, cashback, and discounts | No need to carry a physical card |

| Helps build credit score | No interest charges (direct bank-to-bank transfer) |

| Global acceptance for online & offline transactions | Available 24/7, including holidays |

| Fraud protection and chargeback facility | No transaction fees for most payments |

| Disadvantages | |

| High interest rates on unpaid balances | Requires internet access and a smartphone |

| Annual fees and hidden charges may apply | Daily transaction limits apply |

| Risk of overspending and debt accumulation | No credit facility; works only with available balance |

| Requires good credit history for approval | Limited international usage |

| Potential fraud risk if card details are stolen | Risk of fraud and phishing attacks |

Rewards and offers

Credit cards make you feel rich—at least for a while. Cashback, points, lounge access—every swipe gets you something. Play smart, and you could land free flights or fancy dinners. These perks come from the Merchant Discount Rate (MDR), a fee merchants pay. UPI? Not so much. With near-zero fees, there’s little room for rewards. Sure, you get a ₹5 cashback or a scratch card, but let’s be real—you’re not booking a Maldives trip with that.

The RBI’s latest move

Traditionally, credit access in India has been dominated by credit cards, personal loans, and BNPL (Buy Now, Pay Later) options. Now, the RBI’s new directive allows banks to provide a pre-approved credit limit to users via UPI, enabling them to make purchases directly from their credit line without needing a credit card.

- Consumers can enjoy the benefits of credit-based transactions using UPI without the need for a physical card.

- Merchants receive payments instantly, similar to how regular UPI transactions work.

- Banks get an opportunity to expand their credit user base beyond traditional credit card holders.

The catch: Merchant fees and business impact

While this move promises a frictionless credit experience for consumers, it comes with a catch—merchant fees. Every UPI credit transaction will now carry a Merchant Discount Rate (MDR) of 1.5-2%, a shift from the zero-MDR model that businesses previously enjoyed on standard UPI payments.

But who actually pays for this? The merchants do. Just like with traditional credit cards, businesses will bear the cost of these transaction fees. While 1.5-2% is lower than the typical 2-3% MDR on credit card transactions, it’s still an added expense, especially for small businesses operating on thin margins. And let’s be real—some merchants might find ways to pass this cost down to consumers, either through higher prices or surcharges on digital payments.

How big is UPI credit right now?

The adoption of UPI-linked credit cards is still in its early stages but growing fast. As of now, major banks like SBI, HDFC, ICICI, Axis Bank, and Yes Bank have rolled out UPI credit on RuPay credit cards, which are issued by the National Payments Corporation of India (NPCI). Who can get one? If you’re eligible for a traditional credit card, chances are you can apply for a UPI-linked RuPay credit card too. Banks determine eligibility based on your credit score, income level, and repayment history—pretty much the same as any other credit card.

Are credit card companies worried?

The rise of UPI credit threatens the dominance of traditional credit cards in India. Why? Because UPI credit allows users to enjoy the perks of a credit card without carrying a physical card or entering card details for transactions. That’s a big deal in a market that’s rapidly moving towards mobile-first payments.

Banks and credit card issuers are keeping a close eye on how this evolves. While they still earn interest and fees from credit users, they could lose out on interchange fees (the cut banks get from card transactions). Plus, with RuPay leading the charge, Visa and Mastercard—who dominate India's credit card market—may feel the heat as well.

| Feature | Credit Cards | UPI Credit Lines |

|---|---|---|

| Approval Process | Requires application & credit check | Pre-sanctioned by banks |

| Usage | Swipe or online transactions | Direct UPI payments |

| Merchant Fees | 2-3% MDR | 1.5-2% MDR |

| Accessibility | Only available to those with approved cards | More inclusive access via UPI |

| Interest Rates | Varies (typically 30-40% annually) | Likely lower, depending on banks |

Source: Press articles

In the next section, we take a look at the current landscape of UPI and credit cards in India.

CAGR growth and market trends:

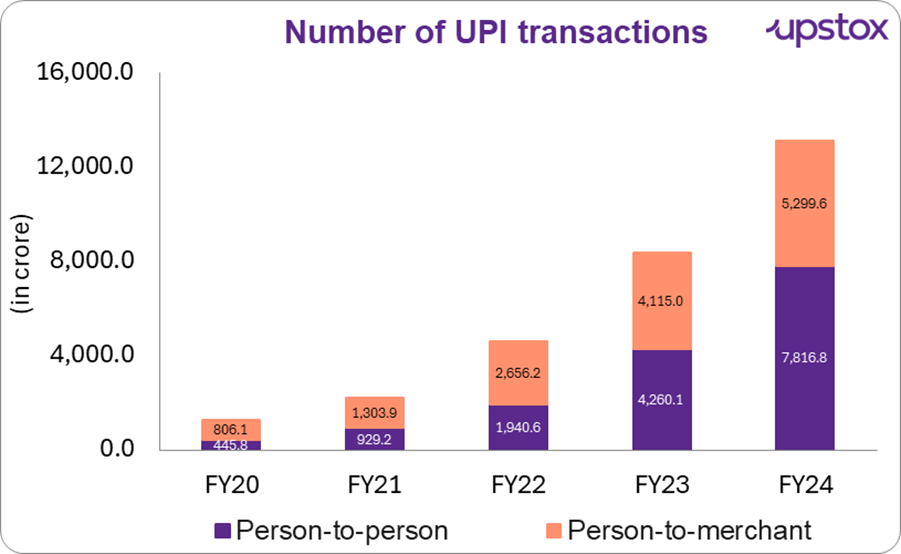

UPI transactions in India have grown at a CAGR of over 50% in the past five years and are projected to continue rising with increased digital adoption.

Source- Department of Financial Services

Source- Inc42

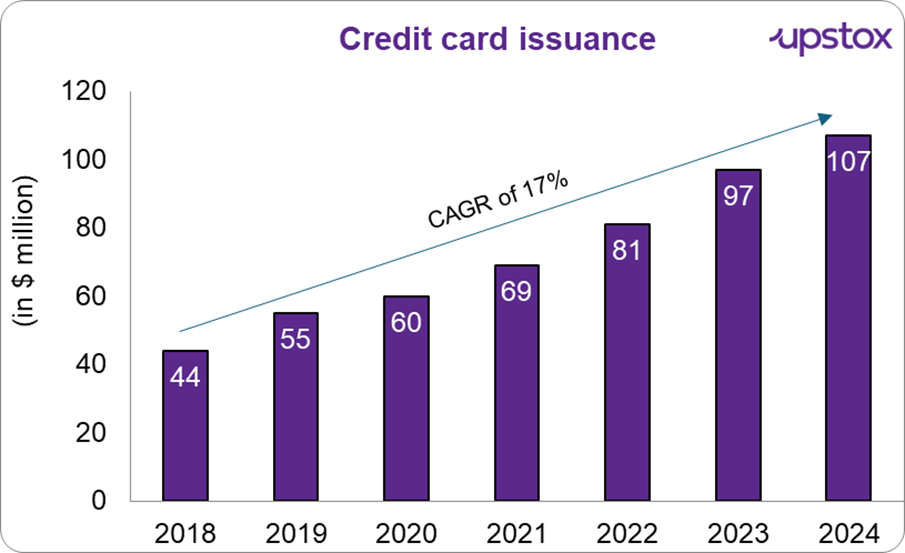

The Indian credit card market is expected to grow at a CAGR of 15-17% due to rising credit awareness and urbanisation.

Source: IBEF

The introduction of UPI-linked credit cards (e.g., RuPay Credit on UPI) will blur the lines between these two payment methods, giving consumers more flexibility.

In summary

Both UPI and credit cards have their moments of glory. If you love instant, hassle-free payments and don’t want to deal with debt, UPI is your best friend. If you’re all about maximizing rewards, travel perks, and don’t mind managing your credit cycle, then credit cards rule. So, what’s the takeaway?

Whether you lean towards UPI, credit cards, or a mix of both, one thing is clear—the way India pays is changing, and businesses need to keep up. Balance them right, and you’ll be a payment ninja. Now go forth and pay wisely!

About The Author

Next Story