Upstox Originals

Understanding risk-off sentiment in the markets

5 min read | Updated on January 29, 2025, 14:55 IST

SUMMARY

Technical indicators point towards a relatively bearish trend in the markets. Any rebound is likely to be challenged. At such times, investors tend to display a risk-off mode, moving away from riskier assets towards safer ones. Utilising RSI and RRG analysis, we try to find potential pockets of opportunities in the current market setup. Investors should however monitor these signals closely for any change in the indicators.

Stock list

After the recent market fall, investors are currently in a risk-off mode

The markets have commenced the new year on a cautious note, with Indian equities underperforming their global counterparts on a year-to-date (YTD) basis (as of January 23, 2025). As of 2025, the Nifty has recorded a negative return of (-1.86%) on a YTD basis.

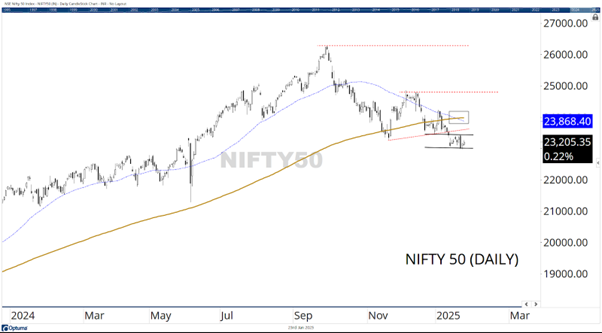

From a technical perspective, several critical levels have been breached, signalling a weak market structure. The Nifty is decisively trading below its 200-day moving average (200-DMA), currently placed at 23,981. Furthermore, the index has experienced a "Death Cross," with the 50-day moving average (50-DMA) crossing below the 200-DMA. On the weekly charts, the situation is equally concerning, as the Nifty has broken its 50-week moving average (50-WMA), positioned at 23,714.

These developments strongly suggest that the market is now entrenched in a secondary trend, with the primary uptrend disrupted. The high of 26,277 is likely to act as an intermediate top. Given the prevailing technical structure, the downward pressure continues to persist, and the best of rebounds are expected to face stiff resistance at levels around 23,700 or higher. Overall, the outlook remains cautious, with market participants likely to remain risk-averse in the current environment.

Understanding risk-off sentiment and its implications

A risk-off sentiment refers to a market environment where investors exhibit heightened caution due to economic uncertainty, geopolitical tensions, or weak market conditions. In such periods, market participants typically move away from high-risk assets, such as equities, and gravitate toward safer havens like government bonds, gold, and defensive stocks. This shift reflects a preference for capital preservation over growth, driven by a fear of potential losses in volatile markets.

During risk-averse and risk-off phases, defensive sectors like Utilities, Consumer Staples, Healthcare, and Energy tend to outperform. These sectors offer consistent cash flows, are less sensitive to economic cycles, and provide a degree of stability in volatile markets. Specifically, the Energy sector often draws attention due to its tangible asset-backed nature and its role in essential services. Higher oil or gas prices, driven by geopolitical disruptions or supply constraints, can further enhance its appeal during such times.

Investors typically respond to risk-off environments by reallocating their portfolios towards safer assets. Additionally, they may reduce exposure to equities, particularly in high-beta sectors like Technology or Financials, and focus on cash or liquid assets for added flexibility and safety. This behaviour reflects a broader preference for protecting capital over pursuing high returns.

Nifty Energy: Signs of potential rebound

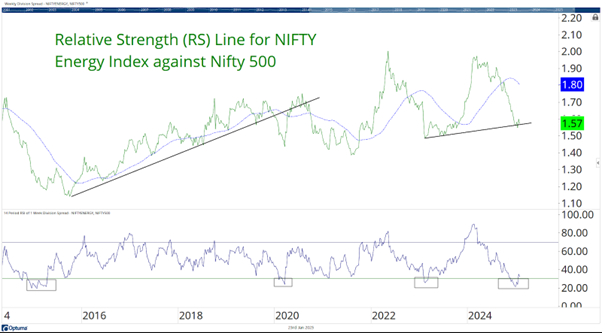

The Energy sector warrants attention as the Relative Strength (RS) of the Nifty Energy Index shows improvement after finding support at a multi-month trendline. Over the past three years, the sector has experienced cycles of sharp outperformance and underperformance, highlighting its cyclical nature.

In 2024, the Nifty Energy Index significantly underperformed the broader Nifty 500. However, the RS line is now taking support at a rising trendline, forming a potential higher bottom - a positive technical development. Notably, RS lines can be analysed using pattern analysis, similar to price trends. Current analysis indicates that the RS line has stabilised, with the Relative Strength Index (RSI) recovering from an oversold zone, crossing above 30.

Historically, such RSI has slipped below 30 in oversold zones on just a handful of occasions over the past decade. After that, following their crossing over 30, Energy stocks have shown significant outperformance relative to broader markets, indicating a possible reversal in the sector's fortunes.

RRG analysis: Nifty Energy shows signs of momentum

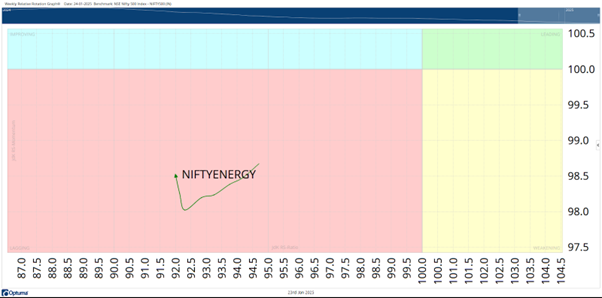

On the Relative Rotation Graph (RRG), the Nifty Energy Index is positioned within the lagging quadrant when benchmarked against the broader Nifty 500. However, the upward trajectory of its tail suggests improving relative momentum, indicating a potential shift in its performance against the broader markets.

Importantly, the Nifty Energy Index is located more than one standard deviation away from the RRG center point. This positioning implies that the farther an index or stock is from the center, the greater the likelihood of generating higher alpha.

Given the current trajectory, the Nifty Energy Index appears poised for enhanced relative performance over the coming weeks. As the sector improves its relative momentum, it is likely to attract renewed investor interest, further strengthening its potential to outperform the broader markets in the near term.

Early signs of bottoming out in energy stocks

The first signs of bottoming out in stocks often emerge when lead indicators display divergences against price action. These divergences, particularly after a downtrend, can be predictors of potential trend reversals.

Currently, such divergences can be observed in energy sector stocks, including Reliance, ONGC, IOC, Coal India, and NTPC. These signals suggest the possibility of early recovery and warrant close monitoring for further confirmation.

In summary

The current market environment reflects a cautious sentiment, with a shift towards risk-averse strategies. Amid this backdrop, the Energy sector shows early signs of recovery, supported by improving relative strength, favorable RRG positioning, and bullish divergences in key stocks. These technical developments highlight the potential for the sector to outperform in the near term. Investors should monitor these signals closely, as they may present opportunities to capitalize on the sector's anticipated resurgence against broader market trends.

About The Author

Next Story