Upstox Originals

Understanding past market corrections: How different sectors reacted

.png)

4 min read | Updated on March 10, 2025, 14:08 IST

SUMMARY

While the recent correction has ushered in a state of panic, do all stocks fall equally? In this article, we’ll delve into why some sectors may be more resilient or vulnerable than others, analyse past data to differentiate between them, and explain how investors can use this phenomenon to manage risk effectively during periods of market volatility.

Appropriate asset allocation can help investors mitigate losses during market corrections

The market has dropped by ~12-15% over the past five months, causing a lot of panic. Stocks that were performing well are now plummeting. Portfolios have started to turn to a shade of dark red. Such times always leave investors wondering about steps they can take to mitigate their losses. In this article, we look at the performance of defensive and cyclical sectors and explain why allocation to defensive sectors can help in reducing portfolio losses.

Before we dive in, let’s first understand what is the meaning of cyclical and defensive sectors.

-

Cyclicals are tied to the economic cycle, performing well in periods of growth but declining during downturns. A simple example is real estate. When the interest rates are reducing, real estate is expected to do better (loans become affordable) and as the rate hike cycle commences, it adversely impacts real estate. Other examples include commodities, automobiles, and luxury goods.

-

Defensive stocks, on the other hand, remain stable across economic fluctuations because their products and services are always in demand; sectors like healthcare, utilities, and consumer staples fall into this category. For example: Whether the market is rising or falling, the demand for medicines is completely unaffected.

While cyclical stocks offer higher returns during economic booms, defensive stocks provide consistent stability, making them an apt choice for risk-averse investors.

Difference snapshot

| Feature | Cyclicals | Defensives |

|---|---|---|

| Performance | Stronger performance in economic booms | Stable across economic cycles |

| Risk Level | Higher | Lower |

| Few examples | Metals and Auto | Pharma and FMCG |

How have these sectors performed in past cycles?

We analyse the performance of these sectors in two major crashes of the past: 1) the Global Financial Crisis and 2) The 2015 market scare.

2007-08 Financial crisis

The 2007-08 financial crisis is also called the Global Financial Crisis. The crisis was precipitated by a housing bubble in the USA and then quickly became a global contagion. Global stock markets experienced sharp declines leading to significant wealth erosion and heightened market volatility, impacting both domestic and international economies.

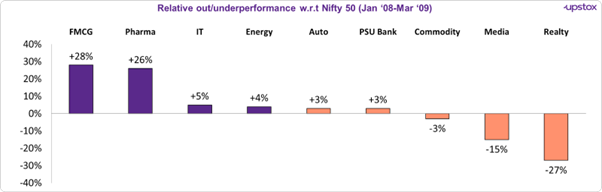

We focused on the period from January 2008 to March 2009, as it marked the market's peak followed by a significant decline of over 60%. In the chart below, we look at the relative out or underperformance of the sectors.

For example - if the Nifty returned 15% and the sector returned 20%, it's an outperformance of 5%. On the other hand, if the Nifty fell by 20% and a particular sector fell by 10%, it is still an outperformance of 10%

Source: niftyindices.com, Note: Purple: defensive sectors & orange: cyclical sectors.

This chart illustrates that sectors like FMCG and Pharma faced relatively smaller declines compared to sectors such as Realty and Media. Investors with a focus on these defensive sectors likely experienced significantly less panic than those invested in the more volatile cyclical sectors.

2015 crash

The 2015 crash was triggered by fears of a slowdown in China, following the Yuan's devaluation (~3% over two days), leading to currency rate declines and stock sell-offs globally. Additional factors included weak earnings from Indian companies, cautious management outlooks, and a below-average monsoon.

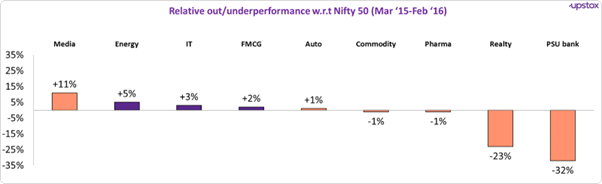

During 2015’s market crash, Nifty 50 witnessed a decline of 25%. Even here, the defensives have largely performed better than their cyclical counterparts.

Source: niftyindices.com, Note: Purple: defensive & orange: cyclical sectors.

One could look at the chart above and point out that the Media sector, a cyclical, performed better than the rest in the 2015 crash. Yes, it did. But, by and large, the outperformers are defensive sectors.

Also, these two charts explain a central point, that investors should not blindly allocate funds to a sector. Prudent asset allocation will involve studying underlying stock dynamics and ongoing events in the sector. A sector that showed resilience during one period of time can decline rapidly during a different period.

Outlook

Market cycles are inevitable, but understanding how different sectors react to downturns can help investors make informed decisions. Defensive stocks provide stability during uncertain times, while cyclical stocks offer high returns during economic booms.

By identifying which sectors perform well during crises, investors can strategically allocate a portion of their portfolios to these resilient sectors according to their risk appetite. For example, an investor with a low-risk agenda can have a higher percentage of his portfolio in sectors that show strength with respect to the larger market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story