Upstox Originals

Tracking two of India's fastest-growing fintech segments

.png)

6 min read | Updated on June 25, 2024, 16:19 IST

SUMMARY

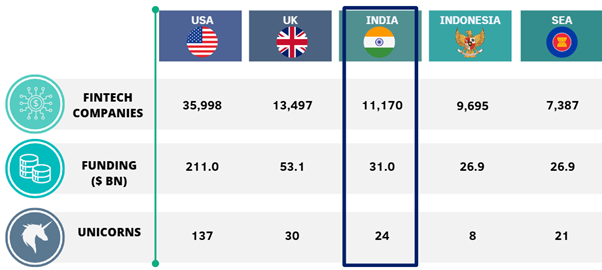

Imagine mobile payments, automated loans, or robo-advisors for investing - that's fintech. Globally, India's fintech market is the third-largest and among the fastest-growing. Let's dive into two key segments driving India's booming fintech industry.

Global share of revenues generated by Indian fintech companies is expected to double.

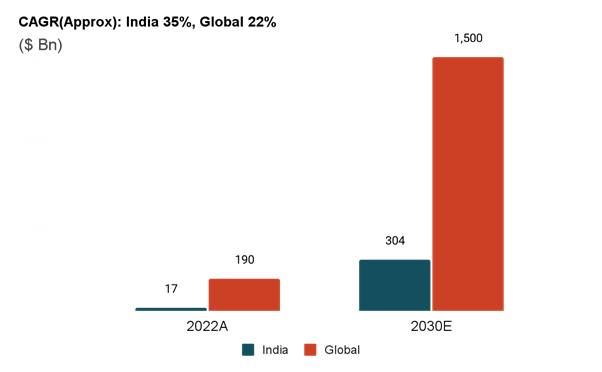

Fintech is one of the fastest-growing industries in India, with overall fintech revenues expected to grow at a CAGR of 35% over 2022-2030. As seen in the chart below, India’s share in global fintech revenues is expected to double from ~6% in 2022 to ~13% by 2030.

Fintech revenue growth projections - India and Global

Source: BCG and Matrix Partners: State of the Fintech Union 2023 report; A = actuals, E = estimated

Source: Tracxn (as of 31st March 2024)

Fintech's landscape is offering a range of solutions beyond just payments. Some of its major segments include PayTech, LendingTech, WealthTech, NeoBanking, and InsurTech.

Let's break it down! Here's a brief overview of the key segments in India's fintech landscape:

| Segment | Details |

|---|---|

| PayTech | The leverage technology to streamline and improve the way we make and receive payments by making transactions faster, easier and more secure. Select examples: Paytm and PhonePe, |

| LendingTech | Unlike traditional banks, LendTech companies handle the entire loan process digitally, from application to servicing. E.g. Policy Bazaar and Lending Kart |

| WealthTech | Also known as Investment Tech, allows more people to participate in the markets. Select examples: Upstox and Zerodha. |

| Neo Banking | Transforming banking with digital experiences and replacing brick-and-mortar branches. Poised to grow at a projected CAGR of 18% by 2030. Select examples: Razorpay and Pine Labs |

| InsureTech | Personalising and simplifying the insurance process, this segment is projected to grow at a CAGR of 12.5% by 2030. E.g. Acko and Digit Insurance |

Fintech offers a variety of innovative services and in this article, we look at two of the largest ones - PayTech and LendingTech

Before we dive in, let's delve into some key metrics commonly used in this industry. Generally, higher values for these key metrics are considered favourable.

| Key Metrics | How is it calculated? | Description |

|---|---|---|

| Average Monthly Transacting User (MTU) | (The Sum of Monthly Unique Users/12) | To measure user engagement and the success of the platform |

| Gross Merchandise Value (GMV) | (Sales Price of Goods) x (Number of Goods Sold) | The total value of sales processed through a platform over a specific period |

| Annual Loan Disbursal | (Periodic Loan Disbursed) x (Number of Periods) | The total amount of money a lending company lends out in a year |

LendingTech

Unlike traditional banks, LendingTech companies handle the entire loan process digitally, from application to servicing. While traditional loan processes can drag on for weeks due to document handling, digital lending shines with efficient verification, completing the same task in just a few hours.

Let’s explore the leading player in the listed LendingTech space

| PB Fintech | FY24 (Cr) | CAGR from FY21 to FY24 (%) |

|---|---|---|

| Annual Loan Disbursal | 14,000 | 67 |

| Revenue (INR) | 3,438 | 34 |

| Profit (INR) | 64* | - |

Source: Company reports; *Company improved from a loss in FY24

PayTech

The digital revolution has fueled the rise of PayTech companies, offering convenient payment solutions for both individuals and businesses, as evidenced by the massive volume of UPI transactions, reaching 117.6 bn transactions in 2023, up 81% YoY. The modern payment landscape is a dynamic ecosystem shaped by various technologies.

Open banking, real-time options offer instant transfers. Global transfers and Buy Now, Pay Later (BNPL) solutions provide flexible payment options. Digital wallets further revolutionise the way we pay.

Let’s dive into the publicly traded PayTech company - Paytm*

| Paytm | FY24 (cr) | FY21- FY24 CAGR (%) |

|---|---|---|

| MTU | 9.6 | 27 |

| GMV | 4,70,000 | 66 |

| Revenue (INR) | 9,978 | 53 |

| Profit (INR) | 5,538 | 148 |

Source: Company reports; * Paytm also had a lending business

India's booming fintech scene isn't just about established players. Let's explore some of the exciting private PayTech and LendingTech companies

| Segment | Company | Status | Total Funding ($ mn) | No. of rounds | Market Valuation* ($ bn) |

|---|---|---|---|---|---|

| Pay Tech | Razorpay | Unicorn | 742 | 11 | 7,500 |

| Pine Labs | Unicorn | 1,610 | 14 | 5,800 | |

| BharatPe | Unicorn | 604 | 15 | 2,700 | |

| PhonePe | Unicorn | 1,010 | 3 | 1,270 | |

| LendingTech | Incred | Unicorn | 318 | 8 | 1,040 |

| Money View | Soonicorn | 219 | 9 | 700 | |

| Lendingkart | Soonicorn | 232 | 27 | 251 |

Source: Tracxn, Press Releases; *Market valuations based on the most recent data

Looking at a major upcoming IPO

MobiKwik, which offers various financial services including PayTech and LendingTech solutions, is reportedly gearing up for an ₹700 cr IPO. The company boasts over 140 mn+ users and 4.1 mn+ partners. According to Tracxn, it has raised $269 mn across 21 funding rounds.

Initially a digital payment services provider, MobiKwik expanded in 2018 to offer credit, insurance, digital gold, and mutual funds.

It has delivered a strong Q1FY24, with adjusted EBITDA up 181% YoY and revenue growing 68% compared to the same quarter last year.

Conclusion

Fintech presents a compelling alternative to traditional banking, driven by technological advancements and regulatory reforms that have slashed financial service costs.

The COVID-19 pandemic catapulted digital payments, with notable increases in UPI transactions and demat accounts. With improved internet access, especially in rural areas, digital lending has flourished, strengthening fintech's market dominance.

The booming fintech industry is fueled by massive funding rounds, digital advancements and innovation. Leading companies showcase robust growth and a promising future, making it an attractive investment opportunity for fintech enthusiasts.

However, careful analysis and due diligence are crucial before diving in.

About The Author

Next Story