Upstox Originals

Themes of India: India’s rapidly evolving industries you should know about

7 min read | Updated on March 11, 2025, 09:22 IST

SUMMARY

Themes of India – where we uncover some of the most compelling and under-the-radar industry shifts. Why are premium tractors gaining traction in rural India? How is rising affluence fuelling a boom in beauty and personal care? And why does India’s housing market present a once-in-a-decade opportunity for real estate players? Dive in to explore these high-growth themes shaping the country's next chapter.

Exploring some of the fastest growing segments in India

India’s long term growth story has long been touted and we are seeing it unfold, but underneath the larger trends - where do the real opportunities lie? For example, given India’s reliance on agriculture, tractors remain critical to the growth of this major sector. But where exactly does the opportunity lie? Are all tractors faring similarly or are there pockets which are showing higher growth compared to the others?

In this article, we explore three key sectors—1) Tractors, 2) Beauty, and 3) Housing—by identifying sub-sectors or specific facets that are outperforming their peers, along with the underlying factors driving these trends.

India’s machinery boom: The rise of premium tractors

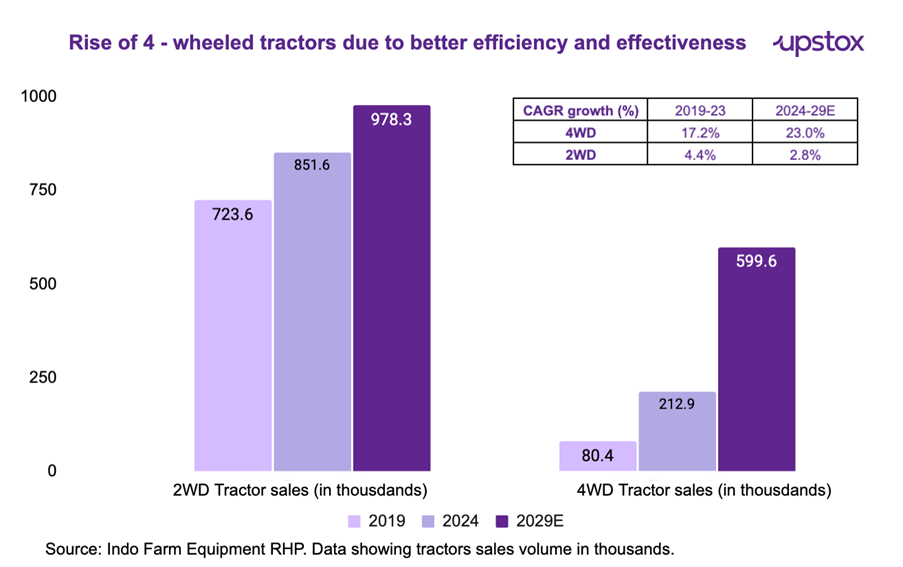

The Indian tractor and construction vehicle market is experiencing significant growth, driven by increasing mechanisation in agriculture and rapid urbanisation. The total tractor market is projected to grow at an 8.2% CAGR, reaching 1.6 million units by 2029.

Within tractors, 4-wheeled or 4WD tractors are expected to grow at a staggering 23% CAGR during 2024-2029 supported by infrastructure development and rapid urbanisation. They have already shown remarkable growth in the past 5 years, and are expected to display even stronger growth in the coming 5 years.

What makes this industry compelling is

India’s dominant position is that of the world’s largest tractor market, consuming 35-40% of global tractor sales. The increasing preference for high-powered and technologically advanced machinery reflects a broader trend of modernisation in farming and construction.

New regulations

The introduction of TREM-IV regulations for tractors now demands more environmentally friendly tractors, which has led to an increase in the cost of tractors by ₹1.5 lakh. So, to get the same horsepower effectiveness for a similar price, farmers are shifting from 2WD to 4WD since these tractors, even with lower horsepower, can offer similar effectiveness of 2WD with higher horsepower.

Diverse needs

The demand for 4WD tractors in India has increased due to their versatility and superior performance in challenging terrains. These tractors are widely used for haulage, tilling, and other heavy-duty agricultural tasks, making them a preferred choice for farmers.

Government subsidy

The government of India decided to aid the farmers and provide a 50% to 80% subsidy for the procurement of agriculture equipment.

Credit and rising rural income

The easy availability of credit and the increasing rural income are other market drivers for the farm equipment industry in India.

As Indian agriculture evolves, 4WD tractors are becoming essential for modern farming, contributing to their rising popularity and growing market share.

India’s beauty boom

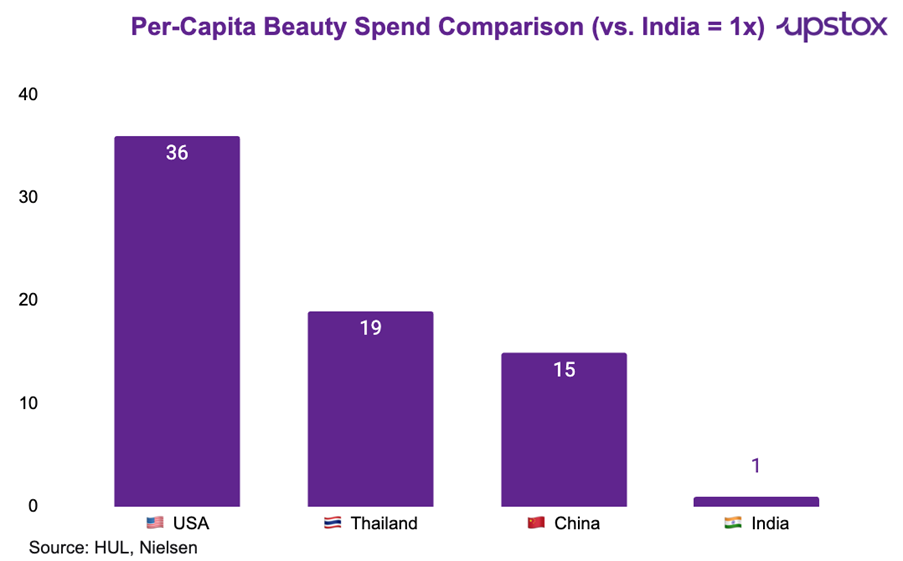

The next big opportunity in personal care India's beauty and personal care market, valued at ₹68,000 crore, presents a massive opportunity, particularly in premiumisation, which is expected to grow at 10-11% CAGR during 2025-28 as per Nielsen. Despite its size, India remains significantly under-indexed in per capita beauty spending, with developed markets like the U.S. spending 36x more per capita.

However, there is strong potential for growth as affluent Indian consumers are already adopting skincare and beauty routines comparable to global peers—using 5.1 to 7.3 products on average, surpassing even USA and China in some segments. The rising trend of self-care, increasing disposable income, and expanding e-commerce penetration are set to drive the industry’s next phase of expansion.

Why is this industry interesting?

With increasing beauty consciousness, social media influence, and a younger demographic fuelling demand, India's beauty sector is at an inflection point.

India’s beauty e-commerce registered an over 30% growth during most of 2024, making it the fastest-growing market in the world as per Nielsen IQ. Because no single player dominates the market, a lot of organised players have entered this space in the last few years, including Nykaa, Reliance (Tira), Tata Cliq Palette, and Birla Cosmetics.

Recently, HUL also announced the acquisition of Minimalist, a beauty product company, for ₹3,000 crore. The shift toward premium and skincare-focused regimes, along with a vast untapped mid-tier segment, makes this a highly lucrative space for brands looking to capture long-term growth. For example, HUL’s beauty and well-being segment derives the highest margin of 29% as compared to its overall margins of 23% as of Q3FY25.

HUL in its latest conference call mentioned that the premiumisation trend deriving demand for beauty because affluent beauty accounts for 50% of the beauty segment and is growing at twice the rate of the overall segment.

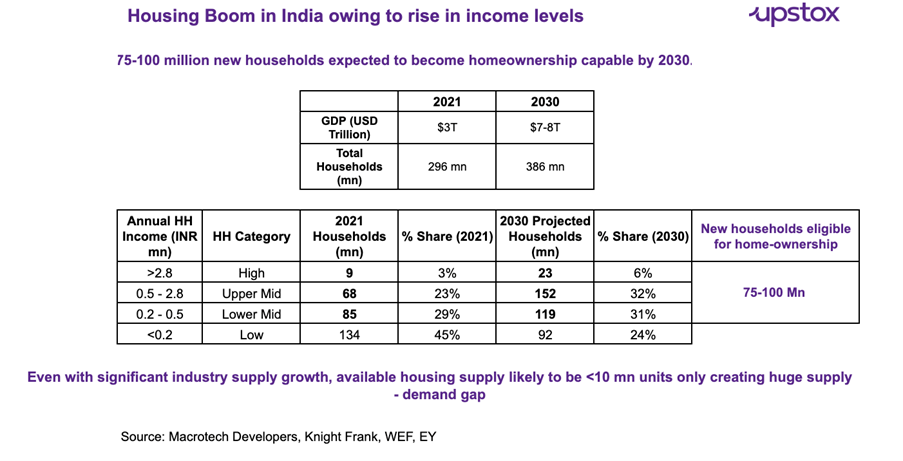

India’s housing boom

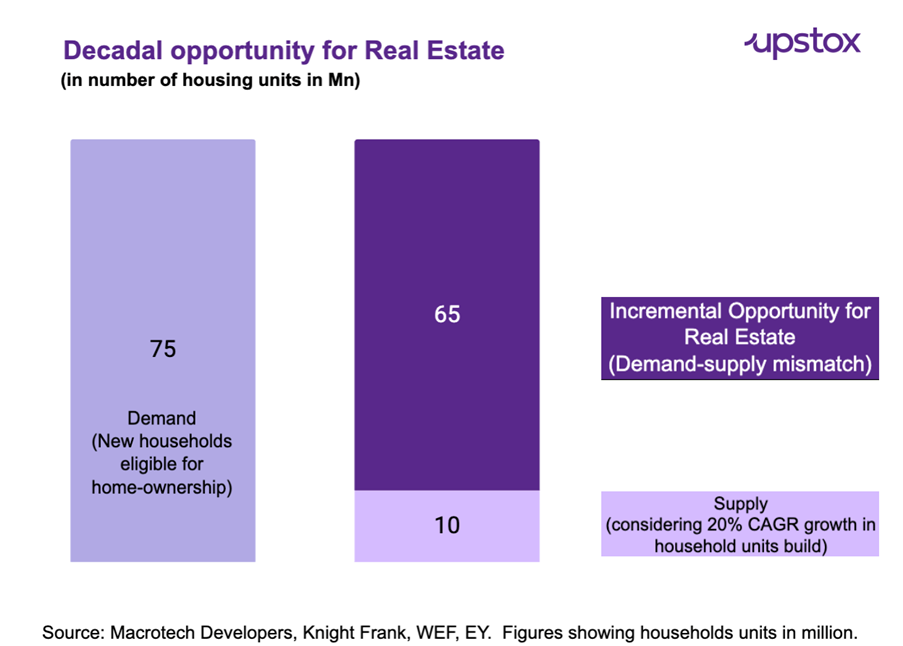

India is on the cusp of a massive housing boom, with 75-100 million new households becoming home-ownership capable by 2030, driven by rising incomes and urbanisation. The upper-middle-income segment (₹0.5-2.8 million annual income) is expected to grow from 68 million households in 2021 to 125 million in 2030, while high-income households is expected to expand from 9 million to 23 million creating demand for premium housing while mid-income category will see 80% rise creating demand for affordable housing segment too.

This shift is fuelled by a projected 2.5x increase in per capita income, reaching $4,819 by FY32 as per EY estimates. Despite this demand surge, housing supply is expected to fall short, with availability likely remaining below 10 million units, creating a wider addressable market for real estate.

Why is this industry interesting?

With India's GDP expected to grow from $3 trillion in 2021 to $7-8 trillion by 2030, real estate developers, mortgage lenders, and construction firms stand to gain immensely. As more Indians transition into higher income brackets, the demand for premium housing will outpace supply, making this sector one of the most promising investment avenues for the decade ahead.

Affordability for housing has improved due to consistent income growth outpacing housing inflation, as per Knight Frank Report. This is the reason why housing demand is not going off the table soon, even when the border economy growth rate has moderated.

Companies set to benefit from this trend are Macrotech Developers, DLF, Suntech Realty, Sobha, and Oberoi Realty.

Affordability Index of leading eight cities of India (EMI to Income Ratio)

| City | 2010 | 2020 | 2022 | 2024 |

|---|---|---|---|---|

| Mumbai | 93% | 61% | 53% | 50% |

| NCR | 53% | 38% | 29% | 27% |

| Bengaluru | 48% | 28% | 27% | 27% |

| Pune | 39% | 26% | 25% | 23% |

| Chennai | 51% | 26% | 27% | 25% |

| Hyderabad | 47% | 31% | 30% | 30% |

| Kolkata | 45% | 30% | 25% | 24% |

| Ahmedabad | 46% | 24% | 22% | 20% |

Source: Knight Frank

In summary

India’s growth story is unfolding across multiple industries, creating a once-in-a-generation opportunity for businesses and investors. As urbanisation accelerates, demand for housing, consumer goods, and personal care products will continue to rise.

Simultaneously, infrastructure expansion and mechanisation will drive industrial growth. The interplay of these trends signals a decade of economic transformation, making India one of the most attractive markets for strategic investment. For those looking to tap into the next phase of India’s economic boom, these sectors offer unparalleled potential.

About The Author

Next Story