Upstox Originals

The zero-for-zero strategy: Can it solve the India-US trade puzzle?

.png)

8 min read | Updated on March 28, 2025, 12:33 IST

SUMMARY

What if India and the US scrapped tariffs for each other? The "zero-for-zero" strategy is theoretically a win-win, easing trade tensions and lowering uncertainty. With India facing pressure to lower duties on American goods, this approach could boost exports and consumer choices. But who truly benefits - and at what cost? While sectors like electronics and jewellery may thrive, agriculture and automobiles could face challenges. Is India ready to trade protection for opportunity?

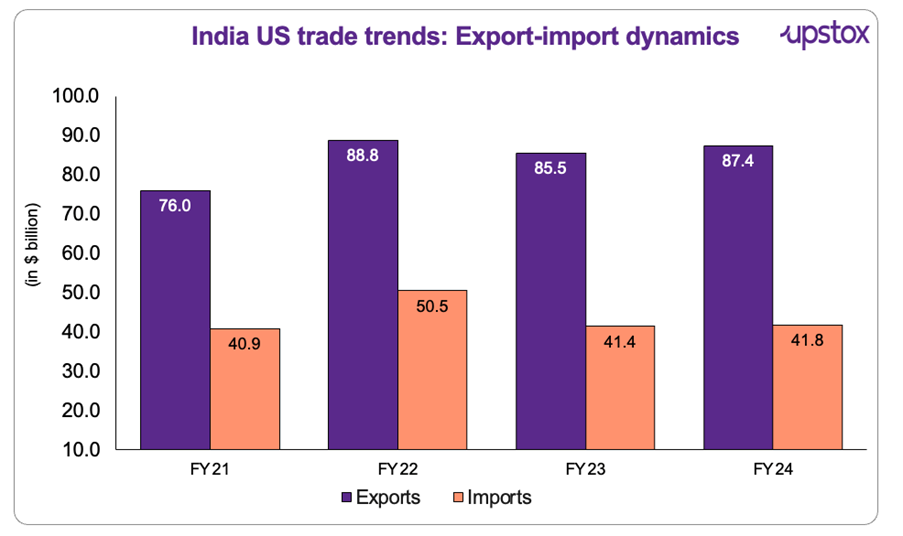

The USA has a trade deficit of ~$46 billion with India

April 2 - a crucial day for India-US trade relations. As the US enforces reciprocal tariffs on nations with high levies on American goods. But why is this happening? The answer lies in the merchandise trade deficit - the gap between what the US imports and exports.

The US is India’s one of the largest trading partners, with total goods trade reaching $129.2 billion in 2024, according to the Observatory for Economic Complexity (OEC). US exports to India stood at $41.8 billion, while US imports from India rose by 2.2% to $87.4 billion. This has resulted in a trade deficit of $45.7 billion, a gap Washington is keen to address.

Source: The Observatory of Economic Complexity

Now, here’s where it gets interesting. India, with a $46 billion trade surplus, is on the radar for these new tariffs. But instead of waiting for restrictions to take a toll on exports, what if India flips the script?

According to a PTI report citing the Global Trade Research Initiative (GTRI) on February 21 2024, one potential approach for India is the "zero-for-zero" tariff strategy, which could provide a balanced way to tackle this.

Understanding the “zero for zero” tariff strategy

The "zero-for-zero" tariff strategy is simple: India removes import duties on select products, and in return, the US eliminates tariffs on an equal number of Indian goods. This simple yet strategic move not only lowers India's overall tariffs - something Washington has long criticized - but also ensures that any retaliatory tariffs from the US have little to no real impact.

India’s tariffs on US goods: A detailed breakdown

Ever wondered how much duty India charges on US goods? The answer isn’t the same across the board - some products face high tariffs, while others are taxed at lower rates.

So, which products are taxed the most? How do average tariffs compare across categories? Let’s take a closer look.

- Maximum tariffs on specific US products: India imposes some of its steepest tariffs on select US products, particularly in the agricultural and beverage sectors. (These are the highest possible tariff rates India imposes on selected US goods imported into India.) Here's a breakdown:

| Product category | Maximum tariff (%) |

|---|---|

| Cereals & Food Products | 150 |

| Beverages & Tobacco | 150 |

| Fruits & Vegetables | 120 |

| Fully-built Cars | 110 |

| Dairy Products | 60 |

| Transport Equipment | 125 |

| Motorcycles (Above 800cc) | 50 |

| Chemicals | 100 |

| Minerals & Metals | 40 |

Source: Economic Times

- Weighted average tariffs on US imports: These represent the overall effective tariff rates across all products in a category.

| Product category | Weighted average tariff (%) |

|---|---|

| Agricultural Products (Overall) | 37.7 |

| Auto Sector (General) | 24.1 |

| Pharma & Chemicals | 9.7 |

| Iron, Steel & Products | 4.5 |

| Electrical, Telecom & Electronics | 7.5 |

| Machinery | 6.6 |

| Textile & Clothing | 10.4 |

| Plastics & Related Articles | 9.9 |

| Diamond, Gold & Jewellery | 15.4 |

Source: Economic Times

The US seeks lower tariffs on key exports like apples, almonds, and automobiles, while India focuses on supporting its domestic industries.

What happens if India removes tariffs on US goods?

A tariff-free trade deal could shake up industries, fueling competition and boosting market access for both nations. The table below breaks down the sectors in play and the duties shaping US-India trade.

Tariff impact on key sectors (2024)

| Sector | US exports to India ($ Mn) | India exports to US ($ Mn) | Tariffs faced by US exports in India (weighted average %) | Tariffs faced by Indian exports in the US (weighted average %) |

|---|---|---|---|---|

| Agriculture, meat, processed food | 1.9 | 6.0 | 37.7 | 5.2 |

| Automobiles | 0.4 | 2.8 | 24.1 | 1.0 |

| Diamonds, gold, and products | 1.9 | 11.8 | 15.4 | 2.1 |

| Chemicals & pharmaceuticals | 3.5 | 18.4 | 9.6 | 1.0 |

| Total (Includes other sectors) | ~ 41.8 | ~ 87.4 | 7.6 | 2.7 |

Source: GTRI, 2024

Currently, US exports to India face an average tariff of 7.6%, while Indian exports to the US are taxed at just 2.7% - a 4.9% gap that highlights the imbalance. If tariffs are removed, let us understand the impact on country-level:

Stronger export footprints

The removal of tariffs will allow Indian industries, particularly in diamonds, pharmaceuticals, and chemicals, to expand their presence in the US market. Reduced trade barriers would make Indian exports more competitive, increasing market penetration and revenue generation.

Strategic trade-offs

The US may leverage tariff reductions to demand additional concessions in other areas such as intellectual property rights (IPR), digital trade regulations, and greater access for American service providers in India. India would need to carefully assess whether the benefits of expanded exports outweigh the risks posed to its domestic industries.

No more protective barriers

India has long used tariffs as a tool to protect emerging sectors, promote self-reliance, and manage trade imbalances. With a zero-for-zero strategy, these policy tools disappear - can India’s industries stand strong on their own? Now, let us understand how this will shake up key industries?

The upside

Boosting exports, attracting investments, and cementing India’s role in global supply chains - zero tariffs could be a game-changer for key industries. From electronics to jewellery, India stands to gain big—but only if it plays its cards right.

Electronics

India is chasing a massive $50 billion in smartphone exports and $80 billion in total electronics exports to the US, pushing toward its $500 billion production target, says India Cellular & Electronics Association. With Apple, Samsung, and Foxconn planning to expand more in India, a zero-tariff deal could cement India’s role in global supply chains.

But if the US hikes tariffs on Indian electronics, investments may shift - giving Vietnam, with its zero-duty advantage, the upper hand.

Gems, gold & jewellery

India dominates the global diamond trade, holding an 18.4% share in exports. Cutting tariffs could further sharpen its competitive edge by easing raw material imports. But will it change the game?

With India already leading in cut and polished diamonds (45%), gold jewellery (24.6%), and lab-grown stones (92%), a zero-tariff deal may not disrupt the balance - though strategic policy shifts may be needed to maintain its stronghold in the US market, says Kirit Bhansali, Chairman of the Gems & Jewellery Export Promotion Council.

The downside

Opening the floodgates to cheaper imports could hit local industries hard, risking jobs and economic stability. For some sectors, zero tariffs might mean zero protection - can India afford the trade-off?

Automobiles

India’s fully built car market is among the most protected, with 110% import duties making foreign entry challenging. While the government is considering cuts, zero duty remains off the table, as automakers fear cheaper imports could hurt local manufacturing.

While the government is considering reducing duties, zero duty remains off the table, as automakers fear cheaper imports could hurt local manufacturing. India’s automobile industry contributes 7.1% to GDP and employs ~19 million people, making it a critical sector for economic stability.

Agriculture

The Global Trade Research Initiative report is clear - zero tariffs on agriculture could be a disaster for Indian farmers. The U.S., with its $100 billion farm subsidies, already exported $1.3 billion worth of fruits, nuts, and vegetables to India in 2024 - what happens if that doubles? India currently shields farmers with 30% to 100% import duties on almonds, walnuts, and cranberries, and 10% on lentils.

India’s agriculture sector, which provides livelihoods for over 150 million people, could face severe instability. The stakes? Food security for 1.4 billion Indians, rural stability, and a sizeable potential loss for the farmers.

Who benefits if India lowers tariffs – Consumers or the country?

Consumers win, but can the country keep up? Lower tariffs mean cheaper imports, better product choices, and fiercer competition - great for buyers. But for India, the impact depends on the sector. Electronics and jewellery could boom, while agriculture might take a hit - if zero for zero is applied to the agriculture sector too.

Small manufacturers? They may struggle against a flood of foreign competition. India risks losing tariff protection that nurtures homegrown industries. The US could gain better access to India’s booming market, shifting trade balances. The real challenge? Striking a deal that benefits both consumers and the economy.

About The Author

Next Story