Upstox Originals

The secret life of the unclaimed deposits with the RBI

.png)

6 min read | Updated on March 31, 2025, 10:44 IST

SUMMARY

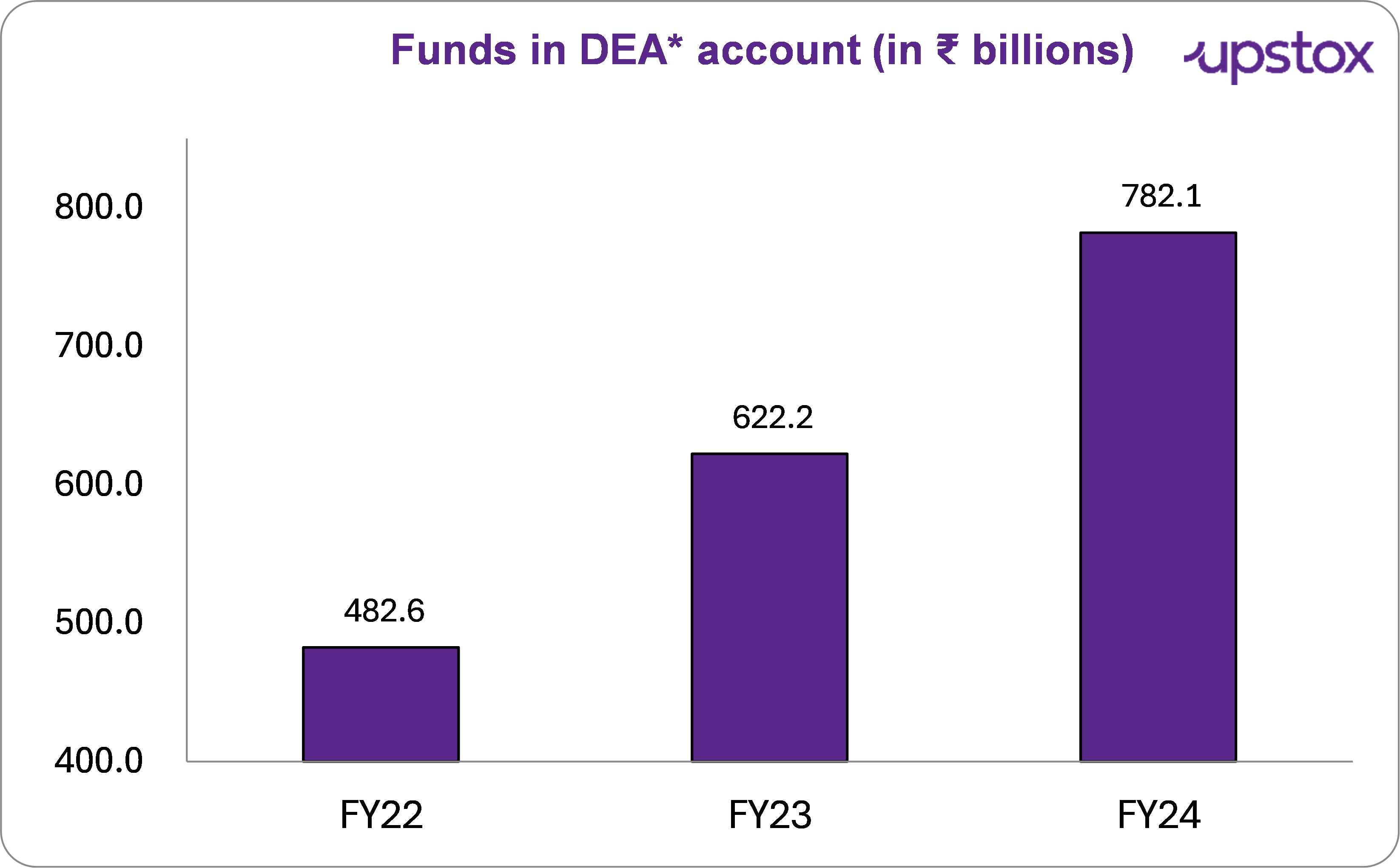

₹782 billion! That is the extent of unclaimed deposits held by RBI. When bank accounts become inactive, the RBI steps in to safeguard those funds until they're reclaimed by their rightful owners. Dive in to discover how these dormant deposits are managed and what new measures are unlocking the forgotten money!

As of March 2024, unclaimed deposits in Indian banks have skyrocketed to ₹782.1 billion

Ever wondered what happens to the money sitting in bank accounts that haven't been touched for years? Perhaps it's money from an account you simply lost track of, or maybe it was a fixed deposit you once made and then overlooked. In India, such unclaimed deposits are managed by the RBI. As of March 2024, unclaimed deposits in Indian banks have skyrocketed to ₹782.1 billion - a massive 26% jump from last year’s ₹622.2 billion.

Source: Reserve Bank of India Annual Report 2023-24; *Depositor Education and Awareness (DEA) Fund

What are unclaimed deposits?

Unclaimed deposits are funds in bank accounts that have remained inactive for 10 years with no deposits, withdrawals, or any other customer-initiated transactions—making it difficult for the bank to locate the rightful account holder. Once this 10-year period elapses, these funds are classified as unclaimed deposits. Unclaimed deposits include various types of bank accounts like savings bank accounts, fixed deposits, and recurring deposits.

Where does this money go?

Instead of keeping these funds indefinitely, banks transfer them to the Depositor Education and Awareness (DEA) Fund, which is managed by the RBI. The table below provides breakdown of these unclaimed amounts in select banks:

| Bank | Unclaimed amount (in ₹ crore) |

|---|---|

| State Bank of India | 8,086 |

| Punjab National Bank | 5,340 |

| Canara Bank | 4,558 |

| Bank of Baroda | 3,904 |

| Union Bank of India | 3,177 |

Source: Financial Express; as at the end of February, 2023

What does the RBI do with this money?

The RBI keeps the funds safe and utilises them to promote financial literacy and awareness programs. The DEA Fund also serves as a reserve from which rightful owners or their legal heirs can reclaim their money whenever they come forward with proper documentation.

How unclaimed deposits are claimed

Unclaimed deposits can be recovered through a process that generally involves several stages, though the exact procedure may vary by bank:

-

Checking with the bank: Many banks offer online portals or branch services that allow individuals to search for unclaimed deposits using their name and address. These resources help identify any dormant accounts.

-

Submitting a claim: When an unclaimed deposit is identified, the next stage generally involves completing a claim form and providing the necessary documentation. This documentation may include:

- KYC documents (such as Aadhaar or PAN)

- Deposit receipts, if available

For legal heirs, a copy of the account holder’s death certificate Verification and refund: Following the submission, the bank, often in coordination with the RBI, verifies the claim. Once verification is complete, the funds are credited to the claimant's account.

RBI’s recent initiatives to help people reclaim their money

100 days - 100 pays

To make it easier for people to track and claim their unclaimed deposits, the RBI launched the “100 Days – 100 Pays” campaign in 2023. This initiative focuses on returning unclaimed money from the top 100 banks within a 100-day period.

By the conclusion of this campaign in September 2023, $57.3 billion had been successfully refunded to rightful claimants. This effort underscored the RBI’s commitment to addressing the issue of unclaimed deposits and ensuring that funds reach their legitimate owners.

Additionally, RBI has directed banks to improve their outreach by:

- Sending reminders to inactive account holders.

- Publishing lists of unclaimed deposits on their websites.

- Encouraging nominees and legal heirs to claim funds promptly.

Launching the UDGAM portal, a centralized platform to help individuals search for unclaimed deposits across multiple banks.

UDGAM portal

The UDGAM portal (Unclaimed Deposits – Gateway to Access Information) is an online platform launched by the Reserve Bank of India on August 17, 2023 to help individuals easily track unclaimed deposits across multiple banks. Here’s how to use it:

-

Visit the UDGAM portal: Go to the official RBI UDGAM website.

-

Register yourself: First-time users need to sign up using their mobile number and email ID.

-

Enter your details: Provide your PAN, Voter ID, or other relevant information to search for unclaimed deposits linked to your identity.

-

View the results: The portal will display any unclaimed deposits found under your name across various banks.

-

Initiate the claim process: If you find an unclaimed deposit, you can follow the instructions provided to reclaim your funds through the respective bank.

Preventing money from becoming unclaimed

Several practices can help minimize the risk of funds being classified as unclaimed deposits:

-

Maintaining regular account activity: Regular transactions—even small ones—can help signal that an account is active and monitored, reducing the chance of it being marked as inactive.

-

Designating a beneficiary: Assigning a nominee to bank accounts, fixed deposits, and other financial assets ensures that funds have a designated recipient, which can simplify the process of transferring assets if the account holder becomes unavailable.

-

Keeping records up-to-date: Accurate and current contact details and KYC information enable banks to communicate effectively with account holders. This ongoing communication helps prevent accounts from becoming dormant due to outdated records.

-

Tracking financial assets: Maintaining a comprehensive list of all bank accounts and deposits allows for regular reviews of one’s financial portfolio, thereby reducing the likelihood that any account will be overlooked or forgotten.

These measures contribute to more active account management and help safeguard funds from eventually being classified as unclaimed deposits.

Final thoughts

The RBI plays a crucial role in safeguarding unclaimed deposits and ensuring that people get their money back when they come forward with valid claims. With over ₹782.13 Bn waiting to be reclaimed, it's a good idea to check if you or someone you know has forgotten about an old account. RBI’s UDGAM portal has made it even easier to track down and claim your unclaimed funds.

Do you think you might have an unclaimed deposit? Take a moment to check—you might just stumble upon some unexpected cash!

About The Author

Next Story