Upstox Originals

The remarkable turnaround of the Indian banking sector

10 min read | Updated on October 01, 2024, 16:59 IST

SUMMARY

FY24 saw the Indian banking sector’s net profit after tax soar to an all-time high of ₹3 lakh crore. But the sector wasn't always this strong. In this deep-dive, we shall explore how the Indian banking industry has attained this heft, and the role played by the government and the Reserve Bank of India (RBI).

India's banking sector has delivered an all-time high net profit in FY24

2014-15: A Pivotal Turning Point for Indian Banking

Global inflation was driven by a sudden spike in crude oil prices, which had surged past $120 per barrel, impacting economies worldwide. The resultant sharp depreciation of the Rupee, sluggish economic growth, and high inflation compounded the problem.

This was a hurdle for the new government’s ambitious plans for revitalising the economy which required substantial financing, which was to come from banks. Therefore, rebuilding the banking sector was essential not only for stabilizing the financial system but also for supporting overall economic growth. ..

- Infrastructure Financing: The government granted CRR and SLR exemptions for funds raised through infrastructure bonds, encouraging banks to invest in infrastructure projects.

- New Bank Licenses: The RBI awarded new licenses to IDFC and Bandhan Financial Services, boosting competition and expanding banking services.

- Introduction of Differentiated Bank Licenses: Draft norms were issued for payments and small banks, introducing differentiated licenses and modernizing the regulatory framework.

- Capital Allocation: The government allocated capital to public sector banks based on their efficiency, signaling a "perform or perish" stance. ….

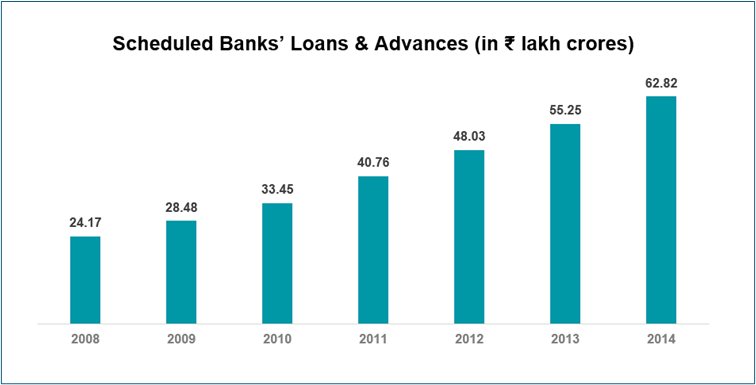

Unveiling the Credit Surge: Loans and NPAs Before the 2014-15 Reforms

In the years leading up to 2014-15 reforms, the Indian banking sector experienced a significant credit boom.

Here’s an overview of Loans and Advances up to this point:

Source: Database on Indian Economy, Reserve Bank of India

According to the RBI, the aggregate gross advances of Public Sector Banks (PSBs) surged from ₹18,19,074 crore on March 31, 2008, to ₹52,15,920 crore by March 31, 2014—a remarkable increase of 186%

Although there was a credit boom, it raises the question: were these bets sound? The soundness of these bets ultimately hinges on the borrowers' ability to repay. When loans go unpaid for an extended period, they turn into bad loans or Non-Performing Assets (NPAs).

Despite the surge in loans, the true scale of NPAs was effectively hidden during this period, leading to a false sense of complacency about the quality of banks' balance sheets.

….

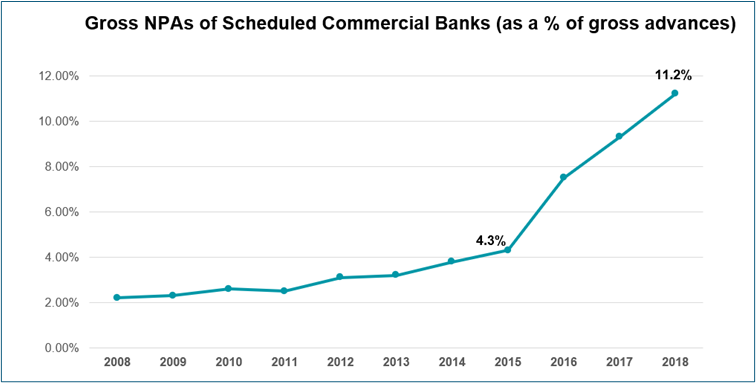

Revealing the Crisis: RBI's 2015 Asset Quality Review

It was the Asset Quality Review (AQR) conducted by the RBI in 2015 that revealed the true extent of these bad loans. The AQR aimed to prompt banks to promptly recognize stressed assets and prevent them from under-reporting.

Source: Database on Indian Economy, Reserve Bank of India

The findings were startling: NPAs surged from a mere 4% in 2014 to 11.2% by 2018, exposing the depth of the crisis.

State-backed PSBs, which hold nearly 70% of the Indian banking industry's assets, were responsible for over 80% of the industry's bad loans.

….

Tracing the Origins of the Crisis

The roots of the crisis partly lie in the credit boom from 2004-05 to 2008-09. During this period, both the global and Indian economies were experiencing significant growth. Indian firms aggressively borrowed to capitalize on the expected growth opportunities. The bulk of these investments were directed towards infrastructure and related sectors, including telecom, power, roads, aviation, and steel.

As Raghuram Rajan, the then-Governor of the RBI, explained, it was during such periods of rapid expansion that banks tended to make mistakes by extrapolating past growth and performance into the future.

However, the anticipated growth did not materialize as expected. Several factors contributed to this downturn:

- Infrastructure Projects: Faced delays due to environmental clearance and land acquisition issues.

- Mining and Telecom: Hit by adverse court judgments.

- Steel: Affected by dumping practices from China.

The global financial crisis of 2007-08 further exacerbated the situation, leading to a slowdown in growth post-2011-12. Revenue projections fell short, and financing costs increased as policy rates were tightened in India.

This combination of adverse factors made it challenging for companies to service their loans, contributing to what is known as India’s Twin Balance Sheet problem, where both the banking and corporate sectors faced significant financial stress.

….

Declaring NPAs wasn’t Enough

Declaring NPAs and writing off bad debts alone wasn’t sufficient to address the underlying issues.

This process left the banking system starved of capital, making it challenging for banks to continue their lending activities. Recognizing the urgency of the situation between FY17 and FY21, the government infused over ₹3 lakh crores into PSBs to bolster their financial strength.

This measure was crucial to ensuring that banks had the necessary capital to support their lending operations and stabilize their balance sheets.

….

Introducing the Insolvency and Bankruptcy Code (IBC) – A Landmark Reform

In 2016, amidst escalating NPAs and ineffective loan recovery mechanisms, the Government introduced a transformative reform: the Insolvency and Bankruptcy Code (IBC). It overhauled corporate distress resolution by consolidating existing laws into a single, time-bound framework.

Unlike previous laws that focused primarily on loan recovery, the IBC’s primary objective was resolution. It aimed to save businesses as going concerns, providing a structured approach to restructuring and ownership changes.

This shift in focus has yielded notable results:

- According to the 2020 Economic Survey, the IBC improved asset recovery to 42.5%, compared to 14.5% under previous laws. (source)

- Moreover, the time to resolve insolvencies decreased significantly. To illustrate, in 2013, it took 4.3 years to resolve an insolvency in India, compared to 0.8 years in Singapore and 1.7 years in China. By 2019, this duration had improved to 1.6 years, surpassing both China and France. (source)

….

Other Crucial Measures

….

Next, the Government Announced Mega Mergers of PSBs

- In 2017, five of the State Bank of India’s associate banks and the Bharatiya Mahila Bank were merged into SBI.

- In April 2019, Bank of Baroda merged with Vijaya Bank and Dena Bank.

- In August 2019, the Finance Minister announced the merger of ten PSBs into four effective April 1, 2020: (source)

- Oriental Bank of Commerce and United Bank of India merged with Punjab National Bank.

- Canara Bank merged with Syndicate Bank.

- Union Bank of India, Andhra Bank, and Corporation Bank were merged into a single entity.

- Indian Bank merged with Allahabad Bank.

As a result, the number of PSBs has been reduced to 12 from 27 in 2017.

….

A Look at Major Scandals Affecting the Banking Industry

-

ICICI-Videocon Scam (2009-2011): ICICI Bank sanctioned a ₹1,875 crore loan to the Videocon Group, raising concerns of conflict of interest due to the involvement of Chanda Kochhar, then-CEO of ICICI Bank, and her husband, Deepak Kochhar, who had business ties with Videocon Group.

-

Kingfisher Airlines Scam (2016): Vijay Mallya defaulted on over ₹9,600 crore owed to 17 Indian banks, resulting in a significant financial loss to the banking sector.

-

PNB Scam (2018): Nirav Modi and Mehul Choksi orchestrated a ₹14,000 crore fraud involving fake letters of undertaking from Punjab National Bank.

-

Yes Bank Fraud (2020): Rana Kapoor and others were involved in a crisis at Yes Bank, with significant exposure to troubled borrowers like the Dewan Housing Finance Limited (DHFL). Kapoor diverted ₹5,050 crore through bribery and corruption, contributing to the bank's financial difficulties.

-

ABG Shipyard Scam (2022): ABG Shipyard used 38 Singapore subsidiaries to divert ₹22,842 crore in a major money laundering scheme, defrauding a consortium of 28 banks. ….

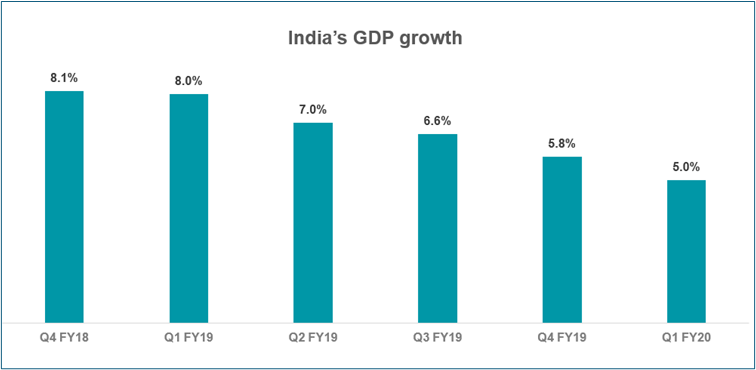

2019: Slowing down of Economy

After the crises of 2018, as we entered 2019, the Indian economy was already showing signs of a slowdown, even before the impact of COVID-19.

Source: India’s Statistics Ministry

-

Internally, the effects of demonetisation, the poor implementation of GST, declining automobile sales, stagnation in core sector growth, and reduced investment in construction and infrastructure all contributed to the downturn.

-

Externally, the global economy was under pressure, with central banks worldwide loosening monetary policy to counter a slowdown exacerbated by escalating US-China trade tensions.

Government Measures to Combat the Slowdown

The corporate tax rate was slashed from 30% to 22%, and for new manufacturing companies, it was cut to 15%, resulting in a ₹1.45 lakh crore revenue loss to the exchequer.

Simultaneously, RBI responded by reducing interest rates five times, bringing the repo rate down from 6.25% in February to 5.15% by October. These steps aimed to boost investment and consumption, with hopes that stronger state banks and leading private banks like HDFC and Kotak would drive credit growth. …. After that, Covid-19 hit, and we knew what was coming and what followed.

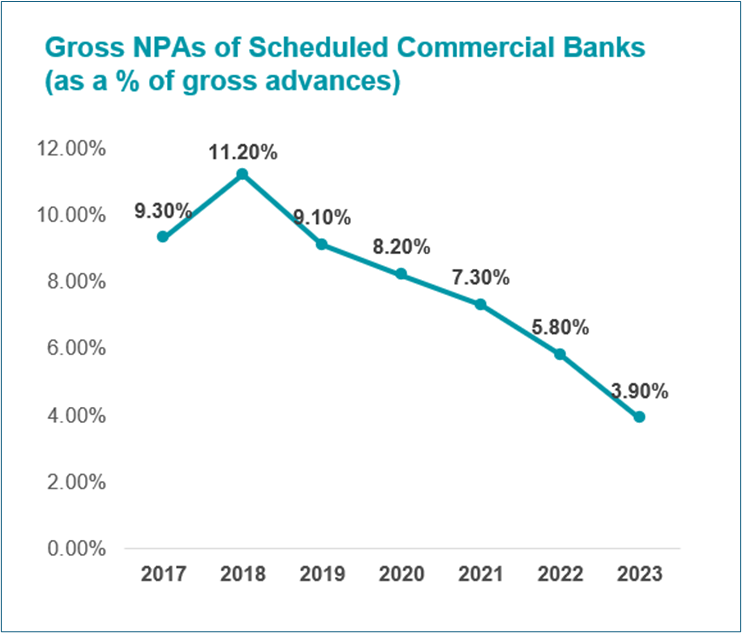

Where do we stand today?

Today, India has transformed from being among the 'fragile five' economies to one of the 'top five' global economies, making a significant contribution to global growth.

The Indian banking sector has strengthened remarkably, driven by:

- Robust macroeconomic fundamentals

- Effective regulatory oversight

- Strategic mergers and capital infusions

- Enhanced governance practices

- Expansion of financial services and digital banking adoption

Gross non-performing loans have decreased to 3.9% in 2023 from 11.2% in March 2018, reflecting improved asset quality. Indian banks, having weathered scrutiny and bad loan challenges, now exhibit robust balance sheets with profits having quadrupled over the past decade.

Source: Database on Indian Economy, Reserve Bank of India

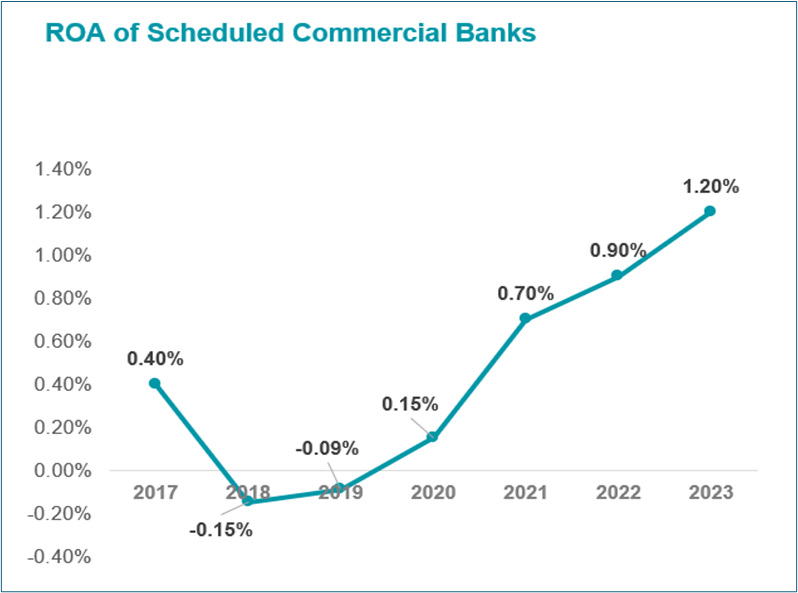

Return on Assets is at its highest since 2017, and both deposit and loan growth have accelerated.

Source: Database on Indian Economy, Reserve Bank of India

Shaktikant Das, in April 2024, highlighted that despite global challenges like the Covid-19 pandemic and geopolitical tensions, India’s economy remains resilient with strong GDP growth, moderated inflation, a stable financial sector, and record-high forex reserves.

….

Looking Ahead: India’s Path to Continued Economic Strength

Looking ahead, India's strong macroeconomic fundamentals, robust oversight, and resilient financial systems position us well for future challenges. With ongoing focus on governance, digital innovation, and stability, India is set to not only sustain but strengthen its global economic position.

Despite a challenging journey, the promise of a thriving future underscores our efforts. With our current trajectory, India is poised for continued growth and meaningful global contributions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story