Upstox Originals

The long game: How time is your best investment ally

3 min read | Updated on September 21, 2024, 15:57 IST

SUMMARY

If someone told you that, over a 15 and 20-year time period, the number of times you lost money in the equity markets was 0, would you believe it? Long-term investing has always been the most endorsed method of investing. It can help build meaningful wealth while curtailing risk. Read on to see just how useful it can be.

Long term investing can help build wealth and also reduce risk

— Ben Graham (author of The Intelligent Investor)

From “Investment 101” textbooks to the most legendary investors, everyone has extolled the virtues of long-term investing, especially for retail investors. It has been suggested as the time-tested method that not only helps build meaningful wealth but also will significantly lower investment risk (especially with equities).

Let’s dive in and evaluate for ourselves using the Nifty50.

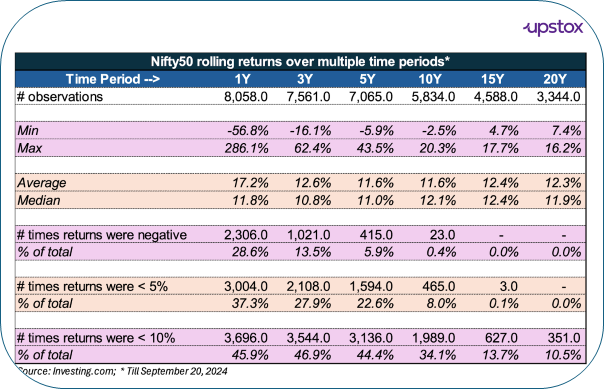

In the table below, I analyse rolling returns from the Nifty50 for over ~34 years - calculated using daily price data. These rolling returns are presented over multiple discrete periods.

Here are a few observations that stood out for me

Long-term investing stands the test of time (no surprise)

Let that sink in for a minute.

Think of everything have overcome in the past two decades. From skirmishes in different parts of the world to political instability, financial meltdowns (a few of them actually) to even a global pandemic that literally stopped the world. If you invested and stayed invested for a 15 or 20-year period, you would not have lost money

Following from the above, you note that as your investment horizon increases, the chances of losing money also start to decline.

Here is a quick disclaimer - past trends are not an indicator of the future. Just because something has not happened in the past, doesn't mean it won't. Please do your research, stay on top of your investments, and don't follow the past blindly.

Systematic investment can be very helpful

The part of this result that gave me pause was the number of times you could earn less than a 10% return. Over a 15 and 20-year time period, the numbers are fairly encouraging, but otherwise, this data caught me off guard.

Take for example a 10Y period - a fairly long one - ~34% of the time (almost 1/3rd) you would have made returns less than 10%. Honestly, this surprised me! You would think, if you committed your investments for 10Y, you would have reasonable confidence of earning market returns.

While initially a little discouraged, deeper thought led me to these conclusions

-

Technically, the odds are still in your favour - 66% of the time you do end up making more than 10% returns.

-

This is an argument in favor of disciplined and systematic long-term investing. Instead of committing a lump sum on a particular date, especially when investing in the index, gradually build up the portfolio via SIPs. This will help further smoothen out any volatility and hey - one might even catch the bottom!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story