Upstox Originals

The comeback stories: Recent business turnarounds

.png)

10 min read | Updated on October 06, 2024, 00:56 IST

SUMMARY

In recent times, a few businesses that had seen their fortunes drop have started to make a comeback! In the ongoing bull markets, their share prices have improved by as much as 50-70%. What were the cause of the downfall and what would investors be on the lookout for this time around? Read on to learn more.

Tracking some of the recent business turnarounds

Till a few months back, stocks like PC Jeweller, Reliance Infrastructure, and SpiceJet were trading at their all time lows. Most news around these stocks was largely negative and investors had almost written them away.

That said, the last few months have seen a remarkable turnaround in the prices of these stocks and renewed investor interest.

In this article, we take a look at the remarkable turnaround in these stocks and the reasons behind it.

Let’s take each case study

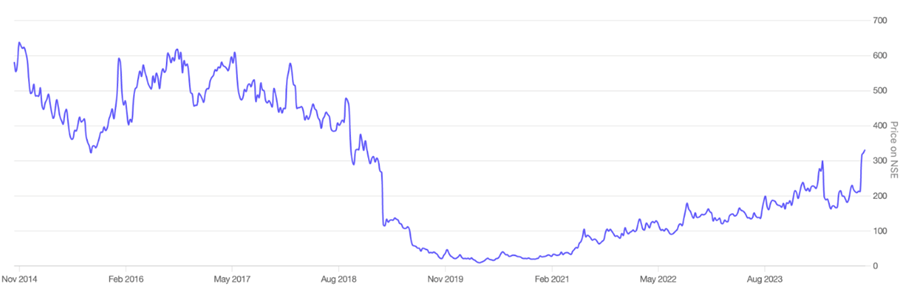

PC Jeweller: Shining again?

The stock was down ~90% from its high of ~₹587 per share in June 2018. Over the last few months, it has rallied ~172%

PC Jeweller share price chart

Source: Screener.in

What went wrong?

FY13-18 was a period of robust performance for this company - both in terms of underlying fundamentals as well as share price. The company used this time to expand into new markets and launch new stores.

However, the descent began in January of 2018. It was disclosed that a company called Vakrangee had picked up a 0.51% stake in PC Jeweller. What was the problem you ask? Well Vakrangee was already under SEBI’s radar for manipulating its shares. As such, this announcement did not sit well with PC Jeweller’s investors.

To make matters worse, it was later disclosed that the promoter had gifted some shares to his relatives. This prompted SEBI to launch an insider trading investigation, further spooking investors.

To make matters worse, there were news articles speculating that the top management could be arrested. This not only shook investor demand, but also that of its customers. Think about it - would customers buy jewellery from a company that is suspected of illegal activities?

What followed was a rapid descent. Within a span of one year, the stocks corrected by 76%.

Finally, there was debt. The expansion we mentioned above, was largely fuelled by increased leverage. Besides this, borrowings were also utilised for working capital purposes. Between FY13-18 borrowings increased at a CAGR of ~29.1% versus only a ~15.7% and 12.2% increase in sales and operating profit respectively. This ultimately led to a very high debt burden, which the company found difficult to service.

| FY13 | FY18 | CAGR%FY13-18 | FY19 | FY24 | CAGR%FY19-24 | |

|---|---|---|---|---|---|---|

| Sales | 3,990 | 9,610 | 15.7 | 8,672 | 604 | -36.9 |

| Expenses | 3,507 | 8,620 | 8,374 | 774 | ||

| Operating Profit | 482 | 990 | 12.2 | 298 | -170 | -26.6 |

| OPM % | 12% | 10% | 3% | -28% | ||

| Net Profit | 291 | 536 | 10.7 | 1 | -629 | -9.7 |

| Debt | 233 | 1,116 | 29.1 | 2,121 | 4,150 | 11.8 |

Source: Screener.in

Why is it making a comeback?

Around June-July 2024, the government announced a ~9% reduction in the customs duty on gold and silver. This move reduced the input costs of jewellery and players such as PC Jeweller would be a key beneficiary.

The company also signed a one time settlement with the banks. Debt of ~₹4,000 crore was settled by repaying ~ ₹2,250 crore.

Finally, the market has also taken note of the company’s cost-cutting measures. In June 2024, sales have risen ~489% YoY and the company again became profitable at the operating level

| In ₹ crore | Jun 2023 | Mar 2024 | Jun 2024 |

|---|---|---|---|

| Sales | 68 | 48 | 401 |

| Operating Profit | -43 | -2 | 52 |

| OPM % | -64% | -3% | 13% |

| Net Profit | -172 | -122 | 156 |

Source: Screener.in

Last but not the least, the company decided to raise fresh funds to the tune of ~₹2,705 crores which will be used for repaying the debt. If successful, the company will have very limited debt on its balance sheet.

Recently the company announced a stock split with each share getting split into 10 shares.

What to watch out for?

The company's improving operating performance is worth noting and debt reduction efforts are commendable. That said, a key challenge will be to regain the faith and trust of investors. If it is unable to do so, the stock will remain volatile and fortunes can turn very quickly .

SpiceJet: The journey from struggle to revival

Richard Branson, co-founder of the Virgin Group is popularly known to have said, “ If you want to be a Millionaire, start with a billion dollars and launch a new airline.”

Once seen as a strong competitor in the low-cost airline market, this company has had very bumpy rides. From falling profitability - which shook investor faith to multiple technical glitches that raised concern among customers for their safety, SpiceJet’s troubles came from multiple corners.

SpiceJet share price chart

Source: Screener.in

What led to the landing of SpiceJet?

The company was facing multiple issues

Financial troubles

In 2019, Boeing’s MAX planes were grounded, due to security issues. At this time, SpiceJet had to ground 13 MAX 8 aircraft in its fleet. The inability to operate its flights led to a serious financial strain.

Over FY16-24, there was a sharp increase in its borrowings from ~₹1,230 crore to ~₹5,400 crore in FY24. Financial losses started to mount and this became a vicious circle. Post this, it was impacted by the COVID-19 lockdown, which further impaired its operational ability. This was further exacerbated as its planes were grounded due to non-payment of rentals. All of this created a perfect storm for SpiceJet.

| In ₹ crore | FY16 | FY24 | CAGR% FY 17-24 |

|---|---|---|---|

| Sales | 5,088 | 7,050 | 3.7 |

| Operating Profit | 546 | -642 | NA |

| Net Profit | 450 | -409 | NA |

| Borrowings | 1,230 | 5,376 | 17.8 |

Source: Screener.in

Management troubles

SpiceJet promoters made a number of top management changes. Most of these management changes were not well received by investors. Additionally, decisions made by the new management regarding airplane management, pricing strategies and cost control, did not yield the desired results.

Technical glitches

In 2022, in 17 days, there were 7 instances of technical glitches in 17 days. Authorities have raised questions regarding regulatory compliance and safety issues.

Other challenges

The combination of legal disputes with the former owner, auditors expressing doubts about its viability as a going concern, and surging fuel prices have significantly curtailed business activity for SpiceJet.

What has changed?

Coming to 2023, the company took several revival steps:

- SpiceJet won a case against its erstwhile owner, who was demanding ~₹679 crore refund. They claimed that SpiceJet had not issued shares to the erstwhile owners in lieu of money paid by them to the company.

- The company decided to convert ~$140 Mn of aircraft dues to its lessor Carlyle into equity in 2023. This relieved the debt burden on the company

- Raised equity funds of ₹5,250 crores from institutional investors, HNIs via QIP and preferential issue mode, further strengthening its balance sheet

- Other airline lessors like Celestial Aviation, Alterna Aircraft, and ELFC decided to withdraw the insolvency petition against the company as both agreed to debt restructuring.

What to watch out for?

Bolstered by this recent turn of events, SpieceJet plans to return 28 grounded aircraft to service and acquire 147 new aircraft to expand its operations. It plans to further clean up its balance sheet by paying down its liabilities.

While all of these are encouraging to note, investors will want to see a sustained improvement in performance. Capital allocation and efficient use of funds will be a key monitorable.

Besides that, investors and even potential customers will be on the lookout for an improved flying experience that will improve confidence in the company.

Reliance Infrastructure: Coming back to power

Once the darlings of the stock markets, this company saw a sharp fall in price and performance, forcing investors to distance themselves from them. Reliance Infrastructure fell by ~99% from 2014 high to 2020 and again rose by ~450% from 2020 to 2024.

Reliance Infrastructure share price chart

Source: Screener.in

What went wrong?

- High debt: The company took on excessive debt for ambitious infrastructure projects, leading to financial strain when projects didn't yield expected returns.

- Regulatory issues: Regulatory actions, including SEBI's restrictions on promoters from accessing the market due to certain violations, damaged investor confidence.

- Project delays and cancellations: Multiple power and infrastructure projects faced significant delays due to land acquisition, environmental clearances, and fuel supply issues. For example - Versova Bandra Sea Link Project delay led to a cost overrun of 60%.

- Leadership instability: Leadership changes and governance issues, particularly after Mr. Ambani stepped down in 2022 following regulatory orders.

- Forced promoter selling - Since the majority of promoter holdings were pledged to banks as security for loans, lenders forcefully shared the pledged shares when the company defaulted on such loans. This led to promoter holding in Reliance Infrastructure to new low as evidenced from the below table:

| Reliance Infrastructure | ||

|---|---|---|

| Promoter Holding % | Promoter Holding Pledge % | |

| Mar 2016 | 49.7% | 56.9% |

| Mar 2017 | 49.6% | 65.6% |

| Mar 2018 | 49.5% | 69.1% |

| Mar 2019 | 41.0% | 98.3% |

| Mar 2020 | 14.7% | 66.1% |

| Mar 2021 | 5.0% | 94.1% |

| Mar 2022 | 5.0% | 94.1% |

| Mar 2023 | 18.7% | 0.0% |

| Mar 2024 | 16.5% | 0.0% |

Source: Trendlyne

What is driving the improvement?

ADAG (Anil Dhirubhai Ambani Company) which owns Reliance Infrastructure is seeing an overall resurgence. The group has sold some of its businesses to repay the debt and revive core business.

For Reliance Infrastructure particularly, some of the key drivers have been:

- The company reduced its debt by ~85-87% to ~₹475 crores. It has either settled or agreed to a one-time settlement with multiple creditors including Edelweiss Asset Reconstruction Company, Life Insurance Corporation, ICICI Bank, among others

- The company reached an agreement with the Adani group to mutually settle their disputes related to the transfer of Reliance Infra’s Mumbai power business to Adani Energy Solutions.

- Further, to strengthen its position, the company has agreed to a fund-raise of up to

$350 million (₹2,930 crore)

What to watch out for?

The company’s business operations are in capital-intensive industries that also have the risk of government regulations/interference. While the recent debt reduction is encouraging, it would not be unexpected for the company to borrow money further, to take-on new projects and expand the business. Investors would look out for efficient uses of funds, and ability to repay its obligations going forward.

Conclusion

The tales of PC Jeweller, Reliance Infrastructure, and SpiceJet have similar journeys of fall and rise. These companies were facing financial losses, corporate governance issues, regulatory intervention, debt default etc along with falling business activity. As India Inc’s corporate profits and balance sheet become stronger, these companies settled its debt by raising equity funds and plan to expand further. The strength and sustenance of this comeback will be a key monitorable by investors.

About The Author

Next Story