Upstox Originals

The big fat Indian wedding: Opportunities in the wedding industry

.png)

4 min read | Updated on August 06, 2024, 16:02 IST

SUMMARY

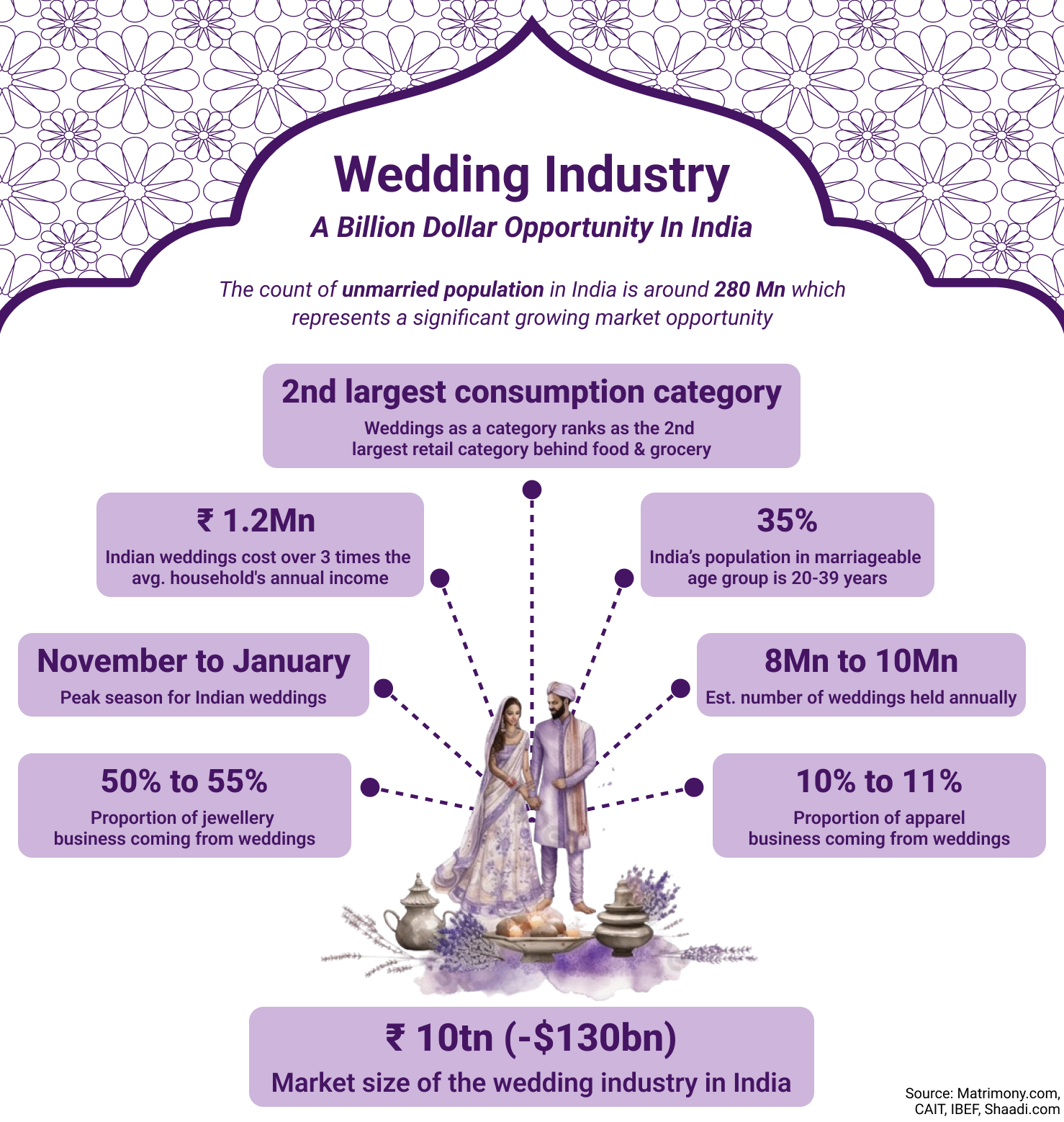

This is India’s 4th largest industry. It attracts one of the highest spending by Indians and is relatively resistant to any economic slowdown. It continues to add millions of potential “new customers” every year. We refer to the Indian wedding industry which currently has a size of around ₹10 lakh crore. Read on to find out how you can join the celebrations.

The wedding industry is the fourth largest industry in India

The Indian wedding industry is a ₹10 lakh crore economy making it 4th largest industry in India. Indians spend most on weddings after food & groceries, making it not just a cultural phenomenon but also a huge driver of economic activity and a lucrative investment opportunity.

Snapshot of the wedding industry

How big is it?

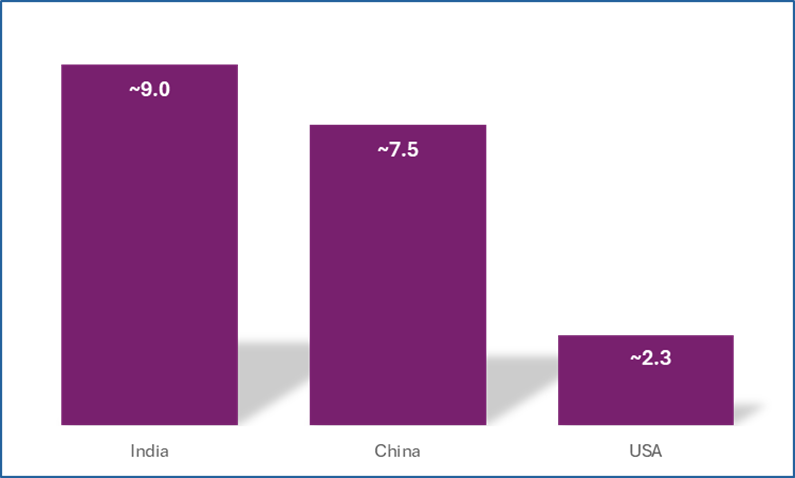

- Hosts between 8-10 million weddings annually, making it the largest global destination by volume.

Comparison of the number of weddings per annum (in million)

Source: CDC, The Knot, CEIC, Ministry of Civil Affairs (China), Confederation of All India Traders (CAIT)

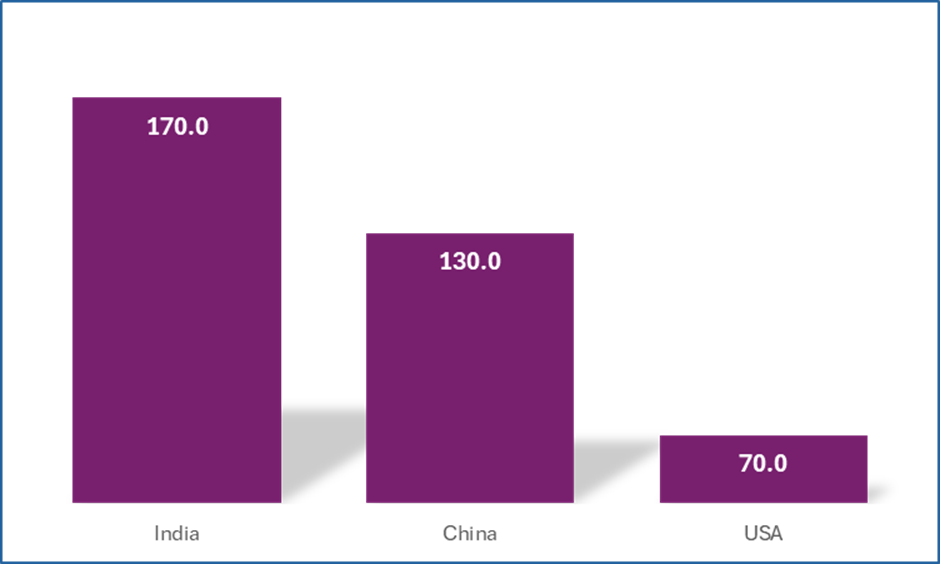

- Nearly twice the size of the USA in value terms

Wedding industry market size (in $ billion)

Source: CDC, The Knot, CEIC, Ministry of Civil Affairs (China), Confederation of All India Traders (CAIT)

What’s driving growth?

-

Demographic benefit: Nearly 35% of India or ~507 million people are between the age of 20-39 years. Of this, number of unmarried people is around 280 million.

-

Rising income: As per an OECD report, Indians are likely to experience the highest income growth over the next decade. This is likely to result in higher luxury spending. With weddings being the 2nd highest consumption spend, it is likely to benefit from this trend.

-

Wed in India: The government launched a ‘Wed in India’ campaign similar to the ‘Make in India’ initiative to promote India as the right choice for a wedding destination.

-

Unorganised market: The Indian wedding market is largely unorganised, which presents potential opportunities for organised players.

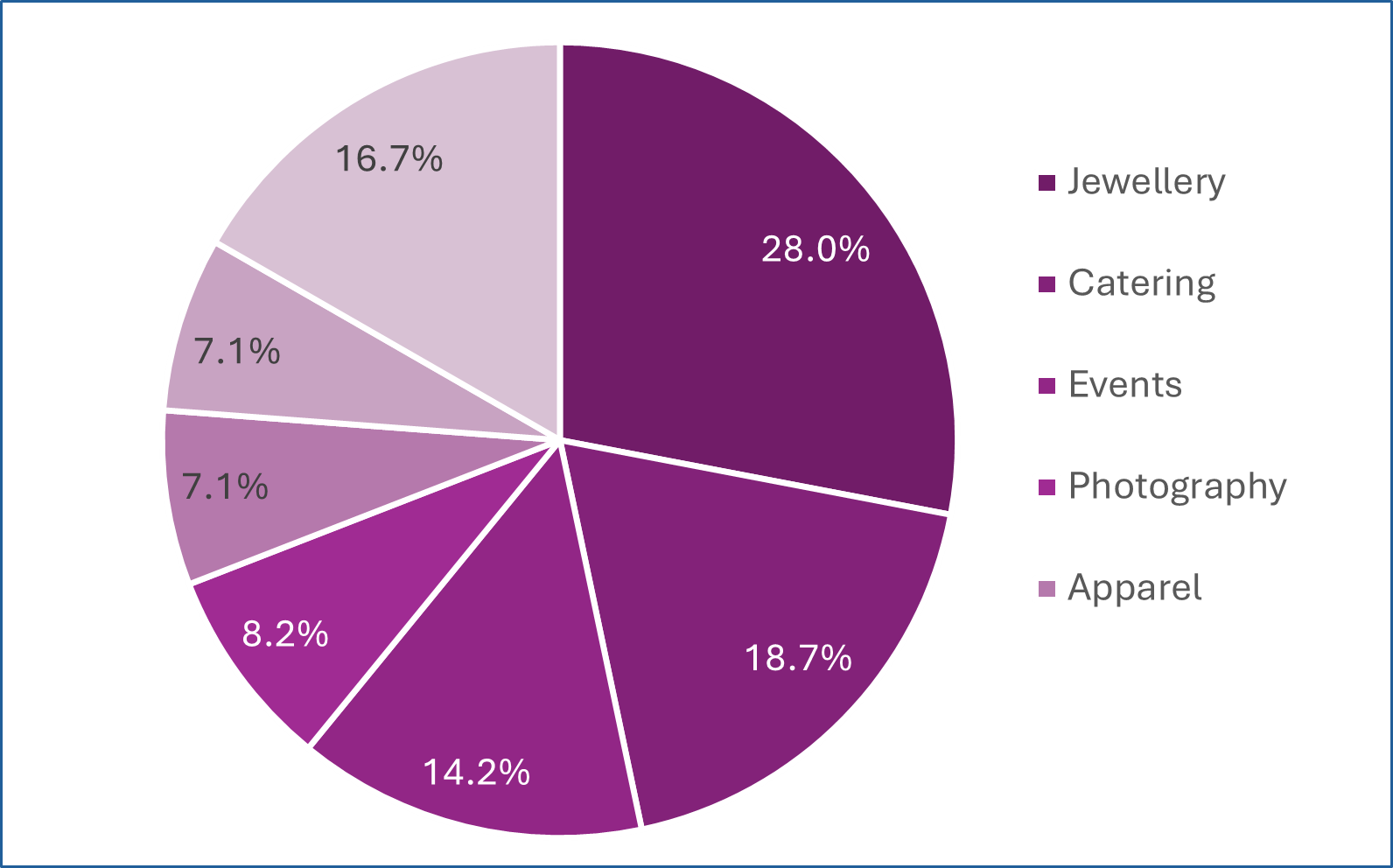

Which sectors & stocks cater to the Indian wedding industry?

The industry is not just one industry but a conglomerate of small industries. For instance:

- Bridal jewellery accounts for over half of the jewellery industry's revenues

- Weddings contribute to ~10% of apparel industry spending

- Besides this, it also indirectly boosts sectors like automobiles, consumer electronics, and paints, which see increased demand around the wedding season.

Breakdown of wedding spend in India

Source: CAIT

Source: CAITBelow is a (non-exhaustive) list of sectors and stocks that could be impacted by this industry

Jewellery stocks

| Stock | ROE % | EBITDA Margin | Stock Price CAGR % - last 3 years |

|---|---|---|---|

| Titan | 32.9 | 10.4 | 26.0 |

| Senco Gold | 16.2 | 7.3 | NA |

| Kalyan Jewellers | 15.2 | 7.4 | 101.0 |

Source: Screener. in; Data as of July 30, 2024

Apparel stocks

| Stock | ROE % | EBITDA Margin | Stock Price CAGR % - last 3 years |

|---|---|---|---|

| Vedant Fashion | 27.6 | 48.0 | NA |

| Raymond | 44.5 | 14.5 | 96.0 |

| Arvind Fashion | 8.8 | 10.6 | 34.0 |

Source: Screener. in; Data as of July 30, 2024

Matchmaking portals

| Stock | ROE % | EBITDA Margin | Stock Price CAGR % - last 3 years |

|---|---|---|---|

| Info Edge | 3.0 | 27.5 | 10.0 |

| Matriony.com | 18.2 | 15.0 | -18.0 |

Source: Screener. in; Data as of July 30, 2024

Hotel Chains

| Stock | ROE % | EBITDA Margin | Stock Price CAGR % - last 3 years |

|---|---|---|---|

| IHCL | 14.3 | 32.0 | 66.0 |

| EIH | 17.6 | 36.9 | 58.0 |

| Chalet Hotels | 16.4 | 41.9 | 69.0 |

| Lemon Tree | 16.3 | 48.8 | 53.0 |

| Apeejay Surrendra Park Hotels | 7.8 | 33.2 | NA |

| Juniper Hotels | 1.5 | 38 | NA |

Source: Screener. in; Data as of July 30, 2024

Conclusion

The Indian wedding industry is a dynamic and vibrant sector that plays a significant role in the country's economy and serves as a reflection of its cultural values. This industry not only drives consumption in various key categories but also influences luxury markets. As household incomes across the nation continue to grow, there is a greater likelihood of increased spending on weddings, further solidifying the industry's position.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story