Upstox Originals

Tariffs & trade wars: Déjà vu?

.png)

6 min read | Updated on April 07, 2025, 09:14 IST

SUMMARY

President Trump’s tariffs bring a sense of deja vu. In his first term, he imposed tariffs on major US trading partners, with the hope of spurring manufacturing in the US, increasing jobs and reducing trade deficits. In this article, we assess the effectiveness of these tariffs—particularly in relation to China—and explore their economic impact on both sides of the equation.

Exploring the impact of tariffs in President Trump's first term

With President Trump back, tariffs are in the spotlight. Similar to his first term, the President has imposed tariffs on multiple countries including China, the EU, Canada, and Mexico. The President has indicated that he is considering imposing tariffs on other trading partners, including India.

In this article, we deep dive into what happened in the first term, with a focus on America-China trade relations. In 2018 the President imposed tariffs on trading partners and much has been published about their impact since then. Before we dive in, let’s first quickly understand:

What are tariffs?

Simply put, it's a tax. Imagine you own a lemonade stand, and a friend from another town wants to sell lemonade in your area. To protect your business, you charge them a fee for every glass they sell. That’s what a tariff does—it makes imported goods more expensive to encourage local production.

What happened in the first term?

During Trump's first term (2016-2020), tariffs were initially imposed on the European Union, Canada, and Mexico. The Trump administration also escalated tariffs on goods from China, leading to a trade conflict.

In 2018, America imposed tariffs of 25% on $50 billion worth of commodities and by 10% on $200 billion worth of commodities imported from China. Additionally, the USA imposed tariffs on goods from the UK, Japan, and Ukraine.

What was the intention?

The idea was simple: impose tariffs on Chinese goods to bring back American manufacturing, reduce reliance on China, and fix the trade deficit. Similar tariffs were also imposed on multiple other trading partners.

But, what actually happened?

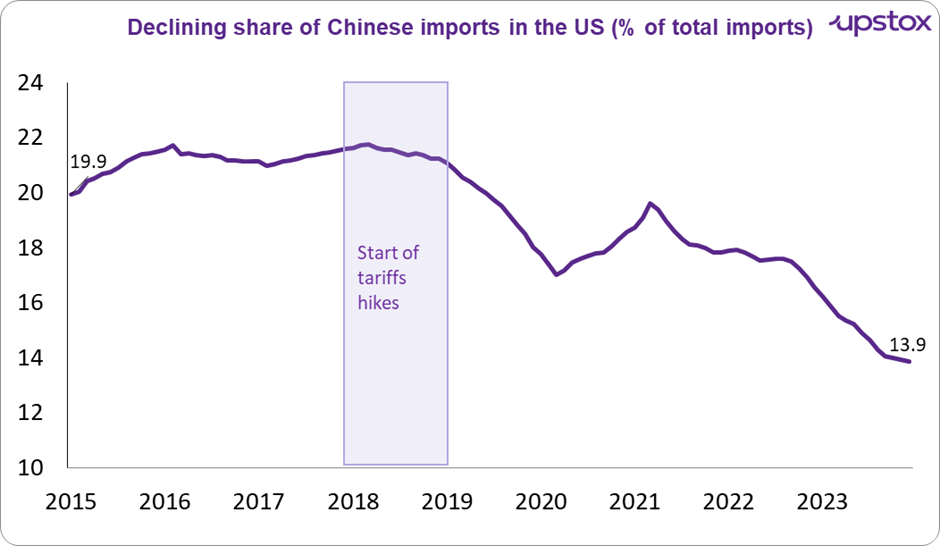

As intended the tariffs did lower the imports from China significantly

Source:federalreserve.gov

However, this came at a significant cost to Americans as well.

Americans paid the price

Numerous studies, including by the National Bureau of American Research found that American companies had to bear a majority of the cost, nearly about $46 billion in tariffs.

While one would think that by simply imposing tariffs, trade would come to an immediate halt, that is rarely the case.

Companies have well-entrenched supply chains on whom they rely for their requirements. Finding alternatives takes time, and in the meantime, companies were forced to buy goods at higher prices. On expected lines, they passed these costs onto consumers, making things more expensive.

A September 2019 report by Moody Analytics indicated that the trade war cost America nearly 300,000 jobs and 0.3% in GDP.

China retaliated

U.S. companies that relied on Chinese materials faced higher costs and supply chain problems. China retaliated with tariffs on $185 billion of U.S. goods, hurting American farmers and manufacturers.

Starting with about 94 agricultural and related items in April 2018, China started to impose tariffs in the range of 5-25%. By December 2019, this list was 1,084 items long with the majority tariffs on agricultural and related items.

A spokesperson for the American Farm Bureau said “Farmers have lost the vast majority of what was once a $24 billion market in China” due to China’s retaliation. The American president was forced to compensate farmers by providing aid to the tune of ~$28 billion by May 2019.

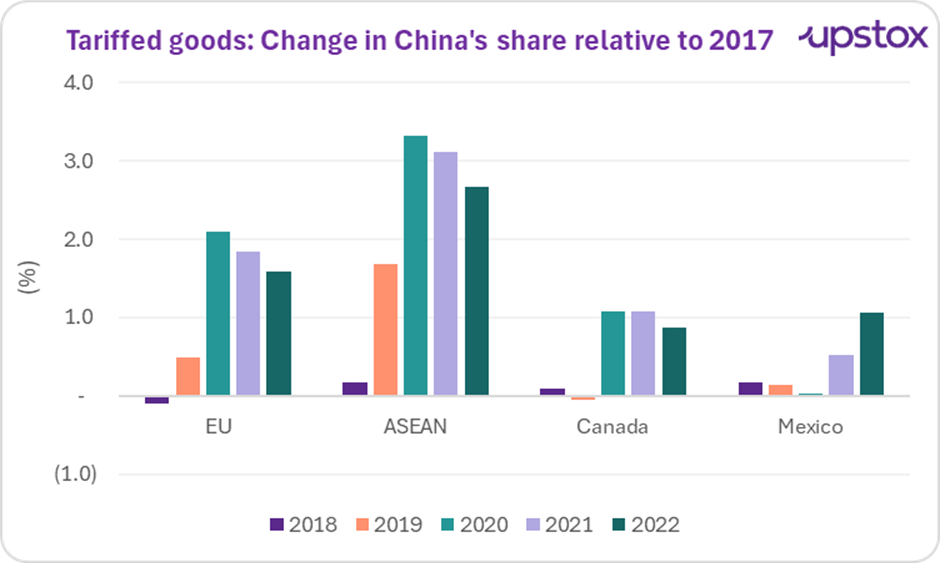

China found other partners

Since China was forced to reduce reliance on the US, it found other buyers. In the chart below, we note the increasing share of goods that were tariffed by the US in other markets. In simpler words, China found other buyers and was able to divert goods that were tariffed by the US to other markets. Besides finding newer buyers, this also helped China more strategically align with other markets.

Did China suffer? Sure. There are a lot of studies that indicate that Chinese manufacturers had to accept lower profit margins for exporting goods to other markets. But the larger fact remains, they found a home in other markets.

Source: US FED

Another example is that of imports of US liquefied natural gas (LNG). As a retaliation to US tariffs, China imposed its own tariffs on LNG imported from US. This caused US LNG shipments to China to drop significantly, falling by about 80% from 3.5 Mn tons in 2017 to just 0.4 Mn tons in 2019, according to the US EIA. On the other hand, China increased LNG imports from Australia, Qatar, and Russia, further strengthening its ties with the other countries.

Factories moved…

…But not necessarily to the U.S. – Some businesses did move out of China, but instead of bringing manufacturing back to America, they went to places like Vietnam, India, Mexico and Malaysia. One notable example being iRobot, the company that makes the Roomba robot vacuum cleaner. They moved their manufacturing from China to Malaysia in order to combat the then trade war.

Did they completely fail?

Honestly, it's difficult to say. In defence of these tariffs, the following Biden government retained a lot of these tariffs on China. President Trump was also able to secure some new trade agreements with a few major trading partners, particularly in North America.

However, that is not the point we are talking about. It is the cost at which these gains were secured, which should be examined in more detail. Spiking uncertainty and a retaliatory tariff war led to a loss of ~$1.7 trillion in stock value in America as per studies by the Federal Reserve Bank of New York and Columbia University.

In summary

Without getting into any political discussions, the point is tariffs are a double-edged sword, and tend to recover their pound of flesh from both parties. For investors, they lead to an increase in uncertainty and dampen overall sentiment. On a more optimistic note, at the time of writing this, the American government has decided to delay many of its tariffs imported on trading partners, in the hopes of securing a better trade deal.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story