Upstox Originals

Swiggy IPO: Charting a new delivery route

.png)

7 min read | Updated on November 08, 2024, 15:00 IST

SUMMARY

Swiggy is getting ready for an IPO to boost its operations and solidify its spot in India’s hyperlocal commerce market. They’re focusing on growth by investing in technology, marketing, and expanding their services. This move is all about staying competitive in a fast-changing industry.

Swiggy is looking to expand its operations with IPO proceeds

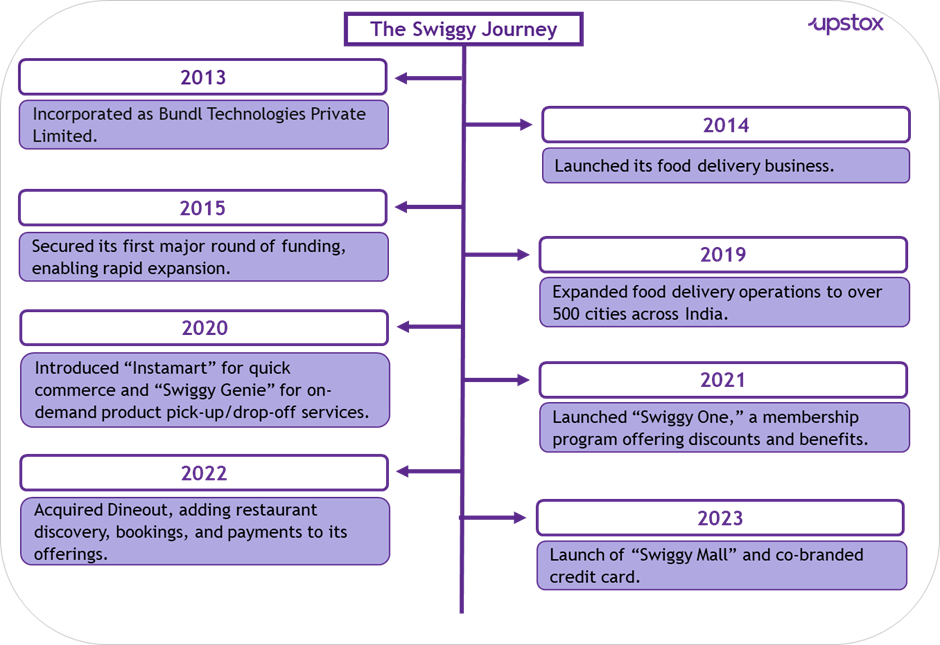

Popular food delivery app and owner of the Instamart brand, Swiggy will soon be tapping the IPO markets. Launched in 2014 with food delivery and expanding into quick commerce in 2020. It has become a key player in India's hyperlocal commerce market. It also provides services for restaurant reservations, event bookings, product pick-up/drop-off, and other hyperlocal commerce activities.

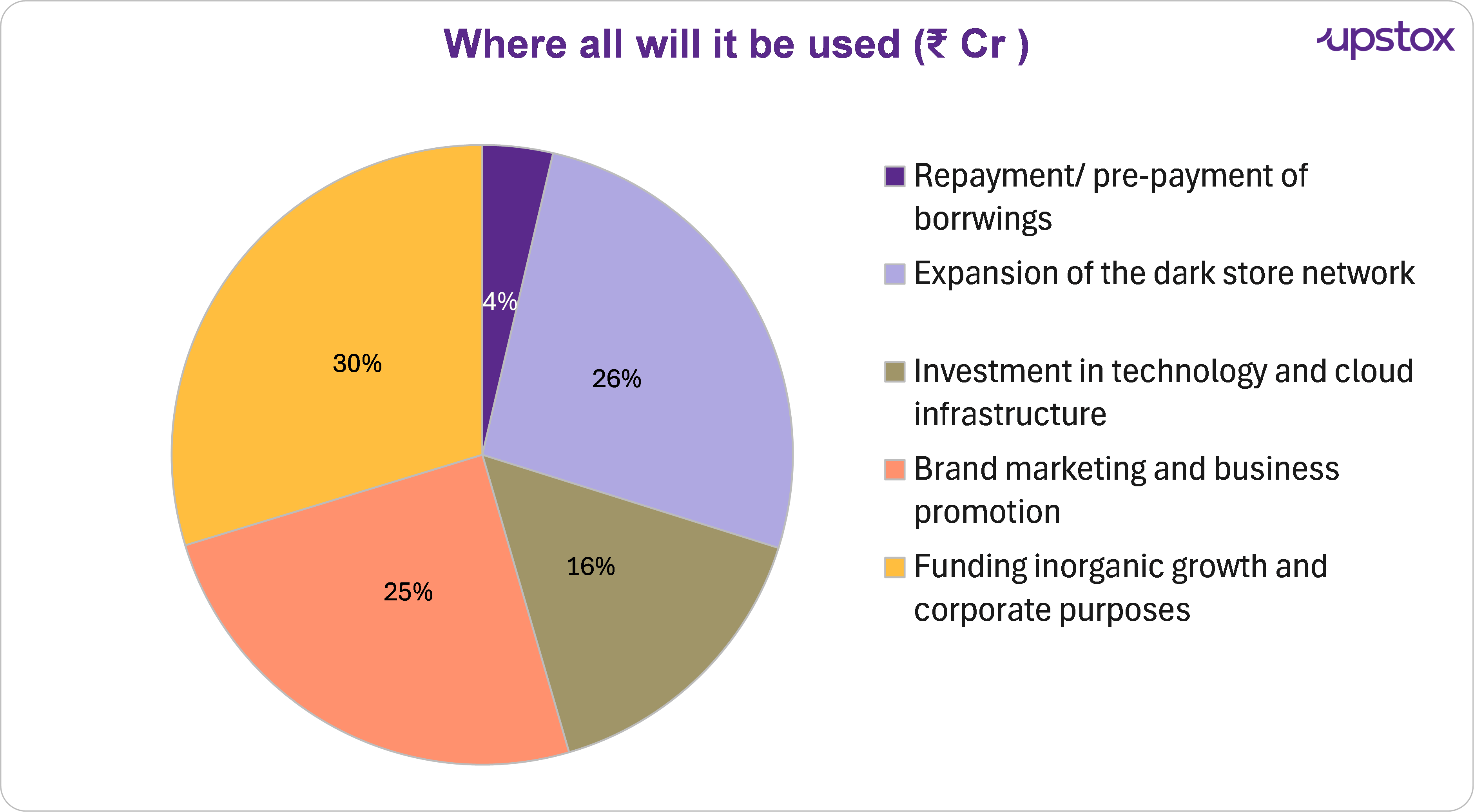

Issue size and use of funds

Swiggy is seeking to raise a total of up to ~₹11,328 crore, with a fresh issue of up to ₹4,499 crore and an OFS for the balance ₹6,828 crores. The fresh issue will be utilized as below.

Source: RHP, press releases, news articles

History

Source: DRHP

Industry Overview

The hyperlocal commerce market in India, where Swiggy operates, is witnessing rapid growth, driven by increasing internet penetration, smartphone usage, and a shift toward convenience-driven services. The online food delivery segment was valued at approximately ₹63,000 crore in FY 2023, with projections indicating it will reach around ₹1.8 lakh crore by FY 2028, growing at a CAGR of 23%.

The quick commerce segment is also expanding, valued at around ₹5,600 crore in FY 2023, and expected to grow to ₹35,000 crore by FY 2028, at a CAGR of 45%. These statistics indicate a high growth potential for Swiggy, as the industry becomes more digitally integrated and consumer preferences evolve

Segments

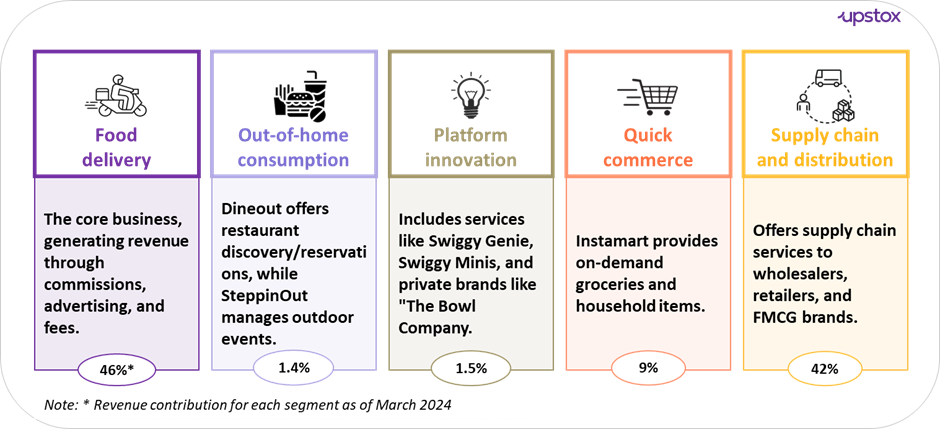

Swiggy operates in five main segments:

Source: DRHP & company website

As of Jun 30, 2024 Food delivery is the only segment that is profitable, and other segments are cutting down on their losses as compared to the last few years.

Swiggy versus Zomato - detailed comparison

We dive in and look at some key operating and financial metrics. We present a side-by-side analysis of Swiggy versus Zomato - its key competitor.

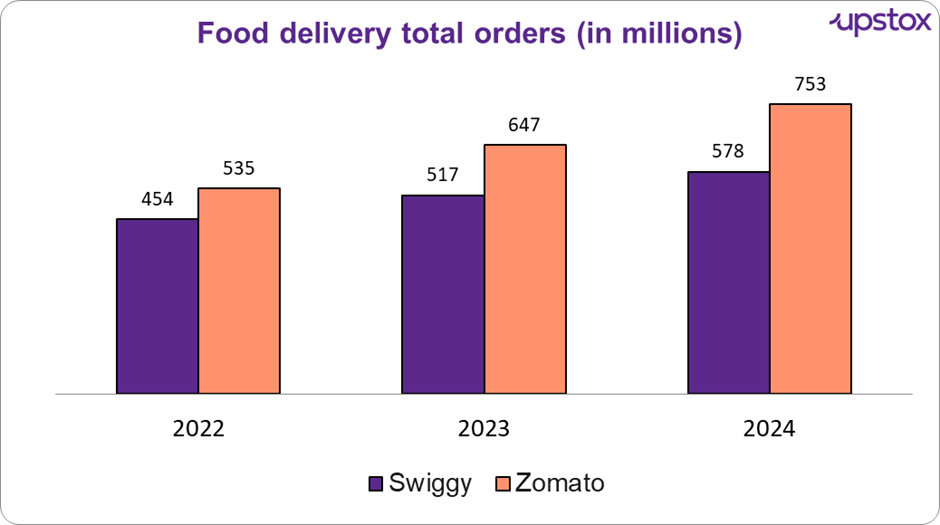

Food delivery

Swiggy’s food delivery segment has been growing steadily over the years. As you can see from the chart below, there’s been a steady rise in the total number of orders.

Source: DRHP

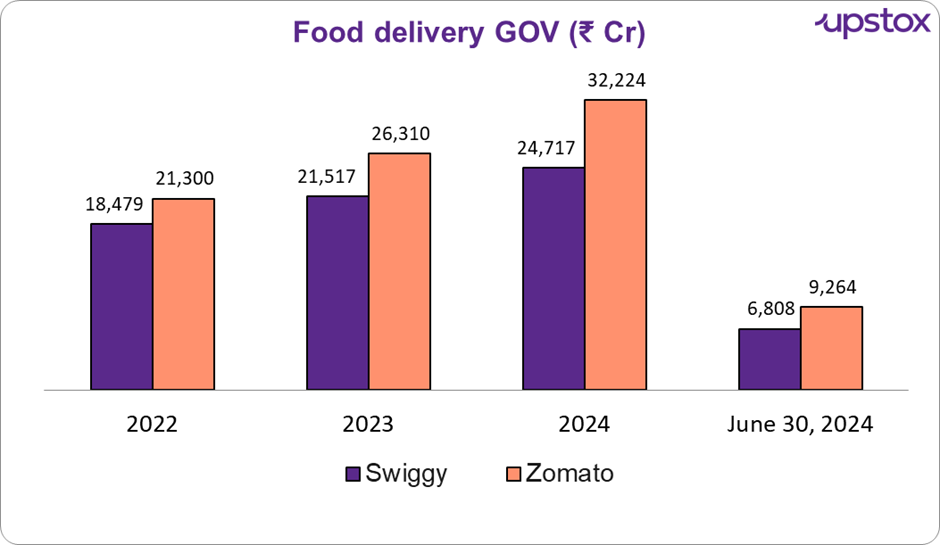

As can be seen below there is a consistent rise of GOV. Gross Order Value (GOV) refers to the total monetary value of all orders placed on Swiggy's platform over a specific period. It includes the cost of items, taxes, and delivery fees before any discounts or promotions.

Source: DRHP, screener.in

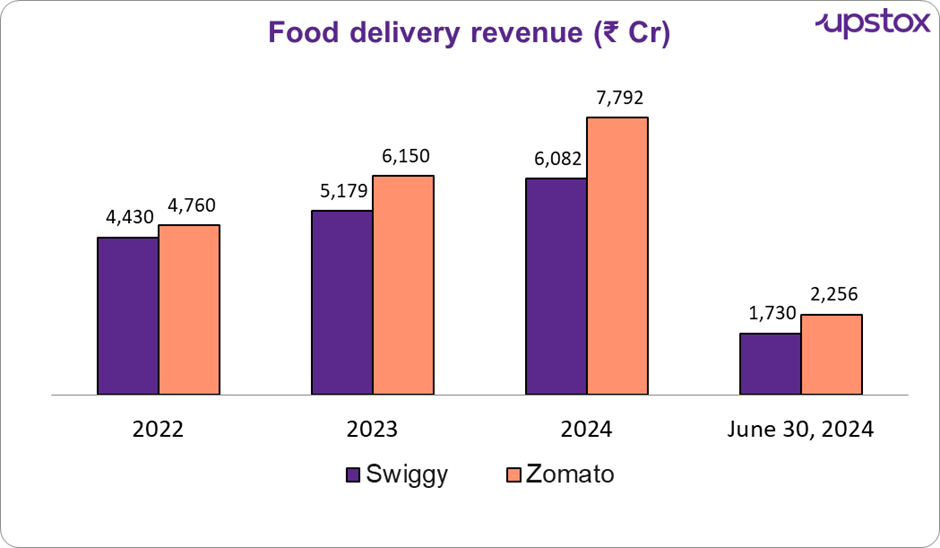

As GOV kept climbing, it naturally boosted the number of transactions and the average order size. This uptick meant more commission revenue and delivery fees, which steadily pushed up their gross revenue over time.

Source: DRHP, screener.in

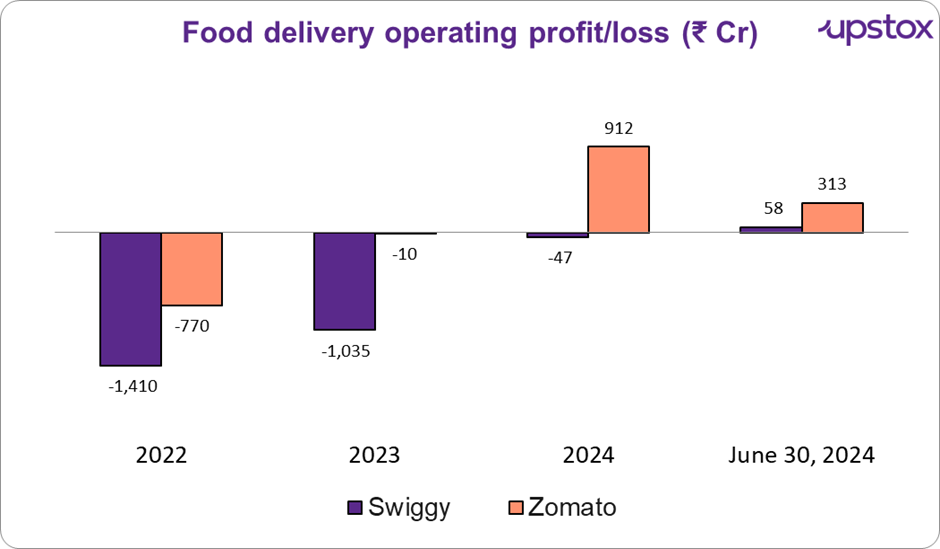

As can be seen from the chart below, both Swiggy and Zomato have started to reduce losses in this segment. That said, Zomato has managed to cut losses faster compared to Swiggy.

Source: DRHP, screener.in

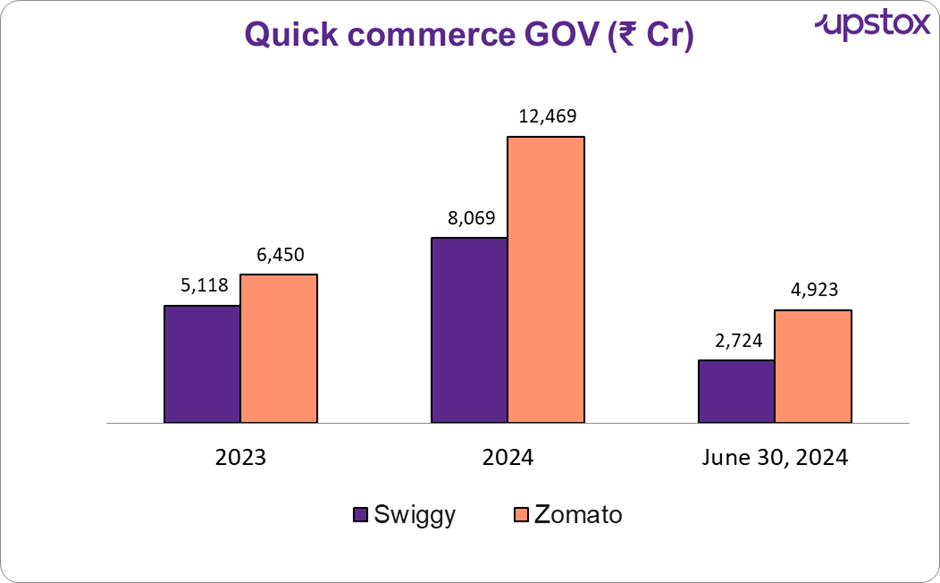

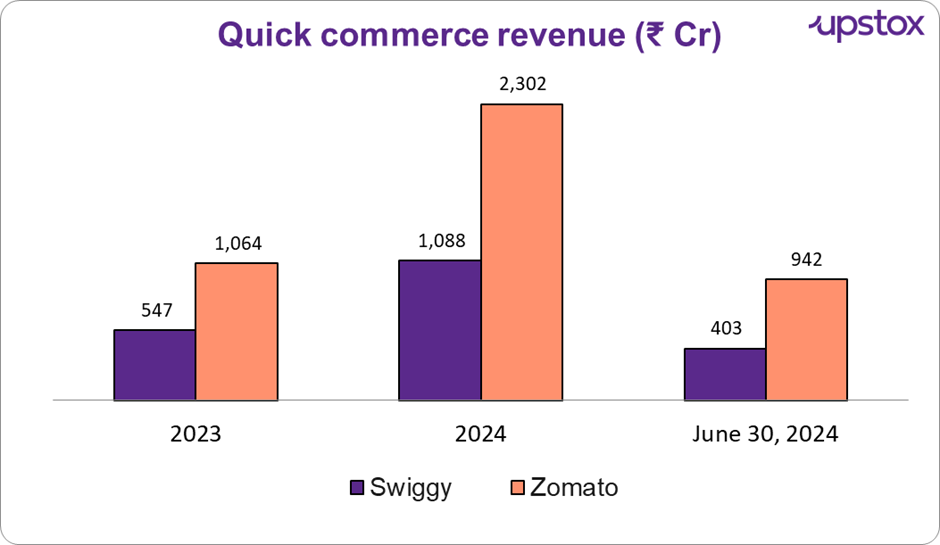

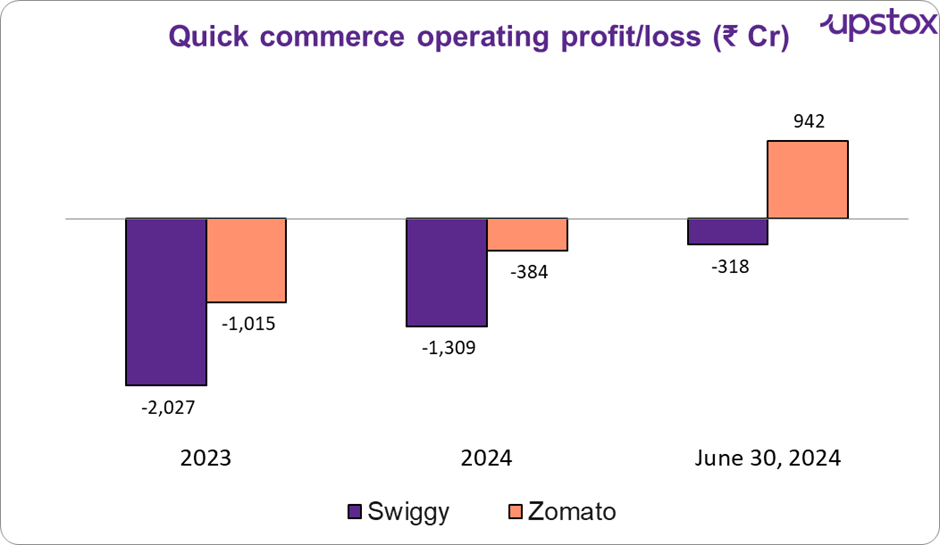

Quick commerce

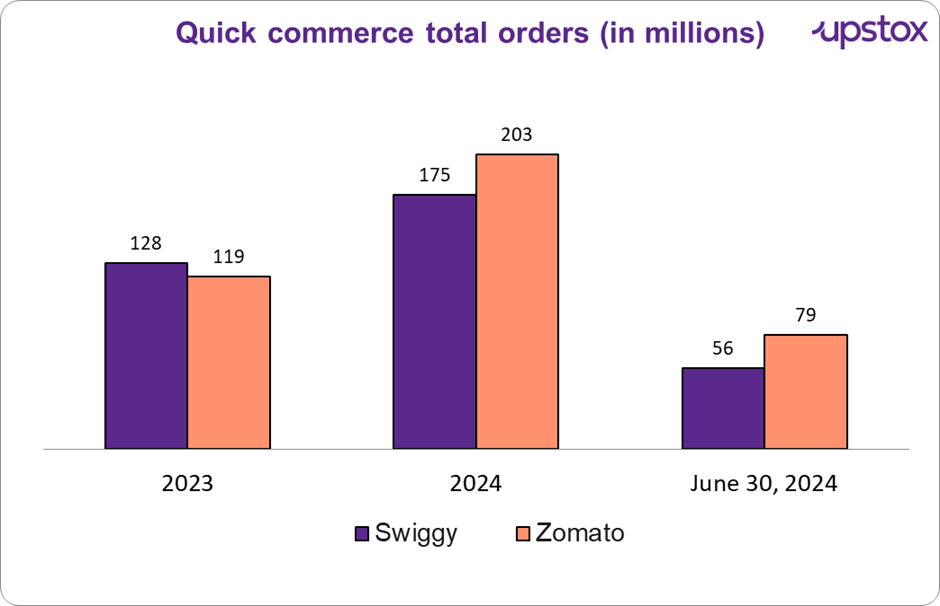

This segment has seen impressive growth, thanks to changing consumer lifestyles, urban demand, and a preference for faster delivery. The model is gaining traction due to its high frequency, streamlined offerings, and evolving distribution capabilities, showing strong potential for further growth.

Similar to food delivery, it is also seeing a rise in the number of orders and revenue in this business as well.

Source: DRHP

Source: DRHP, screener.in

Source: DRHP, screener.in

Source: DRHP, screener.in

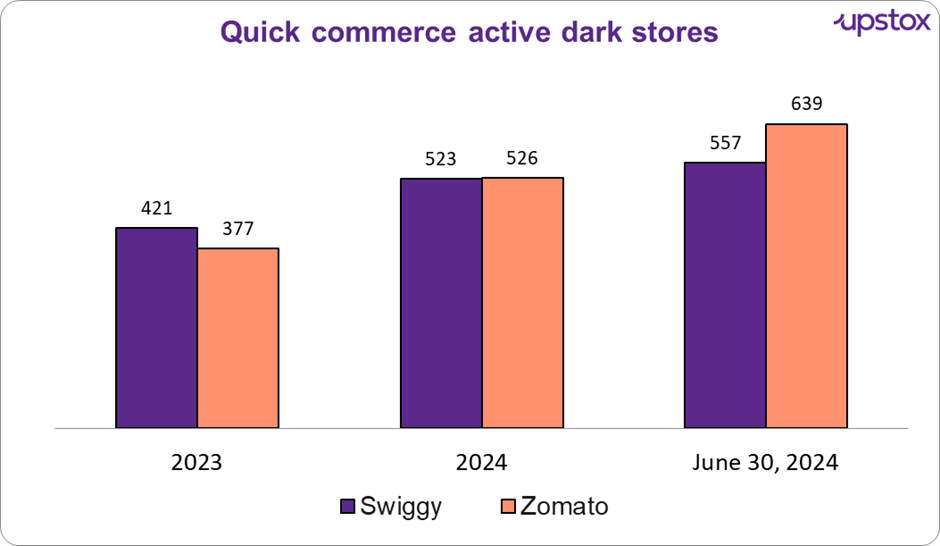

Swiggy’s ability to deliver within 10-20 minutes relies heavily on their network of dark stores. A dark store is a retail facility or warehouse designed exclusively for online orders. It’s not open to walk-in customers and serves as a fulfillment center where products are picked, packed, and quickly delivered to customers, especially for quick commerce and grocery delivery services.

Over the past few years, they’ve significantly increased the number of these stores to meet growing demand. Interestingly, Swiggy and Zomato are growing at a very similar pace in this area.

Source: DRHP

However, similar to the food delivery segment, Zomato is growing at a faster rate in this area as well, while Swiggy’s growth is comparatively slower.

Out-of-home consumption

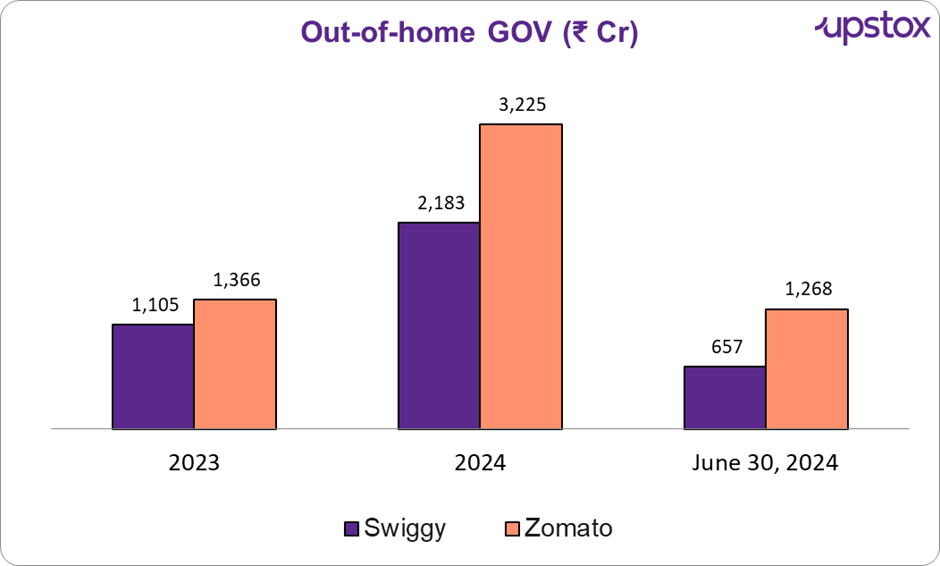

The out-of-home consumption segment includes Swiggy Dineout and Settpinout. Since its inception in 2023, the GOV has experienced significant growth.

Source: DRHP, Screener.in

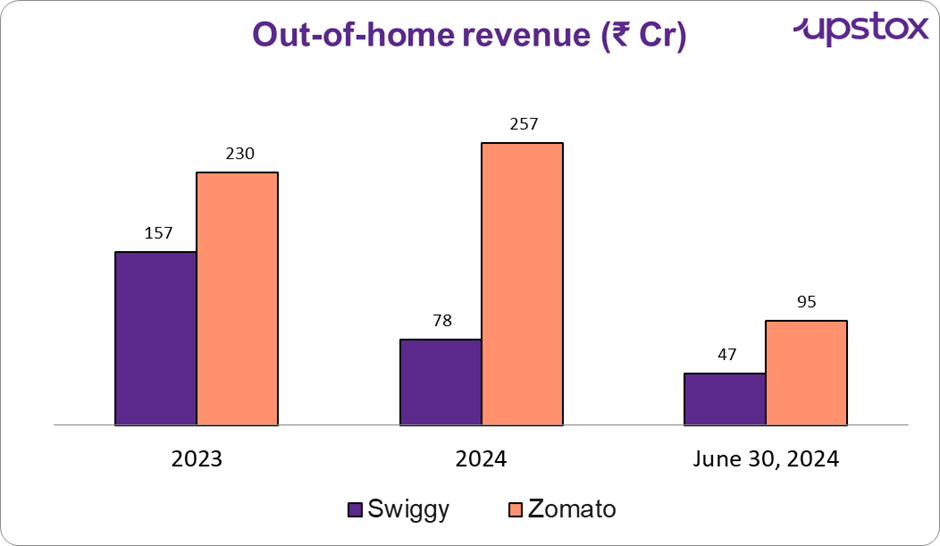

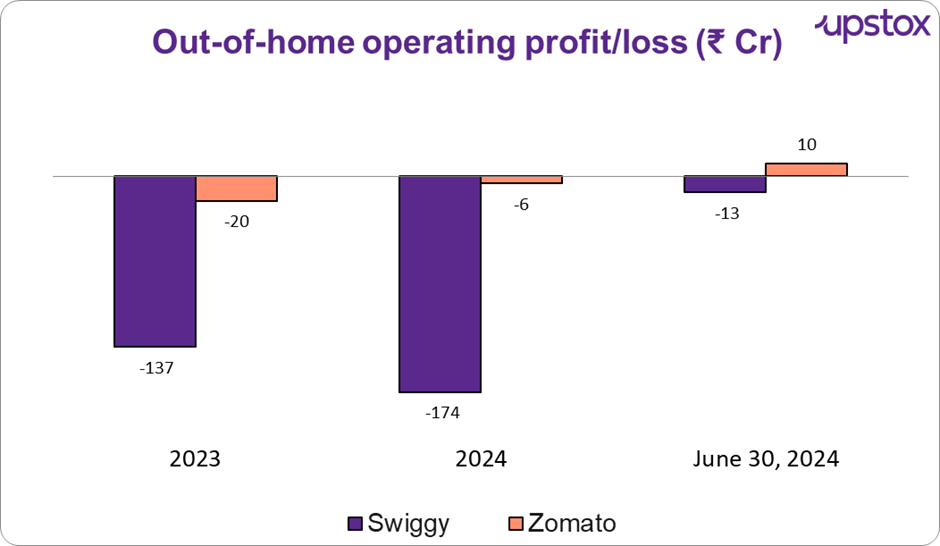

Even though the Gross Order Value (GOV) has gone up a lot, the slow revenue growth suggests that profit margins are getting tighter. This could affect the segment's profitability and long-term sustainability, even with more transactions happening.

Source: DRHP, Screener.in

Source: DRHP, Screener.in

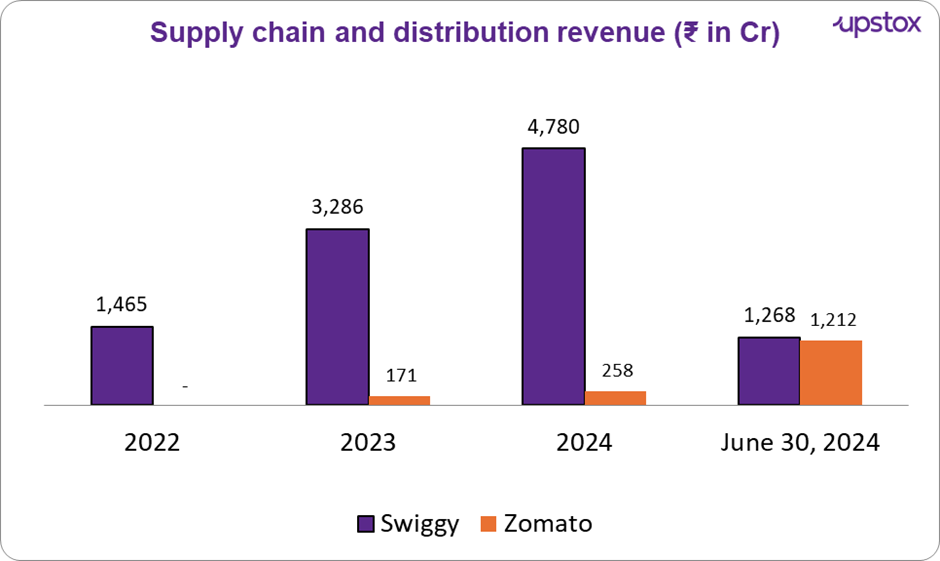

Supply chain and distribution

Swiggy’s Supply Chain and Distribution segment has grown significantly in recent years. They’ve expanded their services to wholesalers and retailers by leveraging their warehousing capabilities, providing reliable and cost-effective order fulfillment. This growth is driven by expanding into new cities, opening new warehouses, and increasing brand partnerships.

As of June 30, 2024, Swiggy managed 2.66 million sq. ft. of warehousing space across 13 cities, had around 680 brand distribution partnerships, and served about 87,000 retailers and wholesalers.

Meanwhile, Zomato has just started venturing into this space, aiming to catch up with Swiggy’s established presence.

Source: DRHP, screener.in

Overall business performance

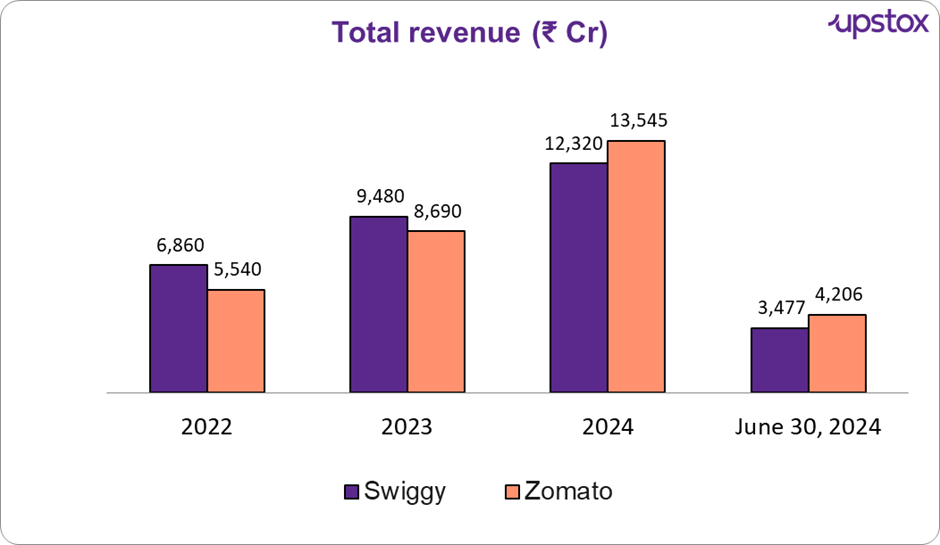

After looking at each of the businesses, we now contrast overall performance of these companies. While both of them have managed to increase reach and revenue, Zomato has pipped Swiggy in the last few years.

Source: DRHP, screener.in

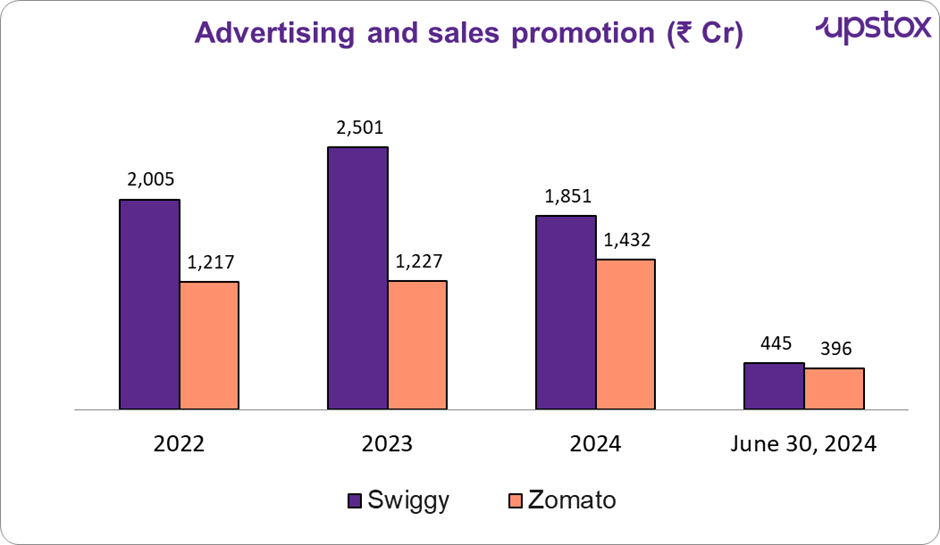

Swiggy plans to use 25% of its funds for brand marketing and business promotion. They focus on increasing their user base and brand awareness through discounts, promotions, and print and social media campaigns. These efforts help attract new users, retain existing ones, and encourage more frequent use of the platform.

Source: DRHP, screener.in

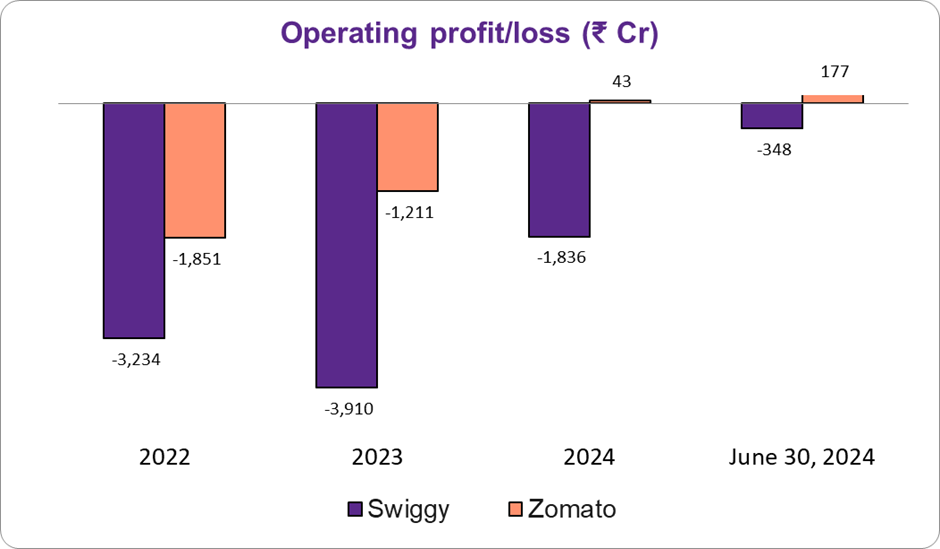

While both have managed to reduce operating losses, higher marketing expesnes have weighed on Swiggy.

Source: DRHP, screener.in

Consumer-friendly features

| Feature | Swiggy | Zomato |

|---|---|---|

| Dark mode | Yes | Yes |

| Loyalty programs | Swiggy Super: Free deliveries, no surge fees | Zomato Gold/Pro: Exclusive discounts, benefits |

| Quick commerce | Swiggy Instamart: Fast grocery delivery | Blinkit (acquired): Quick grocery delivery |

| Package delivery | Swiggy Genie: Send packages within the city | Not available |

| Dining out services | Table reservations, dining discounts | Table reservations, dining discounts |

| Exclusive deals | Partnered with restaurants for special offers | Partnered with restaurants for exclusive deals |

| Subscription services | Swiggy One: Combined benefits of Super and Instamart | Zomato Pro Plus: Enhanced benefits over Zomato Pro |

| Eco-friendly initiatives | Sustainable packaging, reduced plastic usage | Sustainable packaging, reduced plastic usage |

| B2B initiatives | Supply chain management services. | Hyperpure: Sourcing high-quality ingredients |

Source: DRHP, news articles

Future prospects

Swiggy has big plans for growth and expansion. They aim to attract more users by offering greater convenience, a wider range of products, and faster delivery times. Swiggy also plans to expand into more cities where they already operate.

They’ll use their tech infrastructure to quickly understand market demands and introduce new services. Swiggy is focusing on expanding their last-mile delivery network and enhancing their Dark Stores for quicker deliveries. They also plan to offer segmented services like the budget-friendly PocketHero and the premium Swiggy Gourmet to meet diverse customer needs.

Conclusion

In conclusion, Swiggy’s IPO is a major step in strengthening its position in India’s hyperlocal commerce market. The company is focusing on expanding its food delivery and quick commerce segments to meet the growing demand for fast, convenient, and diverse delivery options. By investing in technology, brand marketing, and last-mile delivery networks, Swiggy aims to attract more users and sustain growth.

About The Author

Next Story