Upstox Originals

Surviving the storm: How hybrid funds handle market dips

.png)

5 min read | Updated on November 28, 2024, 18:15 IST

SUMMARY

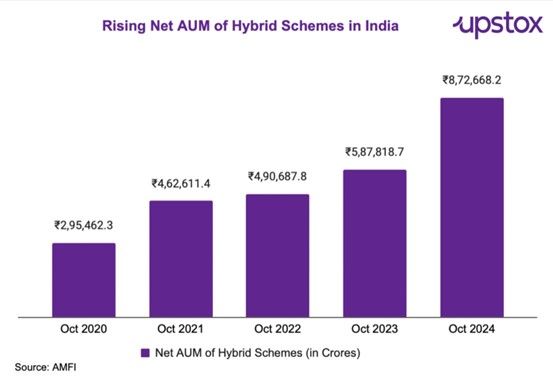

In October 2024, hybrid mutual funds experienced a remarkable ~244% surge in inflows! As market volatility intensifies, investors often seek investment options that offer stable returns with lower downside risk. Hybrid funds have a track record of delivering consistent performance—outpacing the market during downturns. Additionally, these funds are highly versatile, catering to investors with varying risk appetites.

Hybrid funds have seen a 244% rise in flows in October 2024

However such times always make investors wonder if they can invest in avenues that help reduce the downside. This brings us to a balanced investment approach designed for such times: hybrid mutual funds.

Is it, therefore, any surprise that In October 2024, these funds saw a whopping 244% rise month-on-month spike in inflows?

What are hybrid funds?

Hybrid funds blend equity and debt, aiming to provide the best of both worlds—growth from equities and stability from debt. This diversification reduces overall portfolio risk and makes these funds suitable for investors across risk profiles and investment horizons.

Key types of hybrid funds

| Type | About | Equity allocation (%) | Debt allocation (%) |

|---|---|---|---|

| Conservative hybrid funds | These hybrid funds are more tilted toward debt and are suitable for risk-averse investors | 10–25 | 75–90 |

| Equity savings funds | These funds invest in equity, and debt and also invest in equity arbitrage (special situations) to maximise returns. | Min 65 | Min 10 |

| Balanced hybrid funds (BAF) | Given their lower equity allocation, they are even less volatile than aggressive hybrid funds. | 40-60 | 40-60 |

| Aggressive hybrid funds | Given their higher equity allocation, these funds offer a higher-risk, higher-reward option. | 65–80 | 20–35 |

Source: News articles

Why are they suitable during market corrections?

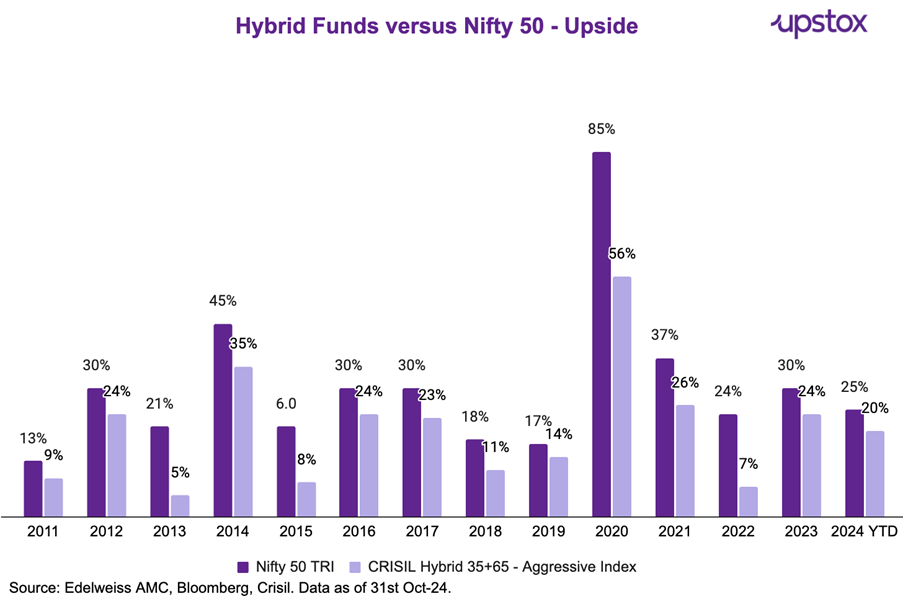

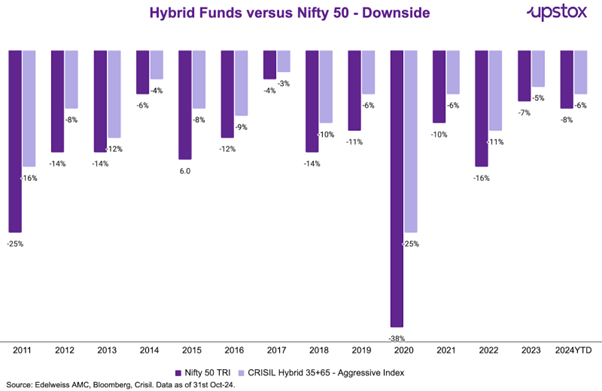

In the table below, we look at the performance of hybrid funds during some of the most challenging market periods and during those when markets made some of the highest gains. As can be seen, hybrid funds have seen smaller declines during downturns and offer decent growth during market upturns.

Returns during the biggest monthly downside and upside

| Schemes | Biggest Fall (%) | 2nd Biggest Fall (%) | 3rd Biggest Fall (%) | Biggest Gain (%) | 2nd Biggest Gain (%) | 3rd Biggest Gain (%) |

|---|---|---|---|---|---|---|

| Month | March-20 | September-18 | February-16 | April-20 | November-20 | March-16 |

| BSE 500 TRI | -24.1 | -8.8 | -8.0 | 14.6 | 11.7 | 10.6 |

| Flexi Cap | -23.4 | -8.6 | -8.6 | 12.9 | 12.3 | 11.0 |

| Aggressive Hybrid | -18.6 | -6.5 | -6.2 | 9.6 | 8.9 | 8.5 |

| Balanced Advantage Fund | -12.8 | -5.0 | -4.4 | 8.6 | 7.7 | 7.3 |

| Equity Savings | -10.1 | -2.8 | -2.5 | 5.8 | 4.5 | 4.3 |

| Conservative Hybrid | -5.5 | -2.3 | -2.2 | 3.6 | 3.5 | 3.1 |

Source: Value Research, Investing.com. Data is being considered for the period 2013 to October 2024.

For those saying, these are only discrete events, we look at a long-term trend of returns delivered by aggressive hybrid funds versus the Nifty 50. During the correction, hybrid funds (even the aggressive ones) has proven resilient. For instance:

-

During the sharp bear cycle from January 2020 to March 2020, the Aggressive Hybrid Fund limited losses to 25%, compared to a 38% drop in the Nifty 50.

-

Overall aggressive Hybrid Funds help in upside participation along with limiting downside

Why do hybrid funds perform well?

-

Debt cushion: The debt allocation acts as a buffer, reducing volatility during market downturns.

-

Rebalancing advantage: Automatic rebalancing between equity and debt ensures the portfolio capitalizes on market cycles while maintaining stability.

-

Diversified equity exposure: These funds invest in a mix of large, mid, and small-cap stocks, enhancing growth potential while mitigating concentrated risks

How do they differ from Flexi Cap funds?

Flexi-cap funds are pure equity funds, which invest across various market caps. Compared to hybrid funds, even the aggressive hybrid funds have a mandatory debt investment, which provides an element of safety and stability. Naturally, a rational investor would expect to make higher returns in flexi-cap funds versus hybrid funds. But as the data above shows, during times of corrections, hybrids funds stand out

Here are the top hybrid funds in each category based on their AUM size

Source: Value Research. Note not an exhaustive list of hybrid funds. Data as of 31st Oct-24.

Risk

While aggressive hybrid funds are less risky than other equity funds (like largecap, flexicap, multicap, etc), but have higher risk and volatility than other categories of hybrid funds (like conservative, equity savings, etc) because of higher equity exposure in their funds. The degree of risk is directly in line with the asset allocation and fund composition.

Conclusion

Hybrid mutual funds, especially aggressive ones, could be the right choice for investors looking to weather market corrections while aiming for growth. By combining equity's potential with debt's stability, they strike the perfect balance between risk and reward.

So, the next time the market wobbles, remember this: it’s not about avoiding the storm; it’s about having the right tools to sail through it.

About The Author

Next Story