Upstox Originals

Shining a light on India’s gold loan rush

.png)

5 min read | Updated on August 30, 2024, 14:23 IST

SUMMARY

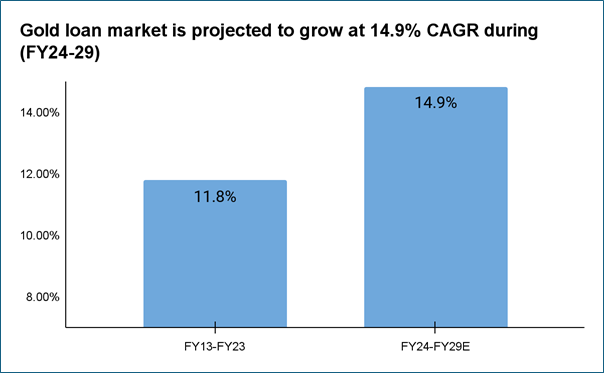

Gold, a symbol of wealth and prosperity in Indian households, has found a new role beyond being a cherished heirloom. The gold loan market in India has experienced significant growth, with a CAGR of 11.8% over the last decade, from FY13 to FY23. What is driving this boom? And what does it mean for the Indian economy and the common man?

Stock list

The gold loan market is expected to grow at a 15% CAGR over the next 5 years

The organized gold loan market in India was valued at ₹7.1 lakh crores in FY24 and is projected to grow at a CAGR of 14.9% until FY29. With the current household gold holding of ₹126 lakh crores, the market penetration of gold loans is currently at 5.6%, indicating substantial untapped potential.

Source: PWC, BT

Why this surge?

- Rising gold prices: As gold prices continue to increase, gold loans become more attractive to borrowers seeking to meet their financial obligations without the burden of high interest rates or stringent credit checks. As of August, the price of 24-carat gold has surpassed ₹71,000 marking a ~12% increase YoY.

- Favorable Loan-to-value (LTV) ratio: With high gold prices, individuals have the opportunity to obtain more substantial loans by pledging gold as security. This is reflected in the rise of the LTV ratio from 60% in 2012 to 75% currently.

- Competitive interest rates: Gold loans often offer lower interest rates than other loan types. Online platforms facilitate comparisons of interest rates and repayment terms from various lenders, enabling borrowers to secure more competitive deals.

Here is a comparison of interest rates offered by some leading banks/NBFCs for personal and gold loans.

| Banks | Personal loan (%) | Gold loan (%) |

|---|---|---|

| SBI | 11.15% - 14.30% | 8.95% onwards |

| Axis bank | 10.99% - 22.00% | 17.00% onwards |

| HDFC | 10.75% - 24.00% | 9.10% -17.90% |

| Kotak Mahindra | 10.99% - 20.00% | 9.00% - 24.00% |

| Muthoot Finance | 14.00% - 22.00% | 10.90% onwards |

| Manappuram Finance | 12.00% onwards | 9.90% onwards |

| IIFL | 12.75% onwards | 6.48% - 27.00% |

Source: Bank Bazaar, Paisabazaar

- Increase in platforms: Banks and NBFCs are increasingly establishing their digital footprint to serve the younger demographic, which represents ~40% of the gold loan disbursal market. Digital gold loan aggregator platforms are facilitating these collaborations and expanding access to digitally savvy customers.

The players: Who’s leading the charge?

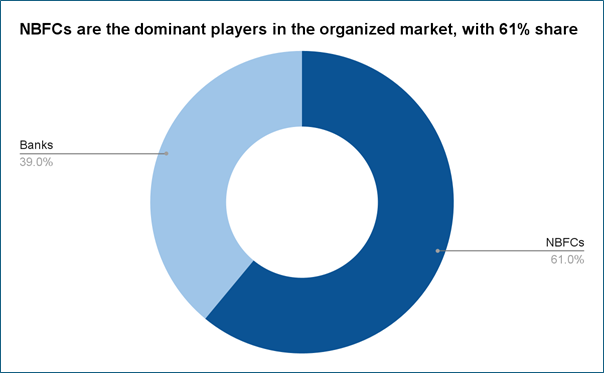

As of FY24, 63% of the gold loan market is dominated by unorganized players, while the remaining 37% is held by organized entities such as banks and NBFCs. Within the organized segment, NBFCs like Muthoot Finance, IIFL and Manappuram Finance have collectively gained 73% of NBFCS gold loan market share as of 2023 due to their specialization in gold loans, extensive reach, quick loan disbursement processes, and competitive interest rates. These factors make NBFCs a preferred choice for customers seeking gold loans.

Source: PWC, data as of September 2023

Comparative analysis: Banks vs. NBFCs vs. Unorganized lenders*

| Parameter | Banks | NBFCs | Un-organised lenders |

|---|---|---|---|

| Interest rate | 10%-18% | 10%-21% | 25%-36% |

| Mode of disbursal | Cash (₹ 20,000 limit), electronic transfer | Cash (₹ 20,000 limit), electronic transfer | Predominantly cash (No limit) |

| Processing fees | Nil for small loans, nominal fees for big-ticket loans | Nil | NA |

| Regulation | Regulated by RBI | Regulated by RBI | Unregulated |

| Turn around time | 15-20 min | 15-20 min | 10-15 min |

Source: Pwc, ET; *data as of August 2024

In an organised market, most of the gold loan disbursal institutions are listed and hold significant shares. Here are a few of the select listed players that offer gold loans

| NBFCs/Banks | Market cap (₹ crore) | Gold loan AUM/Total AUM* | Gold loan AUM (₹ crore) | ROE (%) | NIM* (%) | Stock price CAGR % (5 yrs) |

|---|---|---|---|---|---|---|

| Bajaj Finance | 4,25,238 | 8.6% | 28,415 | 22.1 | 9.1 | 16.0 |

| Muthoot Finance | 79,685 | 96.1% | 72,873 | 17.9 | 11.2 | 26.0 |

| Manappuram Finance | 18,215 | 51.1 | 21,500 | 20.6 | 13.9 | 13.0 |

| IIFL Finance | 19,651 | 29.6% | 23,354 | 18.0 | 7.6 | 32.0 |

| SBI | 7,27,734 | 2.4% | 32,676 | 17.3 | 3.3 | 24.0 |

| Axis bank | 3,64,324 | - | 9,187** | 18.4 | 4.1 | 12.0 |

| ICICI bank | 8,60,315 | 2.0% | 23,600 | 18.8 | 4.4 | 24.0 |

| Average | 3,56,452 | 31.6% | 33,736 | 19.0 | 7.7 | 21.0 |

Source: Screener, company financials; data as of 27 August 2024, *For FY24, **Only rural gold loan

The future: Is the growth sustainable?

While the growth trajectory looks promising, is this surge in gold loans sustainable? The answer lies in India’s deep cultural connection with gold and the evolving financial landscape. With increasing awareness and financial literacy, more people are recognizing the benefits of leveraging their gold assets.

Furthermore, the rising gold prices over the past financial year may influence lenders to adopt a cautious approach to lending rates and pricing. Any significant downward movement in gold prices could lead to a breach in the LTV ratio, creating operational challenges for lenders, such as the need to conduct auctions.

Additionally, the market has diversified beyond traditional collateralized gold loans to include SGBs. The LTV ratio for SGBs is set at 75%, identical to that for conventional gold loans, providing borrowers with another avenue to leverage their gold holdings. Additionally, partnerships between gold loan lenders and digital platforms are expanding the market's reach and catering to the digitally savvy population.

Conclusion

The rise of India's gold loan market is not just a financial trend, it's a reflection of the country’s economic resilience and adaptability. As more people tap into their gold reserves, it will play an increasingly significant role in the financial strategies of Indian households.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story