Upstox Originals

Exploring opportunities in India's pharma sector

.png)

3 min read | Updated on June 13, 2024, 20:42 IST

SUMMARY

Did you know? India currently meets about 60% of the global vaccine demand! From decoding the human genome to revolutionising drug discovery, India's pharmaceutical sector is poised for a transformative leap. It is set to grow at 15% in the next few years and offers multiple investment opportunities. Let's take a closer look.

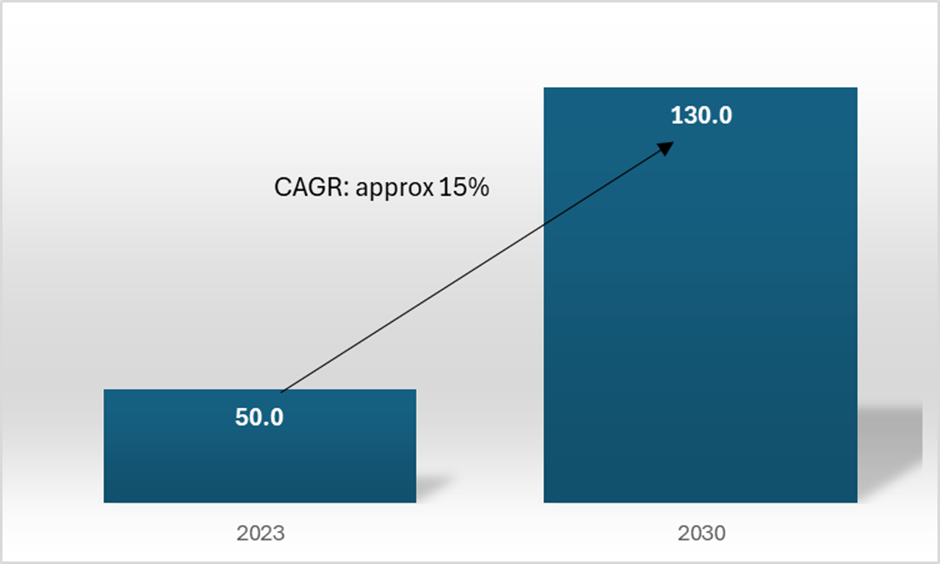

The pharma sector is set to grow at 15% CAGR till 2030

The Indian pharmaceutical industry, known for producing generic medicines and low-cost vaccines, ranks third globally by volume. The sector is expected to grow at a CAGR of around 15% over the next six years to reach $130 bn.

Market size of the Indian pharma sector

Source: InvestIndia, press releases

Currently, India supplies 20% of global generics and meets about 60% of the worldwide vaccine demand, showcasing the sector’s reach and potential. India exports about $2-3 bn every month, indicating the sector’s important presence in the global space. The top five export markets are the US, UK, Netherlands, South Africa and Brazil.

Key drivers fueling the pharma boom in India

-

Government initiatives: Launched in 2021, the performance-linked incentives (PLI) scheme is a six-year program that incentivises pharma companies to boost domestic production and improve drug innovation. By September 2023, 48 projects were approved, attracting ₹3,938.5 crore in investment.

-

FDI inflows on the rise: The rise in FDI inflows, allowing 100% for greenfield and up to 74% for brownfield projects, significantly impacts India's pharma sector. As a result, India has attracted a cumulative FDI equity inflow of around $22.4 bn from April 2000 to December 2023. This constitutes almost 3.4% of the total FDI inflows across sectors.

-

Cost advantage: India's competitive production costs and economies of scale make it ideal for pharma manufacturing and R&D outsourcing. India offers manufacturing costs 30-35% lower than the US and Europe, cost-efficient R&D at about 87% less than developed markets, and cheap skilled labour.

-

Growing healthcare needs: Increasing prevalence of chronic diseases, rising healthcare awareness, and a growing middle-class population drive demand for pharmaceutical products.

In the next section, we look at the key companies in this segment and how their performances stack up.

Key players in the sector

Let's take a look at the leading pharma companies and analyze their performance and valuations

Key metrics for top pharmaceutical companies in India

| Company | Market cap (in ₹ cr) | ROCE | Stock P/E* | EV/EBITDA* | Stock price CAGR (5 yrs) |

|---|---|---|---|---|---|

| Sun Pharmaceuticals | 3,55,931 | 17.3% | 35.5 | 24.3 | 30% |

| Cipla | 1,20,911 | 23.1% | 28.4 | 17.1 | 22% |

| Divi's Laboratories | 1,19,761 | 16.4% | 74.8 | 44.9 | 23% |

| Dr Reddy's Laboratories | 97,136 | 26.9% | 17.4 | 11.0 | 18% |

| Zydus Lifesciences | 1,05,519 | 22.4% | 27.3 | 18.6 | 34% |

| Average | 1,59,852 | 21.2% | 36.7 | 23.2 | 25% |

Source: Screener; *Trailing multiples with stock price as of 5 June, 2024

Conclusion

Backed by government initiatives and rising FDI, India's pharma sector is poised for a major leap. Overall, our analysis indicates the following:

- The sector is performing well with a healthy growth outlook

- Profitability metrics are encouraging

- This presents an attractive opportunity for investors seeking exposure to a rapidly growing market. However, due diligence is crucial.

About The Author

Next Story