Upstox Originals

Rising promoter selling, declining buybacks. Are markets saying something?

.png)

4 min read | Updated on September 22, 2024, 10:24 IST

SUMMARY

There has been a noticeable rise in promoter stake sales in India’s stock market, sparking curiosity about what’s driving this trend. This is further accentuated by the fact that open market buybacks are declining. The fact that this is happening when the market is near peak only adds to the intrigue. So, what’s going on? Let’s dive into a few possible reasons.

Promoter selling has increased, while buybacks have declined

There is a signaling theory of the stock markets. One of the things it talks about is the importance of corporate actions and the consequent signals it sends to investors. For instance, a company that increases its annual dividend could be signaling that they have sufficient cash reserves to distribute among its shareholders! A positive signal.

Effectively, investors read into the actions of a corporation and interpret what it means for their investments.

Our analysis of corporate actions has brought out some very interesting signals. Let’s take a look.

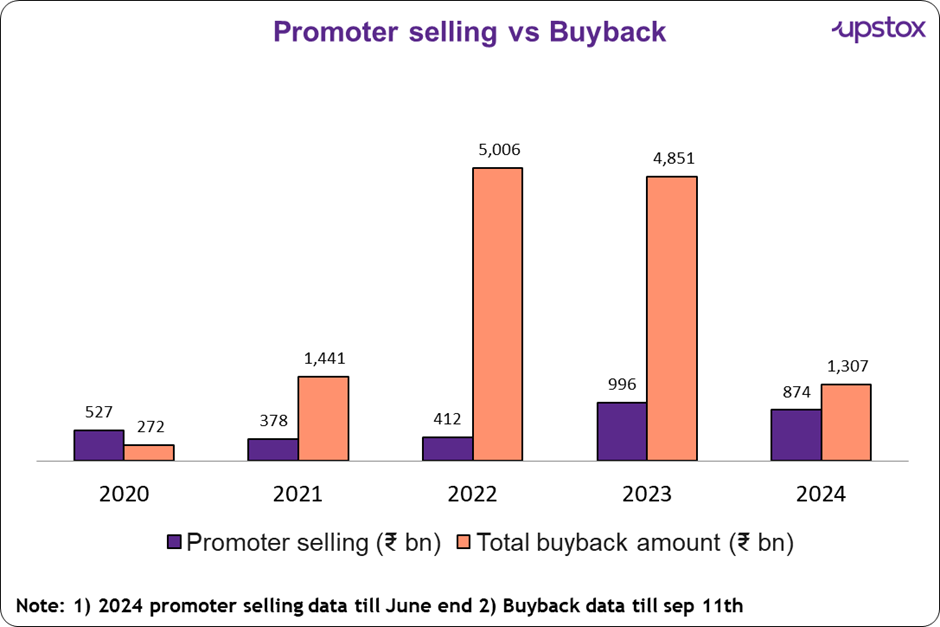

As can be seen from the chart below, promoter selling in the markets has been on a consistent spike over the past few years. Promoter selling till June 2024 (only half the calendar year) is almost equal to the entire 2023 promoter selling level.

On the other hand, curiously, the level of buybacks has been on a decline. One could argue that after 2 strong years, 2024 is just seeing a cooling off - and maybe it’s true, but that is only part of the story.

Source: Prime database, Media reports Kotak Institutional Equities, chittorgarh.com

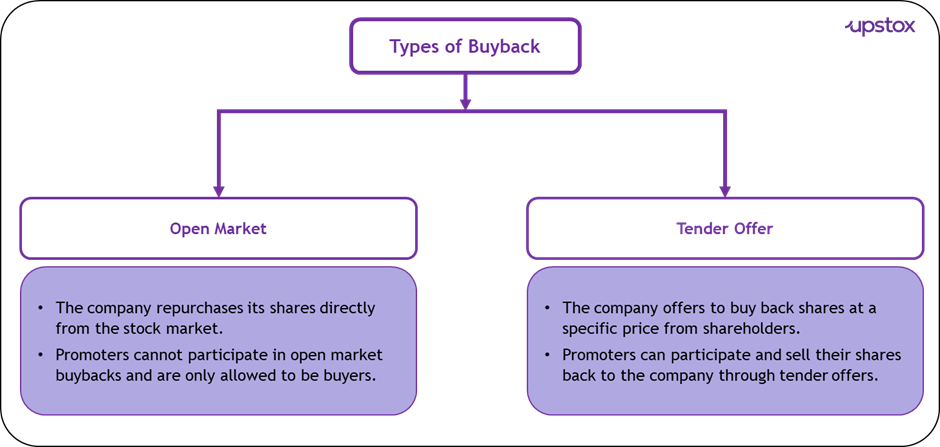

Why do we say that? This shift in behaviour becomes even more revealing when we consider the nature of buybacks. Buybacks are effectively divided into two types, as seen below.

Basically, an increase in open market buybacks would signal the management's confidence in their company’s share price and indicate that they believe their shares are undervalued.

Basically, an increase in open market buybacks would signal the management's confidence in their company’s share price and indicate that they believe their shares are undervalued.A sharp decline in open buybacks

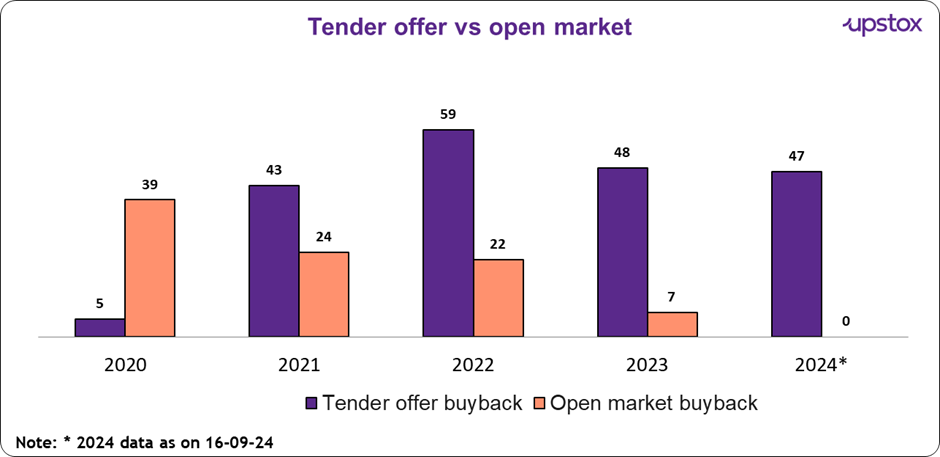

As indicated in the data below, it seems that promoters are increasingly preferring a tender offer compared to an open buyback.

Extending the signaling theory, one could interpret that promoters are themselves a little wary of the current frothy valuations and are preferring to lower their stakes at these elevated stock prices.

Source: sebi.gov.in, Chittorgarh.com

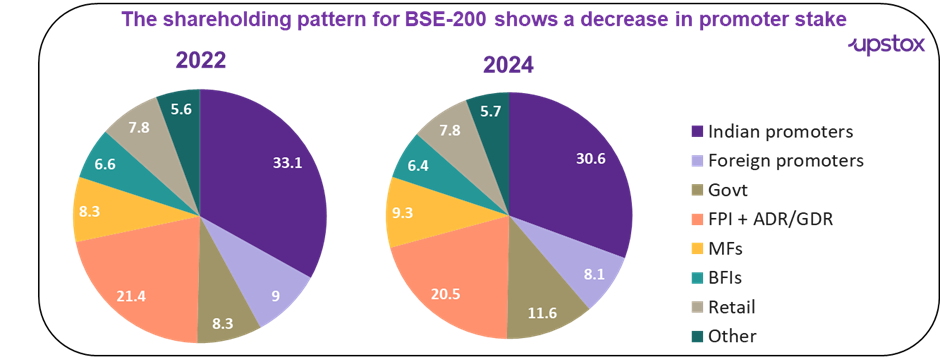

Supporting this interpretation further is the sharp increase in promoter selling over the past few years as seen in the chart below.

Source: BSE, NSE, Prime Database, Kotak Institutional Equities Note: *From the start of the year 2024 till the stake sale date

Now here is the thing, promoter selling is completely legal and can be interpreted in many ways.

| Positives | Negatives |

|---|---|

| Large sales create opportunities for institutional and retail investors to purchase shares at more attractive valuations. | Promoter stake sales at market highs may signal to investors that promoters believe stocks are overvalued, raising concerns about future performance. |

| A shift toward more diverse ownership could lead to stronger corporate governance and increased market participation. | Increased selling could cause higher market volatility, adversely impacting stock prices. |

Reasons why the promoters sell

There are a few reasons behind these sales. Some promoters might be raising funds to grow their businesses or meet minimum public shareholding requirements. Others may want to reduce debt or adjust their family holdings, especially when it comes to wealth diversification or family settlements. In some cases, it’s simply a strategic move to realign their interests.

How should investors read this?

After a promoter sells shares as can be seen from the below table, stock prices can move in either direction. That’s why investors need to focus on the company’s fundamentals before making any decisions.

| Stock name | Mar 2024 promoter stake (%) | Jun 2024 promoter stake (%) | Share price performance after stake sale (%) |

|---|---|---|---|

| Indus Towers | 69 | 52 | 23.3 |

| Kalpataru Projects | 40 | 35 | 24.1 |

| Vedanta | 62 | 59 | 69.1 |

| Gland Pharma | 57 | 51 | 0.8 |

| Mphasis | 55 | 40 | 23.6 |

| Kamat Hotels (India) | 64 | 57 | -22.3 |

| Vodafone Idea | 49 | 38 | -26.0 |

| CSB Bank | 49 | 40 | -10.9 |

Source: screener.in

To sum up, data suggests that some caution is warranted. Multiple market experts have time and again raised concerns about the current market levels and the lofty valuations. The decrease in open offer buybacks, and increased promoter selling are one indication to investors.

The underlying fundamentals of the Indian economy remain robust, that said, current valuation levels could play truant.

About The Author

Next Story