Upstox Originals

Q3FY25 earnings: Growth improves, uncertainty lingers

.png)

4 min read | Updated on February 25, 2025, 20:20 IST

SUMMARY

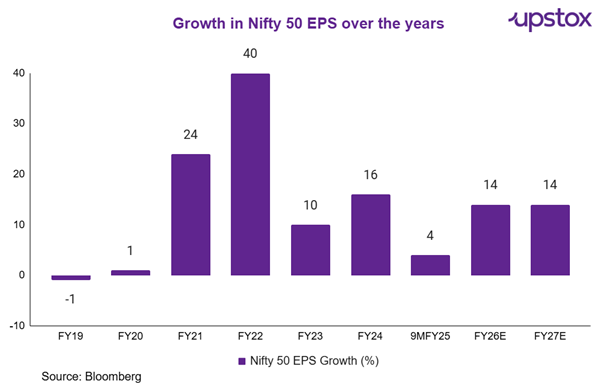

Q3FY25 earnings were a mixed bag—single-digit profit growth disappointed investors, but it marked a return to positive growth after two weak quarters. While sales growth remained modest, profitability improved. This article breaks down sectoral performance, key earnings revisions for Q4FY25 and FY26, and market valuations amid revised forecasts and recent declines.

Q3FY25 earnings were a mixed bag, but multiple challenges still remain

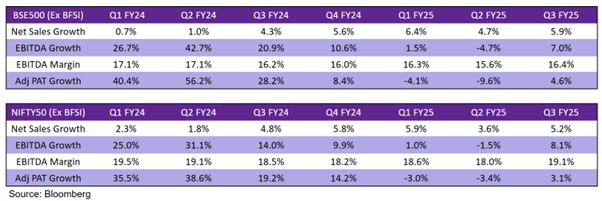

The Q3FY25 earnings season presented a modest growth story, with corporate profits facing headwinds but showing resilience in key sectors. The Nifty50 recorded just 3.1% YoY adjusted PAT growth for Q3FY25, starkly contrasting the robust double-digit PAT growth seen during FY24. A similar trend was seen for BSE500, where Q3 saw single-digit growth, which was in contrast with the double-digit growth seen during FY24.

On a more encouraging note, after two consecutive quarters of negative earnings growth, Q3FY25 saw a return to positive PAT growth. Overall EBITDA margins improved, reflecting better pricing and cost focus.

Trend in earnings and profit growth

Key factors that influenced earnings

Key positives

-

Domestic demand recovery: Due to strong crop yields and government support, rural demand has remained resilient.

-

Cost stabilisation: Lower commodity prices for commodities like metals, chemicals, and energy improved margins. Besides that, companies focus on costs and improving operational efficiencies helped margin improvements

-

Export market stabilisation: IT, pharma, and auto exports showed stabilisation on the strong dollar index.

Key negatives

-

Falling INR makes imports costly for Indian manufacturers, which is evident from the chemicals sector where companies are dependent on imports for raw materials.

-

Volume growth is slowing down across sectors mainly due to a persistent slowdown in urban consumption

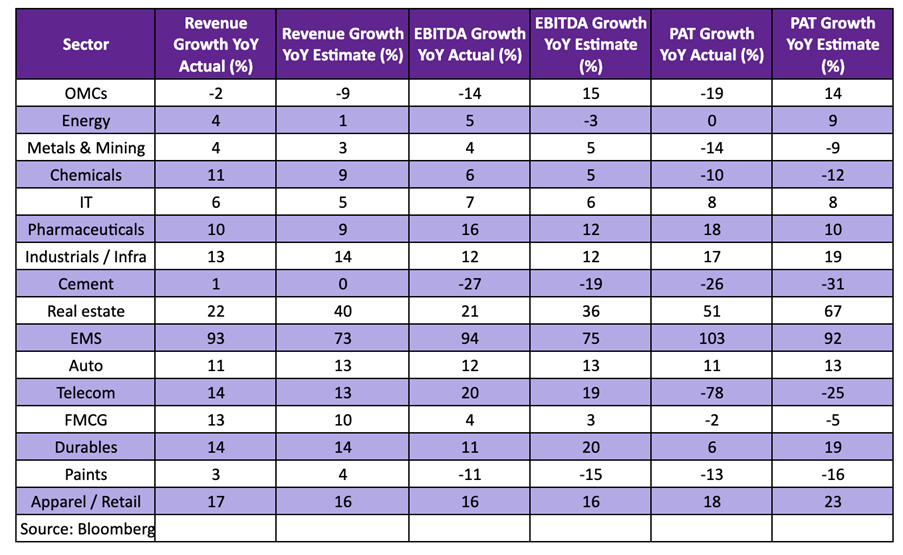

Let’s dive into the key takeaways from sectoral Q3FY25 earnings:

Top 3 outperformers

-

Electronics Manufacturing Services (EMS): Strong demand for electronics and government incentives for manufacturing drove earnings growth.

-

Real Estate: Strong housing demand, higher price realisation, and government push for infrastructure were key drivers.

-

Pharma: Domestic pharma business saw steady growth due to demand from chronic therapies while US business saw low single-digit growth. The opportunity for Indian pharma lies in potential generic drugs whose exclusive patent is expiring since multiple Indian pharma companies are expanding to tap this opportunity.

Top 3 underperformers

-

Retail: Due to a slowdown in urban consumption, the retail segment experienced a slowdown in growth rates.

-

Cement: Lower price realisations led to a decline in the bottom line despite decent volume growth and demand.

-

OMCs - Higher crude prices led to a decline in the performance of OMCs in the current quarter.

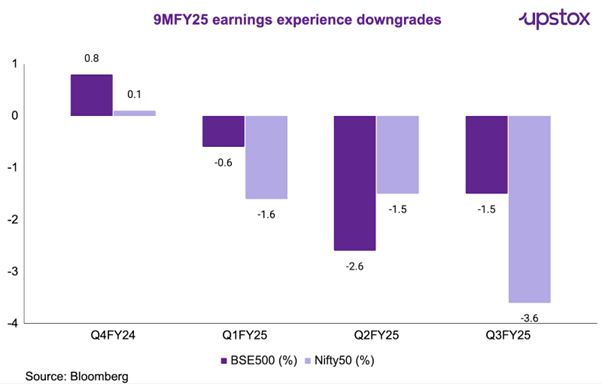

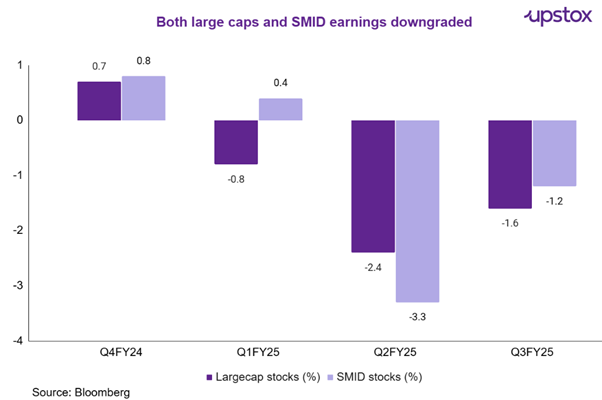

How earnings estimates have fared?

In FY25, earnings estimates have experienced significant downgrades. The BSE500 and Nifty50 both saw sharp declines, with earnings cut by -2.6% and -1.5%, respectively, in Q2FY25. This was exacerbated further with downgrades of -1.5% for BSE500 and -3.6% for Nifty50 in Q3FY25.

FY26 Outlook

While FY25 earnings have been low single digits with downgrades, FY26 is again expected to grow at a double-digit rate of 14%. This is mainly due to a lower base, an inflation cooldown, rising rural demand, and a cut in taxes, which could be a major demand driver.

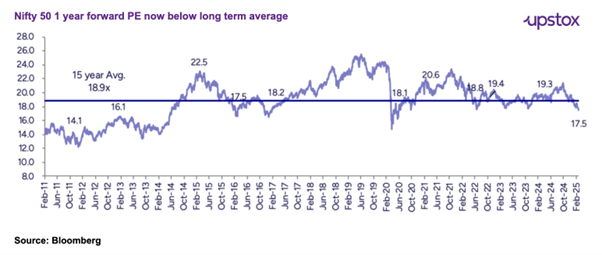

Where do we stand on valuations?

With largely no upgrades in earnings and a ~14% correction in Nifty (from its 2024 high), the Nifty forward PE ratio is now 17.5x, which is below the long-term average of 18.9x. This could provide the market with some cushion against further fall. Any upside earnings surprises for FY26 would be a key trigger to watch out for.

Outlook

Weak earnings growth have been one of the key drivers of the recent market correction. Persistent earnings downgrade now coupled with a meaningful ~14% correction, have brought the markets to a critical juncture. Any upward revision in earnings will boost confidence and provide support to markets. However, earnings remain under pressure due to slowing consumption and global uncertainties, keeping market sentiment cautious and uncertain.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story