Upstox Originals

PSUs are closing the gap with private sector peers; improving margins and asset quality are driving change

.png)

3 min read | Updated on May 27, 2024, 18:32 IST

SUMMARY

Once overlooked in favour of their private counterparts, public sector banks (PSU banks) have significantly improved their performance and are closing the valuation gap with their private peers. The rising investor interest in PSU bank stocks indicates a substantial change in public opinion toward these companies.

PSU banks have seen robust improvement in performance

PSU banks have seen a remarkable turnaround in their performance over the last few years. They are consistently improving their balance sheets and competing with private banks with regarding profitability.

In this article, we look at this journey.

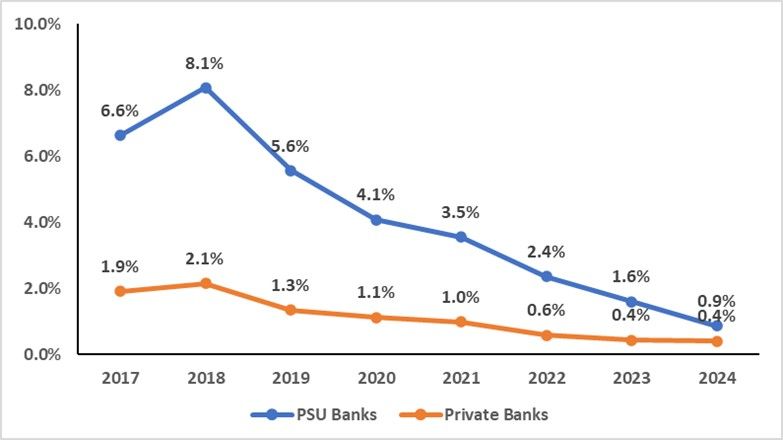

PSU banks' asset quality shows improvement

Asset quality troubles have weighed down PSUs banks in the past. The turnaround moment came in 2015, with the RBI’s Asset Quality Review (AQR), which has led to a sharp clean-up of bad loans. Besides this, bank amalgamation in 2020, robust recovery mechanisms, banks’ decision to diversify portfolio and mitigate risks along with regulations, have all bolstered asset quality.

Net non-performing assets ratio (FY2017-24)

Source: Moneycontrol; Any discrepancy with reported NIMs is largely due to the differences in averaging frequency of interest-bearing assets.

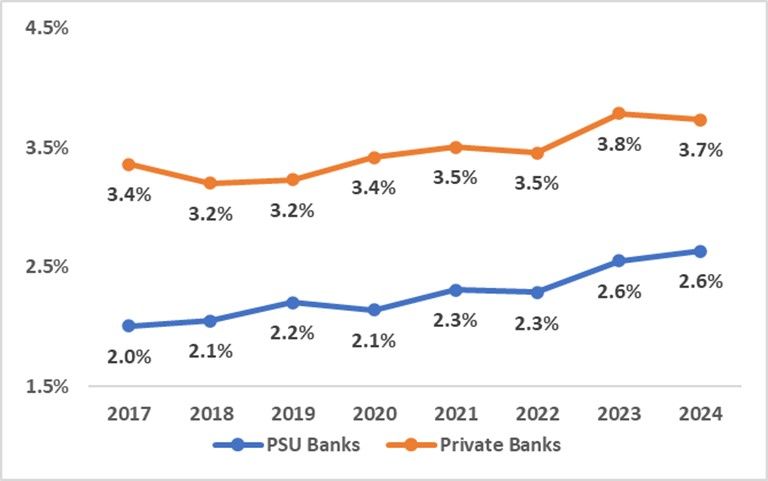

Improved profitability in focus for PSU banks

Over the last six years, net interest margins (NIMs) for both private and PSU banks have seen an improvement. Public banks are competing with their private counterparts, which can be attributed to healthy loan book growth aided by favourable yields on advances.

Net interest margins (FY2017-FY2023)

Source: Moneycontrol, The Economic Times

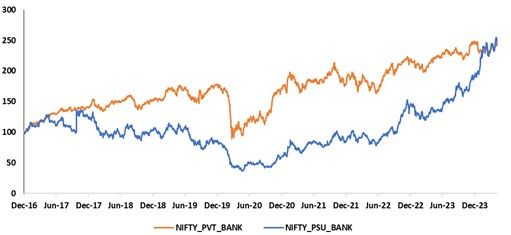

Improvement in the PSU banks fundamentals is also reflected in their market performance.

PSUs are closing the gap with private sector counterparts. Improving fundamentals of these banks is also reflected in their share price performance and valuations. Since 2020, PSU banks have consistently closed the gaps with their private peers.

Indexed price performance (Dec 2016-May 2024)

Source: Capital IQ

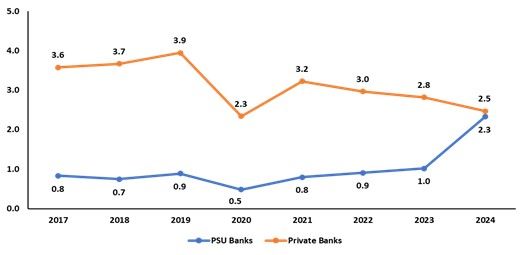

Price-to-book ratio (x) (FY2017-FY2024)

Source: Moneycontrol; *trailing valuation | Note- All book values are taken as on 31.03.24, except Bank of Baroda (as on Dec23) and Union bank of India (as on Sept 23)

That said, investors are encouraged to conduct their due diligence and also take into consideration certain risks to the PSU bank journey. Below we note a key recent event that could impact PSU performance.

RBI pressures PSU banks to cut project finance lending

The Reserve Bank of India's proposed stricter project finance regulations are expected to elevate funding costs for industrial and infrastructure projects, impacting lenders like banks. These regulations entail increasing general provisions from 0.4% to 5% of total loan amounts, with specific provisions during the construction phase gradually rising to 5% by March 2027.

Conclusion

PSU banks have improved their financial performance and health considerably. The decline in NPA and improving profitability could augur well for their future. Overall, the renewed interest from investors in PSU banks shows that they are becoming more confident in their capacity to maintain growth and successfully overcome obstacles. However, recent funding regulations imposed by RBI can affect PSU Banks that have heavily invested in industrial and infrastructure projects which may see reduced profitability due to increased provisions.

Note: For charts 1, 2 and 3, PSU bank ratios and percentages are an average of these top banks: Union Bank of India, Bank of Baroda, Punjab National Bank, Indian Overseas Bank and State Bank of India, and Canara Bank (which covers about 80% of the total PSU banks market cap). Private sector banks ratios and percentages are an average of these top banks: HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, and IndusInd Bank (which covers about 88% of the total market cap of private banks)

About The Author

Next Story